When working in the online PDF editor by FormsPal, you can complete or edit Missouri Form 4795 right here and now. FormsPal is dedicated to providing you the absolute best experience with our tool by consistently presenting new functions and enhancements. Our editor is now much more useful thanks to the most recent updates! Currently, working with PDF forms is easier and faster than ever. All it requires is just a few simple steps:

Step 1: First, access the tool by pressing the "Get Form Button" above on this webpage.

Step 2: When you open the tool, you'll notice the document ready to be filled in. Besides filling out different blanks, you might also perform some other things with the PDF, particularly adding your own text, editing the initial textual content, inserting images, affixing your signature to the form, and much more.

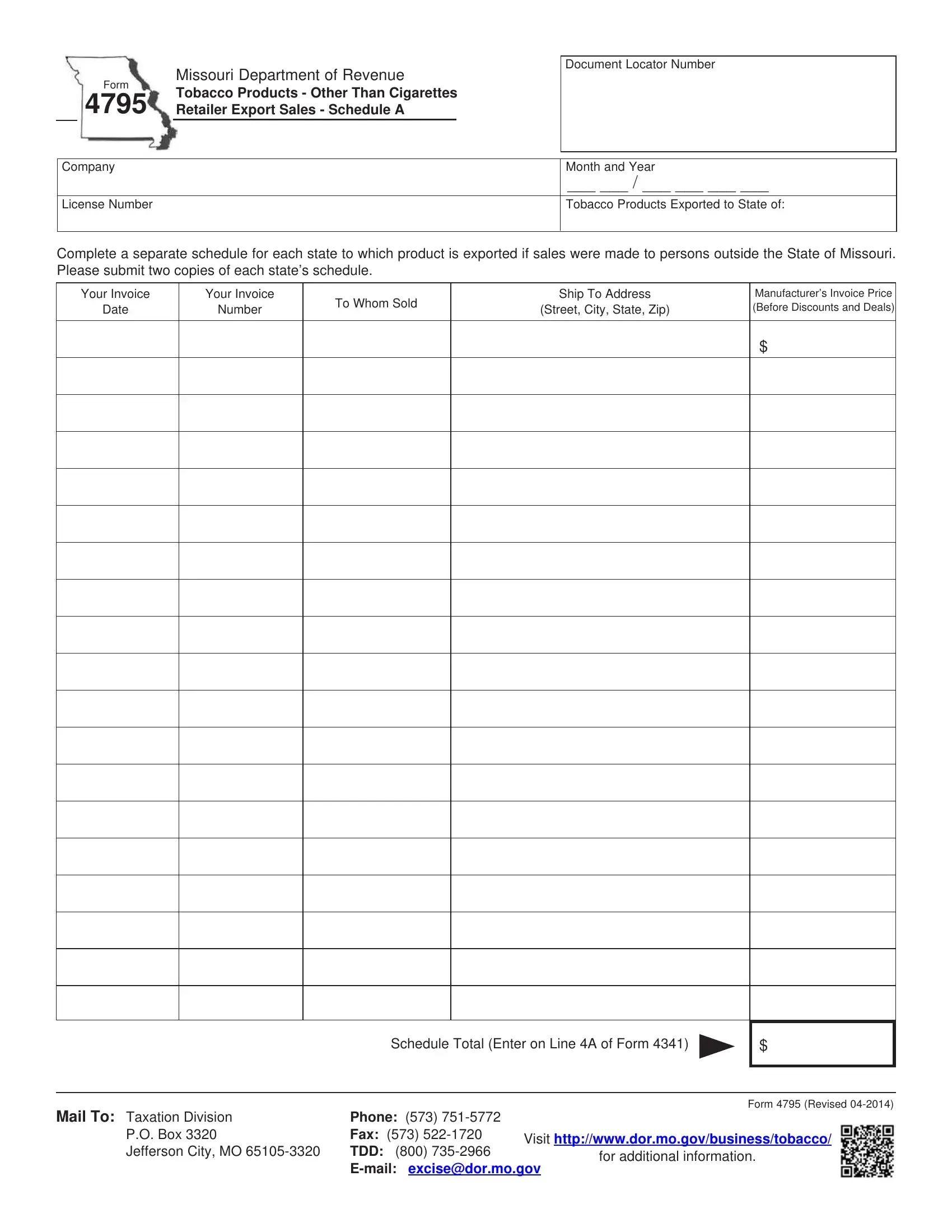

As a way to complete this PDF document, ensure that you enter the information you need in every single field:

1. The Missouri Form 4795 requires particular details to be entered. Be sure the following blanks are finalized:

Step 3: Confirm that your details are accurate and click on "Done" to proceed further. Make a free trial plan with us and acquire instant access to Missouri Form 4795 - download, email, or change from your FormsPal account. We do not share any information you provide whenever completing documents at our website.