Dealing with PDF documents online can be a breeze with our PDF tool. Anyone can fill out Missouri Form 8821 here painlessly. The editor is constantly improved by our team, getting useful functions and becoming even more convenient. Starting is effortless! What you need to do is stick to these simple steps down below:

Step 1: Just click the "Get Form Button" in the top section of this page to access our pdf editing tool. This way, you will find everything that is necessary to work with your document.

Step 2: As soon as you launch the file editor, you will notice the document prepared to be completed. Besides filling out different fields, you might also perform many other actions with the form, specifically adding custom text, editing the initial text, adding illustrations or photos, placing your signature to the document, and a lot more.

Pay attention when filling in this document. Make sure every blank is completed correctly.

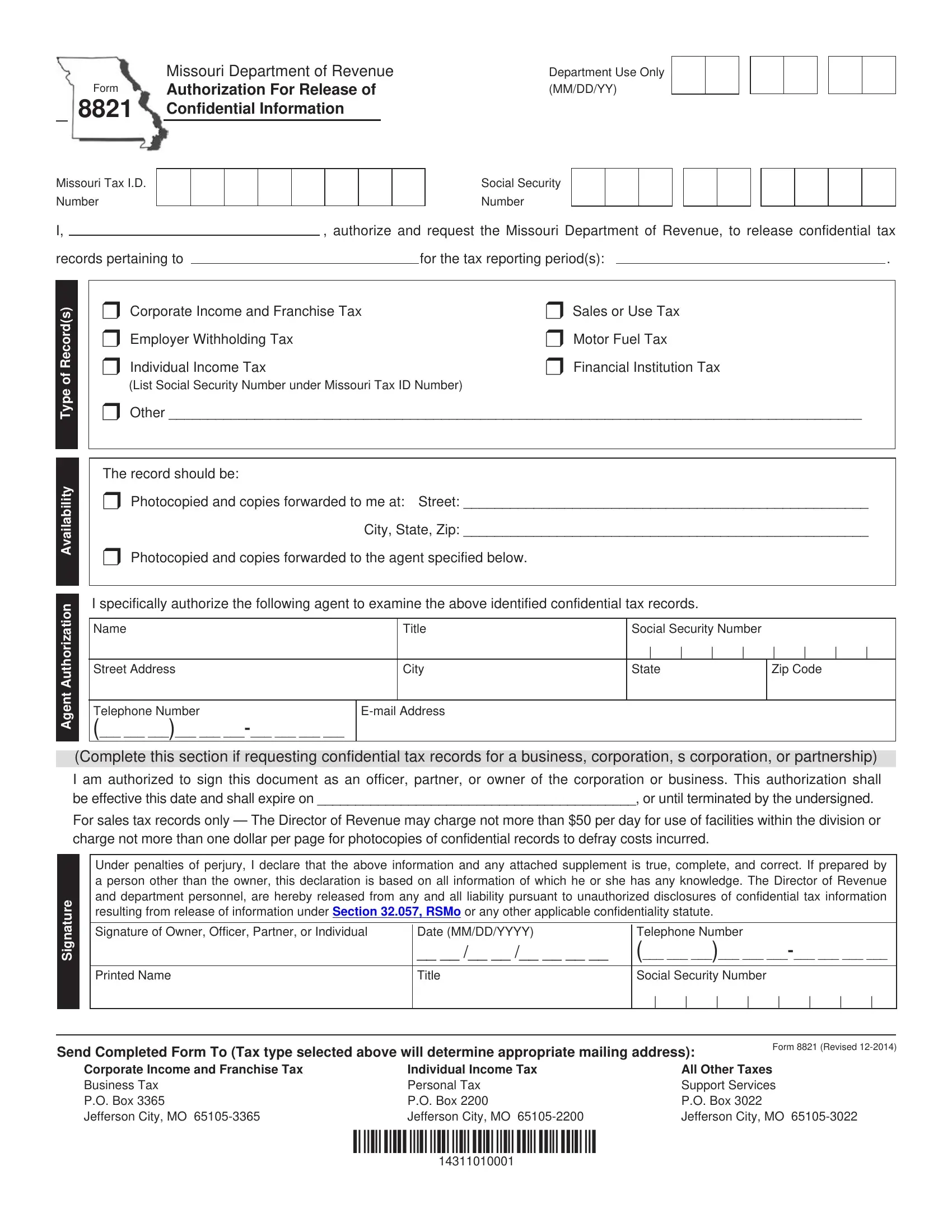

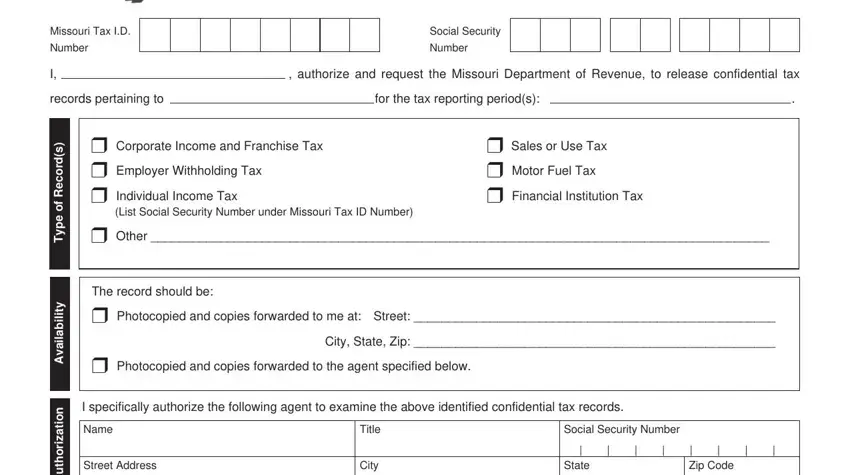

1. To start with, while completing the Missouri Form 8821, start in the page that features the next fields:

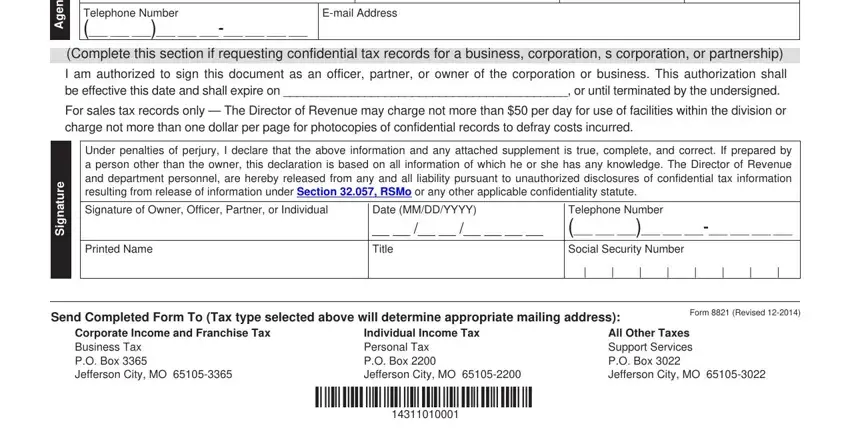

2. When this array of blanks is done, proceed to enter the applicable information in these - t n e g A, Telephone Number, Email Address, Complete this section if, I am authorized to sign this, For sales tax records only The, e r u t a n g S, Under penalties of perjury I, Signature of Owner Officer Partner, Printed Name, Date MMDDYYYY, Title, Telephone Number Social, Send Completed Form To Tax type, and Corporate Income and Franchise Tax.

It is easy to make an error while filling out the Telephone Number, consequently be sure to go through it again before you'll submit it.

Step 3: After you have looked once more at the information in the file's blank fields, click "Done" to complete your FormsPal process. Go for a free trial subscription at FormsPal and gain instant access to Missouri Form 8821 - downloadable, emailable, and editable inside your personal cabinet. FormsPal guarantees your information confidentiality via a protected system that in no way records or distributes any kind of sensitive information used in the file. Be assured knowing your paperwork are kept protected when you work with our services!