If your business has multiple worksites that require different forms to be filled out in order to stay compliant with laws and regulations, it can be time-consuming, stressful and expensive. Luckily, there is an efficient way of dealing with multiple worksite forms – using a single Multiple Worksite Form for each site. In this blog post, we will discuss how a Multiple Worksite Form can help streamline processes and save money for businesses operating at various sites. We’ll cover the benefits of using such a form, as well as some tips on how best to set it up so that you get the maximum efficiency from it. Make sure to read through all sections thoroughly so you understand how this approach can help improve compliance across all of your sites!

| Question | Answer |

|---|---|

| Form Name | Multiple Worksite Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | california multiple worksite report, ca multiple fill, california 3020, bls pdf fillable printable |

California Employment Development Dept |

Multiple Worksite Report - BLS 3020 |

|

Labor Market Information Division |

Form Approved, O.M.B. No. |

|

P.O. Box 826220 |

Expiration Date: 05/31/2016 |

|

In Cooperation w ith the U.S. Department of Labor |

||

Sacramento CA |

||

|

||

Phone: (916) |

California |

This report is mandatory under Section 320.5 of the California Unemployment Insurance Code and Section

BUSINESS MAILING ADDRESS Please print.

Business Name: __________________________________________

Street Address: ___________________________________________

City: ___________________________ ST: ______ ZIP: __________

__________________________________________________

QUARTERLY REPORT INFORMATION

U.I. NUMBER: ______________________

QUARTER ENDING: ___ / ___ / ___

DUE DATE: ___ / ___ / ___

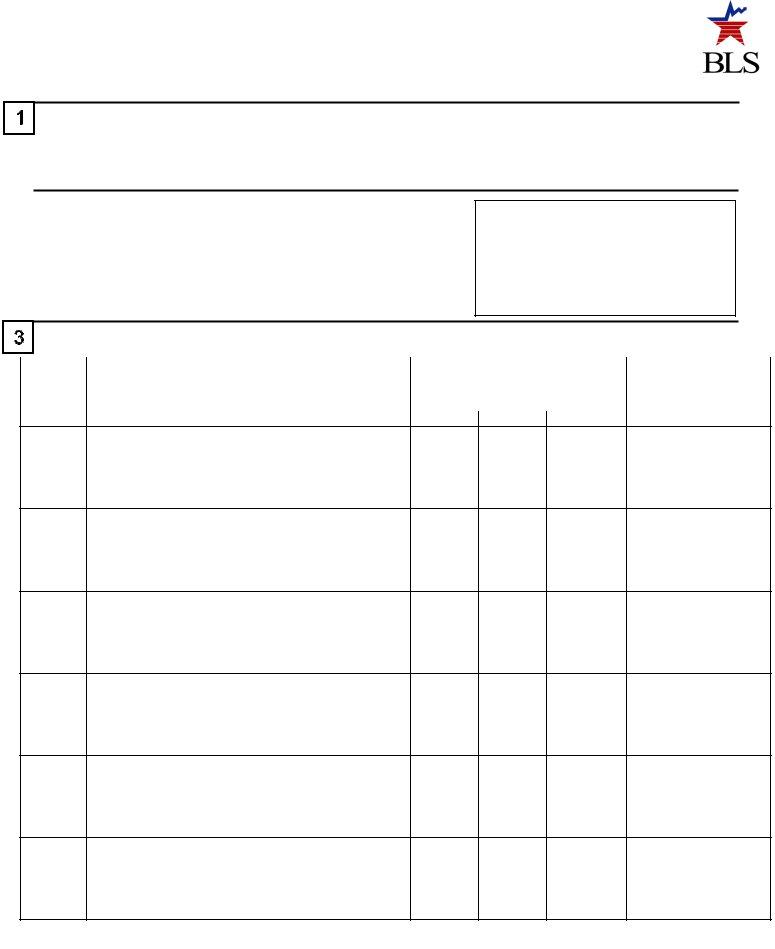

WORKSITES

OFFICE USE

BUSINESS NAME (division, subsidiary, etc.)

STREET ADDRESS (physical location)

CITY, STATE, AND ZIP CODE

WORKSITE DESCRIPTION (plant name, store number, etc.)

NUMBER OF

EMPLOYEES

(subject to UI Law s)During the Pay Period

Which Includes the 12th of the Month

Month 1 |

Month 2 |

Month 3 |

QUARTERLY WAGES

OF WORKSITES

(subject to UI law s) Round to the nearest dollar

.00

.00

.00

.00

.00

.00

Note: The totals MUST agree (except for rounding) |

|

Total: ______ ______ ______ $ ___________.00 |

with your Form DE9, DE9C. |

|

|

|

|

|

|

|

|

|

|

|

CONTACT PERSON (for questions regarding this report) |

||

NAME: ________________________________________ PHONE: _____________________________________________ |

||

INSTRUCTIONS

Please follow these steps to prepare your Multiple Worksite Report. Contact the Agency listed in Step 6 if you have any questions or if you need additional information, or see http://www.bls.gov/cew/cewmwr00.htm

1.Review the business name, contact name, and mailing address and make any necessary corrections (Section 2).

2.The Worksites list (Section 3), shows the individual worksites (business locations) that appear in our files for the U.I. Number.

(a)Please read across the row for each worksite and do the following:

•NAME/ADDRESS/DESCRIPTION: Review the name and physical location address for each worksite and make any necessary corrections. Review the description below the physical location to be sure it uniquely identifies each worksite

(plant name, store number, etc.). If there is no printed description, please enter a unique identifier for the site.

•EMPLOYMENT: Enter employment for each month of the quarter. Employment is the total number of full- and

•WAGES: Enter wages paid during the quarter that are subject to State Unemployment Insurance laws, including the

portion that exceeds the State’s taxable wage base. Round wages to the nearest dollar.

•LARGE CHANGES: Use the space beside the worksite to explain any large changes in employment and/or wages.

Changes might result from store closings, strikes, layoffs, bonuses, seasonal increases or decreases, or similar events.

•CLOSED OR SOLD: If a worksite has been sold, closed, or is otherwise inactive, use the space beside the worksite to

show the date closed or sold; (b) if sold, the name of the company that bought the business at that worksite; and (c) the purchaser’s U.I. Number, if you know it.

3.Is the list in Section 3 complete? That is, does the business operate any worksites using this U.I. Number that do not appear on the form, such as

•MISSING WORKSITES: Provide the following information for each additional worksite. You may use available blank lines or attach a separate page. If you are not sure how to report a worksite or employee, please call the office listed in Step 6 of these instructions.

a.The business name, street or physical location address (NO POST OFFICE BOXES), city, state, and zip code

b.A unique description or identifier for each worksite (e.g., plant name, store number, or similar description)

c.The number of employees for each month of the quarter, and quarterly wages

d.The county, township, city, independent city, or similar geographic area in which the worksite is located

e.The main business activity at the worksite

f.In addition, if you purchased any of these worksites from another company, please provide:

g.The name of the company that sold the worksite

h.The effective date of the sale, and

i.The seller’s U.I. Number, if you know it.

4.Complete the Totals section at the end of the list. For each month, sum the number of employees at all worksites. Then sum the wages for the quarter at all worksites. Except for rounding, these figures MUST agree with the totals on your Quarterly

Contribution Return and Report of Wages (Form DE9, DE9C).

5.Using the enclosed envelope, return your completed form to the central processing facility.

6.If you have questions, please contact your State Agency listed below:

California Employment Development Dept

Labor Market Information Division

P.O. Box 826220

Sacramento CA

Phone: (916)

Fax: (916)

GENERAL INFORMATION

PURPOSE OF THIS REPORT

This Multiple Worksite Report (MWR) collects employment and wages by individual work location in this State. If you operate businesses from more than one location under the Unemployment Insurance Account Number (U.I. Number) shown above, the MWR supplements your Quarterly Contributions Report. Data from the MWR enable our agency to monitor and analyze conditions of business activities by geographic area and industry in this State. The information collected on this form by the Bureau of Labor Statistics and the State agencies cooperating in its statistical programs will be used for statistical and Unemployment Insurance program purposes, and other purposes in accordance with law.

PAPERWORK REDUCTION ACT STATEMENT

We estimate that this form will take from 10 minutes to 60 minutes to complete per response, with an average of 22 minutes. This includes time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing this information. If you have any comments regarding these estimates or any aspect of this form, send them to the Bureau of Labor Statistics, Division of Administrative Statistics and Labor Turnover, Room 4840, 2 Massachusetts Avenue N.E., Washington, D.C. 20212. The OMB control number for this survey is