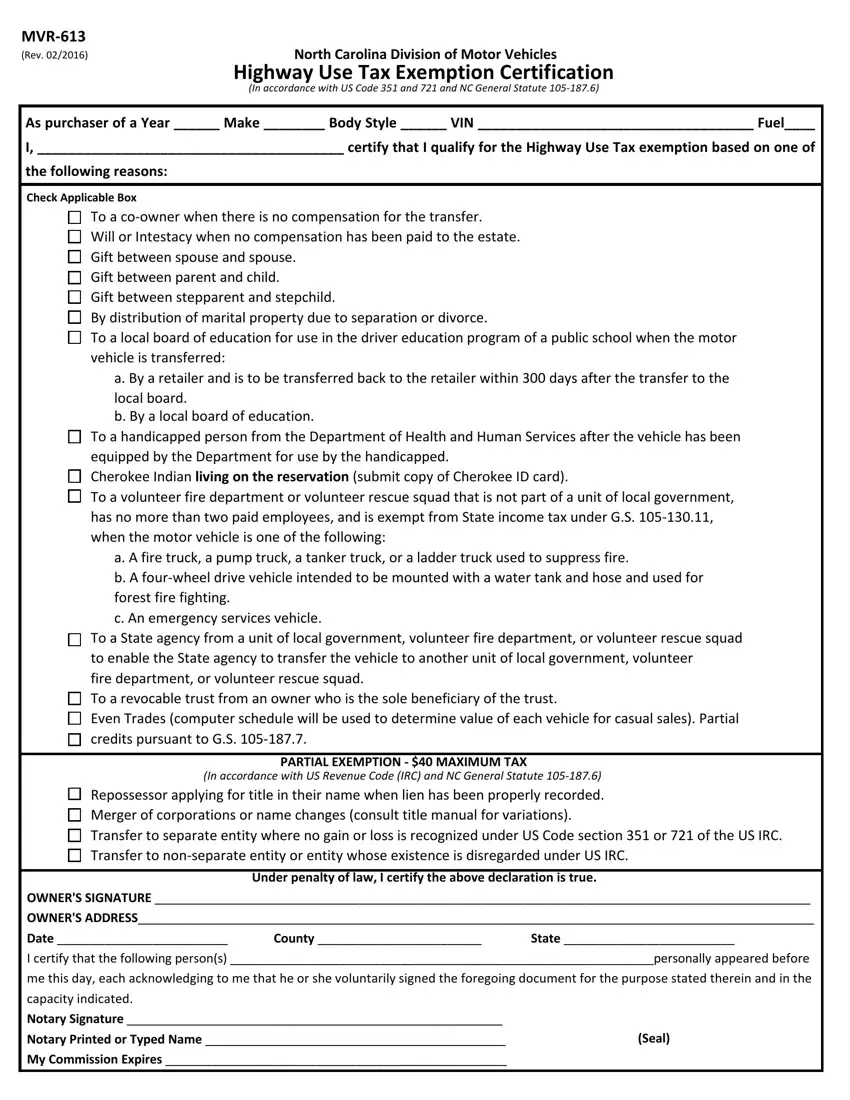

MVR-613

(Rev. 02/2016) |

North Carolina Division of Motor Vehicles |

|

Highway Use Tax Exemption Certification |

|

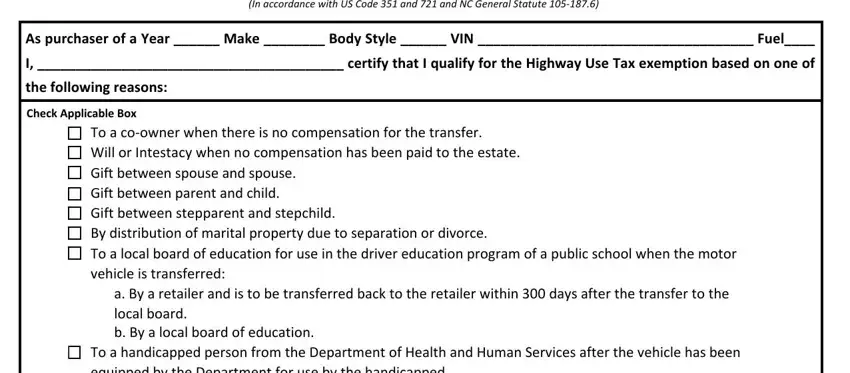

(In accordance with US Code 351 and 721 and NC General Statute 105-187.6) |

As purchaser of a Year ______ Make ________ Body Style ______ VIN ____________________________________ Fuel____

I, ________________________________________ certify that I qualify for the Highway Use Tax exemption based on one of

the following reasons:

Check Applicable Box

To a co-owner when there is no compensation for the transfer.

Will or Intestacy when no compensation has been paid to the estate. Gift between spouse and spouse.

Gift between parent and child.

Gift between stepparent and stepchild.

By distribution of marital property due to separation or divorce.

To a local board of education for use in the driver education program of a public school when the motor vehicle is transferred:

a. By a retailer and is to be transferred back to the retailer within 300 days after the transfer to the local board.

b. By a local board of education.

To a handicapped person from the Department of Health and Human Services after the vehicle has been equipped by the Department for use by the handicapped.

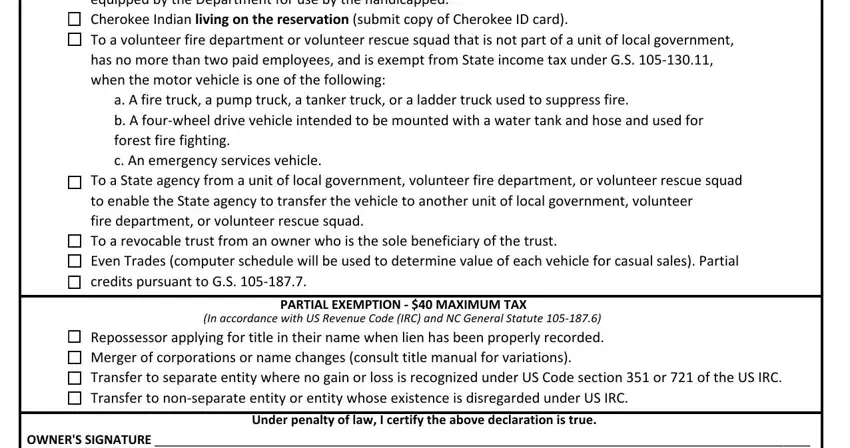

Cherokee Indian living on the reservation (submit copy of Cherokee ID card).

To a volunteer fire department or volunteer rescue squad that is not part of a unit of local government, has no more than two paid employees, and is exempt from State income tax under G.S. 105-130.11, when the motor vehicle is one of the following:

a. A fire truck, a pump truck, a tanker truck, or a ladder truck used to suppress fire.

b. A four-wheel drive vehicle intended to be mounted with a water tank and hose and used for forest fire fighting.

c. An emergency services vehicle.

To a State agency from a unit of local government, volunteer fire department, or volunteer rescue squad to enable the State agency to transfer the vehicle to another unit of local government, volunteer

fire department, or volunteer rescue squad.

To a revocable trust from an owner who is the sole beneficiary of the trust.

Even Trades (computer schedule will be used to determine value of each vehicle for casual sales). Partial credits pursuant to G.S. 105-187.7.

PARTIAL EXEMPTION - $40 MAXIMUM TAX

(In accordance with US Revenue Code (IRC) and NC General Statute 105-187.6)

Repossessor applying for title in their name when lien has been properly recorded. Merger of corporations or name changes (consult title manual for variations).

Transfer to separate entity where no gain or loss is recognized under US Code section 351 or 721 of the US IRC. Transfer to non-separate entity or entity whose existence is disregarded under US IRC.

Under penalty of law, I certify the above declaration is true.

OWNER'S SIGNATURE ________________________________________________________________________________________________

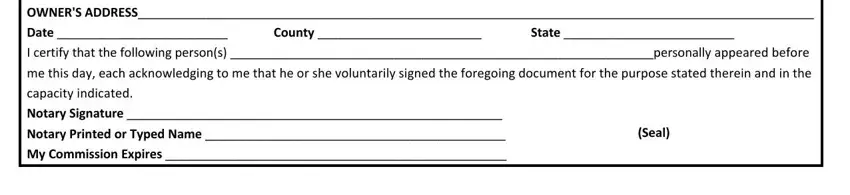

OWNER'S ADDRESS___________________________________________________________________________________________________

Date _________________________ County ________________________ State _________________________

I certify that the following person(s) ______________________________________________________________personally appeared before

me this day, each acknowledging to me that he or she voluntarily signed the foregoing document for the purpose stated therein and in the capacity indicated.

Notary Signature _______________________________________________________ |

|

Notary Printed or Typed Name ____________________________________________ |

(Seal) |

My Commission Expires __________________________________________________ |

|