The Nebraska 2210N form, crucial for individuals who find themselves having underpaid their estimated taxes throughout the year, serves as a detailed document to calculate and report any penalties due. This form becomes a necessary attachment to the Nebraska Individual Income Tax Return, Form 1040N, for residents whose withheld state income taxes or estimated tax payments were insufficient. It breaks down the process into clear steps, starting with the calculation of total Nebraska income tax after credits and weaving through required annual payment comparisons, installment dates, and payment amounts. Specifically, it applies to several groups, including those who owe more than expected because their withholding or estimated payments didn't meet the state's requirements and farmers and ranchers under certain conditions. Notably, the form offers a structured way to compute underpayment penalties, taking into account various criteria such as the due date of installments, amounts paid, and overpayment applications. Furthermore, it provides provisions for exceptions, ensuring that individuals with legitimate reasons, such as casualty, disaster, or retirement after age 62, may be exempt from penalties. The meticulous detail in which the form explains how to figure underpayments and calculate penalties emphasizes its importance for maintaining compliance with Nebraska's tax laws and avoiding unnecessary financial burdens.

| Question | Answer |

|---|---|

| Form Name | Nebraska Form 2210N |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | f_2210n nebraska department of revenue form 2210 |

|

|

Individual Underpayment of Estimated Tax |

|

|

FORM 2210N |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

nebraska |

|

|

|

• Attach to Form 1040N |

|

|

|

|

|

2000 |

|||

|

department |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

• Read instructions on reverse side |

|

|

|

|

||||||

|

of revenue |

|

|

|

|

|

|

|

|

|

|

|

||

Name and Address as Shown on Form 1040N |

|

|

|

Taxable Year |

Social Security Number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

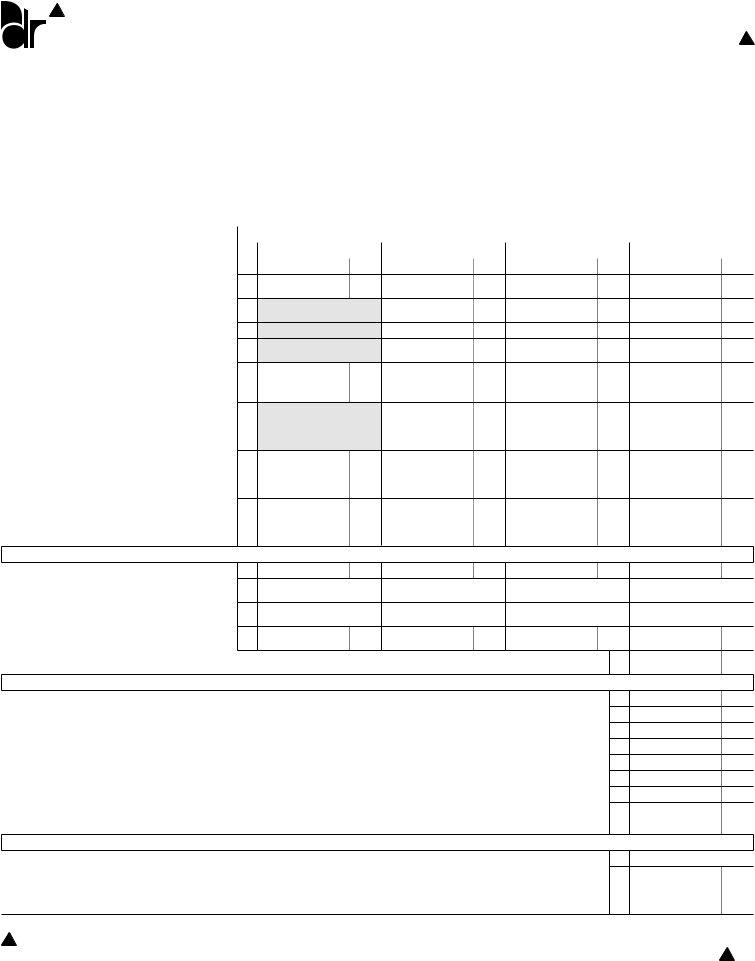

1 |

Total Nebraska income tax after nonrefundable credits (line 27, Form 1040N) |

|

|

1 |

|

|

|

|

|

|||||

2 |

............................................................................................................Form 4136N and refundable child/dependent care credit |

|

|

2 |

|

|

|

|

|

|||||

3 |

.............................................................................................................................................................Subtract line 2 from line 1 |

|

|

|

|

3 |

|

|

|

|

|

|||

4 |

...........................................................................................................................................................Multiply line 3 by 90% (.90) |

|

|

|

|

4 |

|

|

|

|

|

|||

5 |

...................................................Amount of tax withheld for 2000, if any. Do not include any estimated payments on this line |

|

|

5 |

|

|

|

|

|

|||||

6 |

...........................Subtract line 5 from line 3. If less than $300, stop here; do not complete this form. You do not owe penalty |

|

6 |

|

|

|

|

|

||||||

7 |

Enter your 1999 income tax. (see instructions) |

............................................................................................................................ |

|

|

|

7 |

|

|

|

|

|

|||

8 |

. ..........................................................................................................Required annual payment. Enter smaller of line 4 or line 7 |

|

|

8 |

|

|

|

|

|

|||||

|

If line 5 is equal to or more than line 8, do not complete this form. You do not owe penalty. |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

• Calculate each column separately |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

9 |

Due date of installments |

|

9 |

APRIL 15, 2000 |

JUNE 15, 2000 |

SEPT. 15, 2000 |

|

|

|

JAN. 15, 2001 |

||||

10 |

Enter 25% of line 8 in each column |

10 |

|

|

|

|

|

|

|

|

|

|

||

11Amount paid on estimate plus tax withheld

for each period (see instructions) |

11 |

12Overpayment of previous installments

from line 18 of the previous column |

12 |

13 Add lines 11 and 12 |

13 |

14Add amounts on lines 16 and 17 of the

previous column and enter result |

14 |

15Subtract line 14 from line 13. If zero or less, enter

amount from line 11) |

15 |

16 Remaining underpayment from previous |

|

period. If the amount on line 15 is zero, |

|

subtract line 13 from line 14. Otherwise, |

|

enter |

16 |

17UNDERPAYMENT. If line 10 is greater

than or equal to line 15, subtract line 15 from line 10, and go to the next column; otherwise,

go to line 18 |

17 |

18OVERPAYMENT. If line 15 is greater than line 10, subtract line 10 from line 15, and go

to line 12 of the next column |

18 |

|

FIGURE THE PENALTY |

19 Amount of underpayment (line 17) |

19 |

20Date of payment or April 15, whichever

is earlier |

20 |

21Number of days from due date of installment

to the date shown on line 20 |

21 |

22 Penalty (9% per year on the amount on |

|

line 19 for the number of days on line 21) |

22 |

23Total amounts on line 22. Check the box on Form 1040N, line 33, and show this amount in the space provided on that line.

|

Increase the amount of the “Balance Due” or decrease the amount of the “Overpayment” accordingly |

23 |

|

FARMERS AND RANCHERS — UNDERPAYMENT OF ESTIMATED TAX |

|

24 |

Enter line 3. If tax paid and return filed by March 1, you do not owe penalty |

24 |

25 |

Enter 66 2/3% of line 24 |

25 |

26 |

Amount of tax withheld for 2000, if any |

26 |

27 |

Subtract line 26 from line 24. If less than $300, do not complete the rest of this form. You do not owe penalty |

27 |

28 |

Enter your 1999 income tax (see line 7 instructions) |

28 |

29 |

Enter the smaller of line 25 or line 28 |

29 |

30 |

Amounts withheld and amounts paid or credited by January 15 |

30 |

31 |

Underpayment of estimated tax (line 29 minus line 30). If less than zero, you do not owe penalty |

31 |

|

PENALTY CALCULATIONS |

|

32 |

Number of days from January 15 to date of payment, or April 15, whichever is earlier |

32 |

33Penalty: (9% per year on the amount on line 31 for the number of days on line 32). Check the box on Form 1040N, line 33, and show this amount in the space provided on that line. Increase the amount of the “Balance Due” or

decrease the amount of the “Overpayment” accordingly |

33 |

INSTRUCTIONS

WHO MUST FILE. Individuals who determine on line 17 of this form that their Nebraska individual income tax was not sufficiently paid at any time throughout the year must file Individual Underpayment of Estimated Tax, Form 2210N, to calculate the amount of penalty due.

WHO MUST PAY THE UNDERPAYMENT PENALTY. An individual who did not pay enough estimated tax by any of the due dates or who did not have enough state income tax withheld may be charged a penalty. This is true even if you are due a refund when you file your tax return. The penalty is figured separately for each due date. Therefore, you may owe the penalty for an earlier payment due, even if you paid enough tax later to make up the underpayment.

In general, you may owe the penalty for 2000 if you did not pay at least the smaller of:

1.90% of your 2000 tax liability; or

2.100% of your 1999 tax liability (if you filed a 1999 return that covered a full 12 months).

EXCEPTIONS TO THE PENALTY. You will not have to pay the penalty if either 1 or 2 applies:

1.You had no tax liability for 1999 , you were a U.S. citizen or resident for the entire year, and your 1999 Nebraska tax return was (or would have been had you been required to file) for a full 12 months.

2.The total tax shown on your 2000 return minus the amount of tax you paid through withholding is less than $300. To determine whether the total tax is less than $300, complete lines

Nebraska Tax on Annualized Income. No penalty will be imposed if your Nebraska tax payments equal or exceed 90% of the Nebraska tax for a Nebraska tax liability based on annualized income earned through the end of the month preceding the installment date. Attach a separate schedule showing your computation similar to the federal Annualized Income Installment Method Schedule.

Other Circumstances. Attach a statement to this form outlining why the penalty should not be imposed. This would include an underpayment due to casualty, disaster, or other unusual circumstance where it would be inequitable to impose the penalty. Penalty may also be waived if in 1999 or 2000, you retired after age 62 or became disabled, and your underpayment was due to reasonable cause. Attach a statement if this circumstance applies to you.

WHEN AND WHERE TO FILE. Form 2210N must be attached and filed with the Nebraska Individual Income Tax Return, Form 1040N.

SPECIFIC LINE INSTRUCTIONS

LINE 7, 1999 TAX. Use your 1999 tax after nonrefundable credits from your 1999 tax return. If the 1999 tax year was for less than 12 months, do not complete this line. Instead, enter the amount from line 4 on line 8 and complete the remainder

of the form. If federal adjusted gross income in 1999 was more than $150,000 ($75,000 – married separate), enter 108.6% of your 1999 taxes on line 7.

LINE 9, INSTALLMENT PAYMENTS. If you filed your Nebraska income tax return and paid the balance of the tax due by January 31, that balance is considered paid as of January 15.

Fiscal Year Taxpayers. The installment due dates for fiscal year taxpayers are the 15th day of the following months: the first month of the second quarter, the third month of the second quarter, the third month of the third quarter, and the first month of the following fiscal year. All dates on Form 2210N are to be considered in the corresponding month of the fiscal year.

LINE 11, TAX WITHHELD. An equal part of the Nebraska income tax withheld during the year by your employer is considered paid on each required installment date unless you establish the dates on which withholding occurred and consider such withholding as paid on the dates when actually withheld.

For nonresident individuals, the amount of tax withheld by S corporations, partnerships, limited liability companies, or fiduciaries shall be considered paid on the last day of the organization’s taxable year unless you establish the dates on which all amounts were actually withheld and consider such withholding as paid on the dates when actually withheld.

LINE 18, OVERPAYMENT. Any overpayment of an installment on line 18 in excess of all prior underpayments should be applied as a credit on line 12 against the next installment.

LINES

19.If the payment applied is less than the underpayment, make separate penalty calculations through the date of payment and for the remaining underpayment through the date it is paid, then add the results together and enter on line

22.See the instructions for Federal Form 2210 for more information. The penalty is calculated at 9% per annum for all installments.

SPECIAL RULES FOR FARMERS AND RANCHERS. If your gross income from farming, ranching, or fishing is at least

1.How to Figure Your Underpayment. If the gross income test was met but the date for filing and payment of the tax was not, complete lines 24 through 31. If no underpayment is indicated on line 31, do not complete lines 32 and 33.

2.Penalty Calculation. Complete lines 32 and 33 to determine the amount of the penalty which is calculated at 9%.