It is possible to complete mta6 and mta 8 forms effectively in our online editor for PDFs. Our team is dedicated to making sure you have the ideal experience with our editor by continuously presenting new capabilities and improvements. Our tool is now even more helpful as the result of the newest updates! At this point, working with PDF files is a lot easier and faster than ever before. Here is what you'll want to do to begin:

Step 1: Click on the "Get Form" button at the top of this page to get into our PDF tool.

Step 2: Once you launch the file editor, you'll see the document made ready to be filled in. Aside from filling in different fields, you may also do other sorts of things with the form, specifically putting on your own textual content, changing the initial text, inserting images, affixing your signature to the document, and a lot more.

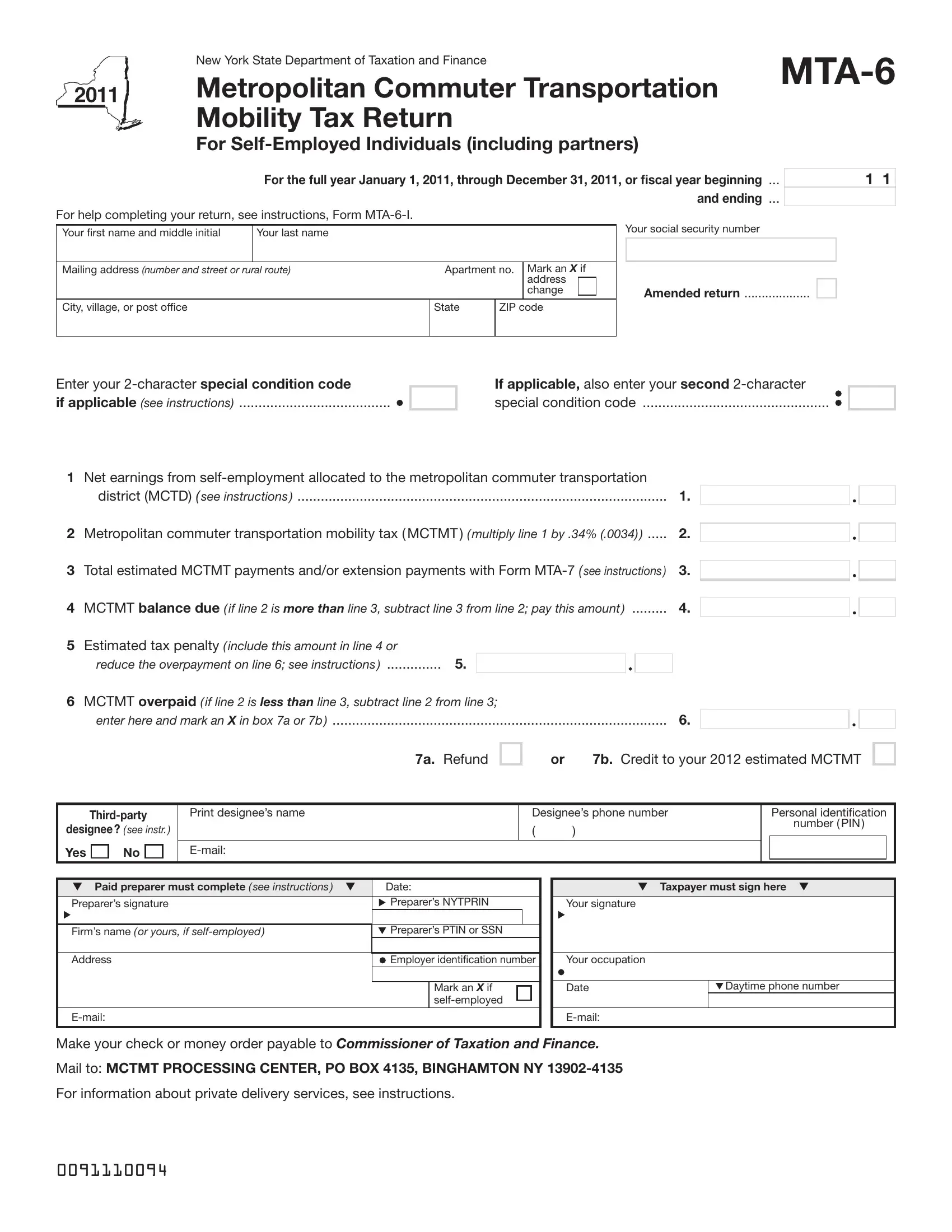

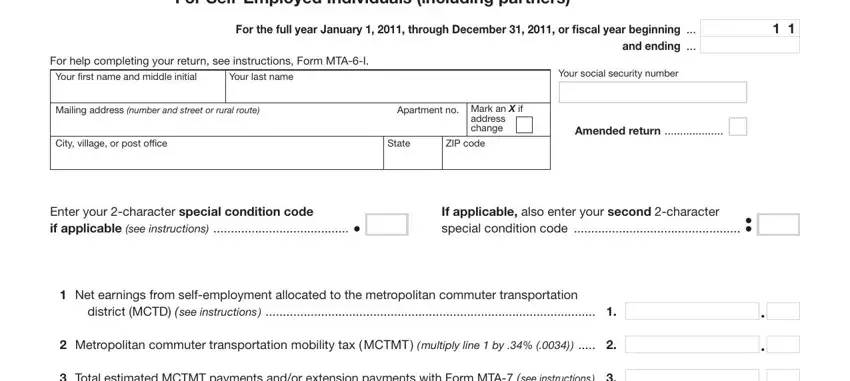

With regards to the blanks of this precise form, here's what you should consider:

1. Complete the mta6 and mta 8 forms with a number of essential blanks. Gather all the necessary information and make sure there's nothing neglected!

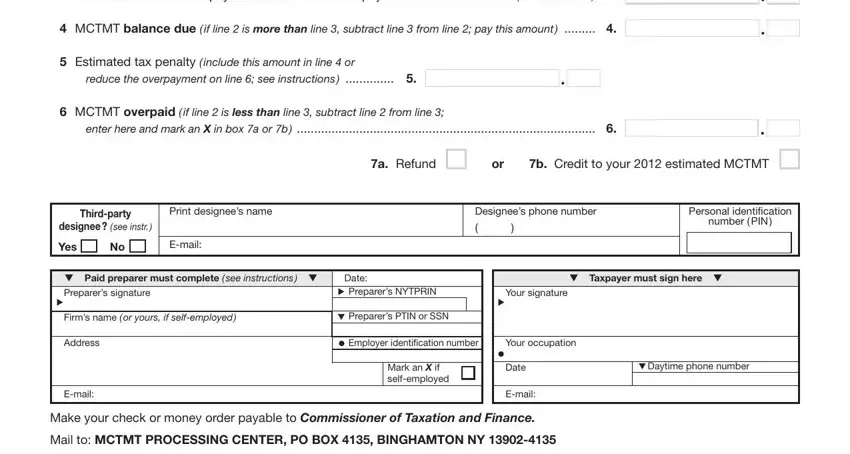

2. Given that this section is completed, you should add the required particulars in Total estimated MCTMT payments, MCTMT balance due if line is, Estimated tax penalty include, reduce the overpayment on line, MCTMT overpaid if line is less, enter here and mark an X in box a, a Refund, b Credit to your estimated MCTMT, Thirdparty, designee see instr, Print designees name, Yes, Email, Designees phone number, and Personal identiication so you're able to move forward to the third part.

People generally make some errors while completing Personal identiication in this part. Don't forget to go over whatever you enter here.

Step 3: Prior to submitting this form, you should make sure that blanks are filled in properly. When you verify that it is correct, click on “Done." Grab the mta6 and mta 8 forms the instant you subscribe to a free trial. Readily use the pdf document in your FormsPal account page, with any modifications and adjustments conveniently synced! We do not sell or share the details that you use whenever completing documents at our site.