“Estimated Income Tax” is the amount of income tax you expect to owe for the year after subtracting the amount of tax you expect to have withheld and the amount of any tax credits you plan to claim.

Who Must Make Estimated Income

Tax Payments

You should make estimated income tax payments if the tax due on your individual tax return, reduced by the amount of tax withheld and tax credits, will be $1,000 or more.

You should estimate your income tax carefully to avoid having to pay a large balance when you ile your income tax return (Form D-400) and to avoid owing interest for

underpayment of estimated income tax (see discussion on Interest for Failure to Pay Your Estimated Income Tax). You may find it convenient to increase your withholding tax to avoid paying estimated income tax. If you do choose to increase the amount withheld, you should make sure the balance due on your income tax return will be less than $1,000.

When To Pay Your Estimated Income Tax

Generally you must make your irst estimated income tax payment by April 15. You must either pay all of your estimated income tax at that time or pay in four equal amounts on or before April 15, June 15, September 15 and January 15 of the following year. When the due date for the estimated income tax payment falls on a Saturday, Sunday or holiday, the payment is due on or before the next business day.

Although a payment of estimated income tax may not be due on April 15 based on your situation at that time, your expected income or exemptions may change so that a payment is due at a later date. In such cases, the payment dates are as follows:

If requirement is met after: Payment date is:

-April 1 and before June 1 |

June 15 |

-June 1 and before September 1 |

September 15 |

-September 1 |

January 15 |

If the first estimated income tax payment you are

required to make is due after April 15, or if you are required to change your payments after paying the irst installment, you should pay the remaining installments

as follows:

If the installment is due-

June 15: pay 1/2 of the balance of the net estimated income tax at that time, 1/4 of the balance on September 15 and the remaining 1/4 on January 15.

September 15: pay 3/4 of the balance of the net estimated income tax at that time and the remaining 1/4 on January 15.

If you ile your income tax return (Form D-400) by January 31 of the following year and pay the entire balance due, you do not have to make the payment which would otherwise be due on January 15.

Farmers and Fishermen

If at least two-thirds of your estimated gross income is

from farming (including oyster farming) or commercial ishing, your estimated income tax may be paid at any time on or before January 15 of the following year. If your income tax return (Form D-400) is iled and the total tax is paid on or before March 1, you do not have

to make an estimated income tax payment.

Fiscal Year

If your income is reported on a iscal year basis, your due dates are the 15th day of the 4th, 6th and 9th months of your iscal year, and the irst month of the following iscal year. For more information on how to complete the Form

NC-40 when paying your estimated income tax on a iscal year basis, please refer to the instructions on Completing the Estimated Income Tax Form (NC-40) on this page.

Interest for Failure to Pay Your

Estimated Income Tax

You may owe interest for underpayment of estimated income tax or for not making payments on time. Interest

will not be due if each installment payment is timely and equals twenty-ive percent (25%) of the lesser of: (a) 90% (66 2/3% for farmers and ishermen) of the tax due on your current year’s return; (b) 100% of the tax due on your previous year’s return, if your previous year’s return was a taxable year of 12 months and a return was iled for that year; or (c) 90% of the tax igured by annualizing the taxable income received during the year up to the

month in which the installment is due.

Underpayment interest will not be due if you had no tax liability for the previous year.

Compute underpayment interest on Form D-422, Underpayment of Estimated Tax by Individuals. You

may obtain the form by writing the N.C. Department of Revenue, Post Ofice Box 25000, Raleigh, North Carolina 27640-0001, by calling the Department at

1-877-252-3052 (toll-free), or from the Department’s website at www.dornc.com.

Completing the Estimated Income

Tax Form (NC-40)

The instructions that follow will help you complete the forms correctly.

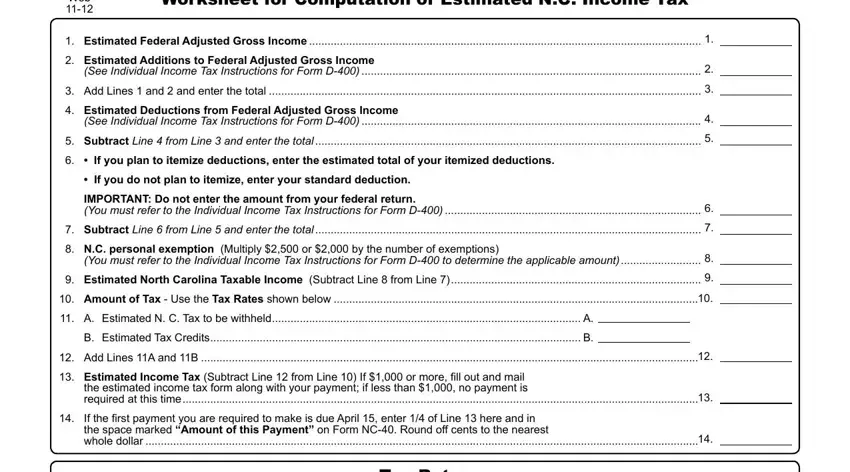

(1)First complete the worksheet on Page 2 to determine your estimated income tax for the tax year.

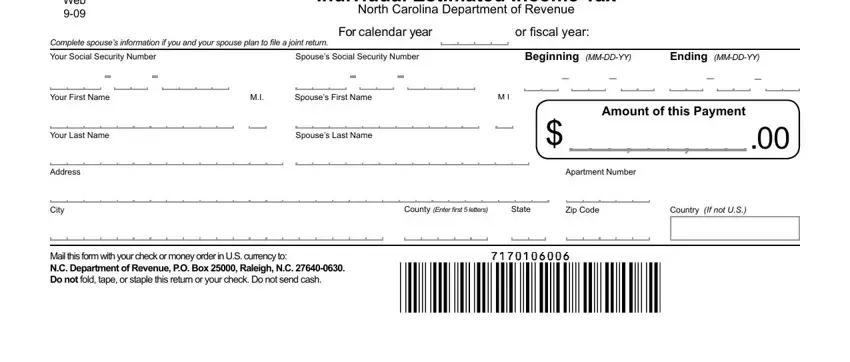

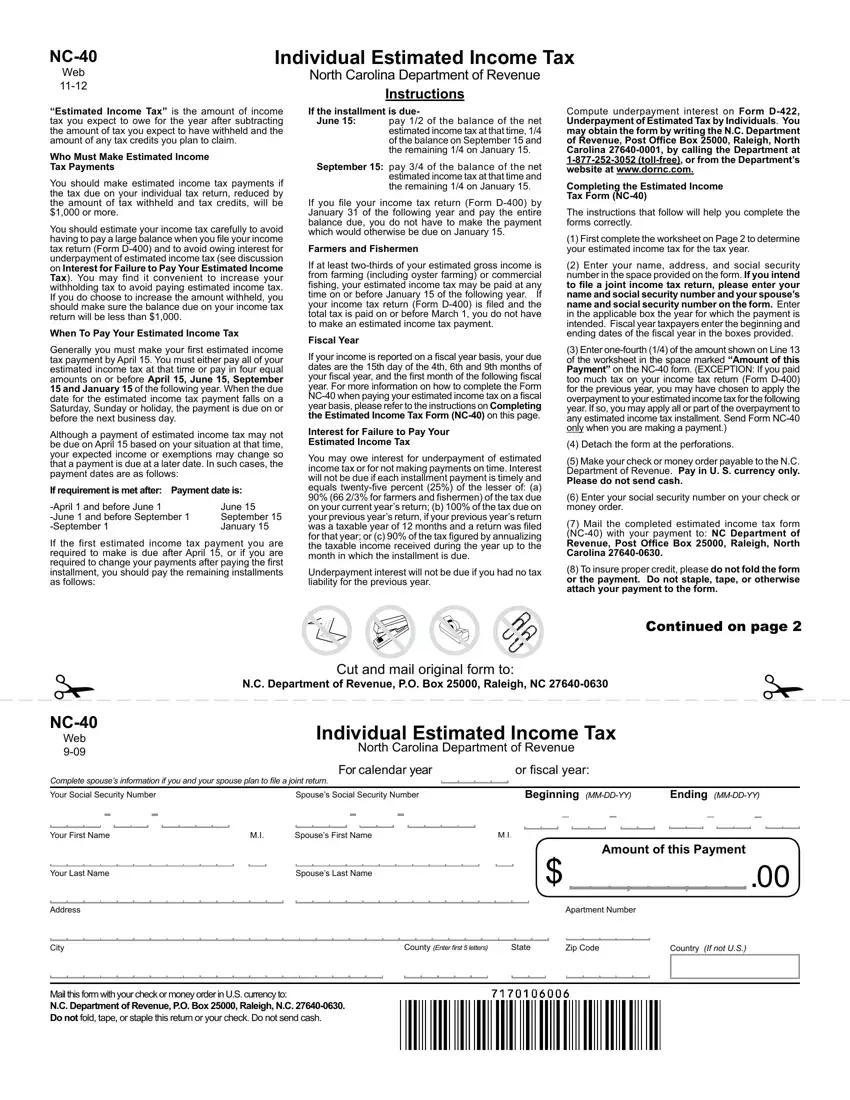

(2)Enter your name, address, and social security

number in the space provided on the form. If you intend to ile a joint income tax return, please enter your name and social security number and your spouse’s

name and social security number on the form. Enter in the applicable box the year for which the payment is

intended. Fiscal year taxpayers enter the beginning and ending dates of the iscal year in the boxes provided.

(3)Enter one-fourth (1/4) of the amount shown on Line 13 of the worksheet in the space marked “Amount of this Payment” on the NC-40 form. (EXCEPTION: If you paid too much tax on your income tax return (Form D-400) for the previous year, you may have chosen to apply the overpayment to your estimated income tax for the following year. If so, you may apply all or part of the overpayment to any estimated income tax installment. Send Form NC-40 only when you are making a payment.)

(4)Detach the form at the perforations.

(5)Make your check or money order payable to the N.C. Department of Revenue. Pay in U. S. currency only.

Please do not send cash.

(6)Enter your social security number on your check or money order.

(7)Mail the completed estimated income tax form

(NC-40) with your payment to: NC Department of

Revenue, Post Ofice Box 25000, Raleigh, North

Carolina 27640-0630.

(8)To insure proper credit, please do not fold the form or the payment. Do not staple, tape, or otherwise attach your payment to the form.