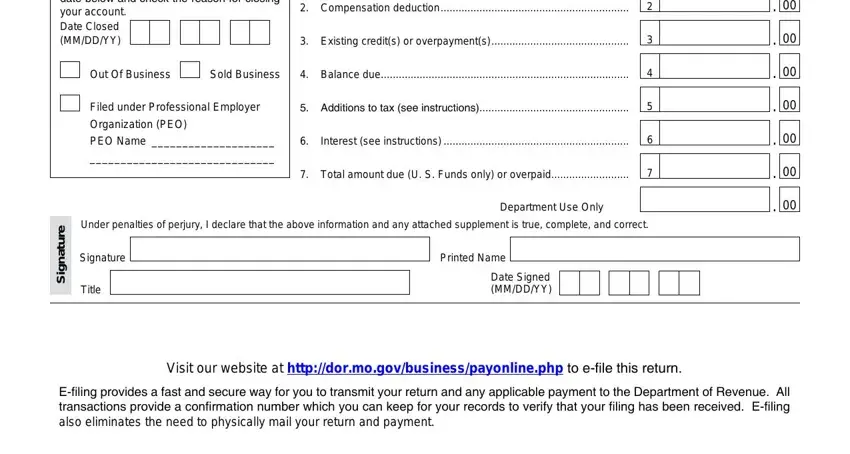

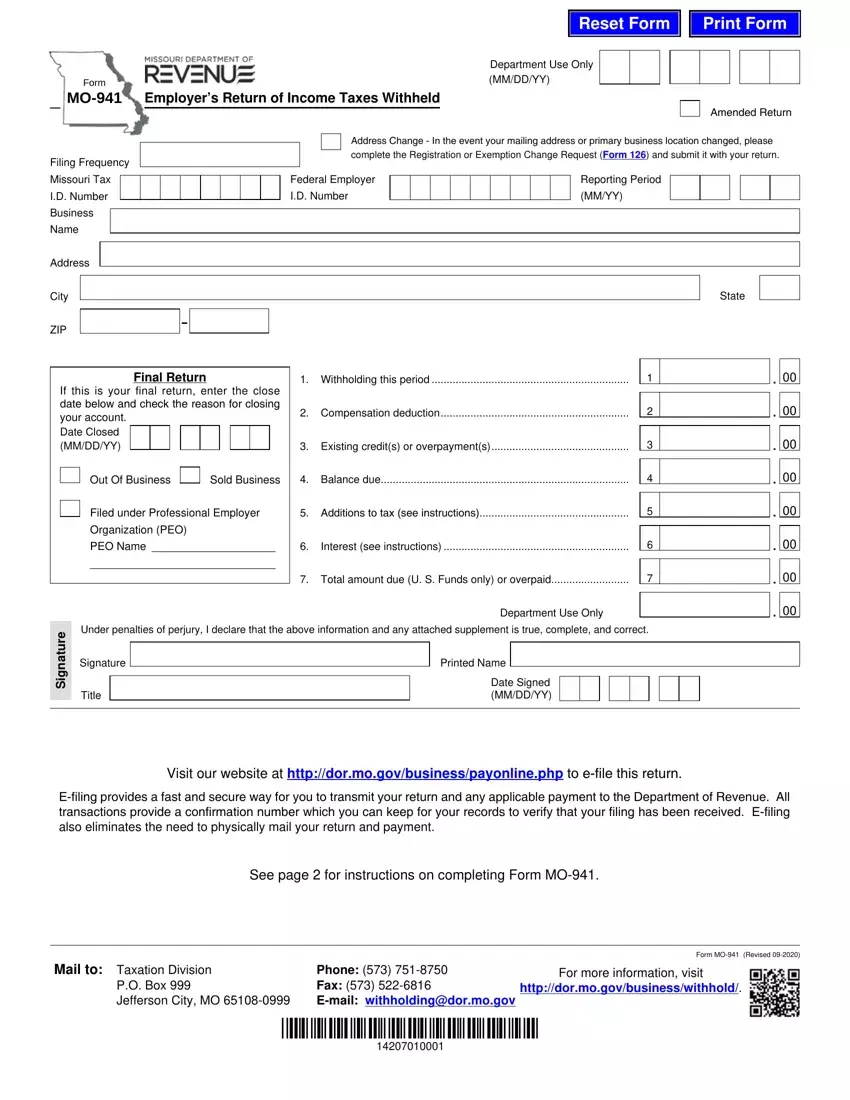

Amended Return Box should be selected if you have previously filed a return and need to increase or decrease tax liability.

Note: A separate MO-941 must be filed for each tax period in which tax liability needs to be adjusted.

If the increased return and payment are being submitted after the period(s) due date, penalties and interest will apply to the additional amount of tax liability reported. Visit http://dor.mo.gov/business/withhold to view the due dates in the Employer’s Withholding Tax Guide.

To show a decrease in liability: attach proper documentation for verification of changes made. Provide a copy of the W-2C if the error was caught after the original W-2 was submitted. Provide a copy of the payroll ledger if the error was caught before a W-2 was issued. To correct withholding on a 1099-R submit a copy of the original 1099-R, and a copy of the corrected 1099-R to show the change in tax due.

Note: If documentation is not provided for an amended return, no changes will be made.

Note: if an overpayment has been authorized, the overpayment is subject to be used as an offset toward any debt. To receive a refund of the overpayment attach the Employer’s Refund Request (Form 4854). If no form is attached, overpayment(s) generated will remain as credit(s) on the account. For additional information and to locate the refund request form visit the Online Credit Inquiry System at http://www.dor.mo.gov/business/creditinquiry/.

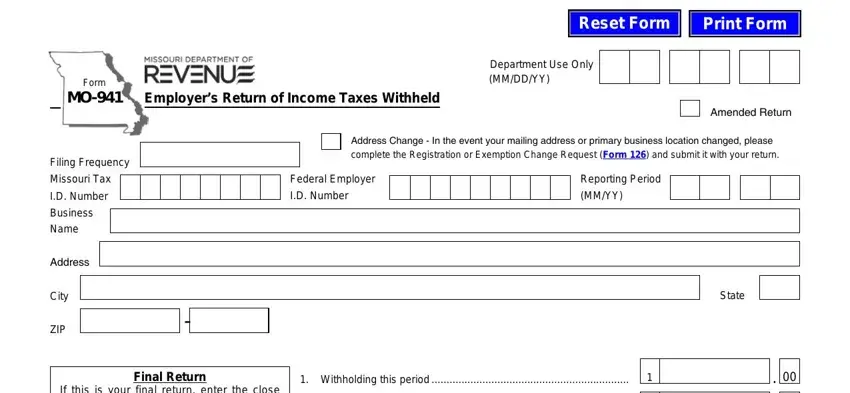

Address Change Check Box — This box should be selected if you need to update or correct the address of your business. Please complete the Registration or Exemption Change Request (Form 126) and submit it with your return.

Filing Frequency — This is the frequency in which you are required to file your returns.

Missouri Tax I.D. Number — An eight digit number issued by the Missouri Department of Revenue to identify your business. If you have not registered for an identification number you can do so by visiting https://dor.mo.gov/registerbusiness/index.php or by completing the Missouri Tax Registration Application (Form 2643). If you have misplaced this identification number and are an authorized person for the account, you may call (573) 751-5860 to obtain the number issued to you.

Federal Employer I.D. Number — This is a nine digit identification number issued by the Internal Revenue Service to identify your business.

Reporting Period — This is the tax period you are required to file based on your filing frequency. For due dates you may access Form 2414W at http://dor.mo.gov/forms/.

Business Name, Address, City, State, and ZIP — Enter the name, address, city, state and ZIP code of your business.

Line 1

Withholding This Period — Enter the total amount of state withholding tax withheld for the reporting period. If there was no withholding during the reporting period enter zero.

Line 2

Compensation Deduction — Enter the amount retained for timely payment(s). For a breakdown of compensation deduction, see the Employer’s Withholding Tax Guide (Form 4282) at http://dor.mo.gov/business/withhold/.

Line 3

Existing Credits or Overpayments — If your withholding account has an existing credit, enter the amount to apply towards the report period. To determine the amount of credit on an account view the Online Credit Inquiry System at http://dor.mo.gov/business/creditinquiry/.

Line 4

Balance Due — Subtract Line 2 and Line 3, if applicable, from Line 1. Enter the difference on Line 4.

Line 5

Additions to Tax - Enter the total amount of additions on Line 5.

A.For failure to pay withholding tax by the due date – subtract Line 3, if applicable, from Line 1 and multiply the result by 5%; or

B.For failure to file your return by the due date – subtract Line 3, if applicable, from Line 1 and multiply the result by 5% for each month late, not to exceed 25%.

Line 6

Interest — Enter on Line 6. Divide the annual interest rate by 365 (366 for leap years) to obtain the daily interest rate. Then subtract Line 3 from Line 1 and multiply the result by the daily interest rate for each day late.

* The annual interest rate is subject to change each year. Access the annual interest rate at http://dor.mo.gov/intrates.php.

Line 7

Total Amount Due or Overpaid — Add Lines 4, 5 and 6. An overpayment should reflect a negative figure.

Sold Business

Sold Business