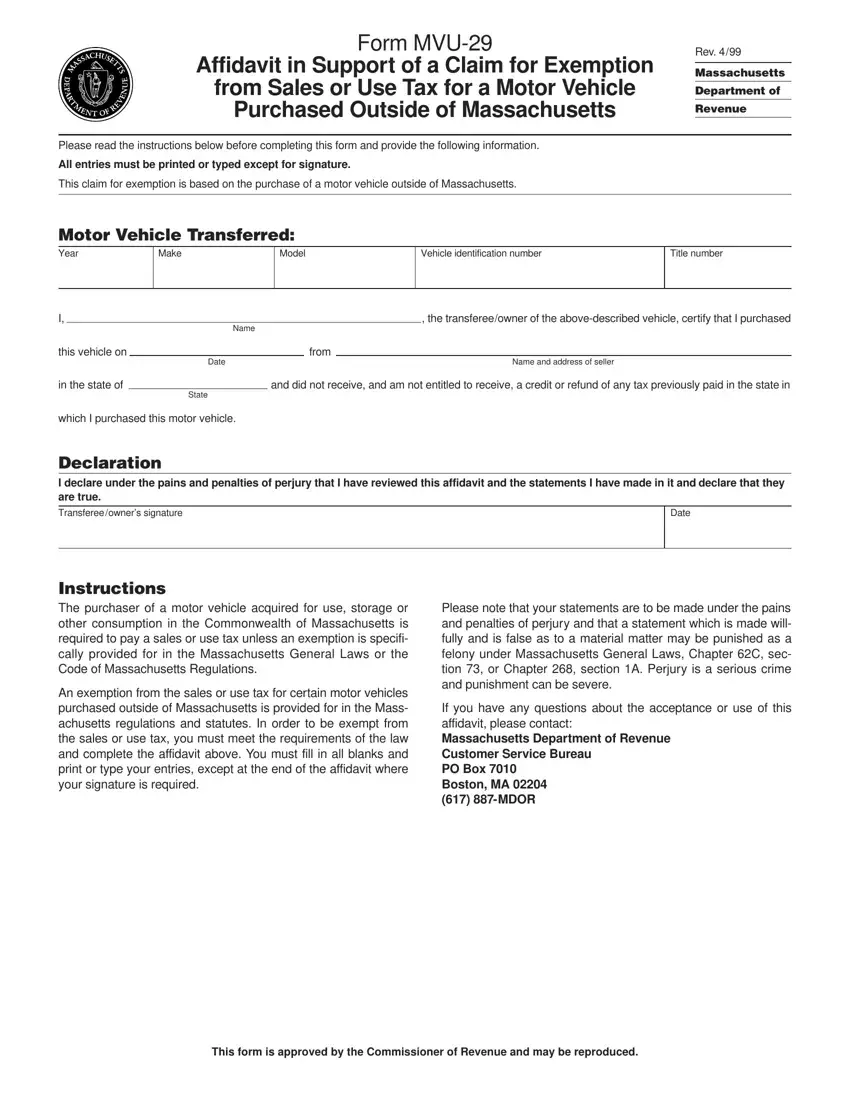

The PDF editor makes it simple to create the fillable mvu 29 form. It's possible to create the form effortlessly through using these simple steps.

Step 1: The page has an orange button that says "Get Form Now". Click it.

Step 2: At this point, you're on the document editing page. You may add content, edit existing details, highlight particular words or phrases, insert crosses or checks, add images, sign the file, erase needless fields, etc.

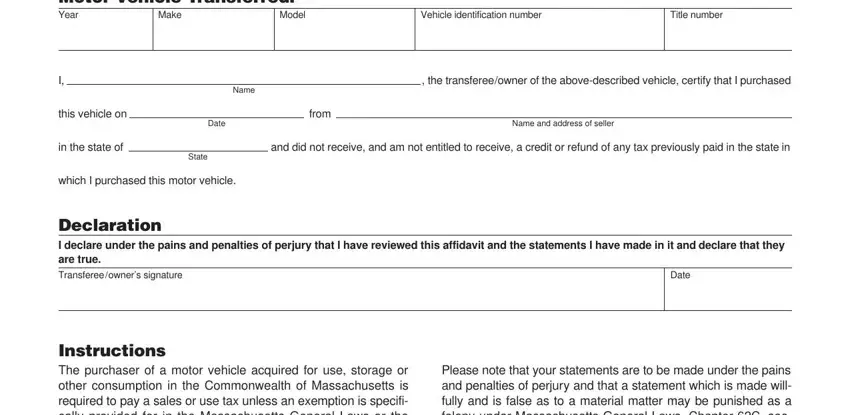

For every single part, complete the details required by the software.

Step 3: Click the "Done" button. Then, you can transfer your PDF file - download it to your electronic device or deliver it through email.

Step 4: It's possible to make copies of the form tokeep away from different possible concerns. Don't be concerned, we do not display or record your data.