Date: |

|

|

|

|

|

|

|

|

|

|

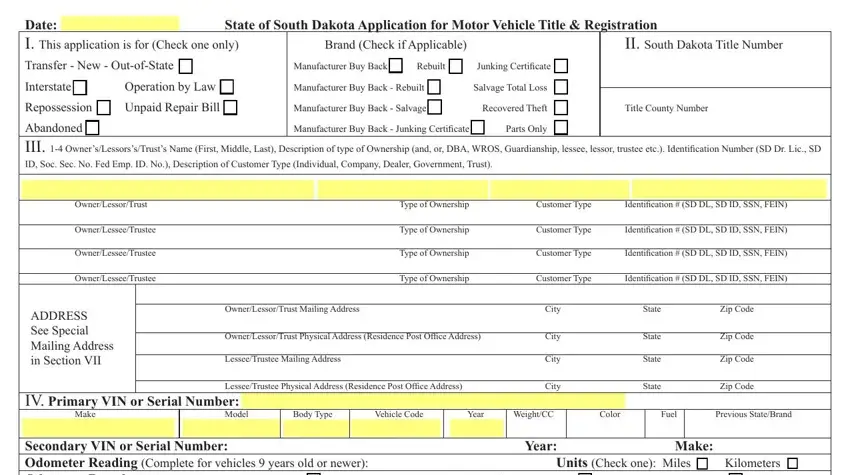

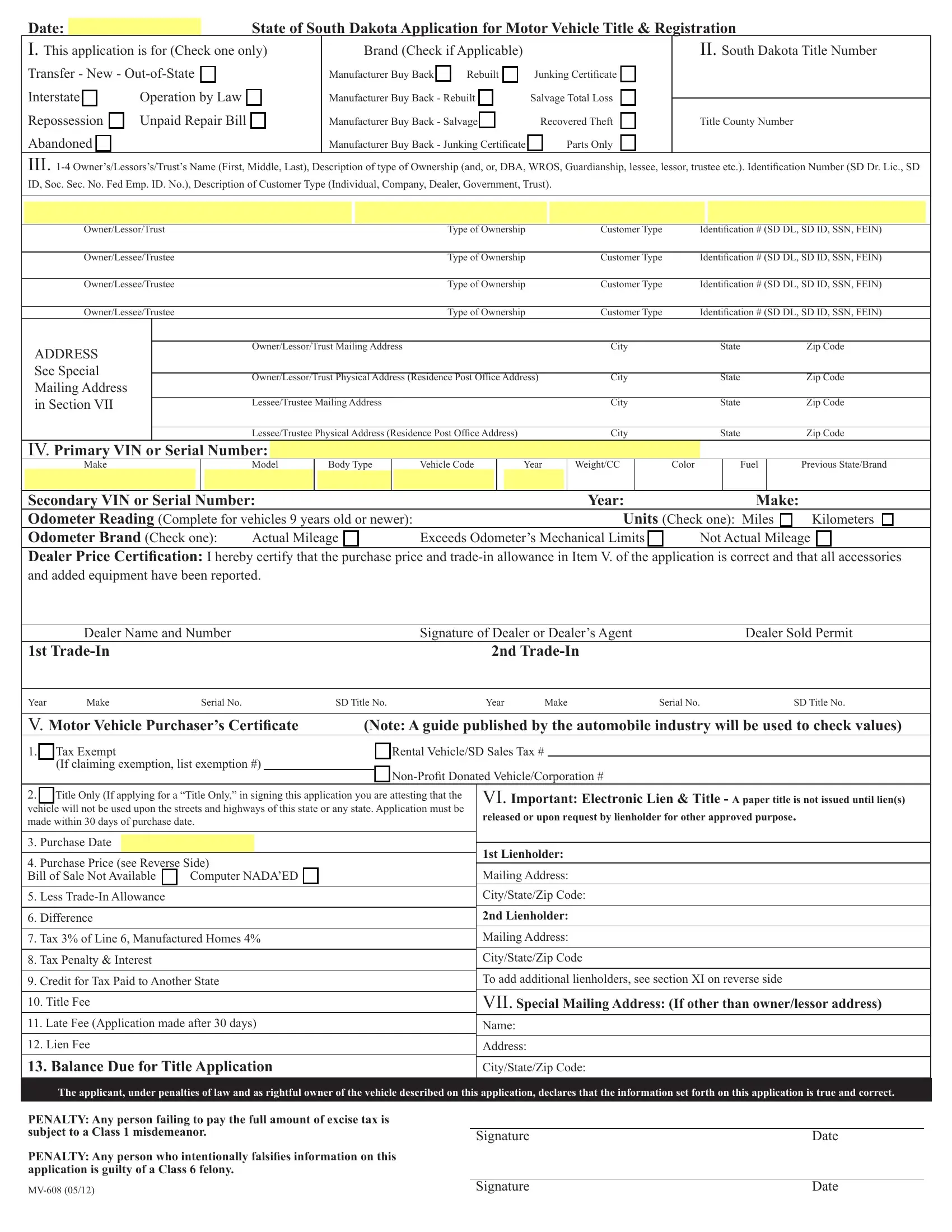

State of South Dakota Application for Motor Vehicle Title & Registration |

I. This application is for (Check one only) |

Brand (Check if Applicable) |

|

|

|

|

|

|

II. South Dakota Title Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer - New - Out-of-State |

|

|

|

|

|

|

Manufacturer Buy Back |

|

Rebuilt |

|

|

Junking Certiicate |

|

|

|

|

|

Interstate |

|

|

|

|

|

Operation by Law |

|

|

|

|

Manufacturer Buy Back - Rebuilt |

|

|

|

|

|

|

Salvage Total Loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repossession |

|

|

Unpaid Repair Bill |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturer Buy Back - Salvage |

|

|

|

|

|

Recovered Theft |

|

|

Title County Number |

|

|

|

|

|

|

|

|

|

|

Manufacturer Buy Back - Junking Certiicate |

|

Parts Only |

|

|

|

|

|

Abandoned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III. 1-4 Owner’s/Lessors’s/Trust’s Name (First, Middle, Last), Description of type of Ownership (and, or, DBA, WROS, Guardianship, lessee, lessor, trustee etc.). Identiication Number (SD Dr. Lic., SD ID, Soc. Sec. No. Fed Emp. ID. No.), Description of Customer Type (Individual, Company, Dealer, Government, Trust).

|

|

|

|

|

|

|

|

|

|

|

|

Owner/Lessor/Trust |

|

|

Type of Ownership |

|

Customer Type |

Identiication # (SD DL, SD ID, SSN, FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

Owner/Lessee/Trustee |

|

|

Type of Ownership |

|

Customer Type |

Identiication # (SD DL, SD ID, SSN, FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

Owner/Lessee/Trustee |

|

|

Type of Ownership |

|

Customer Type |

Identiication # (SD DL, SD ID, SSN, FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

Owner/Lessee/Trustee |

|

|

Type of Ownership |

|

Customer Type |

Identiication # (SD DL, SD ID, SSN, FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

Owner/Lessor/Trust Mailing Address |

|

City |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

See Special |

|

|

|

|

|

|

|

|

|

|

|

|

Owner/Lessor/Trust Physical Address (Residence Post Ofice Address) |

|

City |

|

|

State |

Zip Code |

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in Section VII |

|

Lessee/Trustee Mailing Address |

|

City |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lessee/Trustee Physical Address (Residence Post Ofice Address) |

|

City |

|

|

State |

Zip Code |

IV. Primary VIN or Serial Number:

Make |

Model |

Body Type |

Vehicle Code |

Year |

Weight/CC |

Color |

Fuel |

Previous State/Brand |

Secondary VIN or Serial Number: |

|

|

|

|

|

|

|

|

Year: |

|

Make: |

|

Odometer Reading (Complete for vehicles 9 years old or newer): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Units (Check one): Miles |

|

Kilometers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Odometer Brand (Check one): |

|

|

|

|

|

|

|

Actual Mileage |

|

|

|

Exceeds Odometer’s Mechanical Limits |

|

Not Actual Mileage |

|

|

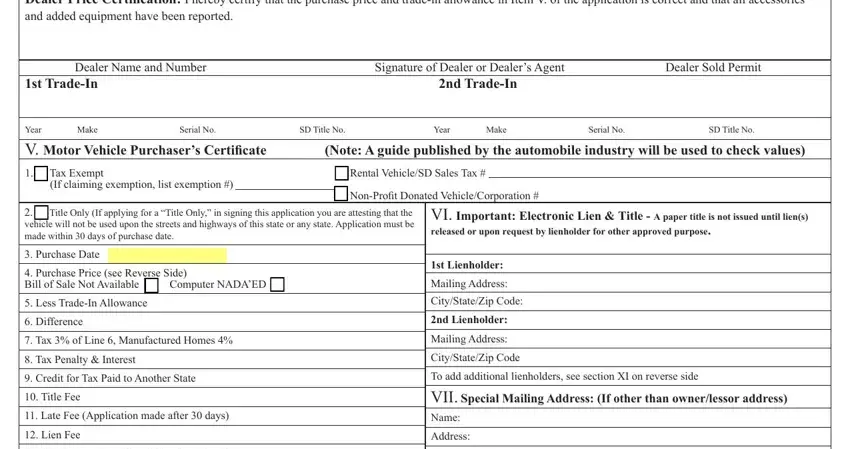

Dealer Price Certiication: I hereby certify that the purchase price and trade-in allowance in Item V. of the application is correct and that all accessories |

|

and added equipment have been reported. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dealer Name and Number |

|

|

|

|

|

|

Signature of Dealer or Dealer’s Agent |

|

Dealer Sold Permit |

1st Trade-In |

|

|

|

|

|

|

|

|

|

2nd Trade-In |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

Make |

Serial No. |

|

|

SD Title No. |

|

|

Year |

Make |

Serial No. |

SD Title No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V. Motor Vehicle Purchaser’s Certiicate |

|

|

(Note: A guide published by the automobile industry will be used to check values) |

1. |

|

Tax Exempt |

|

|

|

|

|

|

|

Rental Vehicle/SD Sales Tax # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If claiming exemption, list exemption #) |

|

|

|

|

Non-Proit Donated Vehicle/Corporation # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Title Only (If applying for a “Title Only,” in signing this application you are attesting that the |

|

VI. Important: Electronic Lien & Title - A paper title is not issued until lien(s) |

vehicle will not be used upon the streets and highways of this state or any state. Application must be |

|

released or upon request by lienholder for other approved purpose. |

made within 30 days of purchase date. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Purchase Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st Lienholder: |

|

|

|

|

|

|

|

|

|

|

4. Purchase Price (see Reverse Side) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

Bill of Sale Not Available |

Computer NADA’ED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Less Trade-In Allowance |

|

|

|

|

|

|

|

|

|

City/State/Zip Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2nd Lienholder: |

|

|

|

|

|

|

|

|

|

|

6. Difference |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Tax 3% of Line 6, Manufactured Homes 4% |

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Tax Penalty & Interest |

|

|

|

|

|

|

|

|

|

City/State/Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Credit for Tax Paid to Another State |

|

|

|

|

|

|

|

|

To add additional lienholders, see section XI on reverse side |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Title Fee |

|

|

|

|

|

|

|

|

|

VII. Special Mailing Address: (If other than owner/lessor address) |

11. Late Fee (Application made after 30 days) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

12. Lien Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

13. Balance Due for Title Application |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/State/Zip Code: |

|

|

|

|

|

|

|

|

|

|

|

|

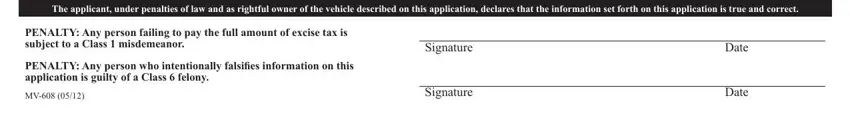

The applicant, under penalties of law and as rightful owner of the vehicle described on this application, declares that the information set forth on this application is true and correct. |

PENALTY: Any person failing to pay the full amount of excise tax is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

subject to a Class 1 misdemeanor. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PENALTY: Any person who intentionally falsiies information on this application is guilty of a Class 6 felony.

MV-608 (05/12) |

Signature |

Date |

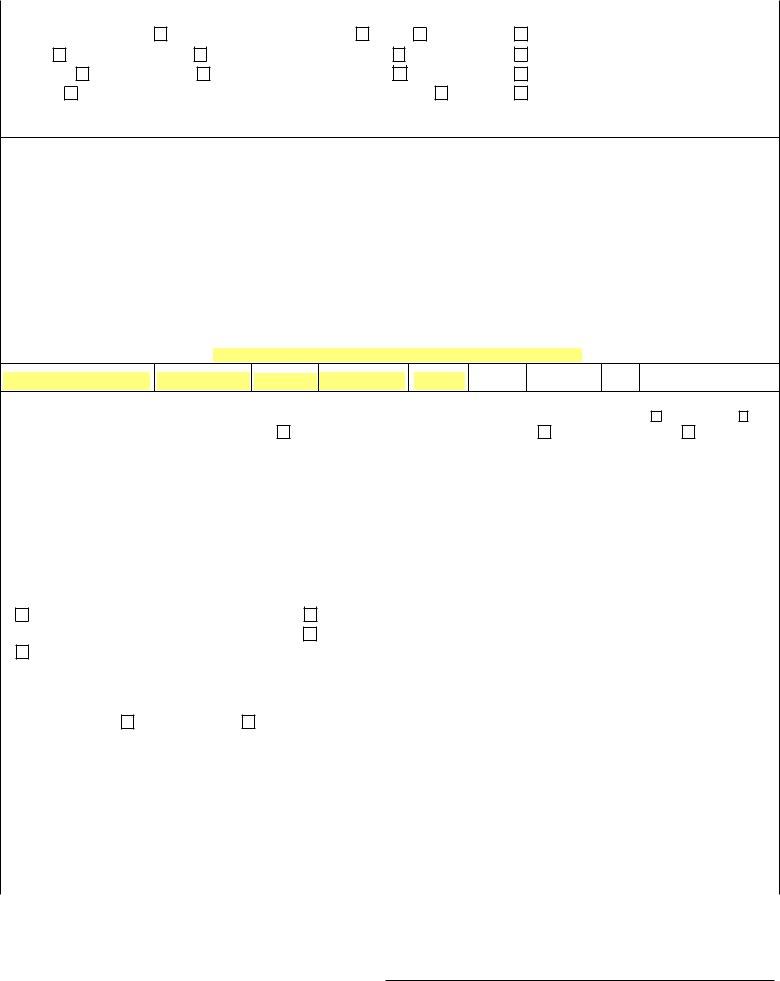

VIII

TAX EXEMPTIONS: If vehicle is exempt from tax, enter number corresponding to exemption in item “V” of the application. Exemptions 05 through 11 must have been titled previously in S.D. Refer to MV-609 or SDCL 32-5B-2 for a complete list of exemptions.

01.Vehicle owned by United States, state, county, municipality, public school corporation, Indian tribes or schools, non-proit adjustment training centers, ire departments, buses owned by churches, or farm vehicles as deined in SDCL 32-5-1.3.

02. Vehicle acquired by inheritance from or bequest of a decedent.

03.Vehicle previously titled or licensed jointly in the names of two or more persons and subsequently transferred without consideration to one or more of such persons.

04.Vehicle transferred without consideration between spouses, between a parent and child, and between siblings.

05.Vehicle/boat transferred pursuant to any mergers or consolidations of corporations or plans of reorganization by which substantially all of the assets of a corporation are transferred.

06. Vehicle transferred by a subsidiary corporation to its parent corporation.

07. Vehicle transferred between an individual and a corporation where the individual and the owner of the majority of the capital stock of the corporation are one and the same.

08. Vehicle transferred between a corporation and its stockholders or creditors when to effectuate a dissolution of the corporation.

09.Vehicle transferred between an individual and a limited or general partnership where the individual and the owner of the majority interest in the partnership are one and the same person.

10.Vehicle transferred to effect a sale of all or substantially all of the assets of the business entity.

11.Vehicle transferred between corporation, both subsidiary and nonsubsidiary, if the individuals who hold a majority of stock in the irst corporation also hold a majority of stock in the second corporation; but these individuals need not hold the same ratio of stock in both corporations.

12.Vehicle acquired by a secured party or lienholder in satisfaction of a debt.

13.Vehicle irst transferred to a person other than a licensed motor vehicle dealer when such vehicle was previously license and registered pursuant to SDCL 32-5-27 (exemption applies only if title previously coded 27).

14.Any motor vehicle sold or transferred which is eleven or more model years old and which is sold or transferred for $2,200 or less, before trade-in.

VII

PURCHASE PRICE IS:

(1)For a new motor vehicle sale or lease, the total consideration whether received in money or otherwise. However, when a motor vehicle is taken in trade as credit or part payment on a new motor vehicle, the credit or trade-in value allowed by the seller shall be deducted from the total consideration for the new vehicle to establish the purchase price.

(2)For a used motor vehicle sold or leased by a licensed motor vehicle dealer, the total consideration for the used motor vehicle whether received in money or otherwise. However, when a motor vehicle is taken in trade by the dealer as a credit or part payment on a used motor vehicle, the credit or trade-in value allowed by the dealer shall be deducted from the consideration so that the net consideration is established.

(3)For a used motor vehicle sold, leased or transferred by any person other than a licensed motor vehicle dealer, the total consideration received in money or otherwise. However, when a motor vehicle is taken in trade as a credit or part payment on a used motor vehicle, the credit or trade-in value shall be deducted from the total consideration so that the net consideration is established. The purchaser and seller of the motor vehicle shall submit to the county treasurer a bill of sale, approved and supplied by the secretary. If a bill of sale is not submitted, the excise tax will be assessed on the retail value as stated in a nationally recognized dealers’ guide as approved by the secretary of revenue. If the excise tax is assessed on the retail value, the value of the motor vehicle taken in as credit on trade-in shall be the retail value as stated in the nationally recognized dealers’ guide.

(4)For a new or used motor vehicle acquired by gift or other transfer for no or nominal consideration, the manufacturer’s suggested dealer list price for new motor vehicles and for used motor vehicles the value stated in a nationally recognized dealers’ guide approved and furnished by the secretary of revenue.

(5)For a motor vehicle manufactured by a person who registers it under the laws of this state, the amount expended for materials, labor and other properly allocable costs of manu- facture or in the absence of actual expenditures for the manufacture of a part or all of the motor vehicle, the reasonable value of the completed motor vehicle.

(6)For a rebuilt motor vehicle, upon its initial registration and titling, the total consideration for the salvage vehicle, whether received in money or otherwise.

(7)For a closed lease, total consideration is all lease payments including cash, rebates, the net trade-in, extended warranties, administrative fees, acquisition fees, or any other fees assessed on the purchase of the vehicle. Total consideration does not include title fees, registration fees, or state and federal excise tax, insurance and refundable deposits.

(8)For an open end lease or lease in which the terms of the lease are not certain at the time the lease contract is executed, purchase price is the purchase price of the vehicle, plus cash, rebates, the net trade-in, extended warranties, administrative fees, acquisition fees, or any other fees assessed on the purchase of the vehicle.Total consideration does not include title fees, registration fees, state or federal excise tax, insurance and refundable deposits.

X

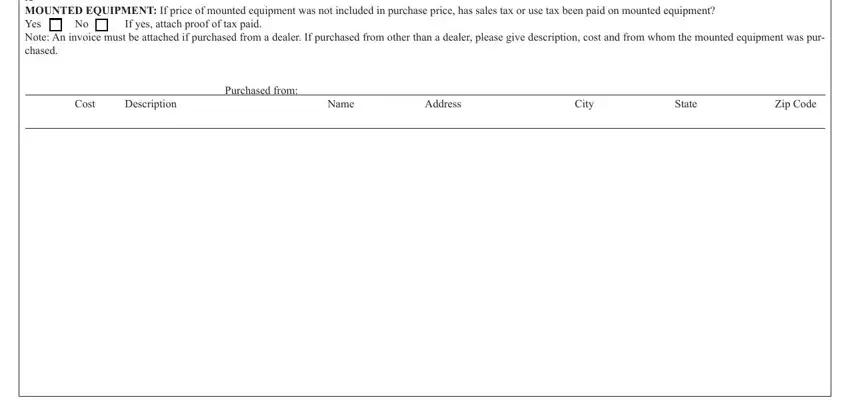

MOUNTED EQUIPMENT: If price of mounted equipment was not included in purchase price, has sales tax or use tax been paid on mounted equipment?

Yes |

|

No |

|

If yes, attach proof of tax paid. |

Note: An invoice must be attached if purchased from a dealer. If purchased from other than a dealer, please give description, cost and from whom the mounted equipment was pur- chased.

Purchased from:

Cost |

Description |

Name |

Address |

City |

State |

Zip Code |

|

|

|

|

|

|

|