The entire process of filling out the mortgage invoice template is pretty simple. Our experts made certain our tool is not hard to understand and can help prepare virtually any document in no time. Check out a few steps you will have to take:

Step 1: Choose the "Get Form Here" button.

Step 2: Now, you're on the file editing page. You can add text, edit present details, highlight specific words or phrases, place crosses or checks, add images, sign the file, erase needless fields, etc.

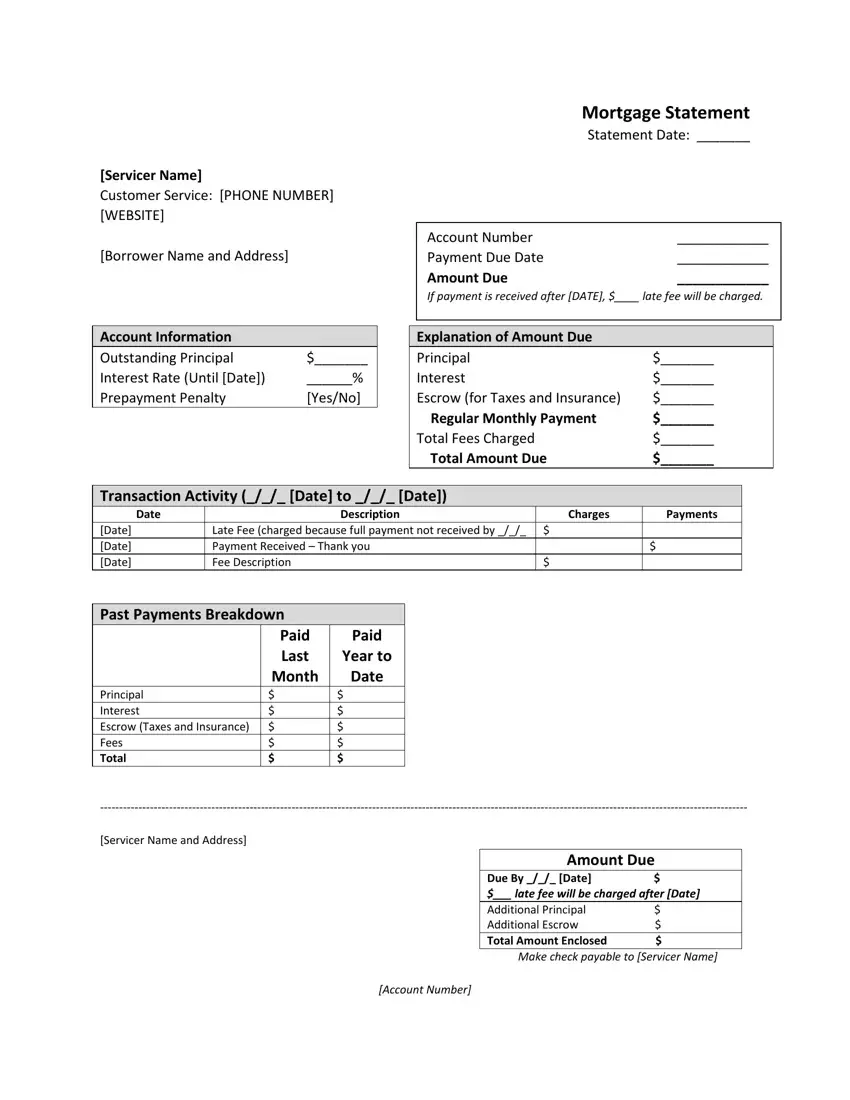

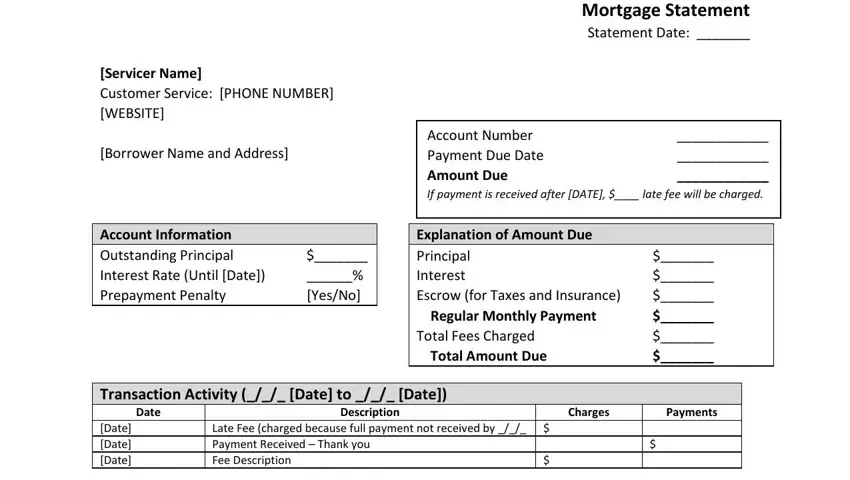

Enter the necessary material in each segment to get the PDF mortgage invoice template

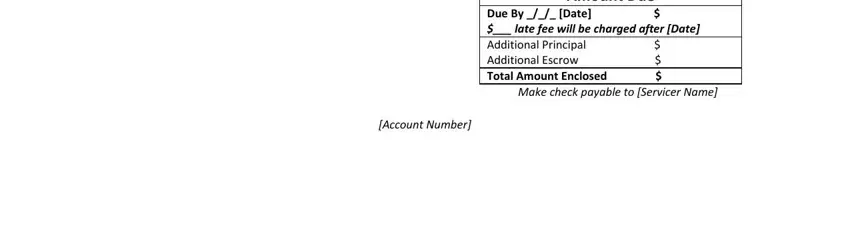

Please note the demanded information in the Amount Due Due By Date late fee, Make check payable to Servicer Name, and Account Number space.

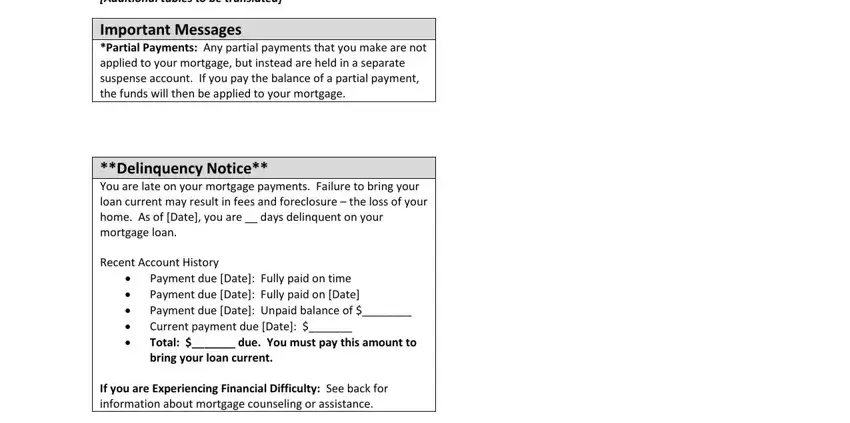

Outline the key data in the Additional tables to be translated, Important Messages Partial, Delinquency Notice You are late on, Recent Account History, Payment due Date Fully paid on, and If you are Experiencing Financial part.

Step 3: Hit the Done button to save the file. Now it is accessible for transfer to your device.

Step 4: It will be easier to have duplicates of your document. There is no doubt that we will not distribute or view your details.