Once you open the online PDF tool by FormsPal, you're able to fill in or change wells fargo mortgage application pdf here and now. FormsPal is focused on giving you the ideal experience with our editor by continuously introducing new capabilities and enhancements. Our editor has become even more intuitive with the latest updates! Now, filling out documents is simpler and faster than ever. To get the process started, take these simple steps:

Step 1: Just click on the "Get Form Button" at the top of this webpage to launch our pdf file editing tool. This way, you will find everything that is needed to work with your file.

Step 2: This editor enables you to change your PDF in many different ways. Change it with your own text, adjust original content, and include a signature - all when you need it!

This document will need you to provide some specific information; to guarantee consistency, take the time to bear in mind the subsequent tips:

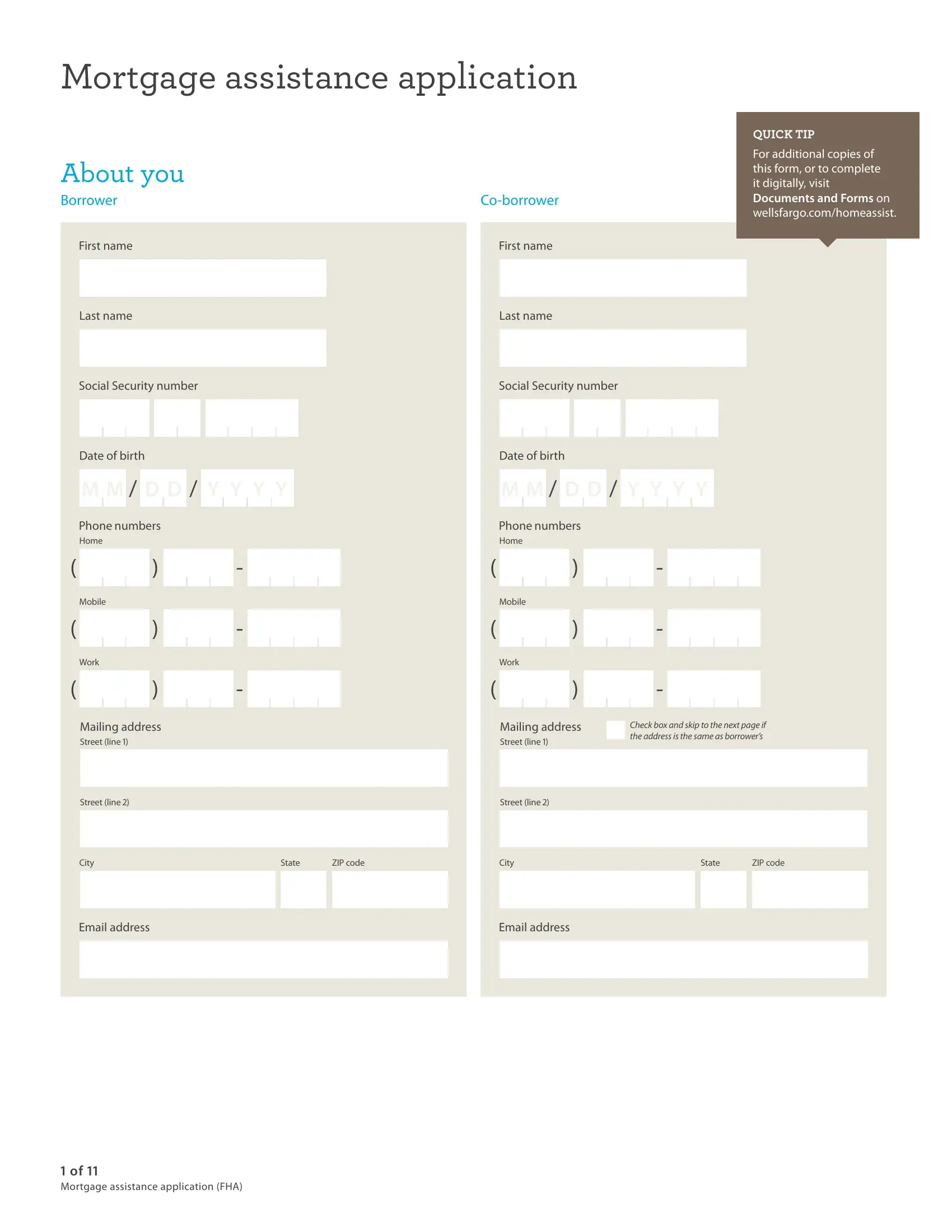

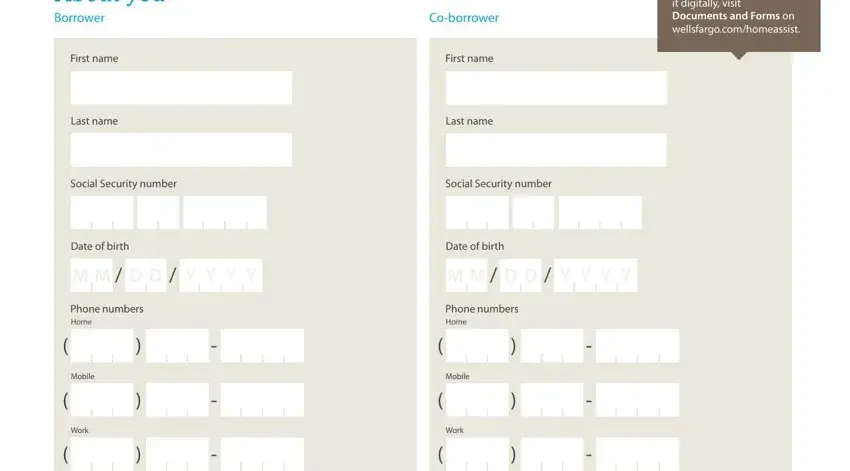

1. Complete the wells fargo mortgage application pdf with a selection of necessary blanks. Gather all the necessary information and be sure absolutely nothing is forgotten!

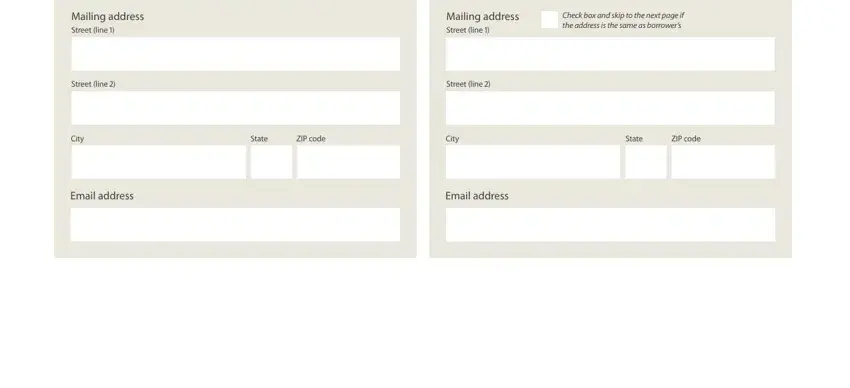

2. After the previous segment is finished, it's time to insert the essential specifics in Mailing address Street line, Mailing address Street line, Check box and skip to the next, Street line, Street line, City, State, ZIP code, City, State, ZIP code, Email address, and Email address so that you can proceed to the next step.

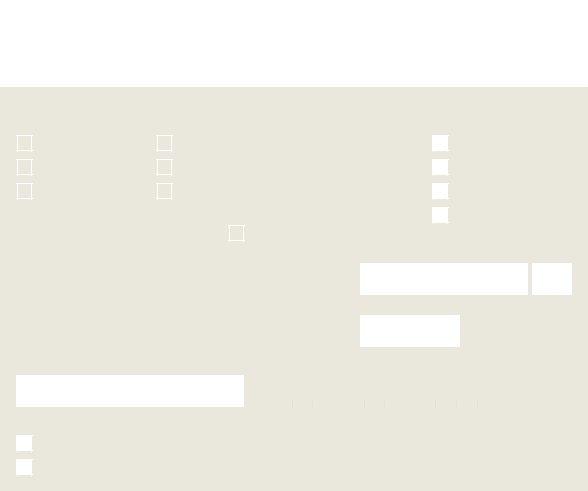

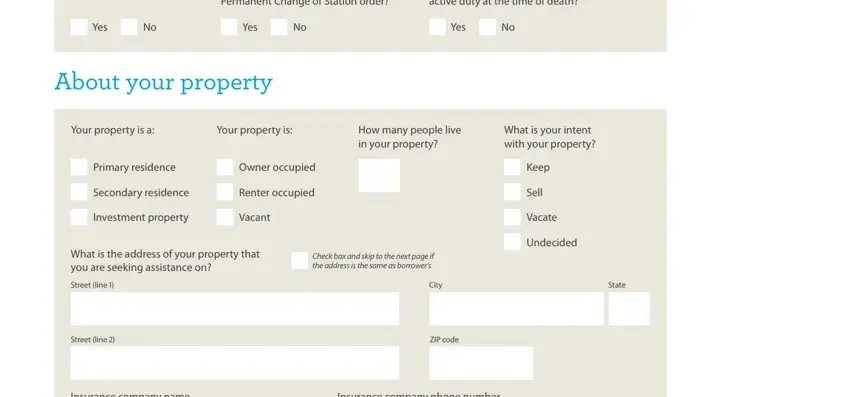

3. This next part is about Has any borrower been deployed, Is any borrower the surviving, Yes, Yes, Yes, About your property, Your property is a, Your property is, How many people live in your, What is your intent with your, Primary residence, Owner occupied, Secondary residence, Renter occupied, and Investment property - fill in these blanks.

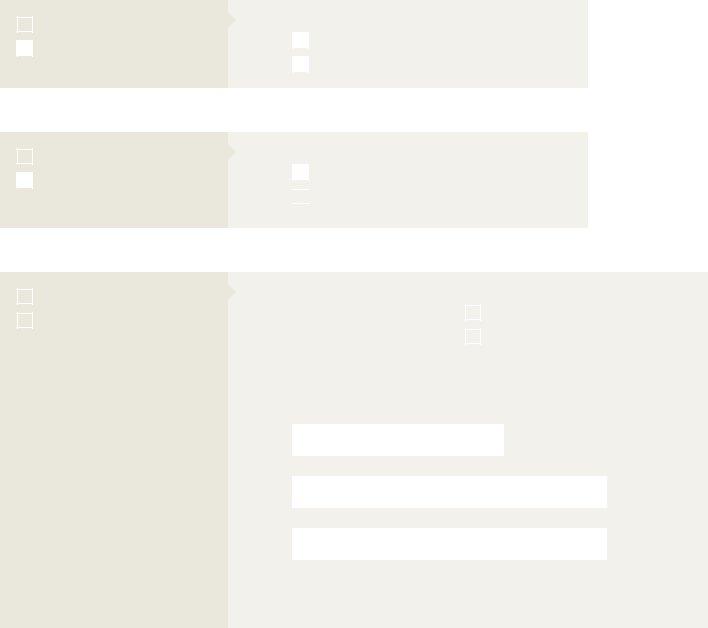

4. It's time to fill out this next part! In this case you will get these Insurance company name, Insurance company phone number, Is your insurance policy current, and Yes empty form fields to fill out.

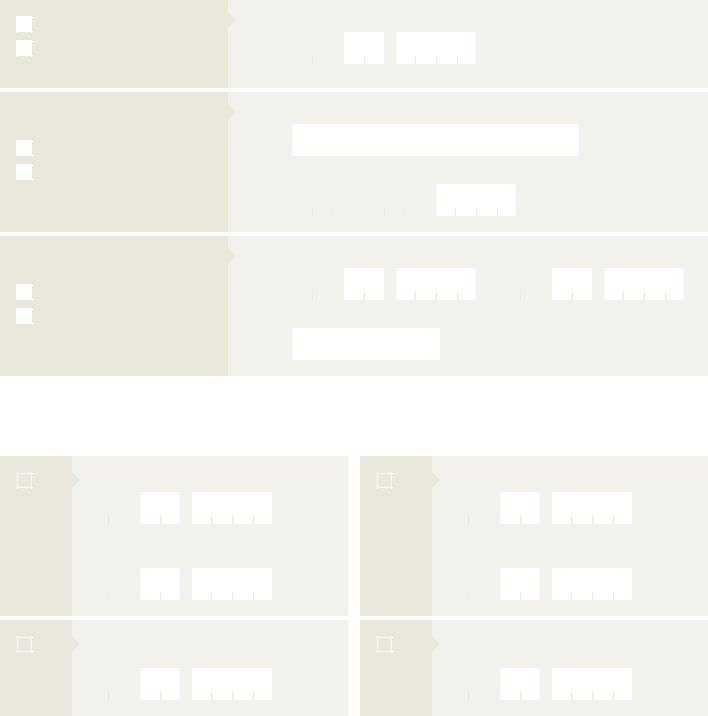

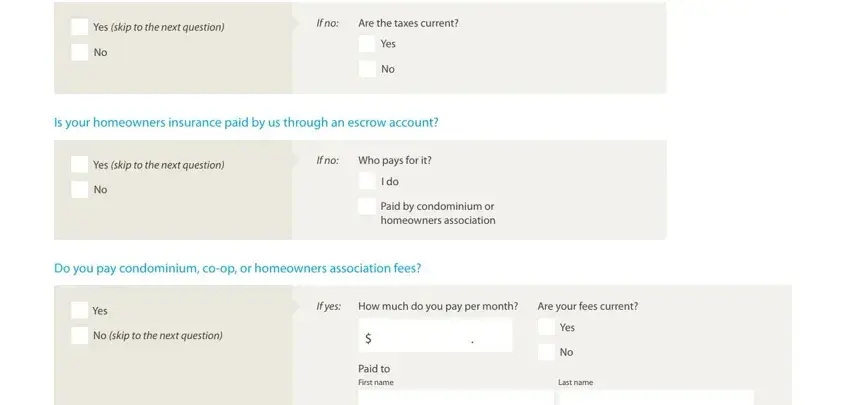

5. The document has to be completed by going through this segment. Further you will notice a full list of form fields that need specific information to allow your document usage to be accomplished: Yes skip to the next question, If no, Are the taxes current, Yes, Is your homeowners insurance paid, Yes skip to the next question, If no Who pays for it, I do, Paid by condominium or homeowners, Do you pay condominium coop or, Yes, No skip to the next question, If yes, How much do you pay per month, and Are your fees current.

Always be really attentive while filling in Are the taxes current and Do you pay condominium coop or, as this is the section in which many people make a few mistakes.

Step 3: Prior to moving forward, it's a good idea to ensure that all form fields have been filled out as intended. When you establish that it's good, click “Done." Go for a free trial account at FormsPal and acquire direct access to wells fargo mortgage application pdf - download or modify from your personal cabinet. FormsPal is invested in the personal privacy of all our users; we make sure that all personal data processed by our tool remains protected.