Working with PDF files online can be very easy with this PDF editor. You can fill out nc e536r here within minutes. To have our editor on the forefront of efficiency, we work to put into action user-oriented capabilities and improvements on a regular basis. We're always grateful for any suggestions - play a vital part in reshaping the way you work with PDF files. It just takes a couple of basic steps:

Step 1: Press the "Get Form" button above. It will open up our pdf editor so you can start filling out your form.

Step 2: The editor provides the opportunity to work with your PDF in a variety of ways. Modify it by writing personalized text, adjust original content, and add a signature - all when it's needed!

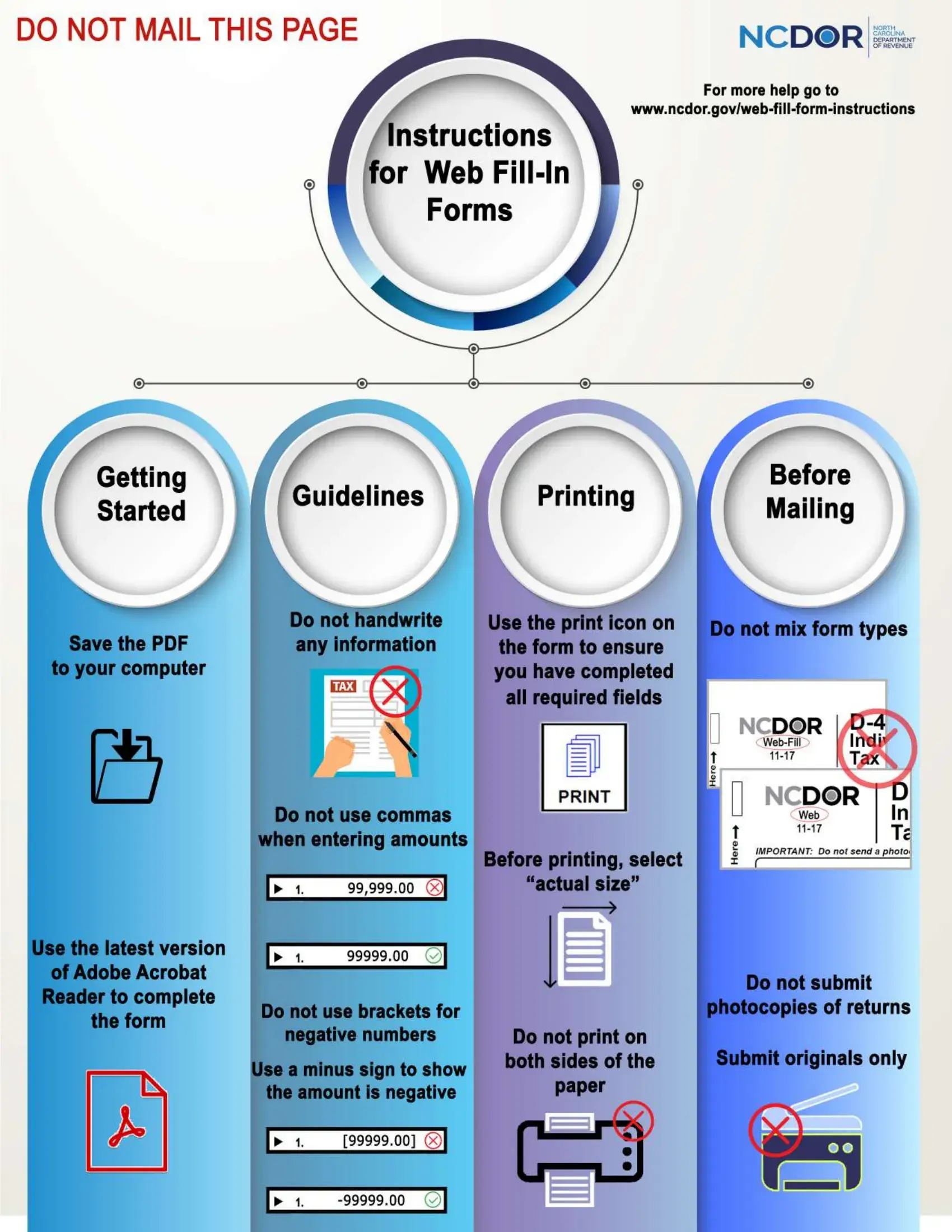

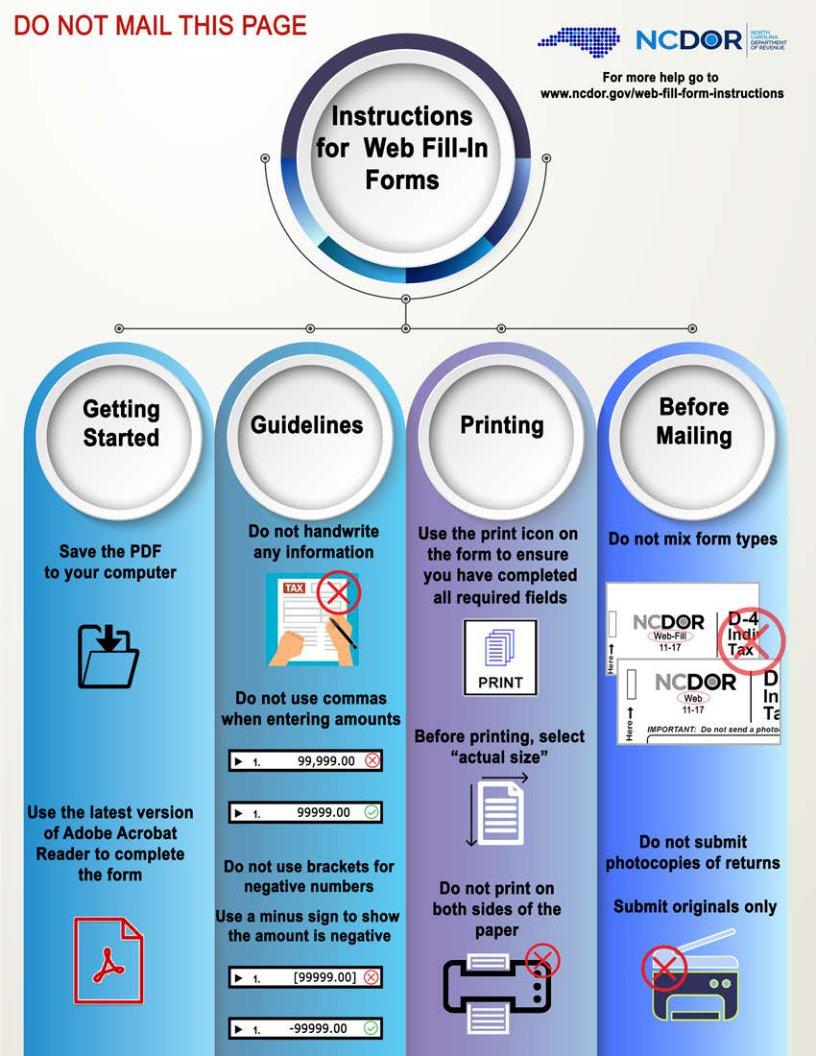

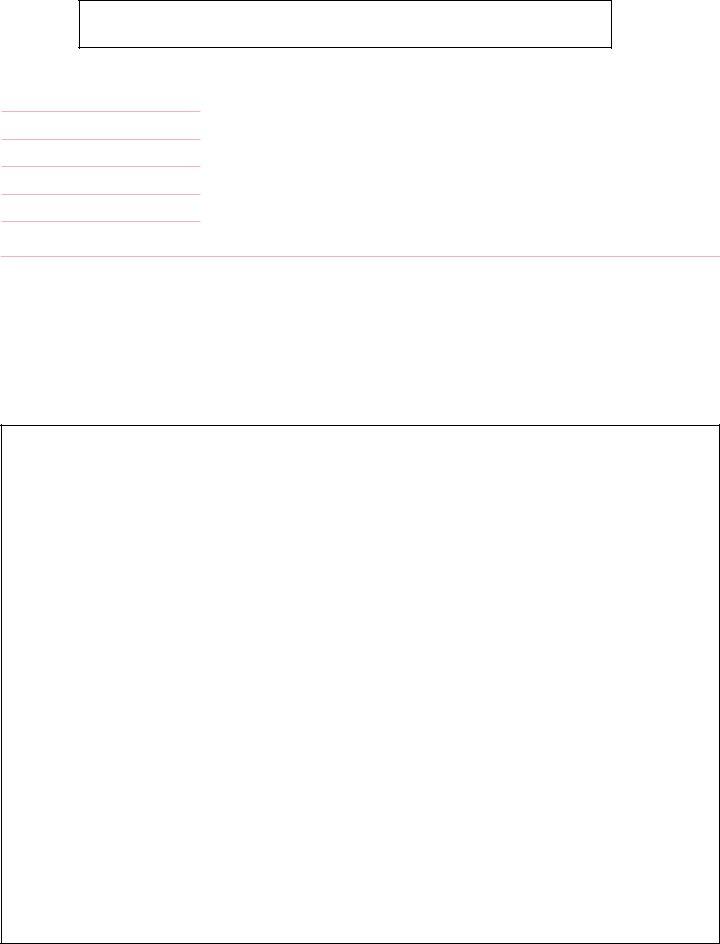

As a way to finalize this form, ensure you type in the information you need in each and every blank field:

1. Start completing the nc e536r with a selection of major blank fields. Collect all of the important information and make sure there's nothing neglected!

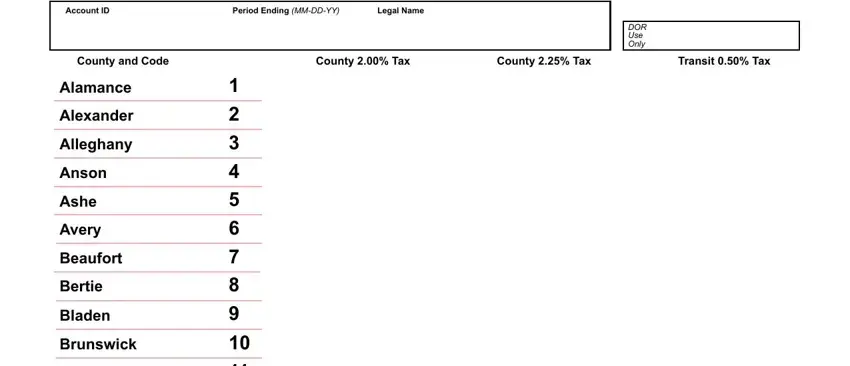

2. Soon after finishing the previous part, go on to the subsequent step and fill in all required particulars in all these fields - Buncombe, Burke, Cabarrus, Caldwell, Camden, Carteret, Caswell, Catawba, Chatham, Cherokee, Chowan, Clay, and Cleveland.

People often make mistakes when filling out Cabarrus in this part. Be certain to double-check everything you enter here.

3. This third part should also be relatively straightforward, Columbus, Craven, Cumberland, Currituck, Dare, Davidson, and Davie - each one of these blanks will have to be filled in here.

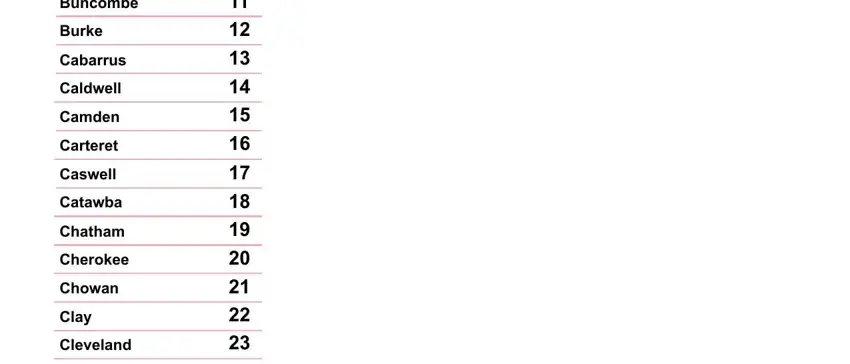

4. To go onward, this next stage requires completing several fields. Examples include Page, ER WebFill, Account ID, Period Ending MMDDYY, Legal Name, County and Code, County Tax, County Tax, Transit Tax, Duplin, Durham, Edgecombe, Forsyth, Franklin, and Gaston, which are key to carrying on with this PDF.

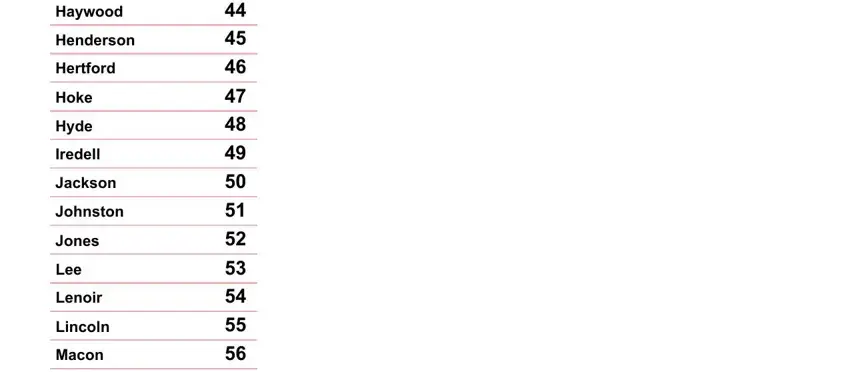

5. Finally, this last subsection is what you have to complete prior to submitting the document. The blank fields under consideration are the next: Haywood, Henderson, Hertford, Hoke, Hyde, Iredell, Jackson, Johnston, Jones, Lee, Lenoir, Lincoln, and Macon.

Step 3: Just after looking through your fields and details, click "Done" and you are done and dusted! After starting afree trial account here, you will be able to download nc e536r or send it through email promptly. The PDF form will also be readily accessible through your personal cabinet with all your adjustments. FormsPal is devoted to the confidentiality of all our users; we ensure that all information used in our editor remains secure.