The Momentum Myriad Application form encapsulates a comprehensive process designed to tailor a life insurance policy to fit the specific needs of its applicants. This detailed document covers various crucial aspects, starting from basic policy information, questioning whether it aligns with group solutions or stands alone, to the intricate details about the insured lives under the policy. It inquires about the total number of beneficiaries, stand-alone benefits, and if the application constitutes part of multiple policies, thus demonstrating the form's thorough reach in understanding the client's requirements and circumstances. Furthermore, it delves into policy start dates, offering options for automatic or fixed commencements, emphasizing the importance of timing in policy activation. The form also addresses the vital role financial advisers play, including their commission splits and the requisite confirmation of their understanding and acceptance of marketing life insurance under regulatory standards. This aspect underscores the collaboration between clients, advisers, and Momentum in crafting the insurance coverage. The application probes into more personal territories, such as the insured lives' details, highlighting the necessity of accurately capturing client data for tailored insurance solutions. It assesses the potential policyholder's financial stability, health history, and occupation, factors that significantly influence policy terms and conditions. Furthermore, the form inquires about any existing insurance policies or applications, ensuring transparency and avoiding overlaps or unnecessary replacements that might not serve the client's best interests. Remarkably, it incorporates sections for declaring any hazardous avocations and detailed medical history, pinpointing risks that could affect policy terms or necessitate special underwriting considerations. Lastly, with options to connect with Momentum Interactive and queries about lifestyle and health for possible discounts, the application exemplifies a holistic approach towards customizing life insurance, thereby offering a glimpse into the meticulous and client-centric nature of the Momentum Myriad Application process.

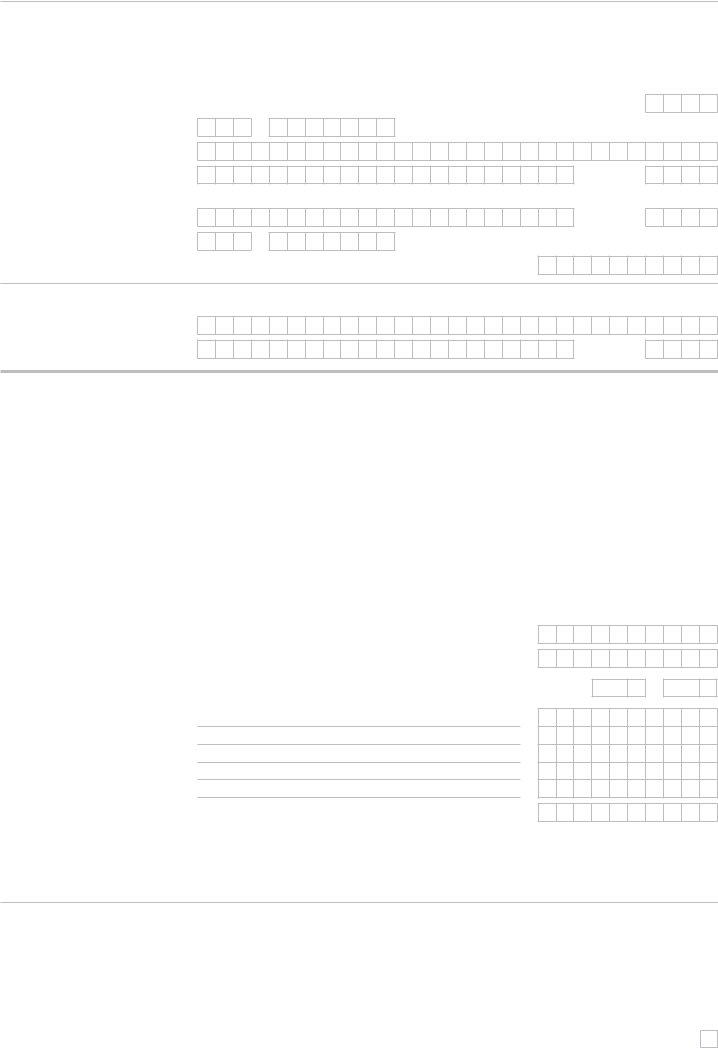

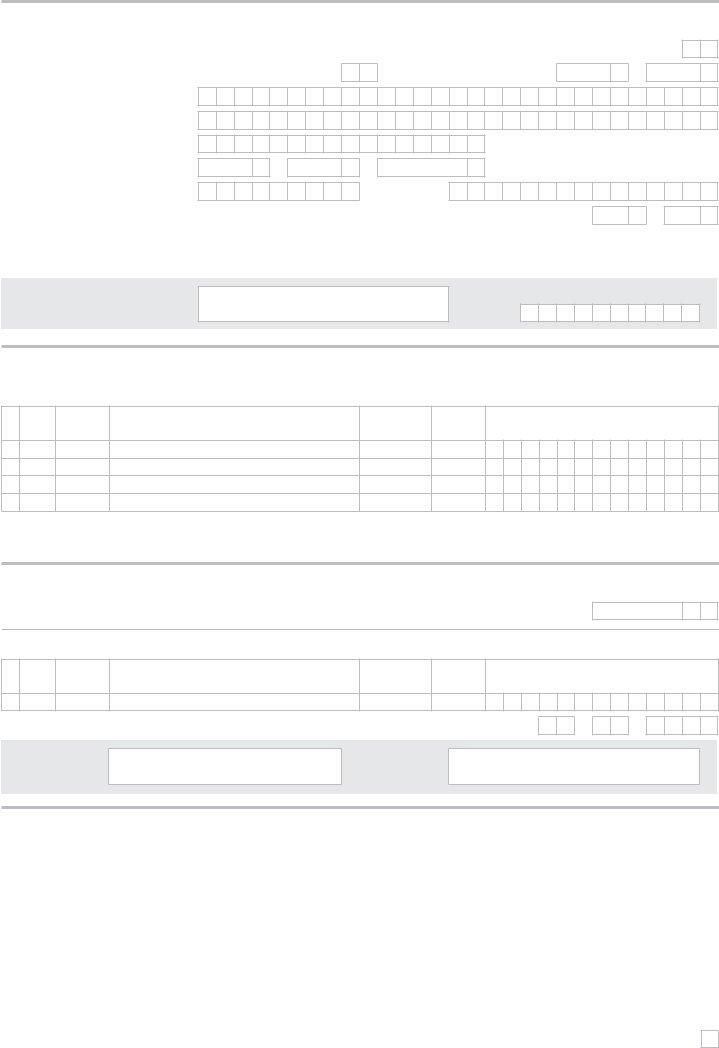

| Question | Answer |

|---|---|

| Form Name | Momentum Myriad Application Form |

| Form Length | 26 pages |

| Fillable? | Yes |

| Fillable fields | 1373 |

| Avg. time to fill out | 35 min 8 sec |

| Other names | ADW, DFIX, RMB, RSA |

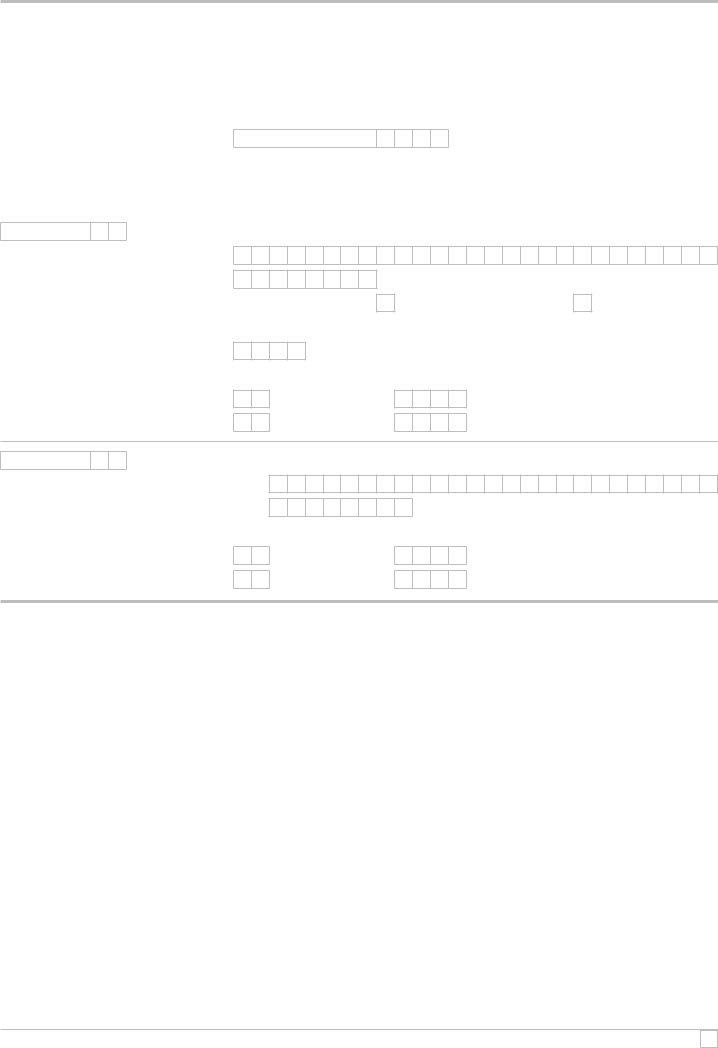

Application for Myriad

Policy number

Policy details

Is this application for one of a group of policies? |

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

||

Is this policy linked to a Myriad group solution policy? |

Yes |

|

|

No |

|

|

|

|

|

|

|

How many clients (insured lives and applicants) are there under this policy?

How many

How many beneiciaries does this policy have?

Multiply application included? |

Yes |

|

|

No |

|

|

|

|

|

|

|

Group number

Please number this application

Is this a conforming policy?

Yes

of

No

Starting date of policy

Automatic starting date

Fixed starting date*

The starting date will be the irst day of the month following the acceptance of the beneits.

0 1 – M M – 2 0 Y Y

* The starting date will be the date that the applicant has indicated, unless:

1.Momentum accepts the beneits after the date that the applicant has indicated and provided that none of the insured lives has had a birthday between the indicated date and the date of acceptance. The starting date will then be the irst day of the month following acceptance.

2.Momentum accepts the beneits after the date that the applicant has indicated and one of the insured lives has had a birthday between the indicated date and the date of acceptance. The starting date will then be the irst day of the month of the insured life’s birthday.

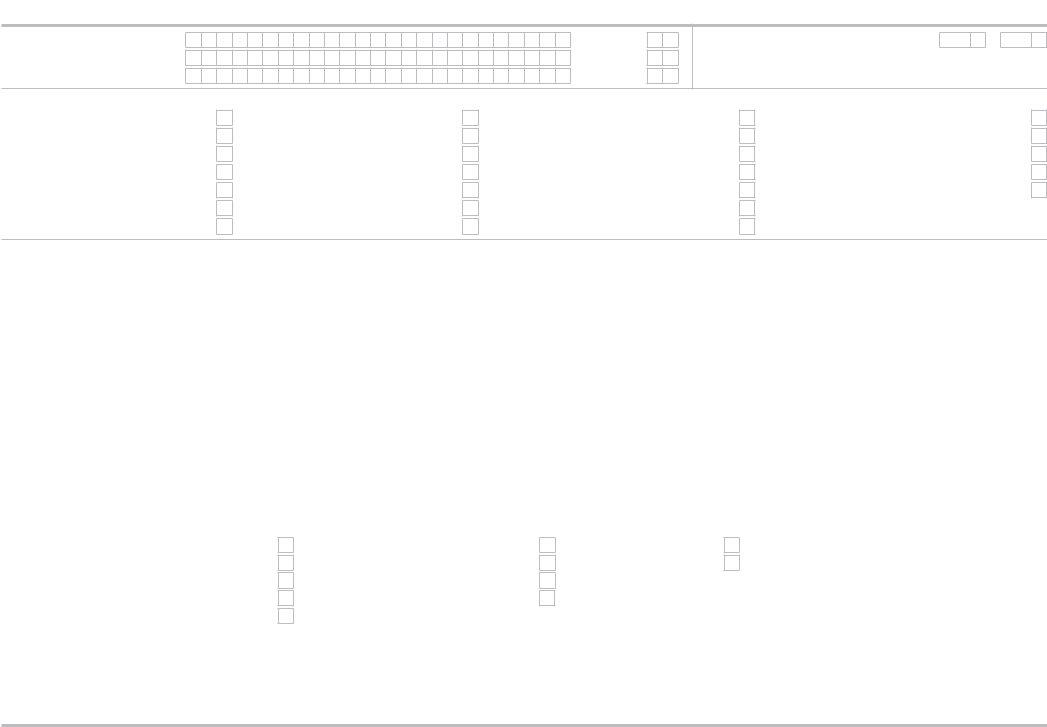

Financial adviser details

The commission split below applies to the entire policy contract. * Please complete details of servicing inancial adviser.

Name |

Financial adviser’s code |

Broker house code |

Commission ref no |

Commission split % |

*

Are you registered to market life insurance under the Association for Savings & Investment South Africa (ASISA) and are you fully conversant with and do you accept the ‘S’ reference system and the consequences thereof?

Yes

No

Fastlane requires the inancial adviser’s consent for the Momentum medical staff to visit the client

I request Momentum to contact my client(s) directly if the company requires additional medical information or tests. If you

do not want Momentum to contact your client, please mark No. (This service may not be available in certain areas and/or Yes for specialised examinations.)

Please complete the consultation address of the client in the space that we provide below the doctor’s information in Section 1.

No

FICA declaration

I conirm that I have identiied the client, including the policyholder, insured life/lives, premium payer and cessionary, where applicable, and veriied his/her/their details on this contract under the requirements that Section 21 of the Financial Intelligence Centre Act, No 38 of 2001 sets out. I further conirm that, in terms of section 22 of the same Act, I have stored all the veriication documents.

Yes

No

Signature of servicing inancial adviser

Date

D

D

–

M M

–

20

Y

Y

MYRIAD0010309E RISKAPP

1

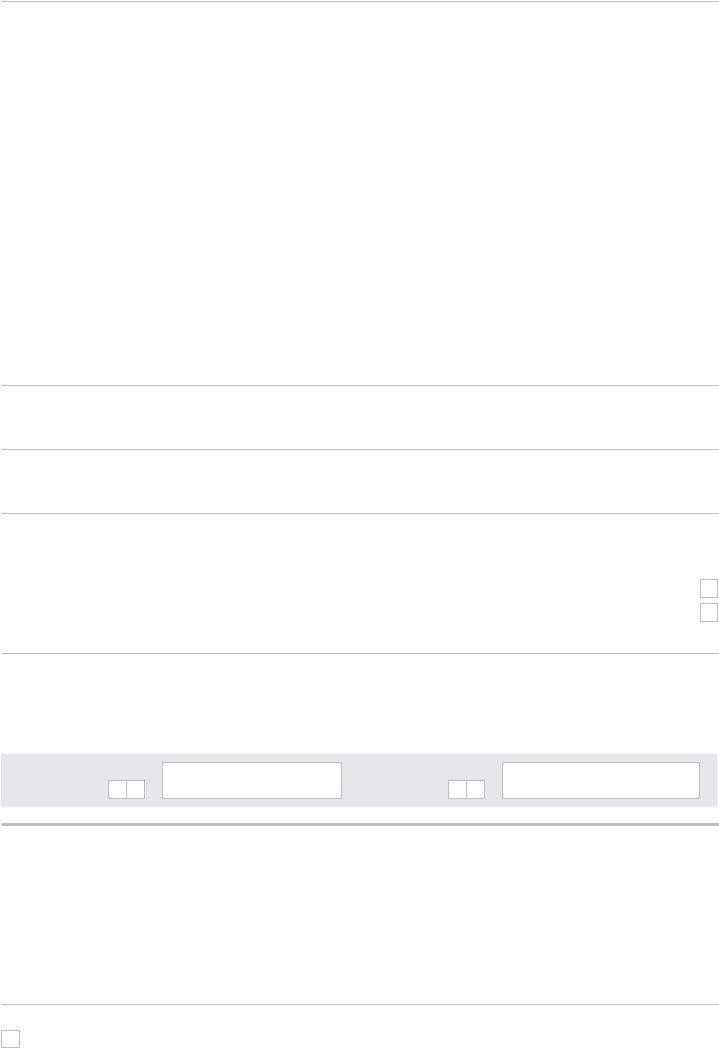

Replacement of insurance

Does this application replace the whole or any part of your existing insurance with any insurer (whether replacement is to occur immediately or to replace an insurance discontinued within the last four months or within the next four months)?

If Yes, the inancial adviser must discuss and complete the Replacement Policy Advice Record (MYRIAD013).

Yes

No

Important note: The replacement of any insurance has various potentially detrimental consequences which your inancial adviser should disclose to you.

Momentum will not automatically cancel a Momentum policy(ies) on acceptance, unless the client submits a conditional termination form with this application form.

Declaration by the inancial adviser

I hereby declare that I have requested and recorded the client’s response to the above question with regard to replacement and that the client is fully aware of the possible detrimental consequences of the replacement of an insurance policy.

I further declare that, irrespective of the client’s response to the question with regard to replacement, that I have explained the following to the client:

1.The meaning of replacement,

2.That a replacement is potentially prejudicial, and

3.That where a replacement is considered, the client is legally entitled to comprehensive information regarding the consequences of replacement.

Signature of inancial adviser

Date

D

D

–

M M

–

20

Y

Y

Marketing adviser details

Name

Branch name

Marketing adviser’s code

Telephone - work

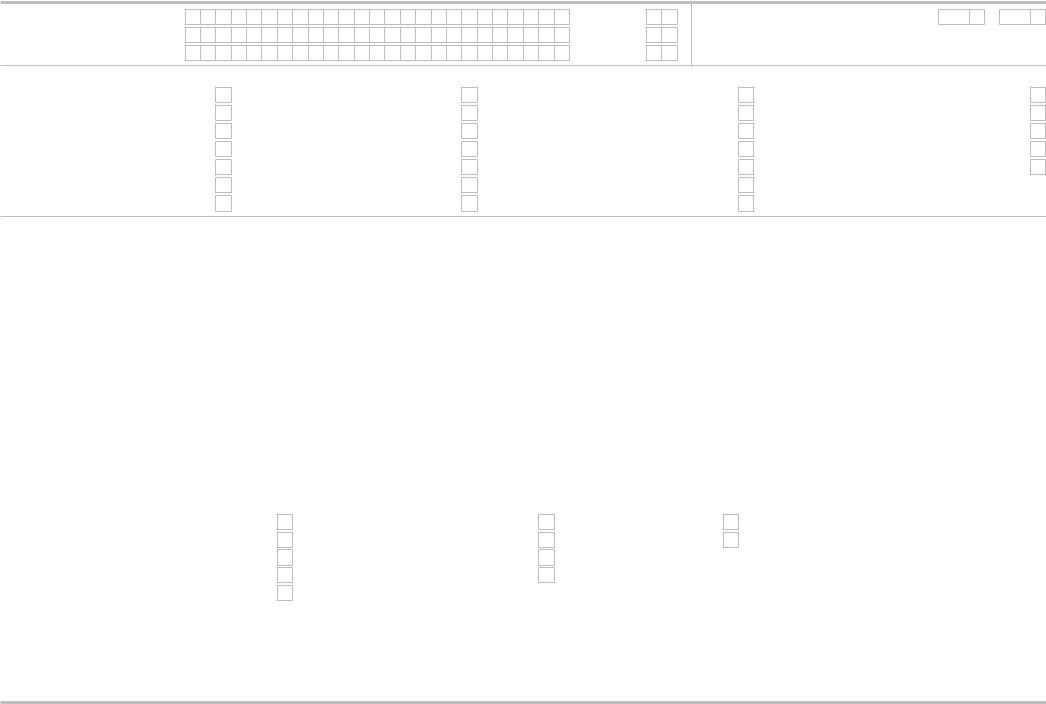

Section 1: Insured life details

ROLE(S)

Client number 0 1

Tick the appropriate role(s) that this client will play on this policy:

Policyholder (contracting party) |

|

|

% Ownership |

|

|

|

|

|

|

|

|

|

|

Insured life

X

Title

Surname

Previous surname(s)

Gender

Date of birth

Permanent identity/passport number Postal address

|

|

|

|

Initials |

|

|

|

|

First name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

Female |

|

|

Correspondence language |

English |

|

|

Afrikaans |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

D |

D |

– |

M |

M |

– |

Y |

Y |

Y |

Y |

|

|

Nationality |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permanent RSA ID |

Yes |

|

|

No |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal code |

|

|

|

|

|

|||

Residential address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal code |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Telephone - work |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax - work |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Telephone - home |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax - home |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cellphone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Which method of communication do you prefer? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Post |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Note: Certain Momentum documents are not yet available electronically and the posting of those will continue for the time being. |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Are you currently insolvent? |

Yes |

|

|

|

No |

|

|

|

|

|

|

If Yes, date of insolvency |

D |

D |

– |

M |

M |

– |

Y |

Y |

Y |

Y |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Marital status |

Single |

|

|

|

Married |

|

|

|

Separated |

|

|

|

Divorced |

|

|

Widowed |

|

|||||||||||||||

Interest of applicant in the insured |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Business overheads cover |

|

|

|

|

|

Contingent liability |

|

|

|

|

|

|

|

|||||||||||||||||||

life (need for insurance or insurable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

interest): |

Debtor’s cover |

|

|

|

Income replacement |

|

|

|

Keyperson |

|

|

Loan account protection |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Personal/Estate duty |

|

|

Security for loan/bond |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

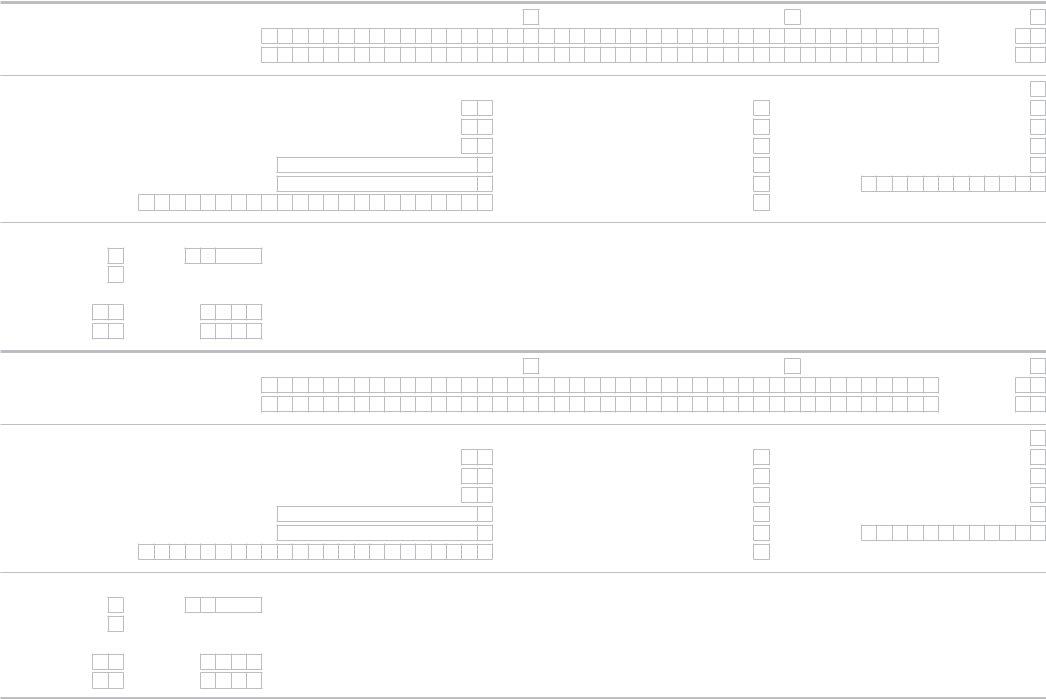

Section 1: Insured life details (continued)

Highest educational qualiication |

No matric |

|

|

Matric |

|

|

|

|

|

|

|

|

|

||||

|

|

||||

Highest educational qualiication of |

|

|

|

|

|

|

|

|

|||

No matric |

|

|

Matric |

|

|

spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Name of educational institution |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Monthly income |

Insured life |

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse |

R |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|||

Occupation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Have you been continuously employed in a permanent and |

|

Yes |

|

|

No |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Percentage of working hours spent on travel |

|

|

|

% |

|

|

|

Percentage of working hours spent on administration |

|

|

|

% |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Percentage of working hours spent on supervision |

|

|

|

% |

|

|

|

Percentage of working hours spent on manual labour |

|

|

|

% |

|||||||||||||||||

Description of main duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer

Years with current employer |

|

|

|

Industry |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Do you intend to change your career or to become involved in any other occupation? |

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|||||||||||||

If Yes, please provide details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Will your occupation require you to travel or reside outside the borders of the RSA? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

||||||||||||||

If Yes, to which country, for how long and how often? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

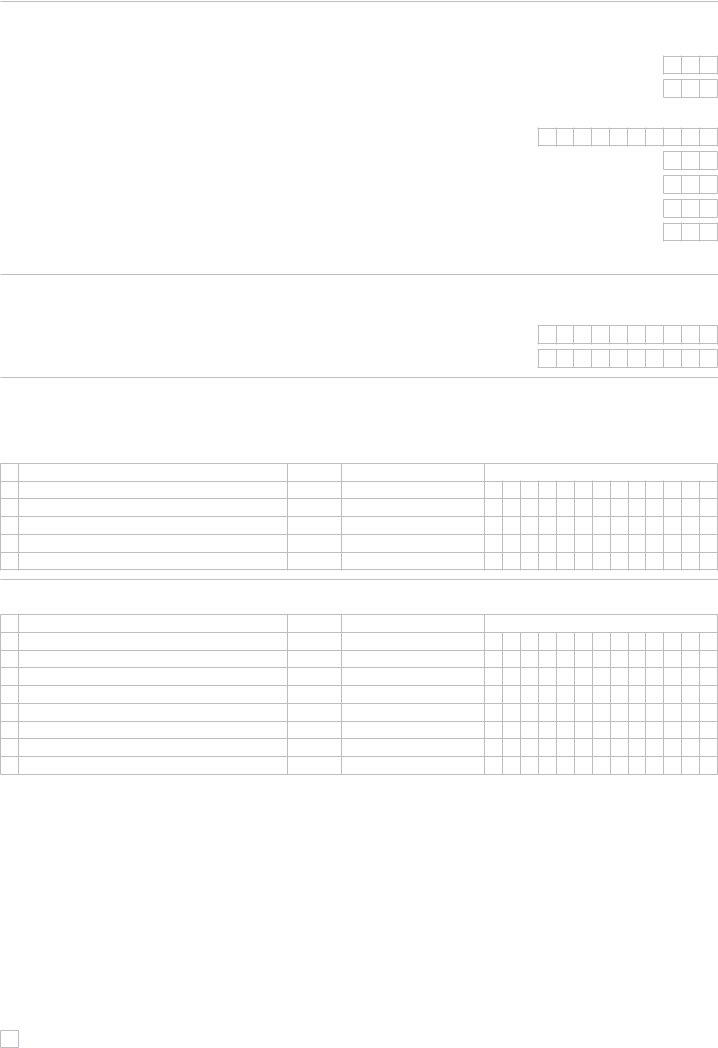

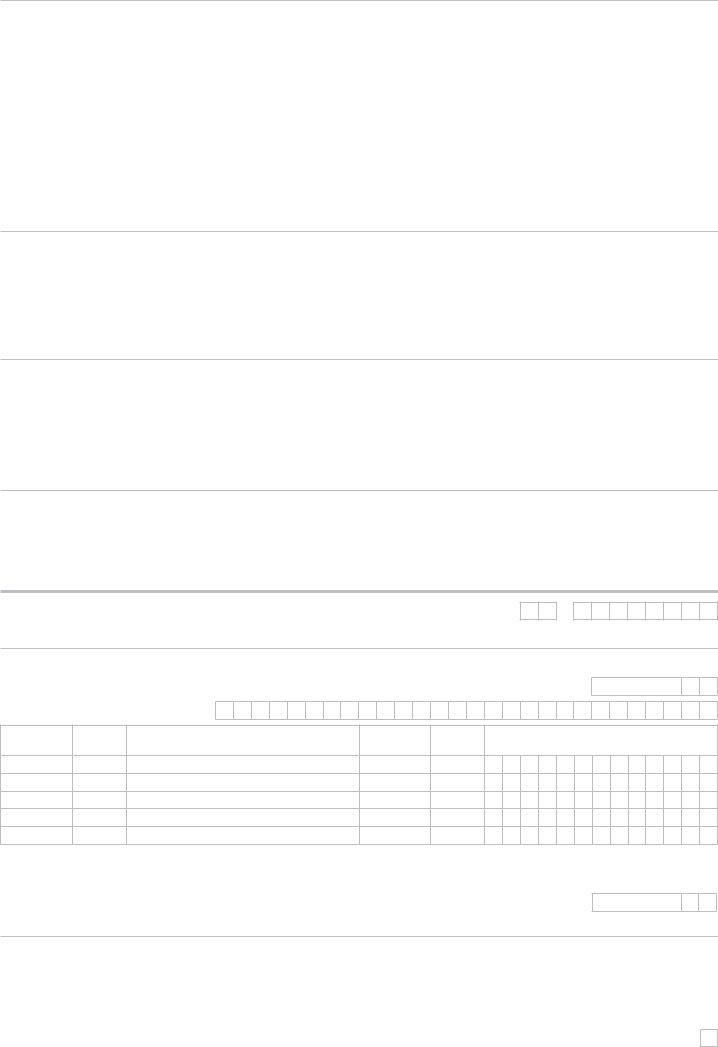

Existing insurance history

Please ill in the table below, giving the total for which your life is currently insured, as well as simultaneous applications with Momentum or any other life insurers.

Existing insurance |

|

Death beneit |

Dread disease/ |

Lump sum disability |

Monthly disability |

Unnatural death/ |

|

critical illness |

income |

accident beneit |

|||

|

|

|

|

|||

|

|

|

|

|

|

|

Business |

R |

|

R |

R |

R |

R |

|

|

|

|

|

|

|

Personal |

R |

|

R |

R |

R |

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simultaneous |

|

Death beneit |

Dread disease/ |

Lump sum disability |

Monthly disability |

Unnatural death/ |

applications |

|

critical illness |

income |

accident beneit |

||

|

|

|

||||

|

|

|

|

|

|

|

Business |

R |

|

R |

R |

R |

R |

|

|

|

|

|

|

|

Personal |

R |

|

R |

R |

R |

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Replacement |

|

Death beneit |

Dread disease/ |

Lump sum disability |

Monthly disability |

Unnatural death/ |

insurance |

|

critical illness |

income |

accident beneit |

||

|

|

|

||||

|

|

|

|

|

|

|

Business |

R |

|

R |

R |

R |

R |

|

|

|

|

|

|

|

Personal |

R |

|

R |

R |

R |

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Momentum Interactive

Do you want to become a member of Momentum Interactive?

If Yes, please complete the following:

Have you had any vehicle accident insurance claims during the last three years? Distance travelled by road during the last year (driver or passenger)

Are you the regular driver of a vehicle insured with Momentum

Please indicate your current Multiply statusNon-member Platinum

Bronze

Private club

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

km

Yes No

Silver Gold

New application*

3

Section 1: Insured life details (continued)

Momentum Interactive (continued)

Annual itness discount

Have you participated and successfully completed one of the following events during the last 12 months?

Yes |

|

|

No |

|

|

|

|

|

|

If Yes, please specify:

Running

Road cycling

Mountain biking

Triathlon

Swimming

Name of qualifying sport event

Half marathon

50 km and longer

35 km and longer

Sprint distance

Marathon and longer

90 km and longer

65 km and longer

Olympic distance and longer

> 1.5 km

Section 2: Underwriting of the insured life

Avocation

Do you, have you or do you intend to participate in any pursuit or avocation that might be considered hazardous (e.g. aviation, diving, racing, parachuting, mountaineering, mining)?

If Yes, please provide full details

Yes

No

Insurance history

Has an insurer ever declined, postponed or withdrawn any of your beneit(s) applied for, or accepted it at an increased premium, or reduced the beneit(s) applied for, or issued a beneit subject to an exclusion clause, or have you ever been medically boarded, or have you ever submitted claims for disability or

If Yes, please provide full details

Yes

No

Medical history

If you answer Yes to any question, please provide full details in the space provided.

1.Heart or blood circulation

Do you have, or have you previously had any heart or blood circulation complaints (e.g. high blood pressure, raised cholesterol, palpitations, heart attack, heart murmur, rheumatic fever, stroke, brain disorders or any cardiac

Yes |

|

|

No |

|

|

|

|

|

|

procedures)? |

|

|

|

|

|

|

|

|

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

2. Respiratory and/or lung complaints

Last symptoms

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

Y |

Y |

M |

M |

|

|

|

|

Fully recovered? |

|

|

|||

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

||||

Yes |

|

|

|

No |

|

|

|

|

|

|

|

Do you have, or have you previously had any respiratory and/or lung complaints (e.g. asthma, bronchitis,

tuberculosis, persistent coughing or any breathing problems)?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.Disorders of the digestive system, gall bladder, pancreas or liver

Do you have, or have you previously had any disorders of the digestive system, gall bladder, pancreas or liver (e.g. hiatus hernia, gall stones, hepatitis A/B/C, jaundice, gastric ulcers or recurrent indigestion problems)?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.Disorders of the kidneys, bladder or reproductive organs

Do you have, or have you previously had any disorders of the kidneys, bladder or reproductive organs (e.g. kidney stones, bladder infection, blood in urine, protein in urine or prostate problems)?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Yes |

|

No |

Y |

Y |

M |

M |

|||

4

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

Section 2: Underwriting of the insured life (continued)

Medical history (continued)

5.Nervous or mental disorders

Do you have, or have you previously had any nervous or mental disorders (e.g. depression, anxiety, consultation(s) with psychiatrist/psychologist, stress, epilepsy, migraine or blackouts)?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.Disorders of the eye, ear, nose or throat

Do you have, or have you previously had any disorders of the eye (excluding conditions corrected by glasses, contact lenses or keratotomy), ear, nose or throat (e.g. defective vision, hearing loss, hoarseness)?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.Problems with your spine, joints, bones, muscles, limbs or skin

Do you have, or have you previously had any problems with your spine, joints, bones, muscles, limbs or skin (e.g. back problems, neck problems, fractures/broken bones, gout, any arthritis, psoriasis, dermatitis)?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.Diabetes, raised blood sugar, other endocrine, glandular, blood or hormonal disorders

Do you have, or have you previously had any form of diabetes, raised blood sugar, other endocrine, glandular, blood or hormonal disorders (e.g. thyroid or other glands problems, anaemia or bleeding disorders)?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.Any form of cancer, growth or tumour

Do you have, or have you previously had any form of cancer, growth or tumour (including ibroadenomas, moles removed - both either malignant or benign)?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.Drugs, tranquillisers or any other medicines

Are you taking, or have you ever taken any drugs, tranquillisers or any other medicines in any form for any other reason than colds and lu (e.g. antidepressants, tranquillisers, any homeopathic medicines, cannabis or cocaine)?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.Have you sought any medical advice during the last ive years for any condition or symptoms, or have you been a patient in a hospital or nursing home, or undergone any medical examination (including but not limited to ECG, scans,

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered? |

||||

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

||

Yes |

|

|

No |

|

|

|

|

|

|

5

Section 2: Underwriting of the insured life (continued)

Medical history (continued)

12.Have you ever been tested for, or received any medical advice, counselling or treatment in connection with AIDS, or any infection by one of the

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.Are you aware of any other illness, disorder, disability or accident, including motor vehicle accidents or other factors (past or present) which may inluence the risk applied for on this policy?

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14.Do you have any intention of having medical investigations, procedures or

Condition/impairment |

|

Doctor’s name |

|

Currently on treatment? |

Last symptoms |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Yes |

|

|

No |

|

|

Y |

Y |

M |

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

Fully recovered? |

|||||

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|||

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|||

Yes |

|

|

No |

|

|

|

|

|

|

|

|

Fully recovered?

Yes No

Yes No

Yes |

|

|

No |

|

|

|

|

|

|

Fully recovered?

Yes No

Yes No

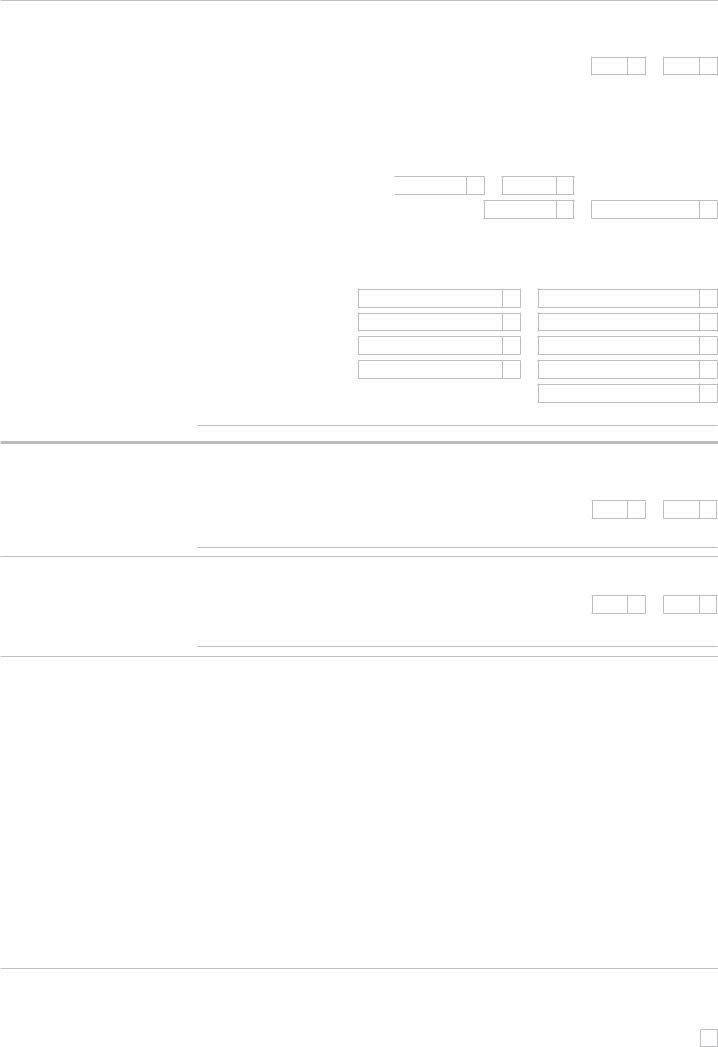

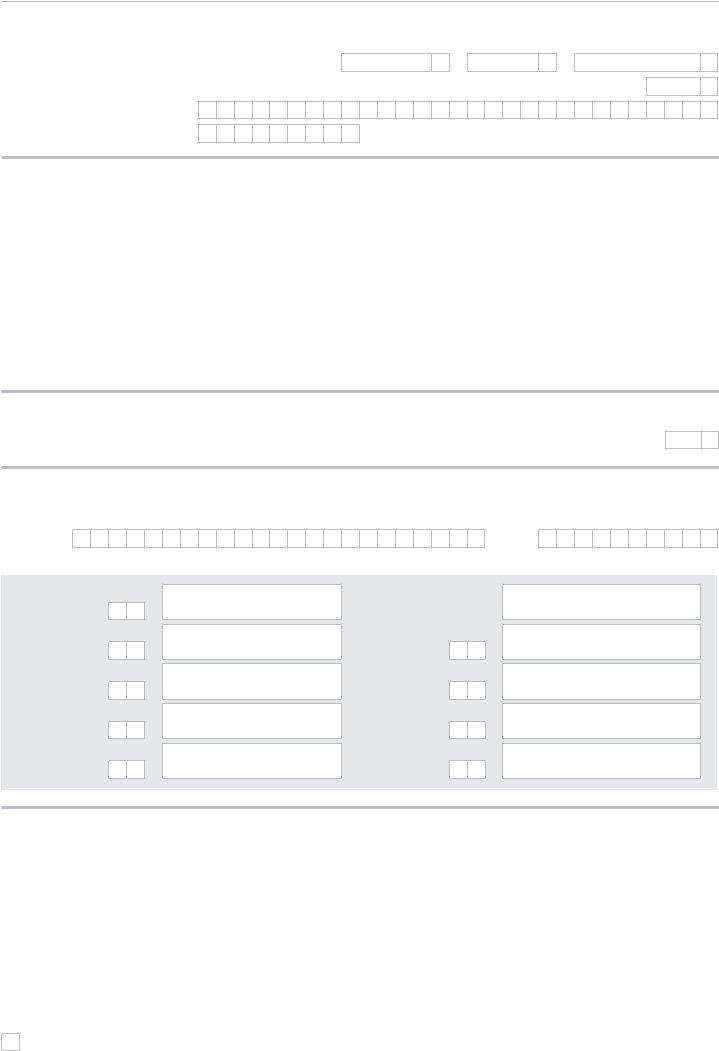

Habits, measurements and family history

1.Habits

1.1Have you smoked or used any other form of tobacco in the past six months? If Yes, quantity per day?

1.2Do you consume any form of alcohol?

If Yes, how many units per week (1 unit = 1 bottle of beer or 1 glass of wine or 1 tot of spirits/liquor)?

1.3Have you ever received medical advice or participated in a rehabilitation programme to reduce alcohol and/or tobacco consumption?

If Yes, please provide full details

Yes

Yes

Yes

No

No

No

2. Measurements

2.2 Height |

|

, |

|

|

m |

Weight |

|

|

|

|

|

|

|

2.2Has your weight changed by more than 5 kg during the last year?

If Yes, please indicate how much it has changed by |

|

|

|

(kg), and why? |

|

|

|

|

|

3. Family history

kg

Yes

No

Has any family member suffered from any major illness or hereditary disorders (e.g. heart disease, raised cholesterol, high blood pressure, diabetes, cancer, depression, porphyria, polycystic kidneys) under the age of 60?

If Yes, please provide full details

Yes

No

Relation

Condition

Age diagnosed

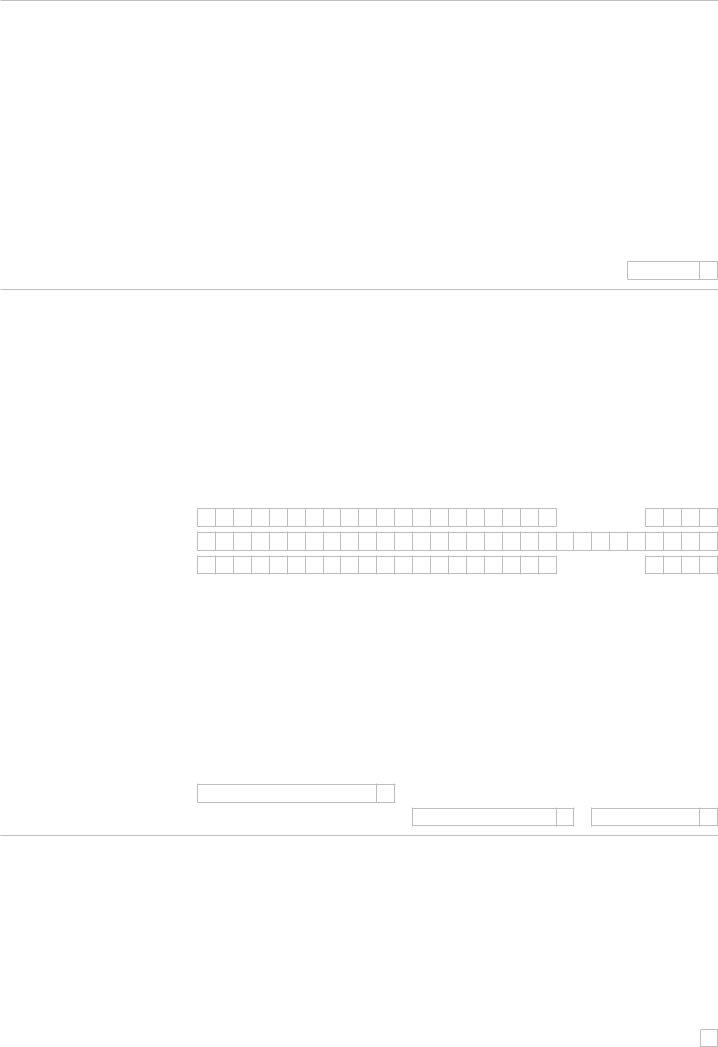

I declare that all the information that I have supplied about my health, hobbies and occupation is correct and complete.

Signature of insured life

Date

D

D

–

M M

–

20

Y Y

6

Section 2: Underwriting of the insured life (continued)

Medical doctor of the insured life

Please indicate the name of the doctor to whom we may send the reasons for health loadings or results of an HIV test. Conidential correspondence: Conidential doctor (may not be a hospital)

Surname |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone - work

Postal address

Postal code

Current/most recent doctor (if other than the above)

Surname

Telephone - work

When did he/she become your regular doctor?

Initials

D D – M M – Y Y Y Y

Fastlane

Consultation address

Postal code

Section 3: Additional beneit information

A. Income Protector and Temporary Income Protector

Income used in determining the beneit amount is deined as one of the following:

Gross Taxable Income

Taxable income payable or beneits receivable on account of the insured life’s employment, or any services rendered by the insured life.

Cost to Company Income

This equals Gross Taxable Income plus the value of the use of a motor vehicle, as well as the employer’s contributions to a medical scheme and a pension fund and the cost of any other beneits paid for by the insured’s employer and drawings in the form of dividends.

Gross Professional Income (professionals only)

For professionals that charge a fee for services, this equals the sum of the professional fee and the net income from trading activities, after deducting business overheads expenses.

1.Details of income

1.1What was your average monthly income from your occupation for the last 12 months?

1.2What amount of this income is based on commission?

1.3Income from other sources (other occupations, investments, rentals, etc.) will not be taken into account when determining a beneit amount. Do you receive such income?

If Yes, please provide details:

R

R

Yes

No

1.4 What will your projected monthly income for the next 12 months be?

2.Does your group beneit include an income disability beneit?

If Yes, please specify the amount:

3.If

R

|

|

|

Yes |

|

|

No |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Yes |

|

|

No |

|

||

|

|

|

|

|

|

|

|

|

|

7

Section 3: Additional beneit information (continued)

B. Business Overheads Protector

1.Number of employees

2.Number of employees with your professional or trade qualiications

3.Details of your interest in the business:

3.1Total monthly overhead expenses

3.2Your percentage (%) share of overhead expenses

3.3Percentage (%) of business turnover from sale of goods

3.4Number of associates

3.5Your percentage (%) share of the business

4.If

R

Yes |

|

|

No |

|

|

|

|

|

|

C. Business Protector (Only for professionals)

The beneit amount is based on the sum of the professional fees, plus net income from trading activities.

1.What was your average monthly fee income and net income from trading activities in the last 12 months?

2.What is your expected average monthly fee income and net income from trading activities for the next 12 months?

R

R

D. Funeral Beneit

Please complete if you are the underwritten insured life on a Funeral Beneit and have children insured lives or extended family insured lives covered under the beneit.

Child insured life(lives)

1

2

3

4

5

Name and surname

Gender

Relationship

Identity number

Extended family insured life(lives) (The spouse is not considered an extended family member)

Name and surname |

Gender |

Relationship |

Identity number |

1

2

3

4

5

6

7

8

1. Has any of the children insured lives or extended family insured lives, to your knowledge, ever been hospitalised, |

|

|

|

|

|

Yes |

|

|

No |

|

|

received treatment for any chronic condition or seen a specialist in the last year? |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

If Yes, please provide details (including name of insured life and medical condition or impairment): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

Section 3: Additional beneit information (continued)

E. Education Protector

Details of biological/legally adopted child(ren) linked to an Education Protector.

Name and surname |

Gender |

|

|

Date of birth |

|

|

|

|

|

|

Identity number |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

D |

M |

M |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

D |

M |

M |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

D |

M |

M |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

D |

M |

M |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

D |

M |

M |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 4: Additional insured life/applicant details

ROLE(S) |

|

|

|

Tick the appropriate role(s) that this client will play on this policy: |

||||||

|

|

|

|

|

|

|

|

|

|

|

Client number |

0 |

2 |

|

Policyholder (contracting party) |

|

|

% Ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insured life

A. Fill in if this client is an applicant or additional insured life

Title

Surname/name of legal entity Previous surname(s)

Contact person in case of legal entity Gender

Date of birth

Permanent identity/passport number Postal address

Residential address

|

|

|

|

Initials |

|

|

|

|

First name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

Female |

|

|

Correspondence language |

English |

|

|

Afrikaans |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

D |

D |

– |

M |

M |

– |

Y |

Y |

Y |

Y |

|

|

Nationality |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permanent RSA ID |

Yes |

|

|

No |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal code

Postal code

Telephone - work |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax - work |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Telephone - home |

|

|

|

|

|

|

|

|

|

|

|

|

Cellphone number |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Which method of communication do you prefer? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Post |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Note: Certain Momentum documents are not yet available electronically and the posting of those will continue for the time being. |

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Are you currently insolvent? |

Yes |

|

|

No |

|

|

|

|

|

If Yes, date of insolvency |

D |

D |

– |

M |

M |

– |

Y |

Y |

Y |

Y |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

If a legal entity, has the legal entity been liquidated, placed under administration or are there any processes pending against |

|

|

|

|

|

|

|

||||||||||||||||||||||

Yes |

|

|

No |

|

|||||||||||||||||||||||||

the legal entity for liquidation or administration? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

Tax status |

Company/Close corporation (M) |

|

|

|

Sole proprietor/Partner (S) |

|

|

Natural person (N) |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax status of trust beneiciaries if the applicant is a trust |

Company (C) |

|

|

|

|

Natural person (P)

9