INSTRUCTIONS

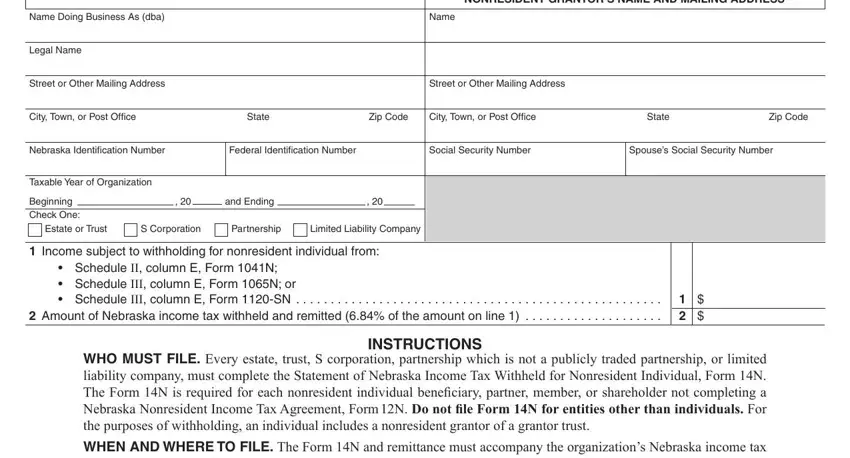

WHO MUST FILE. Every estate, trust, S corporation, partnership which is not a publicly traded partnership, or limited liability company, must complete the Statement of Nebraska Income Tax Withheld for Nonresident Individual, Form 14N.

The Form 14N is required for each nonresident individual beneiciary, partner, member, or shareholder not completing a Nebraska Nonresident Income Tax Agreement, Form 12N. Do not ile Form 14N for entities other than individuals. For the purposes of withholding, an individual includes a nonresident grantor of a grantor trust.

WHEN AND WHERE TO FILE. The Form 14N and remittance must accompany the organization’s Nebraska income tax return when iled with the Nebraska Department of Revenue, P.O. Box 98911, Lincoln, Nebraska 68509-8911. The organization

must also provide a copy of Form 14N to each nonresident individual for whom it remitted tax.

AMOUNT OF WITHHOLDING. The amount withheld is 6.84% of the amount subject to withholding. The total of line 2

entries from each Form14N should equal the amount entered on the applicable tax return:

•Schedule II, column E, Form 1041N, Nebraska Fiduciary Income Tax Return;

•Schedule III, column E, Form 1065N, Nebraska Return of Partnership Income; or

•Schedule III, column E, Form 1120-SN, Nebraska S Corporation Income Tax Return.

NONRESIDENT INDIVIDUAL. Except as noted below, the nonresident taxpayer named on this Form 14N is required to ile a Nebraska Individual Income Tax Return, Form 1040N, with the Nebraska Department of Revenue, P.O. Box 98911, Lincoln, Nebraska 68509-8911. The amount entered on line 2, Form 14N, will be allowed as a credit against the taxpayer’s Nebraska income tax liability and should be claimed as Nebraska income tax withheld on Form 1040N. Attach a copy of the Form 14N you received from the entity to your Form 1040N in the space provided for attaching the Wage and Tax Statement, Federal Form W-2. When e-iling, use Form 8453N to send the Form 14N to the Nebraska Department of Revenue.

Nonresidents are not required to ile Form 1040N if:

1.Their only connection with Nebraska is the conduct of business activities of the organization; and

2.The organization has withheld tax from all the Nebraska income attributable to the nonresident’s share of the organization’s income.

Instead of iling a Form 1040N, the nonresident taxpayer may choose to have the full amount of the withholding retained by the Nebraska Department of Revenue.

A nonresident taxpayer who has a taxable year different from the taxable year shown on the Form 14N for the estate, trust, S corporation, partnership, or limited liability company, should claim the income and withholding on Form 1040N by attaching the Form 14N with a taxable year ending during the individual’s taxable year.

TO BE FILED IN THE ABSENCE OF FORM 12N, NEBRASKA NONRESIDENT INCOME TAX AGREEMENT.

www.revenue.ne.gov, (800) 742-7474 (toll free in NE and IA), (402) 471-5729

ATTACH TO ORGANIZATION’S NEBRASKA TAX RETURN

NONRESIDENT INDIVIDUAL — ATTACH A COPY TO FORM 1040N

MAKE A COPY FOR YOUR RECORDS.

8-282-2010