You are able to fill out navy federal beneficial owner form effortlessly in our PDFinity® editor. Our editor is consistently developing to deliver the best user experience attainable, and that's due to our resolve for constant enhancement and listening closely to testimonials. Getting underway is simple! All you have to do is adhere to the following easy steps below:

Step 1: Click the "Get Form" button above. It will open our pdf tool so you can start completing your form.

Step 2: With this state-of-the-art PDF editor, it is easy to accomplish more than just fill out blank form fields. Express yourself and make your forms appear faultless with customized text added in, or adjust the original input to perfection - all that comes along with the capability to add just about any images and sign the PDF off.

It will be an easy task to fill out the form with this detailed tutorial! This is what you need to do:

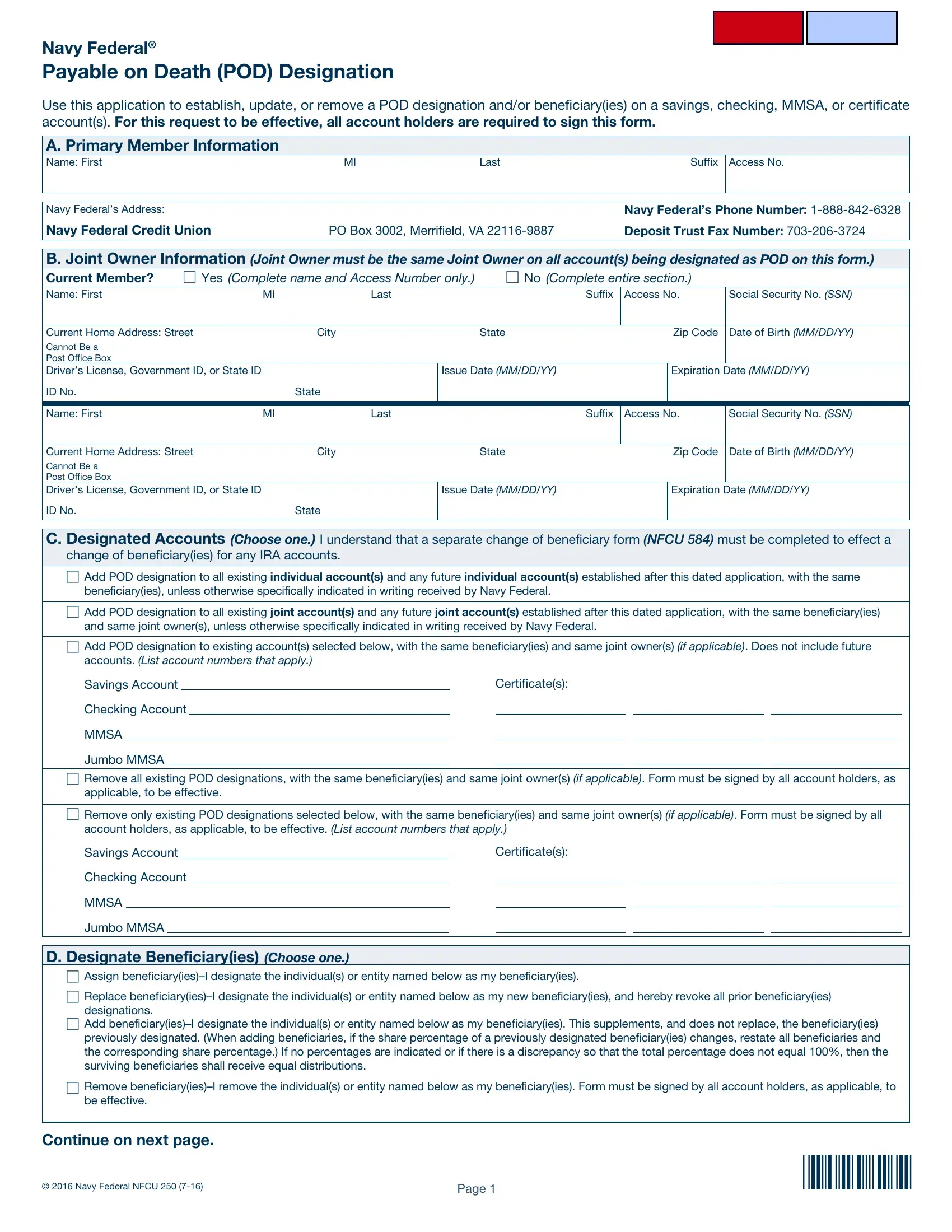

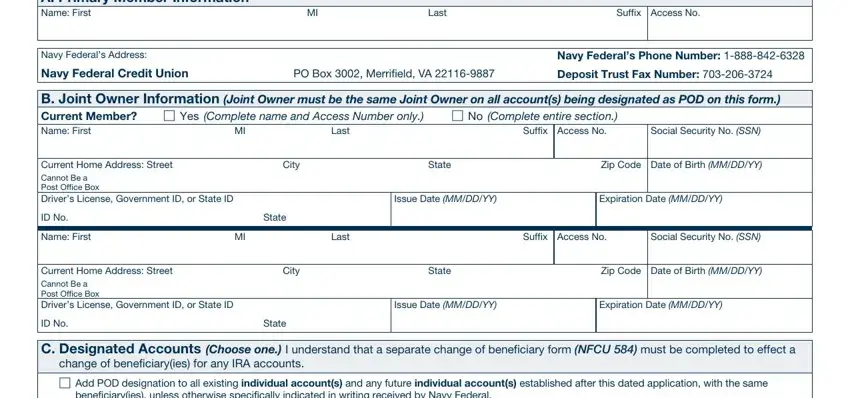

1. Begin completing the navy federal beneficial owner form with a selection of necessary fields. Consider all the information you need and ensure not a single thing overlooked!

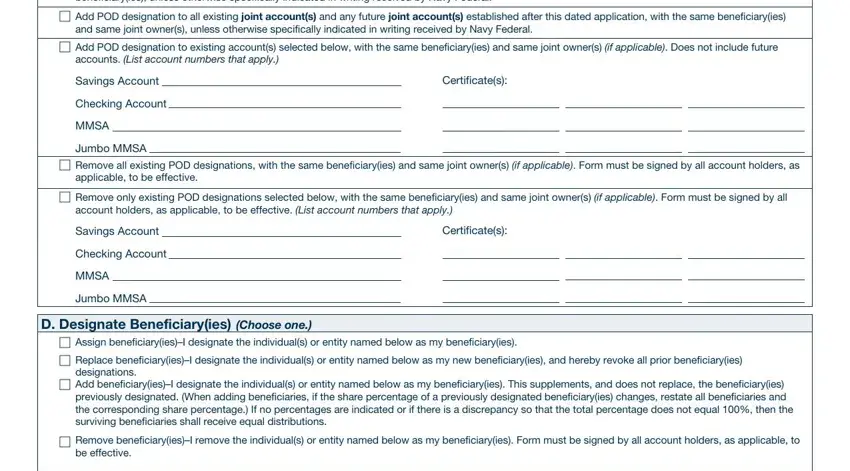

2. Soon after performing this step, go on to the next step and complete the essential particulars in these blanks - beneficiaryies unless otherwise, Add POD designation to all, and same joint owners unless, Add POD designation to existing, accounts List account numbers that, Savings Account, Checking Account, MMSA, Jumbo MMSA, Certificates, Remove all existing POD, applicable to be effective, Remove only existing POD, account holders as applicable to, and Savings Account.

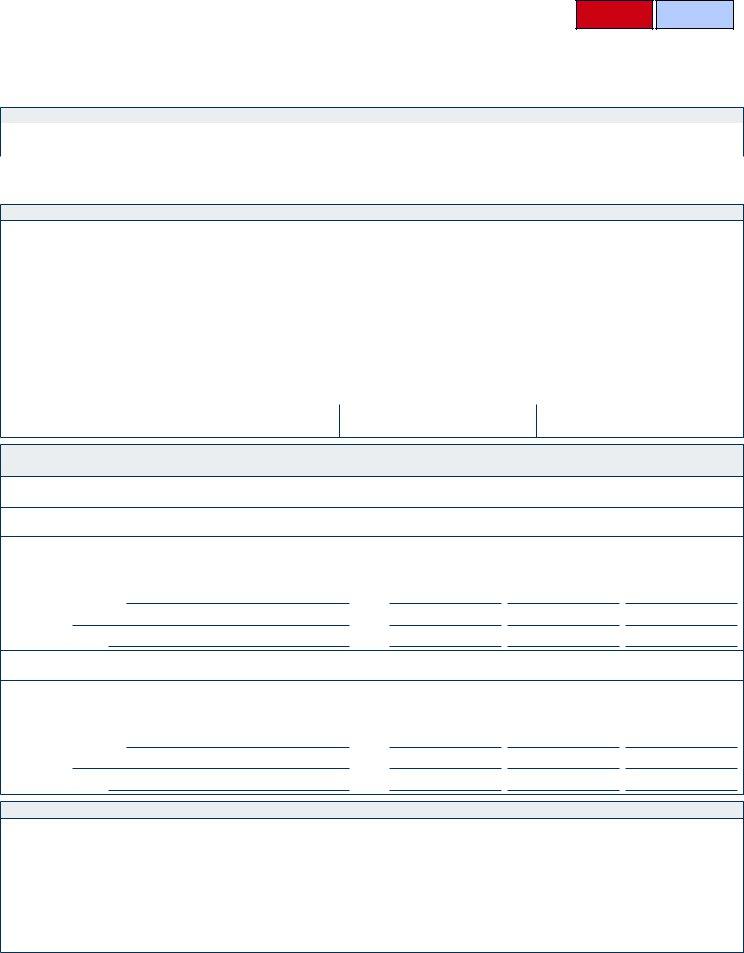

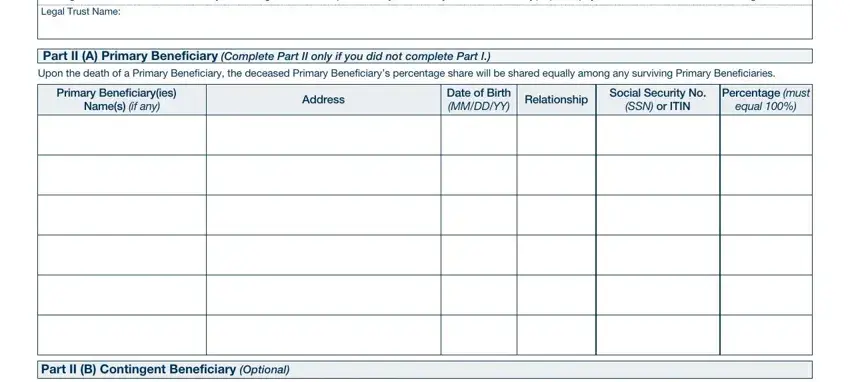

3. The following section is related to If a Legal Trust is named as, Legal Trust Name, Part II A Primary Beneficiary, Upon the death of a Primary, Primary Beneficiaryies, Names if any, Address, Date of Birth MMDDYY, Relationship, Social Security No, Percentage must, SSN or ITIN, equal, and Part II B Contingent Beneficiary - type in each of these fields.

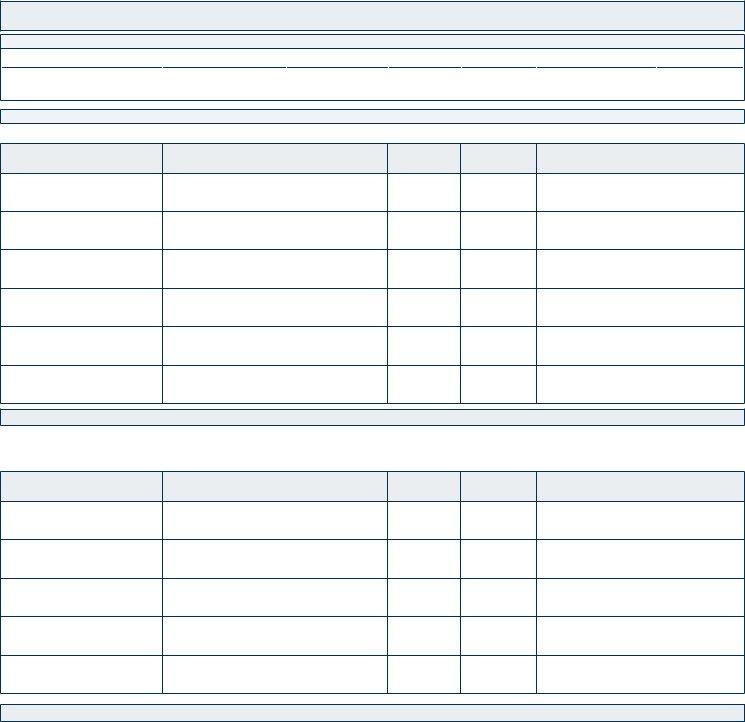

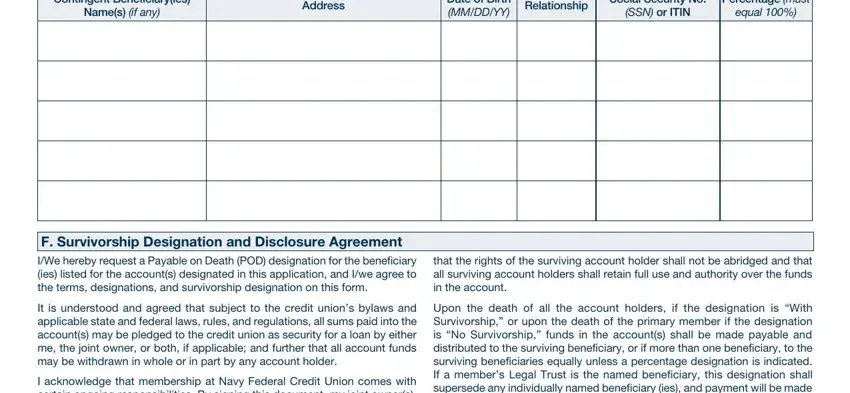

4. The following part requires your information in the following parts: Contingent Beneficiaryies, Names if any, Address, Date of Birth MMDDYY, Relationship, Social Security No, Percentage must, SSN or ITIN, equal, F Survivorship Designation and, IWe hereby request a Payable on, that the rights of the surviving, It is understood and agreed that, I acknowledge that membership at, and Upon the death of all the account. Make certain to type in all requested information to go forward.

Many people often make mistakes when filling in equal in this part. Don't forget to re-examine everything you enter here.

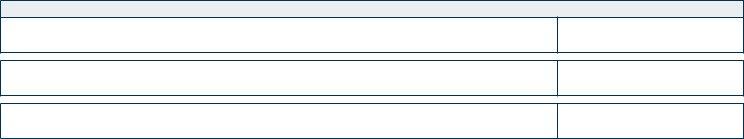

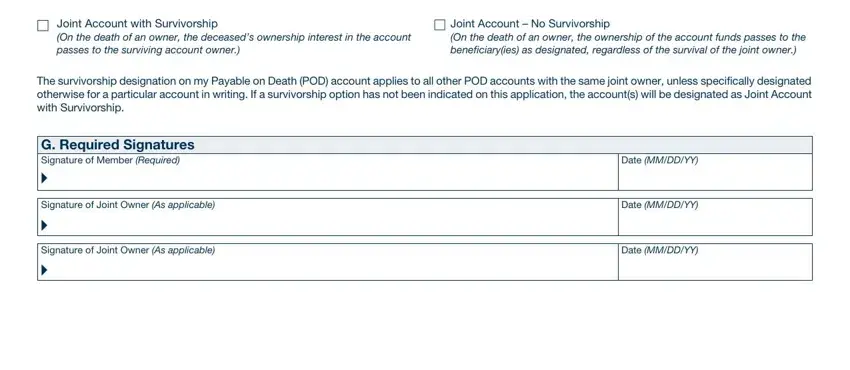

5. The pdf should be wrapped up by dealing with this segment. Below there is a comprehensive listing of blanks that need correct details for your form usage to be accomplished: Joint Account with Survivorship, Joint Account No Survivorship, On the death of an owner the, On the death of an owner the, The survivorship designation on my, G Required Signatures Signature of, Signature of Joint Owner As, Signature of Joint Owner As, Date MMDDYY, Date MMDDYY, and Date MMDDYY.

Step 3: Prior to obtaining the next stage, you should make sure that all form fields were filled out correctly. As soon as you think it's all good, click on “Done." Find your navy federal beneficial owner form the instant you join for a free trial. Instantly use the pdf document inside your personal account, with any modifications and changes conveniently saved! FormsPal is committed to the personal privacy of all our users; we make sure that all information processed by our system is confidential.