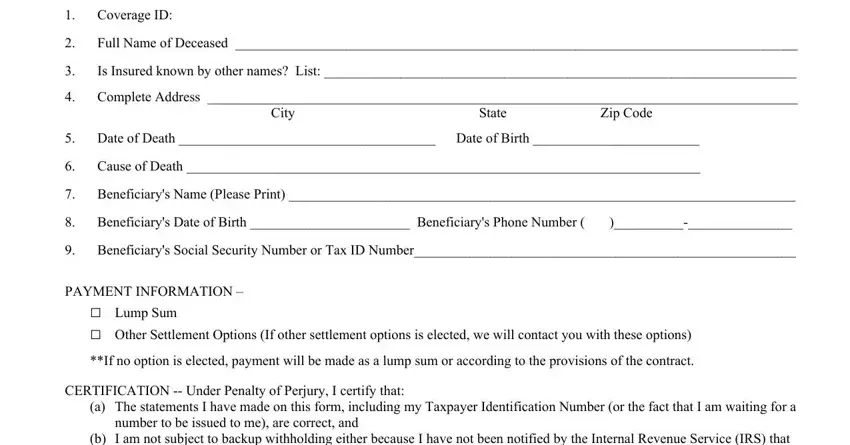

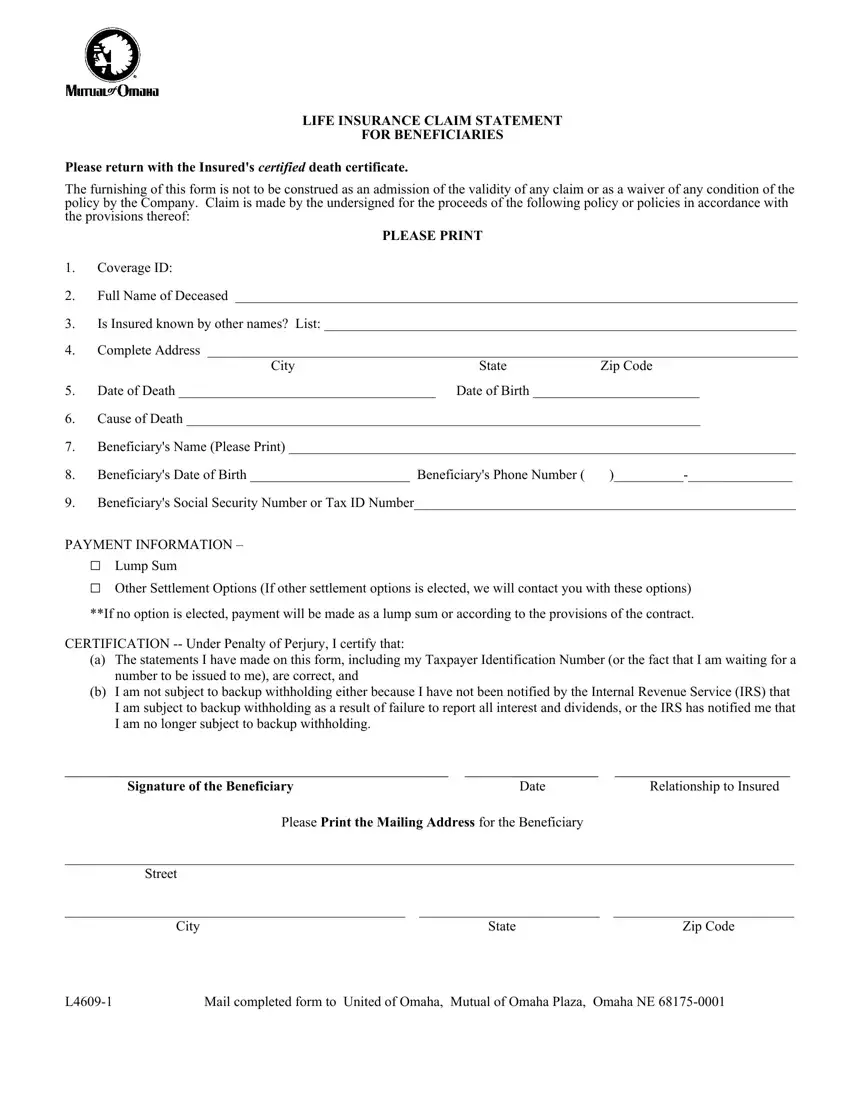

LIFE INSURANCE CLAIM STATEMENT

FOR BENEFICIARIES

Please return with the Insured's CERTIFIED death certificate.

The furnishing of this form is not to be construed as an admission of the validity of any claim or as a waiver of any condition of the policy by the Company. Claim is made by the undersigned for the proceeds of the following policy or policies in accordance with the provisions thereof:

PLEASE PRINT

1.Coverage ID:

2.Full Name of Deceased _________________________________________________________________________________

3.Is Insured known by other names? List: ____________________________________________________________________

4.Complete Address _____________________________________________________________________________________

|

City |

State |

Zip Code |

5. |

Date of Death _____________________________________ |

Date of Birth ________________________ |

6.Cause of Death __________________________________________________________________________

7.Beneficiary's Name (Please Print) _________________________________________________________________________

8. |

Beneficiary's Date of Birth _______________________ Beneficiary's Phone Number ( |

)__________-_______________ |

9.Beneficiary's Social Security Number or Tax ID Number_______________________________________________________

PAYMENT INFORMATION –

Lump Sum

Other Settlement Options (If other settlement options is elected, we will contact you with these options)

**If no option is elected, payment will be made as a lump sum or according to the provisions of the contract.

CERTIFICATION -- Under Penalty of Perjury, I certify that:

(a)The statements I have made on this form, including my Taxpayer Identification Number (or the fact that I am waiting for a number to be issued to me), are correct, and

(b)I am not subject to backup withholding either because I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of failure to report all interest and dividends, or the IRS has notified me that I am no longer subject to backup withholding.

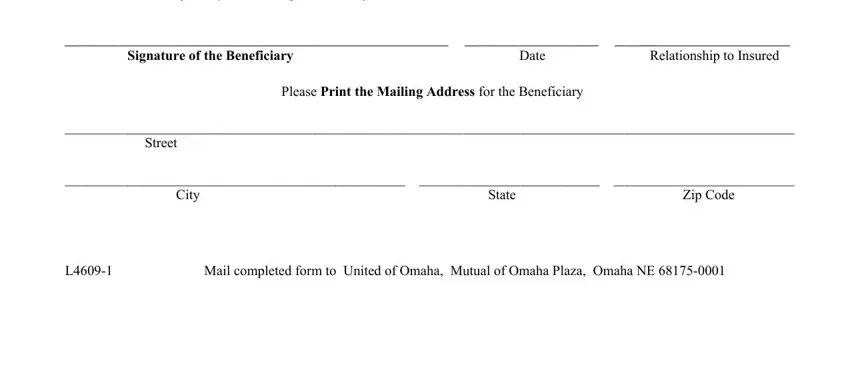

______________________________________________ |

________________ |

_____________________ |

Signature of the Beneficiary |

Date |

Relationship to Insured |

Please Print the Mailing Address for the Beneficiary

_________________________________________________________________________________________________________

Street |

|

|

_________________________________________________ |

__________________________ |

__________________________ |

City |

State |

Zip Code |

L4609-1 |

Mail completed form to United of Omaha, Mutual of Omaha Plaza, Omaha NE 68175-0001 |

FRAUD STATEMENTS

The following fraud language is attached to, and made part of this claim form. Please read and do not remove these pages from this claim form.

**Alabama: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof.

**Alaska: A person who knowingly and with intent to injure, defraud or deceive an insurance company files a claim containing false, incomplete, or misleading information may be prosecuted under state law.

**Arizona: For your protection Arizona law requires the following statement to appear on this form.

Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

**Arkansas: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

**California: For your protection California law requires the following to appear on this form. Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

**Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

**Delaware: Any person who knowingly and with intent to injure, defraud or deceive any insurer, files a statement of claim containing any false, incomplete or misleading information is guilty of a felony.

**District of Columbia: WARNING: It is a crime to provide false or misleading information to an insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

**Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

**Idaho: Any person who knowingly, and with intent to defraud or deceive any insurance company, files a statement containing any false, incomplete, or misleading information is guilty of a felony.

**Indiana: A person who knowingly and with intent to defraud an insurer files a statement of claim containing any false, incomplete, or misleading information commits a felony.

**Kentucky: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

**Louisiana: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

**Maine: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines or a denial of insurance benefits.

**Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison..

**Minnesota: A person who files a claim with intent to defraud or helps commit a fraud against an insurer is guilty of a crime.

**New Hampshire: Any person who, with a purpose to injure, defraud or deceive any insurance company, files a statement of claim containing any false, incomplete or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638:20.

**New Jersey: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

**New Mexico: ANY PERSON WHO KNOWINGLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS OR BENEFIT OR KNOWINGLY PRESENTS FALSE INFORMATION IN AN APPLICATION FOR INSURANCE IS GUILTY OF A CRIME AND MAY BE SUBJECT TO CIVIL FINES AND CRIMINAL PENALTIES.

**New York: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

**Ohio: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

**Oklahoma: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

**Pennsylvania: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

**Puerto Rico: Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation by a fine of not less than five thousand dollars ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or both penalties. Should aggravating circumstances be present, the fixed penalty thus established may be increased to a maximum of five (5) years; if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

**Rhode Island: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

**Tennessee: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

**Texas: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

**Virginia: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

**Washington: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

**West Virginia: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

**If you live in a state other than mentioned above, the following statement applies to you: Any person who knowingly, and with intent to injure, defraud or deceive any insurer or insurance company, files a statement of claim containing any materially false, incomplete, or misleading information or conceals any fact material thereto, may be guilty of a fraudulent act, may be prosecuted under state law and may be subject to civil and criminal penalties. In addition, any insurer or insurance company may deny benefits if false information materially related to a claim is provided by the claimant.