missouri form 4757 can be completed online very easily. Just make use of FormsPal PDF editor to complete the task in a timely fashion. In order to make our editor better and more convenient to work with, we continuously work on new features, with our users' suggestions in mind. In case you are looking to start, here is what it will require:

Step 1: Hit the "Get Form" button above on this webpage to get into our PDF tool.

Step 2: After you start the file editor, you'll see the form made ready to be filled out. Other than filling out various blanks, you can also do several other things with the form, including writing any textual content, changing the initial textual content, inserting graphics, signing the PDF, and more.

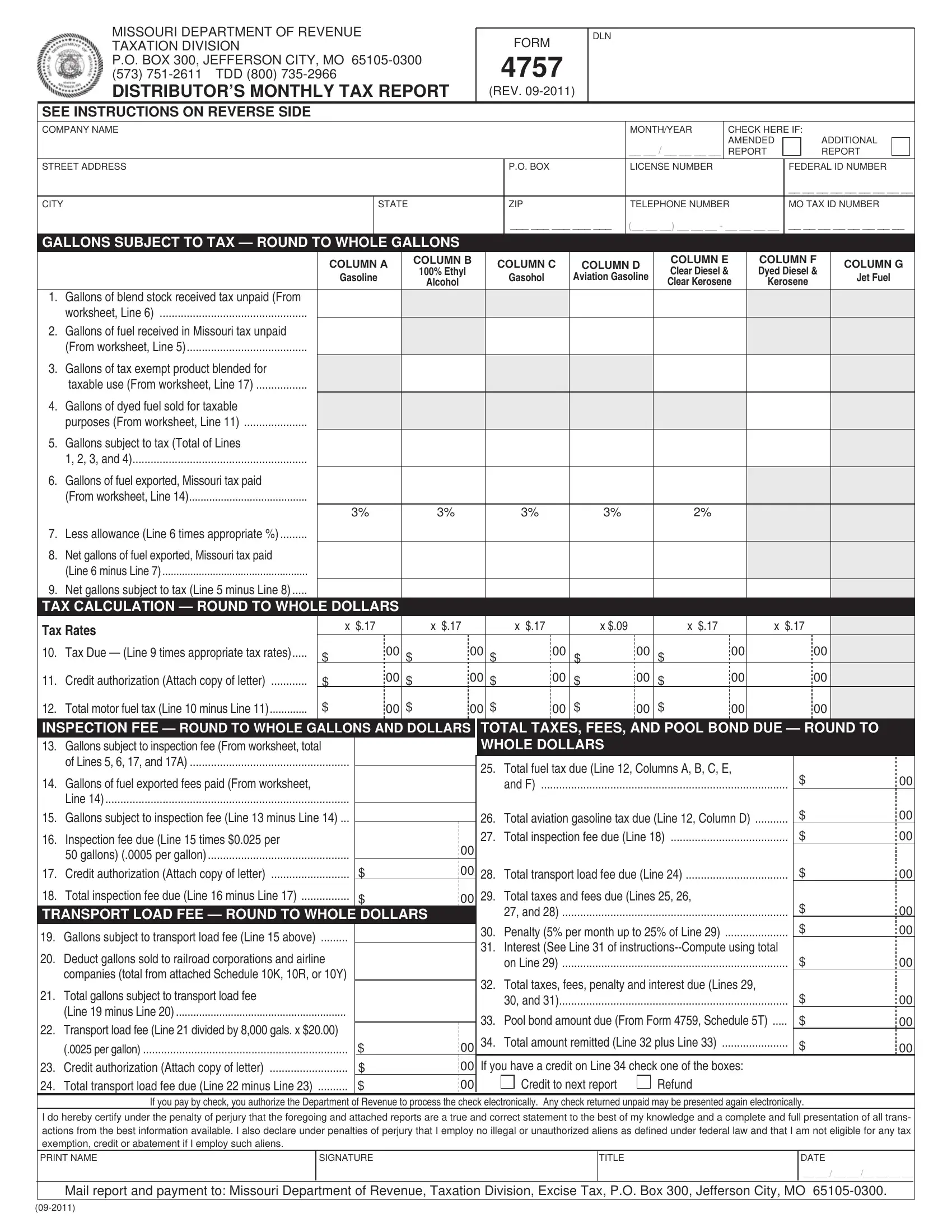

As for the fields of this particular form, here is what you should know:

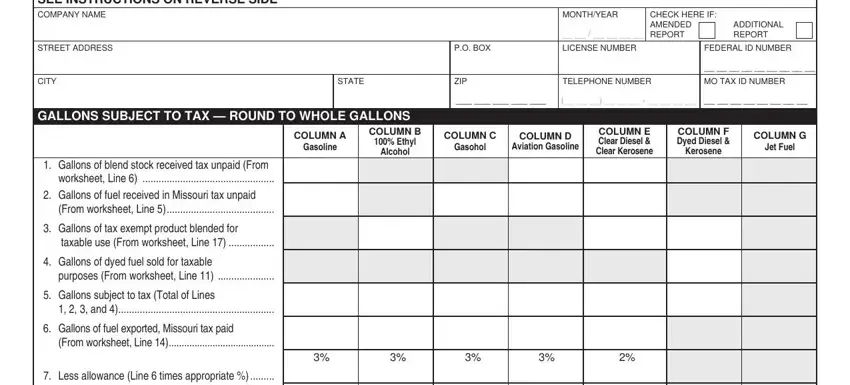

1. The missouri form 4757 requires certain information to be entered. Be sure the following blank fields are finalized:

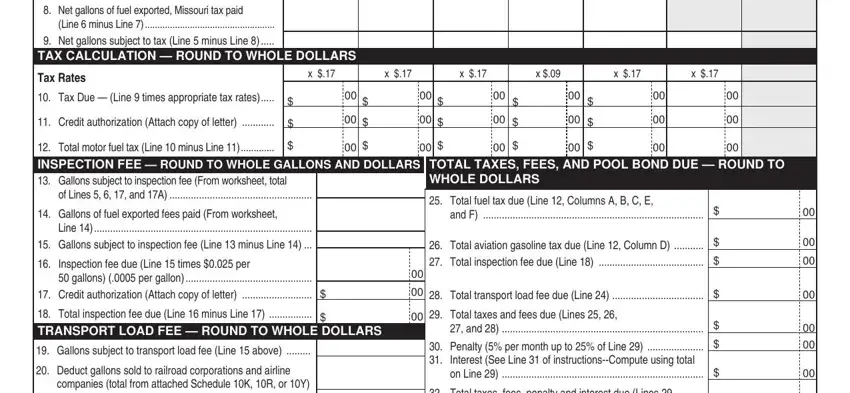

2. Once your current task is complete, take the next step – fill out all of these fields - Net gallons of fuel exported, Tax Rates, Tax Due Line times appropriate, Credit authorization Attach copy, Total motor fuel tax Line minus, of Lines and A, Gallons of fuel exported fees, Inspection fee due Line times, Total inspection fee due Line, Gallons subject to transport load, Deduct gallons sold to railroad, companies total from attached, TOTAL TAXES FEES AND POOL BOND DUE, Total fuel tax due Line Columns, and and F with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

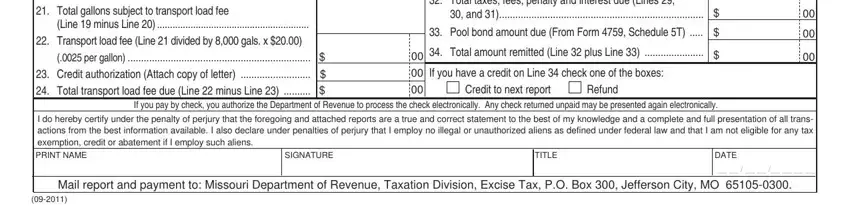

3. The following portion is mostly about Line minus Line, Total gallons subject to, Total taxes fees penalty and, and, Pool bond amount due From Form, Total amount remitted Line plus, If you have a credit on Line, Credit to next report, Refund, If you pay by check you authorize, I do hereby certify under the, SIGNATURE, TITLE, DATE, and Mail report and payment to - fill out all these empty form fields.

When it comes to Pool bond amount due From Form and Total gallons subject to, ensure you review things in this section. Both of these are the most significant fields in this file.

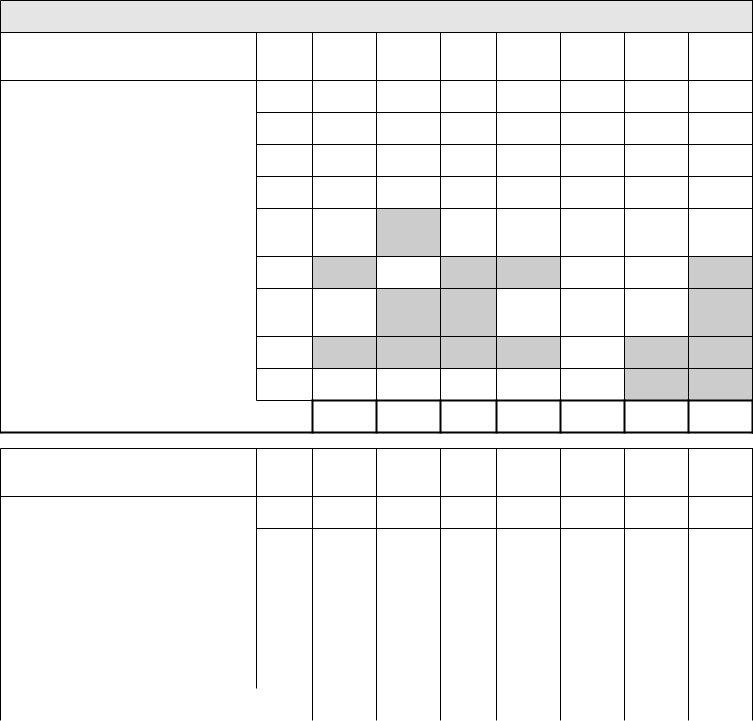

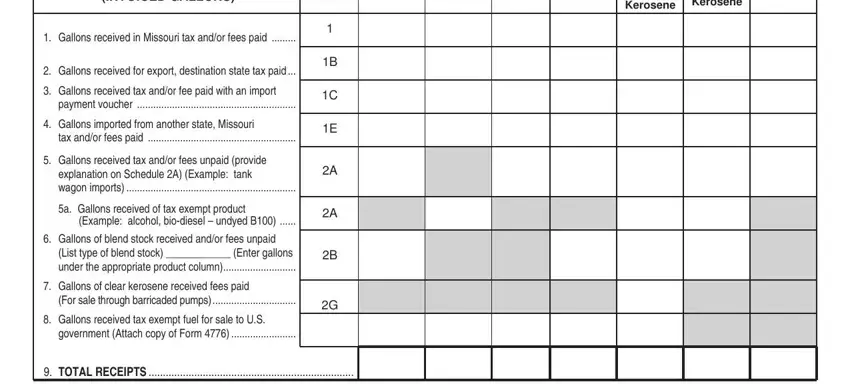

4. This part arrives with all of the following fields to type in your particulars in: INVOICED GALLONS, Schedule, Alcohol, Aviation Gasoline, Clear Diesel Clear Kerosene, Diesel Kerosene, Gallons received in Missouri tax, Gallons received for export, Gallons received tax andor fee, payment voucher, Gallons imported from another, tax andor fees paid, Gallons received tax andor fees, explanation on Schedule A Example, and a Gallons received of tax exempt.

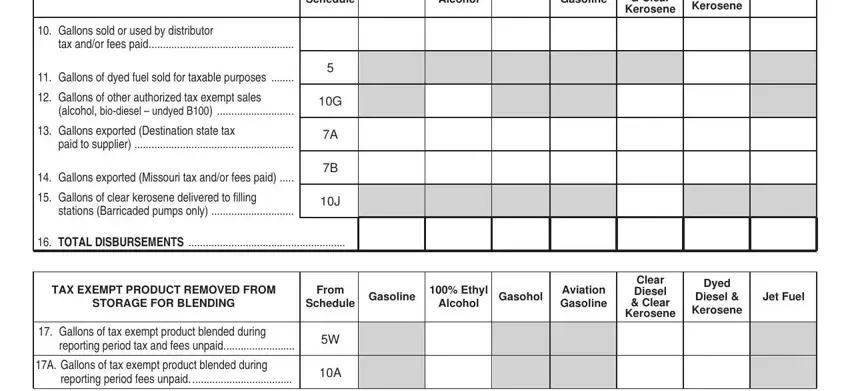

5. This last step to finalize this PDF form is pivotal. You'll want to fill out the mandatory form fields, particularly DISBURSEMENTS, Schedule, Alcohol, Aviation Gasoline, Clear Diesel Clear Kerosene, Diesel Kerosene, Gallons sold or used by, tax andor fees paid, Gallons of dyed fuel sold for, Gallons of other authorized tax, alcohol biodiesel undyed B, Gallons exported Destination, paid to supplier, Gallons exported Missouri tax, and Gallons of clear kerosene, before using the pdf. Otherwise, it might lead to an incomplete and probably invalid paper!

Step 3: Soon after looking through the fields, hit "Done" and you're done and dusted! Obtain the missouri form 4757 the instant you join for a 7-day free trial. Easily access the pdf document within your personal cabinet, along with any edits and changes being all synced! FormsPal provides protected document editing without personal information recording or sharing. Feel comfortable knowing that your data is secure here!