Are you a Nevada resident looking for guidance or assistance filing an unemployment application? The Nevada Employment Security Division (ESD) has created numerous forms and resources that can help provide the necessary information to understand your rights as an unemployed worker. In this blog post, we'll discuss the various types of ESD forms so that you can use them correctly while filing your unemployment claim. From understanding who qualifies for benefits to completing the Declaration and Authorization Regarding Benefits form, we'll cover all of the steps needed to ensure your paperwork is properly filled out and submitted.

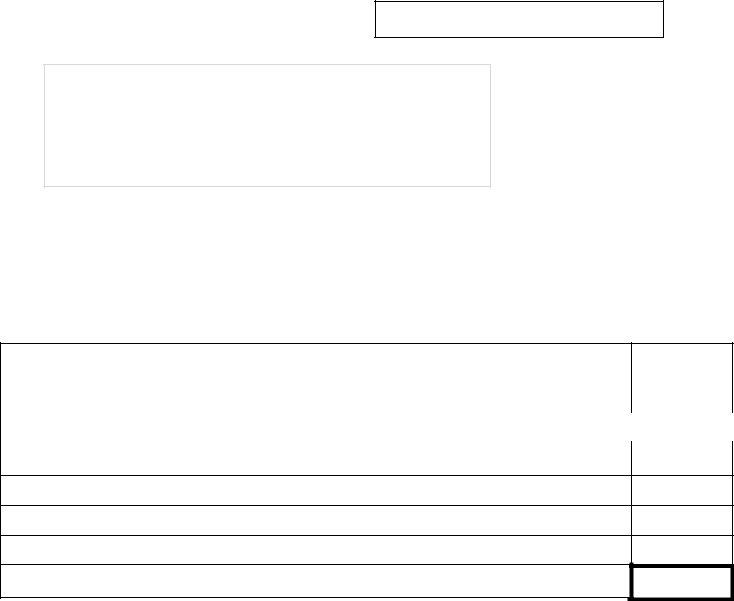

| Question | Answer |

|---|---|

| Form Name | Nevada Employment Security Division Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | uitax nv, https uitax nvdetr org, blank form for rpt3795, nv rpt3795 |

Employment Security Division

Contributions Section

500 E. Third Street

Carson City, NV

https://uitax.nvdetr.org

(775)

Quarter:

Quarter Ending:

Employer Account:

Delinquent After:

BOND FACTOR:

Employer/DBA/Mailing Address

Quarterly Bond Contributions Report

Quarterly bond contributions are due by law in addition to quarterly unemployment insurance (UI) taxes. Bond contributions will continue to be collected quarterly until the bonds issued to pay federal loans for unemployment benefits are fully repaid in late 2017 or early 2018.

Please complete this report to determine the Bond Contributions Amount Due for the quarter stated above.

1.ENTER TAXABLE WAGES PAID THIS QUARTER (Same as LINE 5 on Quarterly Report-

If LINE 5 on

2. |

MULTIPLY BY BOND FACTOR (Your Assigned Bond Factor of .0016, .0029, .0066, or .0089) |

x |

|

|

|

|

|

|

|

|

|

|

|

3. |

BOND CONTRIBUTIONS AMOUNT DUE |

= |

|

|

|

|

|

|

|

|

|

|

|

3a. SUBTRACT CREDIT AMOUNT SHOWN ON BOND BILLING STATEMENT (Equal to or less than LINE 3) -

4. ADD $5.00 FOR ONE OR MORE DAYS LATE FILING THIS REPORT |

+ |

5.ADD ADDITIONAL CHARGE AFTER 10 DAYS (LINE 1 X .001) FOR EACH MONTH/PART OF MONTH LATE+

6.ADD INTEREST ON AMOUNT DUE (LINE 3 X .01) FOR EACH MONTH/PART OF MONTH LATE

7.PAY TOTAL BOND CONTRIBUTIONS AMOUNT DUE (Total LINES 3 through 6)

+

= |

•Return the completed report, along with a separate check for the Total Bond Contributions Amount Due.

Do not combine UI taxes and bond contributions in the same check. UI taxes and bond contributions must be kept separate.

•Make check payable to Employment Security Division. Include your Employer Account Number and “Bond” on the check memo line. NOTE: Electronic payments are not available for bond contributions.

•Use the enclosed return envelope with blue markings. Otherwise, indicate BOND on the envelope.

Print Name of Preparer: ___________________________ Telephone Number: _____________________

BR Rev