You are able to complete seterus form pdf easily using our PDFinity® PDF editor. To have our editor on the leading edge of efficiency, we aim to integrate user-oriented features and enhancements on a regular basis. We're routinely looking for suggestions - play a vital part in revampimg how you work with PDF docs. Starting is easy! Everything you need to do is stick to the next easy steps directly below:

Step 1: First, open the editor by clicking the "Get Form Button" in the top section of this site.

Step 2: The tool gives you the capability to change your PDF form in many different ways. Transform it by including customized text, correct existing content, and put in a signature - all within a couple of mouse clicks!

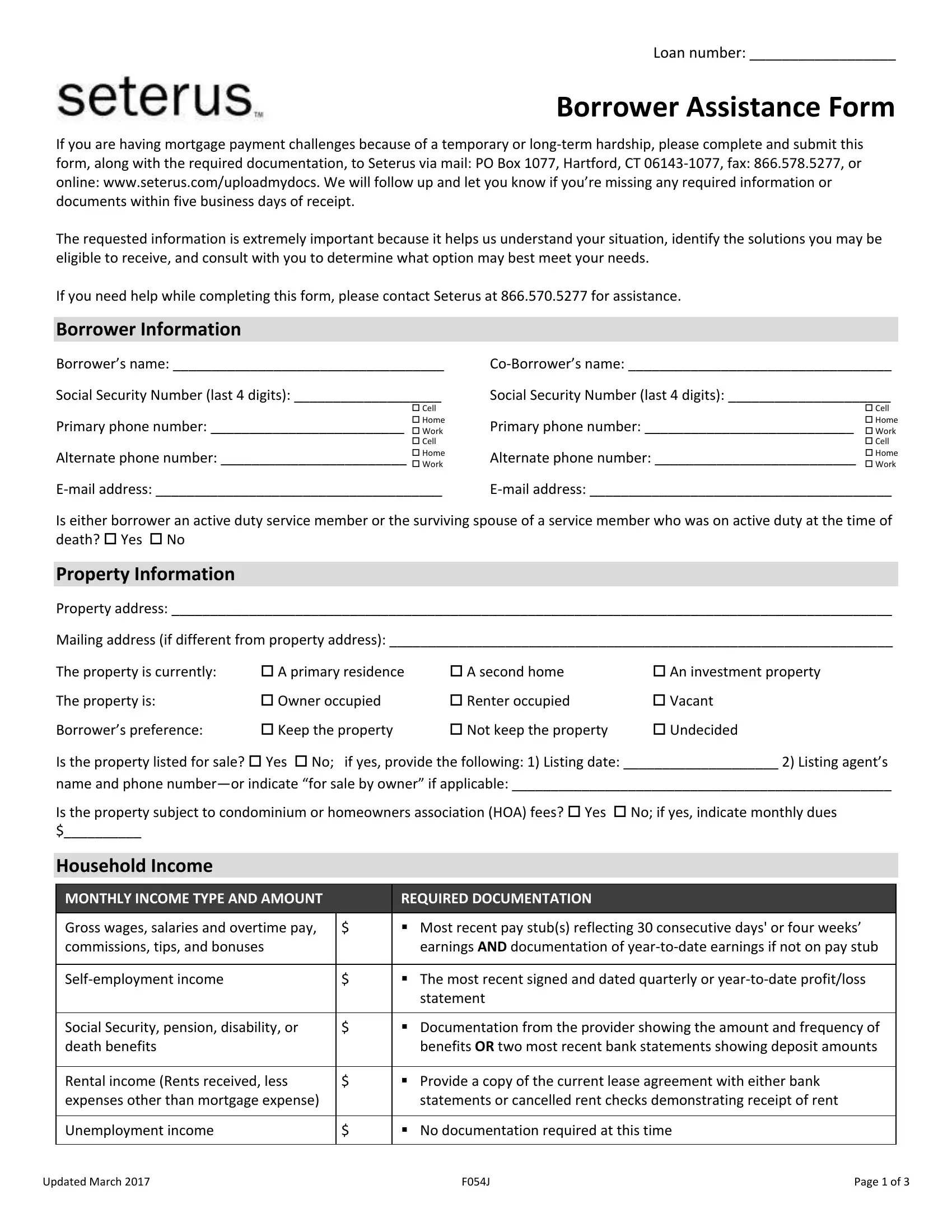

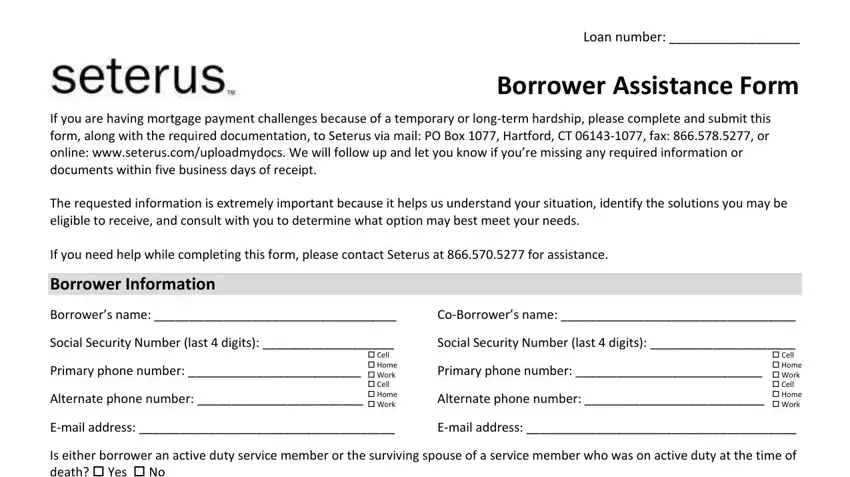

This PDF doc will need specific information; to guarantee accuracy, please be sure to heed the following steps:

1. Start filling out the seterus form pdf with a selection of essential blanks. Note all of the important information and make certain not a single thing forgotten!

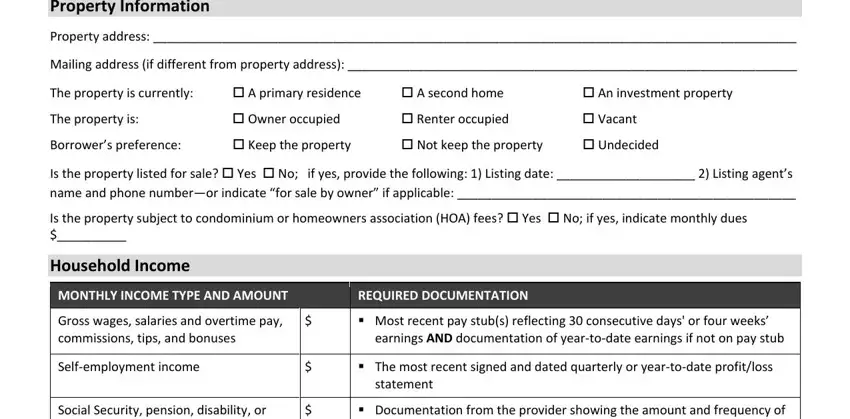

2. Once your current task is complete, take the next step – fill out all of these fields - Property Information, Property address, Mailing address if different from, The property is currently A, A second home, An investment property, The property is, Owner occupied, Renter occupied, Vacant, Borrowers preference, Keep the property, Not keep the property, Undecided, and Is the property listed for sale with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

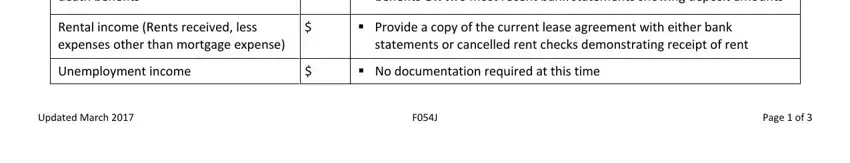

3. The next part is simple - fill in every one of the form fields in Social Security pension disability, Rental income Rents received less, Unemployment income, Updated March, Documentation from the provider, Provide a copy of the current, statements or cancelled rent, No documentation required at this, and Page of to conclude the current step.

It is possible to get it wrong when filling in the Provide a copy of the current, consequently make sure that you take another look before you'll submit it.

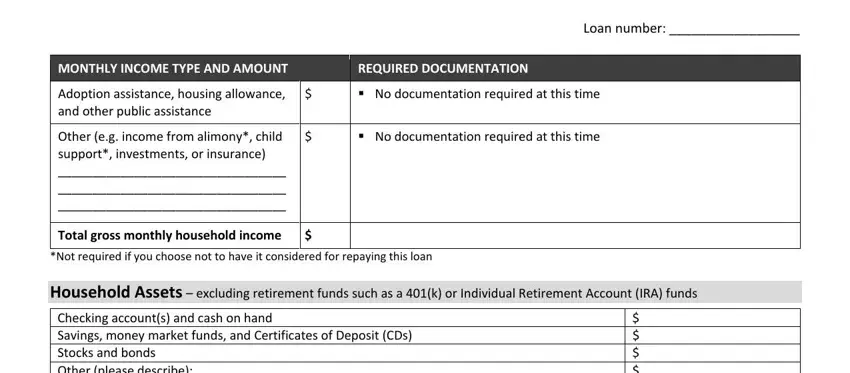

4. It is time to begin working on this fourth part! In this case you will get these Loan number, MONTHLY INCOME TYPE AND AMOUNT, REQUIRED DOCUMENTATION, Adoption assistance housing, Other eg income from alimony child, No documentation required at this, No documentation required at this, Total gross monthly household, Not required if you choose not to, and Checking accounts and cash on hand blank fields to do.

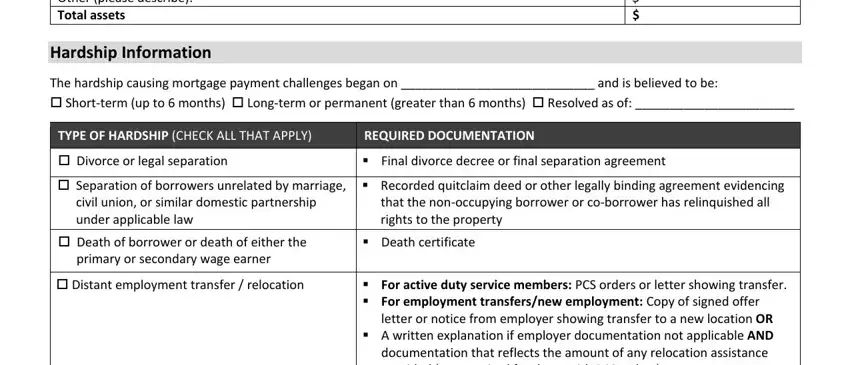

5. Since you come close to the end of your file, there are actually several extra points to do. In particular, Checking accounts and cash on hand, Hardship Information, The hardship causing mortgage, TYPE OF HARDSHIP CHECK ALL THAT, REQUIRED DOCUMENTATION, Divorce or legal separation, Final divorce decree or final, Separation of borrowers unrelated, Recorded quitclaim deed or other, civil union or similar domestic, that the nonoccupying borrower or, Death of borrower or death of, Death certificate, primary or secondary wage earner, and Distant employment transfer should all be filled out.

Step 3: Right after you have glanced through the details in the document, simply click "Done" to conclude your form at FormsPal. Make a free trial plan with us and gain immediate access to seterus form pdf - download or modify in your FormsPal account page. We do not share or sell the details that you enter when dealing with documents at our site.