The tax file number declaration form filling out course of action is quick. Our editor lets you work with any PDF document.

Step 1: To get started, click the orange button "Get Form Now".

Step 2: After you've entered the editing page tax file number declaration form, you'll be able to discover every one of the functions intended for your document in the top menu.

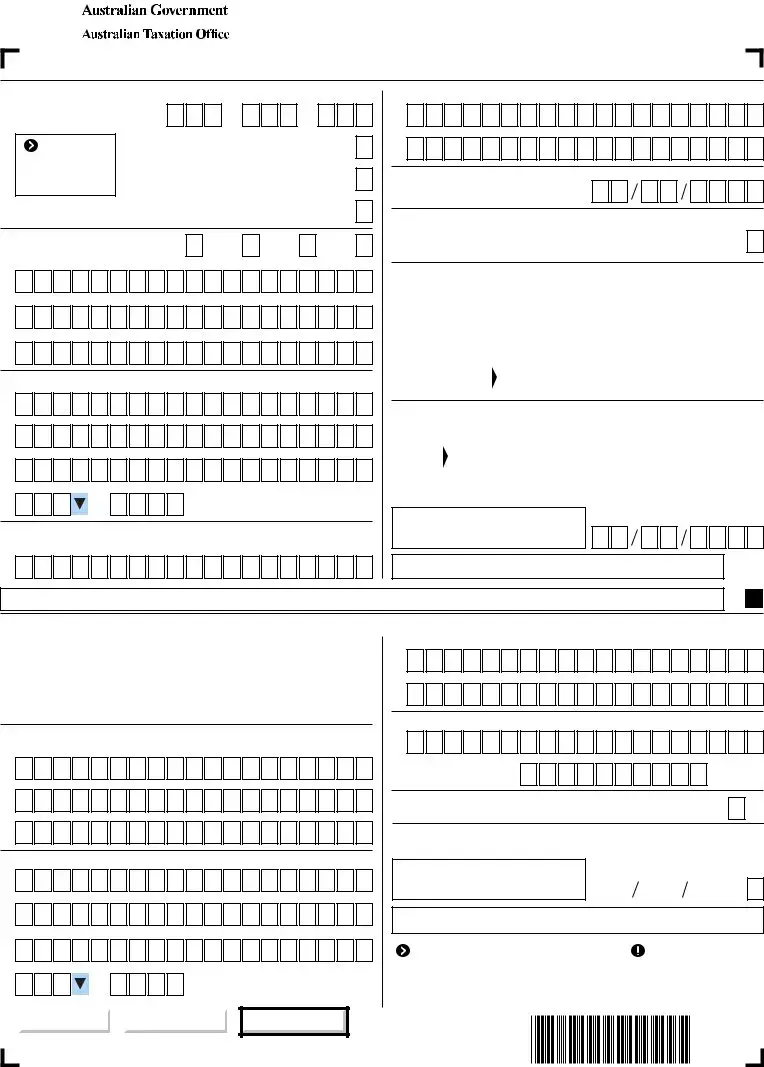

You need to enter the following information if you need to prepare the document:

Type in the necessary information in the space We and your payer are authorised, How do you find your TFN, You can find your TFN on any of, If you have a tax agent they may, If you still cant find your TFN, Monday to Friday, If you phone or visit us we need, You dont have a TFN, If you dont have a TFN and want to, For more information about, For more information about, Question, Complete with your personal, Question On what basis are you, and Check with your payer if youre not.

The system will request information to instantly prepare the section For more information about, You may be able to claim an, Print X in the appropriate box if, obtain your TFN You now have days, are claiming an exemption from, the Veterans Entitlement Act, Military Rehabilitation and, If you are in Australia on a, For more information about working, If youre not an Australian, Temporary residents can claim, Foreign resident tax rates are, and A higher rate of tax applies to a.

The To check your Australian residency, and Tax file number declaration box is where both sides can put their rights and obligations.

Review the areas For more information about lodging, If you receive any taxable, For more information about the, Question Do you have a Higher, Answer yes if you have a HELP VSL, Answer no if you do not have a, You have a HELP debt if either, HECSHELP FEEHELP OSHELP VET, and Contribution Scheme HECS and thereafter fill them out.

Step 3: When you hit the Done button, your finished file can be transferred to all of your gadgets or to email provided by you.

Step 4: Generate a duplicate of each separate file. It will save you time and assist you to keep clear of challenges in the future. By the way, your information won't be revealed or analyzed by us.

There are penalties for deliberately making a false or misleading statement.

There are penalties for deliberately making a false or misleading statement. Once section A is completed and signed, give it to your payer to complete section B.

Once section A is completed and signed, give it to your payer to complete section B. There are penalties for deliberately making a false or misleading statement.

There are penalties for deliberately making a false or misleading statement.