The Momentum Myriad Application form encapsulates a comprehensive process designed to tailor a life insurance policy to fit the specific needs of its applicants. This detailed document covers various crucial aspects, starting from basic policy information, questioning whether it aligns with group solutions or stands alone, to the intricate details about the insured lives under the policy. It inquires about the total number of beneficiaries, stand-alone benefits, and if the application constitutes part of multiple policies, thus demonstrating the form's thorough reach in understanding the client's requirements and circumstances. Furthermore, it delves into policy start dates, offering options for automatic or fixed commencements, emphasizing the importance of timing in policy activation. The form also addresses the vital role financial advisers play, including their commission splits and the requisite confirmation of their understanding and acceptance of marketing life insurance under regulatory standards. This aspect underscores the collaboration between clients, advisers, and Momentum in crafting the insurance coverage. The application probes into more personal territories, such as the insured lives' details, highlighting the necessity of accurately capturing client data for tailored insurance solutions. It assesses the potential policyholder's financial stability, health history, and occupation, factors that significantly influence policy terms and conditions. Furthermore, the form inquires about any existing insurance policies or applications, ensuring transparency and avoiding overlaps or unnecessary replacements that might not serve the client's best interests. Remarkably, it incorporates sections for declaring any hazardous avocations and detailed medical history, pinpointing risks that could affect policy terms or necessitate special underwriting considerations. Lastly, with options to connect with Momentum Interactive and queries about lifestyle and health for possible discounts, the application exemplifies a holistic approach towards customizing life insurance, thereby offering a glimpse into the meticulous and client-centric nature of the Momentum Myriad Application process.

| Question | Answer |

|---|---|

| Form Name | Momentum Myriad Application Form |

| Form Length | 26 pages |

| Fillable? | Yes |

| Fillable fields | 1373 |

| Avg. time to fill out | 35 min 8 sec |

| Other names | ADW, DFIX, RMB, RSA |

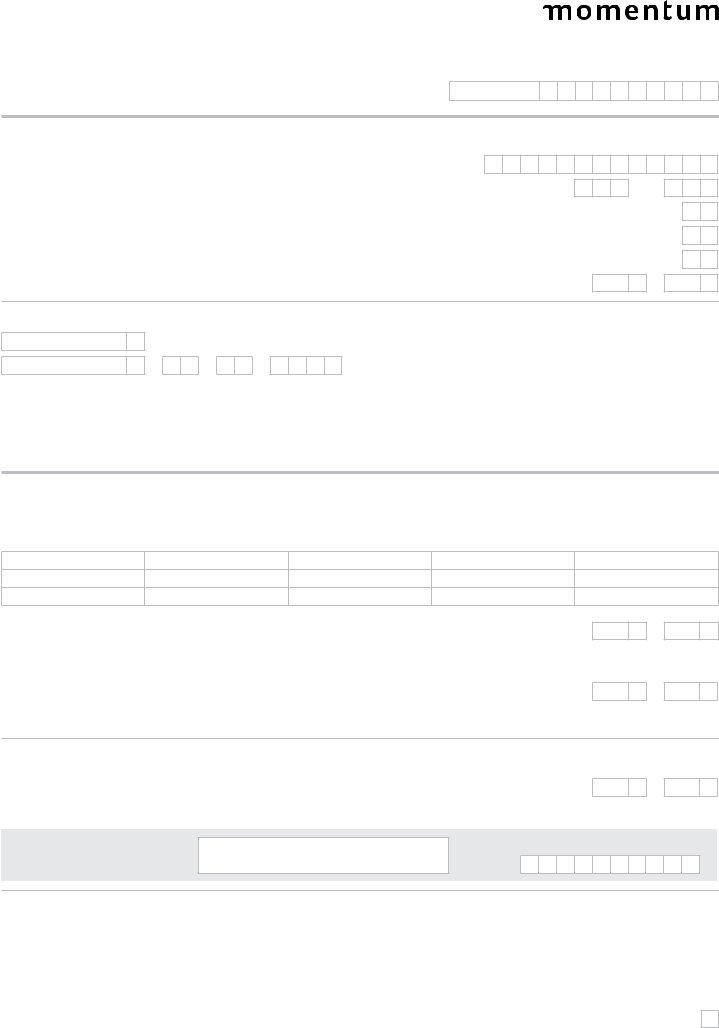

Application for Myriad

Policy number

Policy details

Is this application for one of a group of policies? |

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

||

Is this policy linked to a Myriad group solution policy? |

Yes |

|

|

No |

|

|

|

|

|

|

|

How many clients (insured lives and applicants) are there under this policy?

How many

How many beneiciaries does this policy have?

Multiply application included? |

Yes |

|

|

No |

|

|

|

|

|

|

|

Group number

Please number this application

Is this a conforming policy?

Yes

of

No

Starting date of policy

Automatic starting date

Fixed starting date*

The starting date will be the irst day of the month following the acceptance of the beneits.

0 1 – M M – 2 0 Y Y

* The starting date will be the date that the applicant has indicated, unless:

1.Momentum accepts the beneits after the date that the applicant has indicated and provided that none of the insured lives has had a birthday between the indicated date and the date of acceptance. The starting date will then be the irst day of the month following acceptance.

2.Momentum accepts the beneits after the date that the applicant has indicated and one of the insured lives has had a birthday between the indicated date and the date of acceptance. The starting date will then be the irst day of the month of the insured life’s birthday.

Financial adviser details

The commission split below applies to the entire policy contract. * Please complete details of servicing inancial adviser.

Name |

Financial adviser’s code |

Broker house code |

Commission ref no |

Commission split % |

*

Are you registered to market life insurance under the Association for Savings & Investment South Africa (ASISA) and are you fully conversant with and do you accept the ‘S’ reference system and the consequences thereof?

Yes

No

Fastlane requires the inancial adviser’s consent for the Momentum medical staff to visit the client

I request Momentum to contact my client(s) directly if the company requires additional medical information or tests. If you

do not want Momentum to contact your client, please mark No. (This service may not be available in certain areas and/or Yes for specialised examinations.)

Please complete the consultation address of the client in the space that we provide below the doctor’s information in Section 1.

No

FICA declaration

I conirm that I have identiied the client, including the policyholder, insured life/lives, premium payer and cessionary, where applicable, and veriied his/her/their details on this contract under the requirements that Section 21 of the Financial Intelligence Centre Act, No 38 of 2001 sets out. I further conirm that, in terms of section 22 of the same Act, I have stored all the veriication documents.

Yes

No

Signature of servicing inancial adviser

Date

D

D

–

M M

–

20

Y

Y

MYRIAD0010309E RISKAPP

1