Handling PDF forms online is always surprisingly easy using our PDF editor. Anyone can fill out Nebraska Form 6 here with no trouble. Our development team is continuously endeavoring to improve the tool and ensure it is even better for users with its extensive functions. Take your experience to another level with continually growing and exceptional options we provide! For anyone who is seeking to begin, here's what it's going to take:

Step 1: Hit the orange "Get Form" button above. It'll open our editor so that you could begin completing your form.

Step 2: As you access the editor, there'll be the form made ready to be completed. Apart from filling out different blanks, you may also perform other sorts of actions with the PDF, specifically putting on any textual content, modifying the original textual content, adding illustrations or photos, signing the form, and a lot more.

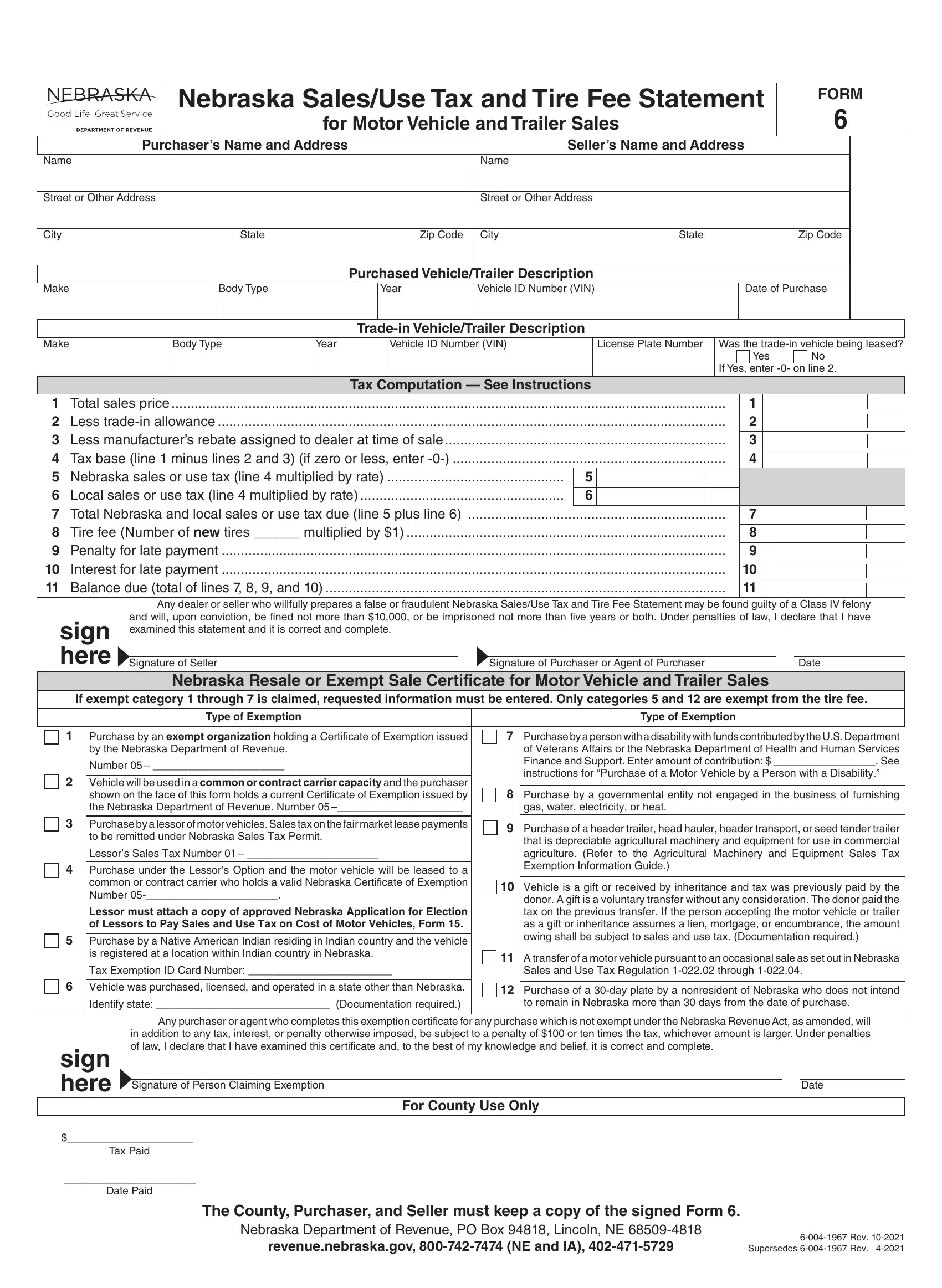

This document requires specific details; in order to ensure accuracy, please adhere to the guidelines listed below:

1. When completing the Nebraska Form 6, ensure to incorporate all needed fields within its associated form section. This will help to facilitate the process, allowing for your information to be processed promptly and accurately.

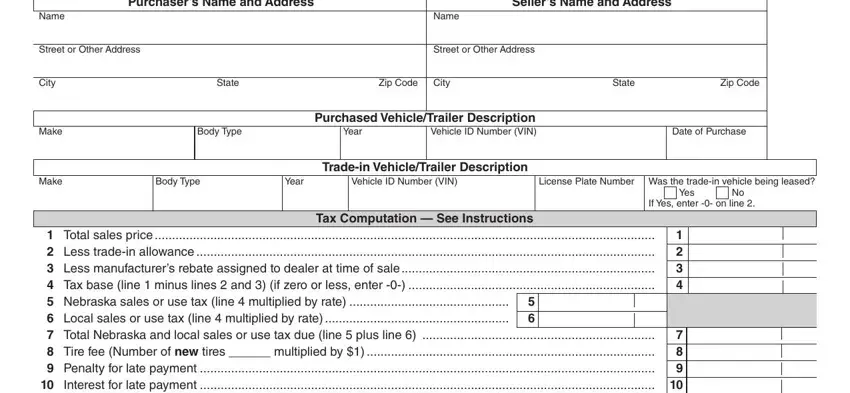

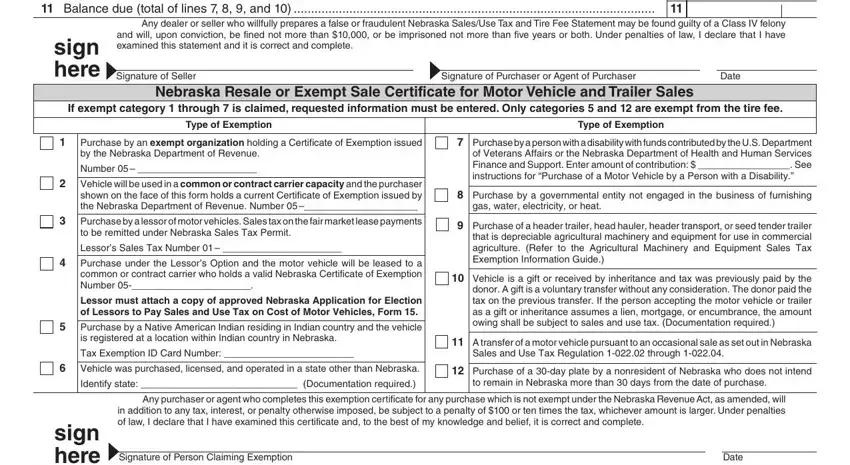

2. After finishing the last section, go on to the next part and fill out the necessary particulars in these blank fields - Total sales price Less tradein, Any dealer or seller who willfully, sign here Signature of Seller, Signature of Purchaser or Agent of, Date, Nebraska Resale or Exempt Sale, If exempt category through is, Type of Exemption, Type of Exemption, Purchase by an exempt, by the Nebraska Department of, Number, Vehicle will be used in a common, Purchase by a lessor of motor, and to be remitted under Nebraska.

Always be really mindful while filling out Vehicle will be used in a common and Type of Exemption, since this is where many people make a few mistakes.

Step 3: Just after rereading your fields and details, click "Done" and you are good to go! Find your Nebraska Form 6 the instant you join for a 7-day free trial. Easily use the pdf form in your personal cabinet, together with any edits and changes being all preserved! We don't share any details that you type in while filling out documents at our site.