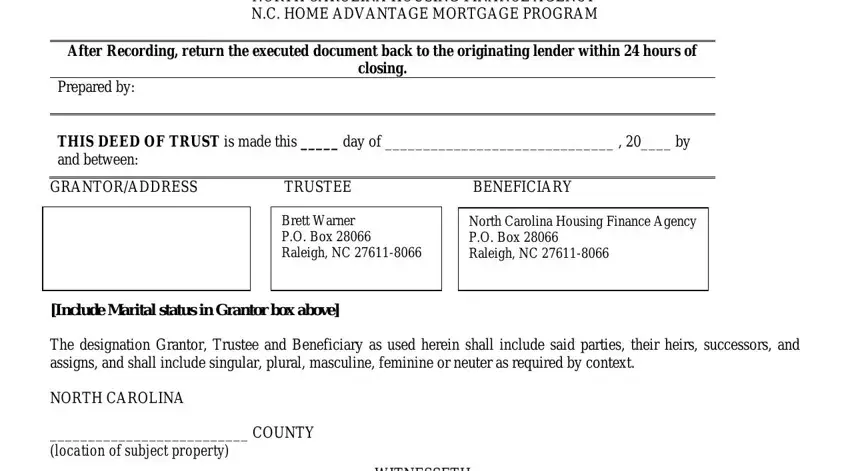

NORTH CAROLINA DEED OF TRUST

NORTH CAROLINA HOUSING FINANCE AGENCY

N.C. HOME ADVANTAGE MORTGAGE PROGRAM

After Recording, return the executed document back to the originating lender within 24 hours of

closing.

Prepared by:

THIS DEED OF TRUST is made this _____ day of ______________________________ , 20____ by

and between:

GRANTOR/ADDRESS |

TRUSTEE |

BENEFICIARY |

Brett Warner

P.O. Box 28066

Raleigh, NC 27611-8066

North Carolina Housing Finance Agency

P.O. Box 28066

Raleigh, NC 27611-8066

[Include Marital status in Grantor box above]

The designation Grantor, Trustee and Beneficiary as used herein shall include said parties, their heirs, successors, and assigns, and shall include singular, plural, masculine, feminine or neuter as required by context.

NORTH CAROLINA

__________________________ COUNTY

(location of subject property)

WITNESSETH:

THAT WHEREAS, the Beneficiary agrees to advance to the Grantor the sum of

Dollars ($) evidenced by the Promissory Note (the 'Note') from the Grantor to the Beneficiary dated the same date as this Deed of Trust, which together with any amounts advanced to protect the security of this Deed of Trust shall be the total amount secured;

AND WHEREAS, it has been agreed that the Loan will be advanced subject to the terms and conditions for use of the property as set forth in the Note and this Deed of Trust, and which is repayable, if not sooner paid, on the date that is fifteen (15) years after the date hereof, all as provided in the Note.

AND WHEREAS, it has been agreed that the Loan shall be secured by the conveyance of the land described in this Deed of Trust;

NOW, THEREFORE, as security for said indebtedness, advancements and other sums expended by Beneficiary pursuant to this Deed of Trust and costs of collection (including attorneys fees as provided in the Note) and other valuable consideration, the receipt of which is hereby acknowledged the Grantor has bargained, sold, given and conveyed and does by these presents bargain, sell, give, grant and convey to said Trustee, his heirs, or successors, and assigns, with power of

Home Advantage – Form 405 – Page 1

Rev. 2/2022

sale, the parcel(s) of land situated in the City of __________________, ___________________ County, North Carolina,

(the "Premises") and more particularly described as follows:

together with all heating, plumbing and lighting fixtures and equipment now or hereafter attached to or used in connection with the premises (the “Property”).

TO HAVE AND TO HOLD the Property, with all privileges and appurtenances thereunto belonging, to the Trustee, the Trustee's heirs, and assigns forever, upon the trust terms and conditions and for the uses set forth in this Deed of Trust.

If the Grantor shall pay the Note secured hereby in accordance with its terms, together with interest thereon, and any renewals or extensions thereof in whole or in part, all other sums secured hereby and shall comply with all of the covenants, terms and conditions of this Deed of Trust, then this conveyance shall be null and void and may be canceled of record at the request and the expense of the Grantor. If, however, there shall be any default (a) in the payment of any sums due under the Note, this Deed of Trust or any other instrument securing the Note and such default is not cured within thirty (30) days from the due date, or (b) if there shall be default in any of the other covenants, terms or conditions of the Note secured hereby, or any failure or neglect to comply with the covenants, terms or conditions contained in this Deed of Trust or any other instrument securing the Note and such default is not cured within thirty (30) days after written notice, then and in any of such events, without further notice, it shall be lawful for and the duty of the Trustee, upon request of the Beneficiary, to sell the land herein conveyed at public auction for cash, after having first giving such notice of hearing as to commencement of foreclosure proceedings and obtained such findings or leave of court as may then be required by law and giving such notice and advertising the time and place of such sale in such manner as may then be provided by law, and upon such and any resales and upon compliance with the law then relating to foreclosure proceedings under power of sale to convey title to the purchaser in as full and ample manner as the Trustee is empowered. The Trustee shall be authorized to retain an attorney to represent him in such proceedings. The proceeds of the Sale shall after the Trustee retains his commission, together with reasonable attorneys fees incurred by the Trustee in such proceedings, be applied to the costs of sale, including, but not limited to, costs of collection, taxes, assessments, costs of recording, service fees and incidental expenditures, the amount due on the Note hereby secured and advancements and other sums expended by the Beneficiary according to the provisions hereof and otherwise as required by the then existing law relating to foreclosures. The Trustee's commission shall be five percent (5%) of the gross proceeds of the sale for a completed foreclosure.

The said Grantor does hereby covenant and agree with the Trustee and Beneficiary as follows:

1.PAYMENT AND PERFORMANCE. Grantor shall pay the Note and perform all other requirements at the time and in the manner provided in the Note and herein.

2.INSURANCE. Grantor shall keep the property and all improvements, now or hereafter erected, constantly insured for the benefit of the Beneficiary against loss by fire, windstorm and such other casualties and contingencies, in the manner and with companies as may be satisfactory to the Beneficiary. The amount of the insurance required by this provision shall be the lesser of either the amount of the Note secured by this Deed of Trust or 100% of the insurable value of the improvements on the Property. Grantor shall purchase such insurance and pay all premiums in a timely manner. In the event that Grantor fails to pay any premium when it is due, then the Beneficiary, at its option, may purchase such insurance. Such amounts paid by the Beneficiary shall be added to the Note secured by this Deed of Trust and shall be due and payable by Grantor upon demand of the Beneficiary.

3.TAXES, ASSESSMENTS, CHARGES. Grantor shall pay all taxes, assessments and charges as may be lawfully levied against the Property before the same shall become past due. In the event that the Grantor fails to pay all taxes, assessments and charges as required, then the Beneficiary at its option may pay them and the amount paid shall be added to the Note secured by this Deed of Trust and shall be due and payable by Grantor upon demand of the Beneficiary.

Home Advantage – Form 405 – Page 2

Rev. 2/2022

Grantor shall promptly discharge any lien which has priority over this Deed of Trust unless Grantor: (a) agrees in writing to the payment of the obligation secured by the lien in a manner acceptable to Beneficiary, but only so long as Grantor is performing such agreement; (b) contests to the lien in good faith by, or defends against enforcement of the lien in, legal proceedings which in Beneficiary’s opinion operate to prevent the enforcement of the lien while those proceedings are pending, but only until such proceedings are concluded; or (c) secures from the holder of the lien an agreement satisfactory to Beneficiary subordinating the lien to this Deed of Trust. If Beneficiary determines that any part of the Property is subject to a lien which can attain priority over this Deed of Trust, Beneficiary may give Grantor a notice identifying the lien. Within 10 days of the date on which that notice is given, Grantor shall satisfy the lien or take one or more of the actions set forth above in this Deed of Trust.

4.WASTE. The Grantor covenants that the Grantor will keep the Property in good order, repair and condition, reasonable wear and tear excepted, and that Grantor will not commit or permit any waste on the Property.

5.WARRANTIES. Grantor covenants with Trustee and Beneficiary that Grantor is seized of the Property in fee simple, has the right to convey the same in fee simple, that the title is marketable and free and clear of all encumbrances, and that the Grantor will warrant and defend the title against the lawful claims of all persons whomsoever, except that the title to the Property is subject to the following exceptions:

(See Exhibit “B” attached hereto and incorporated herein by references, if applicable)

6.OCCUPANCY. Grantor shall occupy, establish, and use the Premises as Grantor’s principal residence.

7.SUBSTITUTION OF TRUSTEE. Grantor and Trustee covenant and agree that in case the Trustee, or any trustee, shall die, become incapable of acting, renounce this trust, or for other similar or dissimilar reason become unacceptable to the Beneficiary or if the Beneficiary desires to replace the Trustee, then the Beneficiary may appoint, in writing, a trustee to take the place of the Trustee; and upon the probate and registration of the writing, the trustee thus appointed shall succeed to all the rights, powers and duties of the Trustee.

8.CIVIL ACTIONS. In the event that the Trustee is named as a party in any civil action as trustee in this Deed of Trust, the Trustee shall be entitled to employ an attorney at law, including himself if he is a licensed attorney, to represent him in said action and the reasonable attorney's fees of the Trustee in such action may be Paid by the Beneficiary and added to the Note secured by this Deed of Trust, and shall be due and payable by Grantor upon demand of the Beneficiary.

9.PRIOR LIENS. Default under the terms of any instrument secured by a lien to which this Deed of Trust is subordinated shall constitute default under this Deed of Trust.

10.SUBORDINATION. Any subordination of this lien to additional liens or encumbrances shall be only upon the prior written consent of the Beneficiary.

11.LOAN APPLICATION. Grantor shall be in default if, during the Loan application process, Grantor or any persons or entities acting at the direction of Grantor or with Grantor’s knowledge or consent gave materially false, misleading, or inaccurate information or statements to (or failed to provide Lender with material information) in connection with the Loan. Material representations include, but are not limited to, representations concerning Grantor’s occupancy of the Property as Grantor’s principal residence and Grantor’s income level.

12.RIGHT TO INSPECT. To assure and protect its right in this Deed of Trust and the Property, the Beneficiary shall have right of access and inspection of the Property at reasonable times and with ample notice to the Grantor.

13.INDEMNITY. If any suit or proceeding be brought against the Trustee or Beneficiary or if any suit or proceeding be brought which may affect the value or title of the Property, Grantor shall defend, indemnify and hold harmless and on demand reimburse Trustee or Beneficiary from any loss, cost, damage or expense and any sums expended by Trustee or Beneficiary shall bear interest as provided in the Note secured hereby for sums due after default and shall be due and payable on demand.

14.SALE OF PROPERTY. Grantor agrees that if the Property or any part thereof or interest therein is sold, assigned, transferred, conveyed or otherwise alienated by Grantor, whether voluntarily or involuntarily or by operation of law other than: (i) the creation of a lien or other encumbrance subordinate to this Deed of Trust which does not relate to a transfer of rights of occupancy in the Property; (ii) a transfer by devise, descent, or operation of law on the death of a

Home Advantage – Form 405 – Page 3

Rev. 2/2022

joint tenant or tenant by the entirety; (iii) a transfer to a relative resulting from the death of a Grantor; (iv) a transfer resulting from a decree of a dissolution of marriage, legal separation agreement, or from an incidental property settlement agreement, by which the spouse of the Grantor becomes an owner of the Property; (v) any other transfer permitted under federal law, without the prior written consent of Beneficiary, Beneficiary, at its own option, may declare the Note secured hereby and all other obligations hereunder to be forthwith due and payable. Any change in the legal or equitable title of the Property or in the beneficial ownership of the Property shall be deemed to be the transfer of an interest in the Property.

15.TERMINATION OF RESTRICTIONS. Any restrictions contained in the Note or this Deed of Trust will automatically terminate if title to the Property is transferred by foreclosure or deed-in-lieu of foreclosure, or if the mortgage is assigned to the Secretary of the United States Department of Housing and Urban Development.

16.PROTECTION OF BENEFICIARY’S INTEREST IN THE PROPERTY AND RIGHTS UNDER THIS DEED OF TRUST. If (a) Grantor fails to perform the covenants and agreements contained in this Deed of Trust, (b) there is a legal proceeding that might significantly affect Beneficiary’s interest in the Property and/or rights under this Deed of Trust (such as a proceeding in bankruptcy, probate, for condemnation or forfeiture, for enforcement of a lien which may attain priority over this Deed of Trust or to enforce laws or regulations), or (c) Grantor has abandoned the

Property, then Beneficiary may do and pay for whatever is reasonable or appropriate to protect Beneficiary’s interest in the Property and rights under this Deed of Trust, including protecting and/or assessing the value of the Property, and securing and/or repairing the Property. Beneficiary’s actions can include, but are not limited to: (a) paying any sums secured by a lien which has priority over this Deed of Trust; (b) appearing in court; and (c) paying reasonable attorneys’ fees to protect its interest in the Property and/or rights under this Deed of Trust, including its secured position in a bankruptcy proceeding. Securing the Property includes, but is not limited to, entering the Property to make repairs, change locks, replace or board up doors and windows, drain water from pipes, eliminate building or other code violations or dangerous conditions, and have utilities turned on or off. Although Beneficiary may take action under this Section 15, Beneficiary does not have to do so and is not under any duty or obligation to do so. It is agreed that Beneficiary incurs no liability for not taking any or all actions authorized under this Section 15.

Any amounts disbursed by Beneficiary under this Section 15 shall become additional debt of Grantor secured by this Deed of Trust. These amounts shall bear interest at the Note rate, if any, from the date of disbursement and shall be payable, with such interest, upon notice from Beneficiary to Grantor requesting payment.

17.CONDEMNATION. If the Property, or any part of the Property, is condemned under any power of eminent domain, or acquired for public use, the damages, proceeds, and the consideration for such acquisition, to the extent of the full amount of indebtedness upon this Deed of Trust and if the Note remains unpaid, are hereby assigned by the Grantor to the Beneficiary and shall be paid to the Beneficiary to be applied by the Beneficiary on account of the indebtedness.

18.WAIVER OF DEFAULT. No sale of the Property and no forbearance on the part of the Beneficiary and no extension of the time for the repayment of the debt secured hereby given by the Beneficiary shall operate to release, discharge, modify, change, or affect the original liability of the Grantor either in whole or in part. The Beneficiary can, in its complete discretion, waive any default, and can waive by written instrument, in advance, any individual actions which might constitute a default.

19.GOVERNING LAW. This Deed of Trust is to be governed and construed in accordance with the laws of the State of North Carolina.

20.SUCCESSORS AND ASSIGNS. The covenants herein contained shall bind, and the benefits and advantages shall inure to the legal representatives, successors and assigns of the parties hereto.

Home Advantage – Form 405 – Page 4

Rev. 2/2022

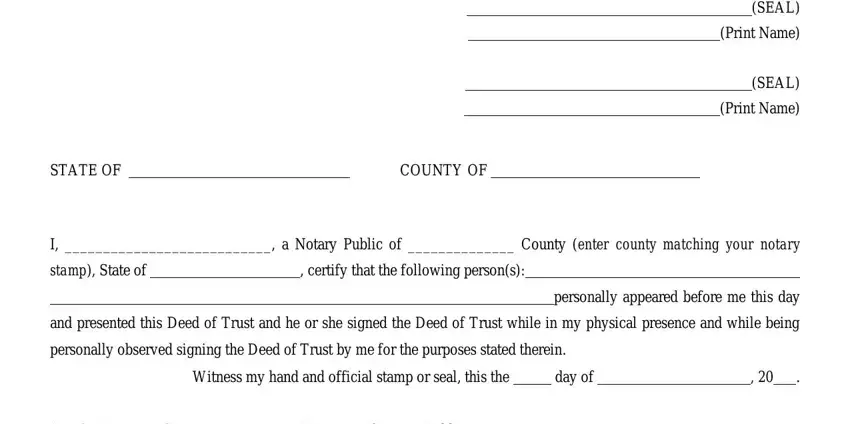

IN TESTIMONY WHEREOF, Grantor(s) has executed this instrument under seal on the date first above written. GRANTOR(S):

(SEAL) (Print Name)

(SEAL) (Print Name)

I, ___________________________, a Notary Public of ______________ County (enter county matching your notary

stamp), State of |

|

, certify that the following person(s): |

|

|

|

|

personally appeared before me this day |

and presented this Deed of Trust and he or she signed the Deed of Trust while in my physical presence and while being personally observed signing the Deed of Trust by me for the purposes stated therein.

|

Witness my hand and official stamp or seal, this the |

|

day of |

, 20 . |

(Apply Notary Seal) |

Signature of Notary Public |

|

|

|

|

|

|

|

|

My Commission expires |

|

|

|

|

|

|

|

|

|

Mortgage Loan Originator Name and NMLS #: |

|

, # |

|

|

(must match 1003) |

Company Name and NMLS #: |

|

|

, # |

|

|

|

(must match 1003) |

Home Advantage – Form 405 – Page 5 |

|

|

|

|

|

|

|

Rev. 2/2022 |

|

|

|

|

|

|

|