At some point in their journey of navigating unemployment benefits, individuals in North Carolina may find themselves needing to adjust how they handle their income tax withholdings or the method by which they receive their payments. This is where the NCUI 500TWC form comes into play, a crucial document provided by the North Carolina Department of Commerce Division of Employment Security. Whether it's a desire to alter the previously elected income tax withholding from unemployment insurance benefits or to switch from direct deposit to receiving benefits via an DES Debit Card, this form serves as the gateway for such modifications. It covers two main areas: income tax withholding and direct deposit. For those choosing to alter their tax withholding, the form offers options to stop federal or state income tax withholdings or to adjust the amount withheld for state taxes. On the flip side, for payment methods, the form allows claimants to either revoke their direct deposit election in favor of a debit card or to change the bank account information currently on file. Completing and signing this form signifies the claimant's authorization of these changes, which will remain in effect for the entire duration of their unemployment claim. In essence, the NCUI 500TWC form empowers individuals to manage their unemployment benefits in a way that best suits their financial needs and preferences.

| Question | Answer |

|---|---|

| Form Name | Ncui 500Twc Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | apply, 500twc, cares act unemployment, form to take taxes out of texas unemployment |

NC Department of Commerce

Division of Employment Security

Post Office Box 25903, Raleigh, North Carolina

FAX NUMBER: (919)

REQUEST TO CHANGE INCOME TAX WITHHOLDING / DIRECT DEPOSIT

(See web site for processing instructions)

Name: |

|

SSN: |

- |

- |

Address:

INCOME TAX WITHHOLDING

I have previously elected to have Federal/State income taxes withheld from the unemployment insurance benefits payable to me. I wish to change that election as indicated by the “X” in the block(s) below.

I no longer want to have Federal Income Tax withheld. I no longer want to have State Income Tax withheld.

I want to change the amount of my State Income Tax deduction to % of the gross weekly

benefit amount due. (A fraction of a percent, decimal, or dollar cannot be processed.)

Signature required below.

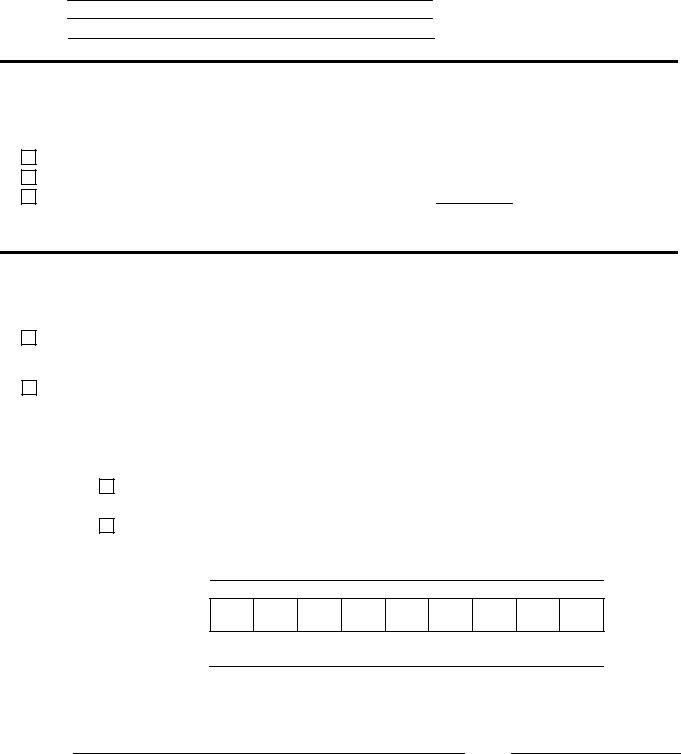

DIRECT DEPOSIT

I have previously elected to have my unemployment benefits paid by direct deposit. I wish to change that election as indicated by the X in the block(s) below:

I no longer want to have my unemployment benefits paid by direct deposit. I understand by checking this box my unemployment benefits will now be deposited on an DES Debit Card.

I authorize the North Carolina Division of Employment Security to change the bank account currently used to deposit my unemployment benefits. Deposit my unemployment insurance benefit payments into my selected account checked below (You must select one).

NOTE: If you bank with a Credit Union or Savings and Loan, please verify the routing and account numbers and complete the section below:

Checking - You must attach a copy of a check (write “VOID” across the face of the check). (Deposit slips cannot be processed.)

Savings

(Please verify the routing and account numbers with your bank and complete the section below)

Name of Bank

Bank Routing Number

Bank Account Number

I understand that any authorizations that I have elected will remain in effect for the duration of my unemployment insurance claim. I also understand that any request to change any part of this authorization must be in writing.

Signature:Date:

NCUI 500TWC (Rev 04/2013)