You'll be able to fill in lenders without difficulty using our PDFinity® online tool. FormsPal is devoted to making sure you have the absolute best experience with our tool by regularly releasing new functions and upgrades. With these updates, using our editor gets easier than ever! To get the process started, consider these basic steps:

Step 1: Hit the "Get Form" button in the top section of this webpage to open our editor.

Step 2: With the help of this advanced PDF editor, you are able to do more than merely complete forms. Edit away and make your forms seem perfect with customized textual content put in, or fine-tune the file's original input to perfection - all that backed up by an ability to add stunning pictures and sign the PDF off.

Completing this document demands attentiveness. Make certain every field is filled in accurately.

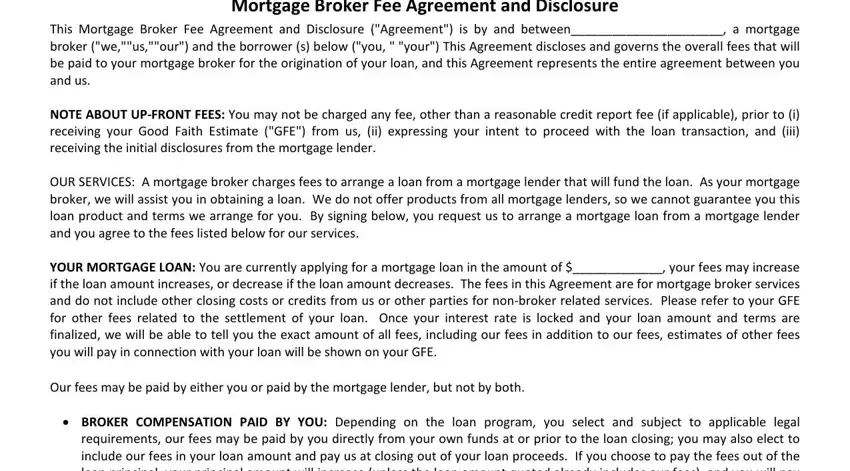

1. Fill out the lenders with a selection of necessary fields. Note all of the important information and ensure there's nothing missed!

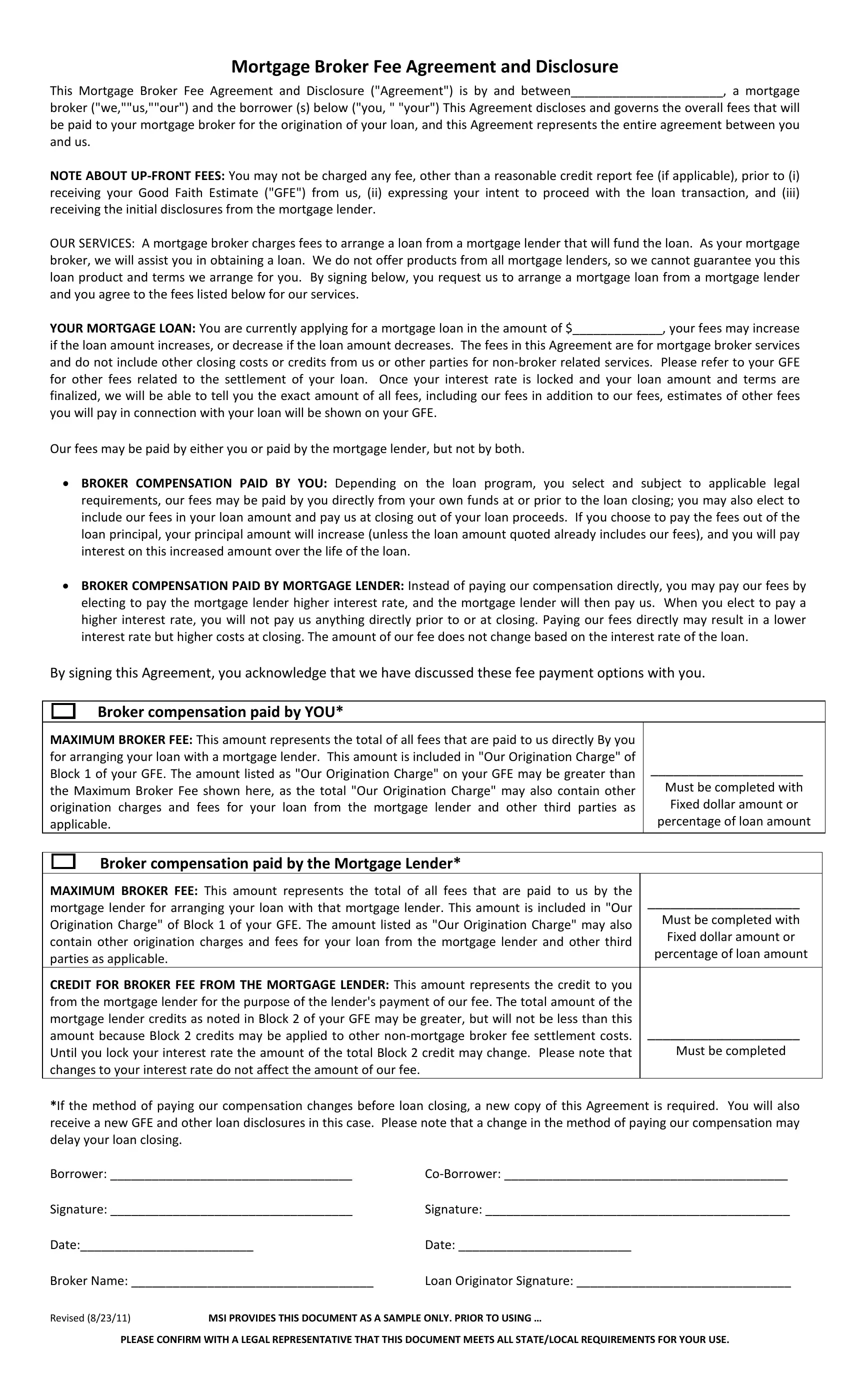

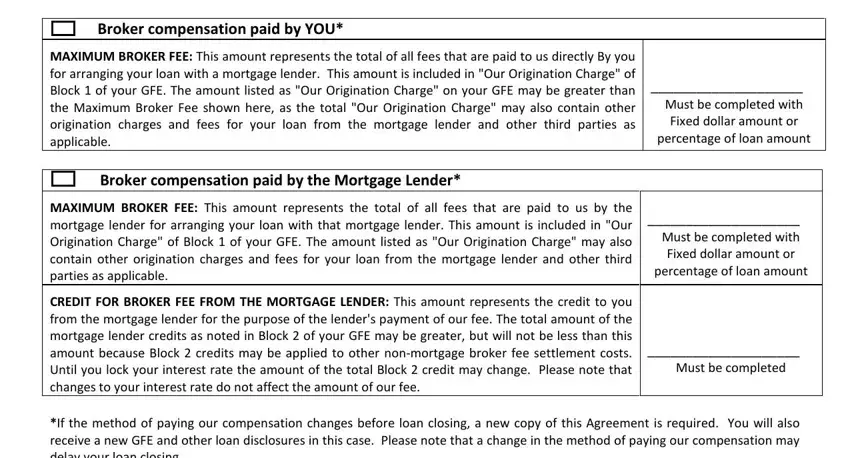

2. The next part is usually to submit the next few blanks: By signing this Agreement you, Broker compensation paid by YOU, MAXIMUM BROKER FEE This amount, Must be completed with Fixed, percentage of loan amount, percentage of loan amount, Must be completed with Fixed, MAXIMUM BROKER FEE This amount, and Must be completed.

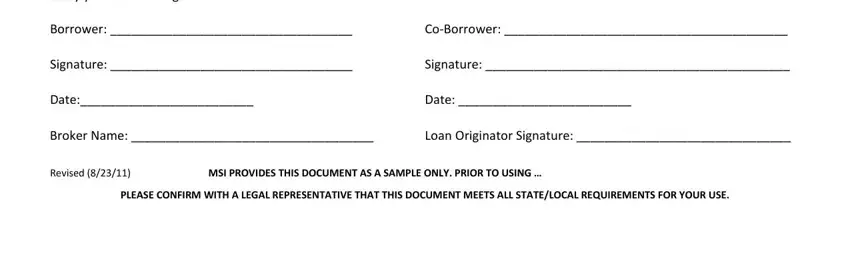

3. This next segment will be focused on MAXIMUM BROKER FEE This amount, Loan Originator Signature, Signature, CoBorrower, Date, Revised, MSI PROVIDES THIS DOCUMENT AS A, and PLEASE CONFIRM WITH A LEGAL - complete every one of these blanks.

When it comes to Revised and CoBorrower, make sure that you take a second look in this current part. The two of these are the most significant fields in this form.

Step 3: Revise everything you've inserted in the blanks and then hit the "Done" button. Find the lenders the instant you subscribe to a free trial. Readily gain access to the form inside your personal account page, together with any edits and adjustments automatically saved! When you use FormsPal, you can fill out forms without stressing about personal data leaks or records being distributed. Our secure software ensures that your personal details are stored safe.