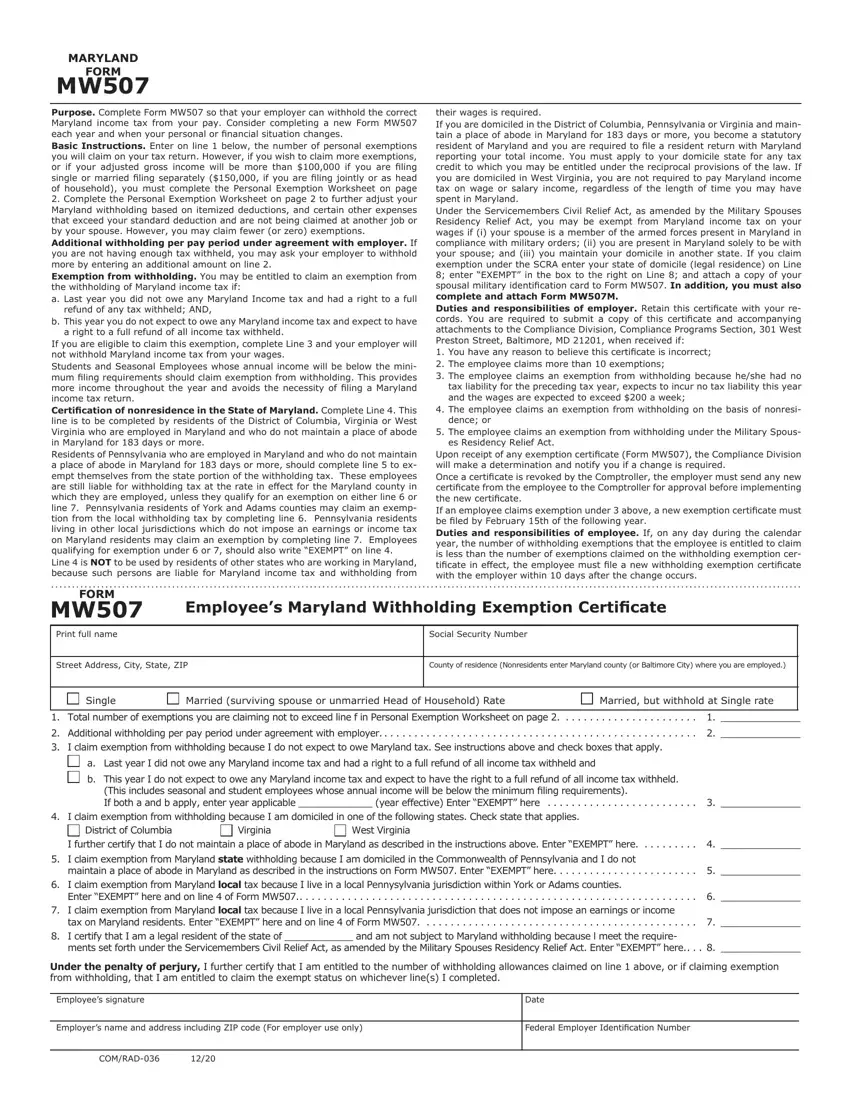

Our top level web programmers worked hard to develop the PDF editor we are pleased to deliver to you. The application enables you to instantly prepare domiciled and saves your time. You just have to try out this specific guide.

Step 1: Initially, select the orange "Get form now" button.

Step 2: When you've entered the domiciled editing page you can discover each of the functions you may perform regarding your document in the top menu.

In order to get the template, enter the content the system will require you to for each of the following areas:

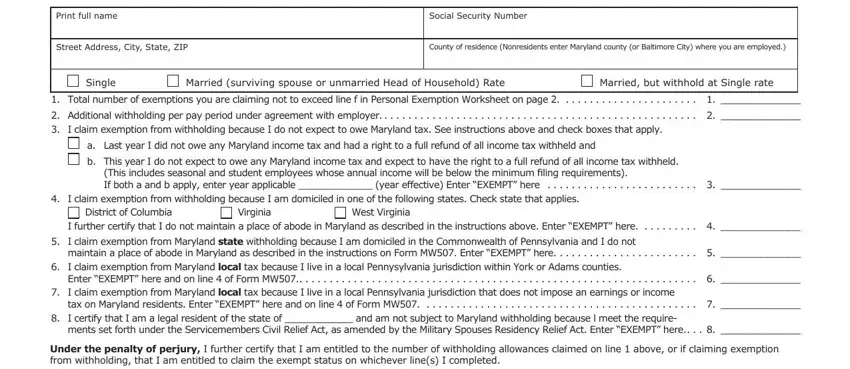

Indicate the information in Employees signature, Date, Employers name and address, and Federal Employer Identification.

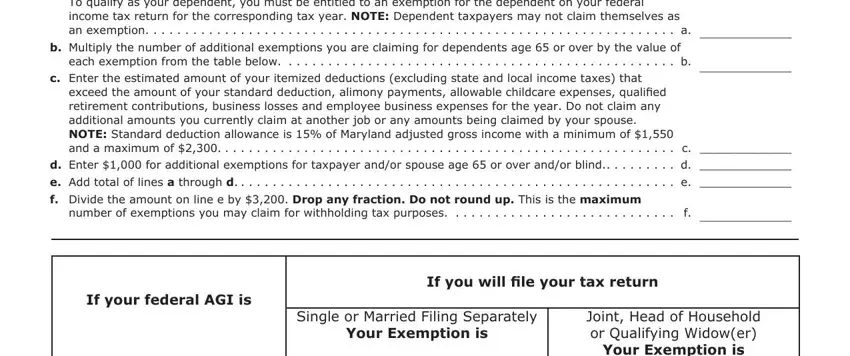

Describe the main details of the Generally the value of your, b Multiply the number of, each exemption from the table, c Enter the estimated amount of, exceed the amount of your standard, d Enter for additional exemptions, e Add total of lines a through d, f Divide the amount on line e by, number of exemptions you may claim, If your federal AGI is, If you will file your tax return, Single or Married Filing, and Joint Head of Household or part.

Step 3: Hit the button "Done". The PDF file can be transferred. You will be able upload it to your computer or send it by email.

Step 4: You should create as many duplicates of your document as you can to remain away from potential complications.