Making use of the online PDF tool by FormsPal, you are able to fill in or alter 2007 here. FormsPal development team is always endeavoring to improve the tool and help it become much easier for clients with its many functions. Take your experience to the next level with continually improving and interesting opportunities we offer! To start your journey, consider these easy steps:

Step 1: Open the PDF inside our tool by pressing the "Get Form Button" at the top of this page.

Step 2: As soon as you start the file editor, you will find the form prepared to be completed. Besides filling in various blanks, you may as well perform some other things with the form, particularly putting on custom textual content, editing the initial text, inserting graphics, signing the form, and more.

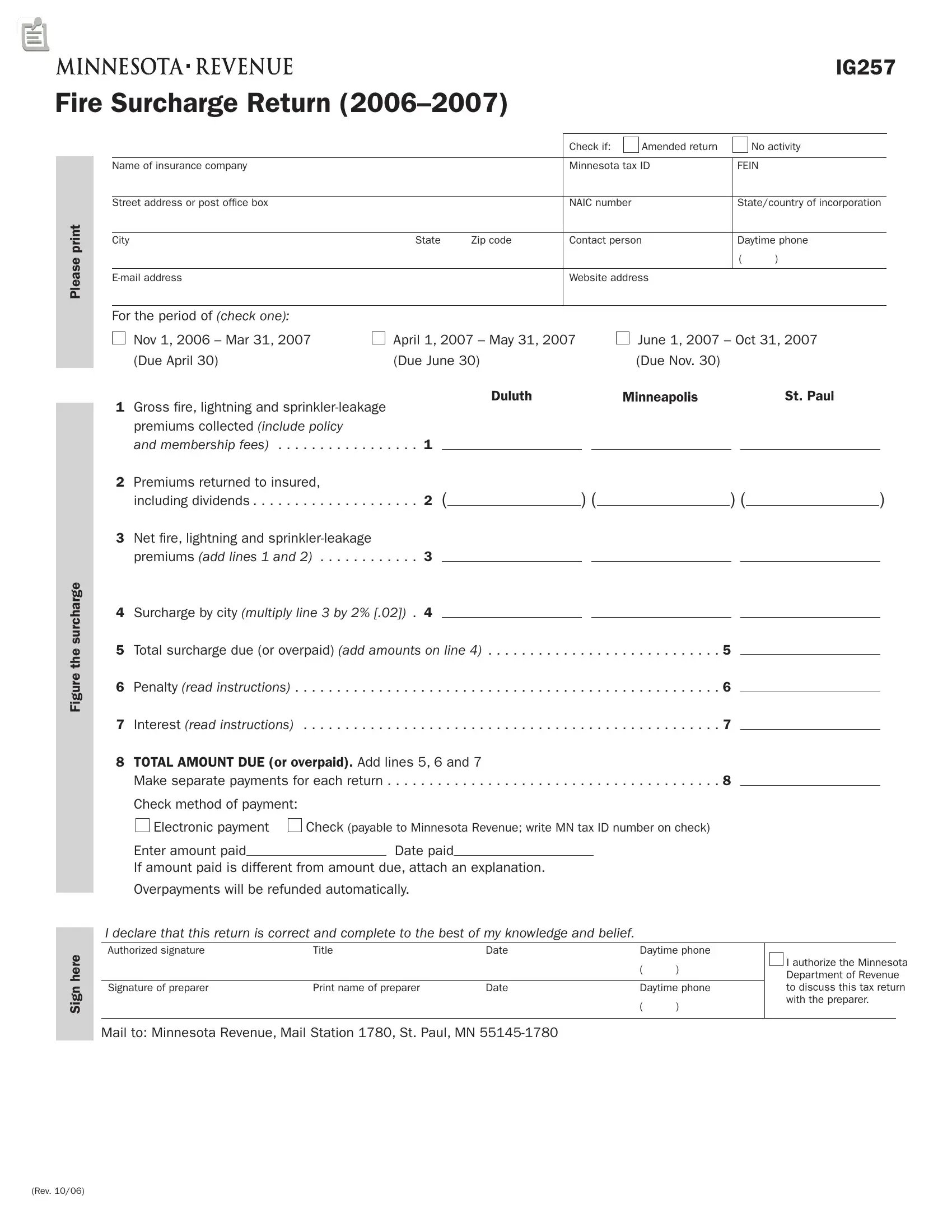

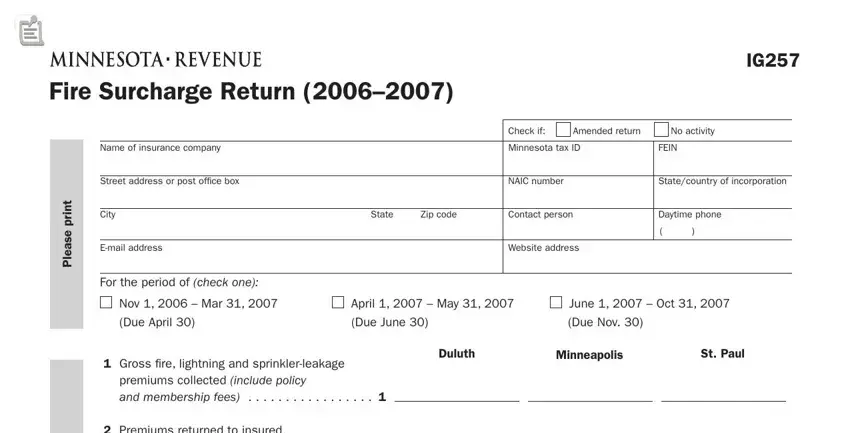

This form will require particular details to be filled in, therefore you should take whatever time to fill in exactly what is required:

1. Whenever filling out the 2007, make sure to incorporate all important blank fields within the associated part. This will help hasten the work, allowing for your details to be processed fast and properly.

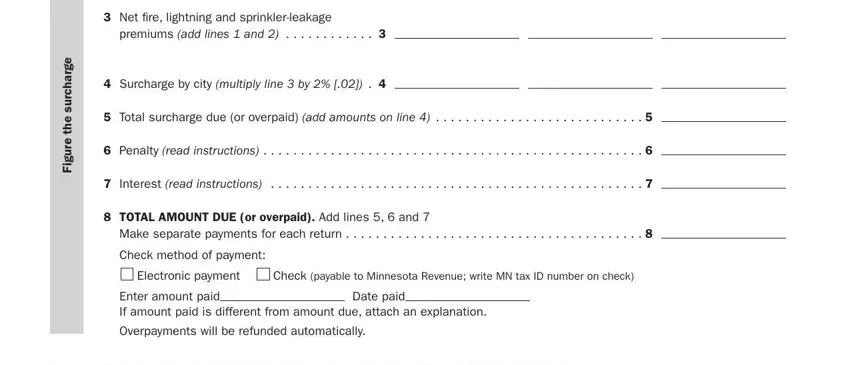

2. Just after filling out the previous part, go to the subsequent stage and complete the essential particulars in all these blanks - Premiums returned to insured, Net fire lightning and, premiums add lines and, Surcharge by city multiply line, TOTAL AMOUNT DUE or overpaid Add, Make separate payments for each, Check method of payment, Electronic payment, Check payable to Minnesota Revenue, Enter amount paid If amount paid, Date paid, Overpayments will be refunded, and e g r a h c r u s e h t e r u g.

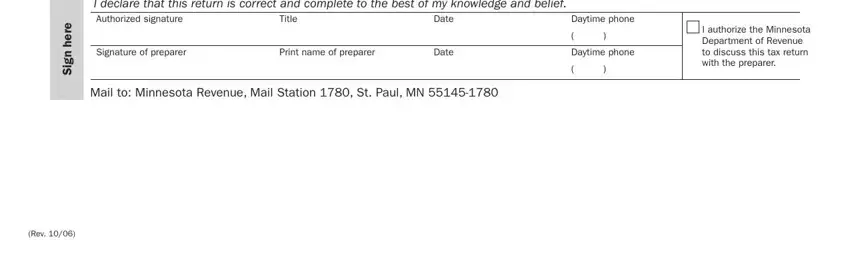

3. This subsequent step is considered rather straightforward, I declare that this return is, Authorized signature, Title, Signature of preparer, Print name of preparer, Date, Date, Daytime phone, Daytime phone, I authorize the Minnesota, Mail to Minnesota Revenue Mail, e r e h n g S, and Rev - each one of these empty fields will need to be filled in here.

When it comes to Authorized signature and Signature of preparer, make sure you take a second look in this section. Both these could be the most important ones in this PDF.

Step 3: Check all the information you have inserted in the blank fields and click the "Done" button. After setting up afree trial account at FormsPal, it will be possible to download 2007 or email it right off. The form will also be available via your personal account menu with your each modification. FormsPal is committed to the personal privacy of our users; we ensure that all personal information used in our editor is kept protected.