If you live in the state of Nevada, there are many resources available to help you access welfare and assistance with your financial needs. The Nevada Welfare Division is an organization within the Department of Health & Human Services that helps residents apply for certain benefits such as food stamps and TANF (Temporary Assistance for Needy Families). In this blog post, we'll discuss how to complete the online application form for services through the Nevada Welfare Division. We'll walk through each step, provide valuable tips that may make completing the form easier and faster, and we'll also point out some important details or restrictions associated with various benefits. Whether you're a first time user looking to gain information about available assistance programs or a returning one in need of guidance on applications - this blog post is here to help!

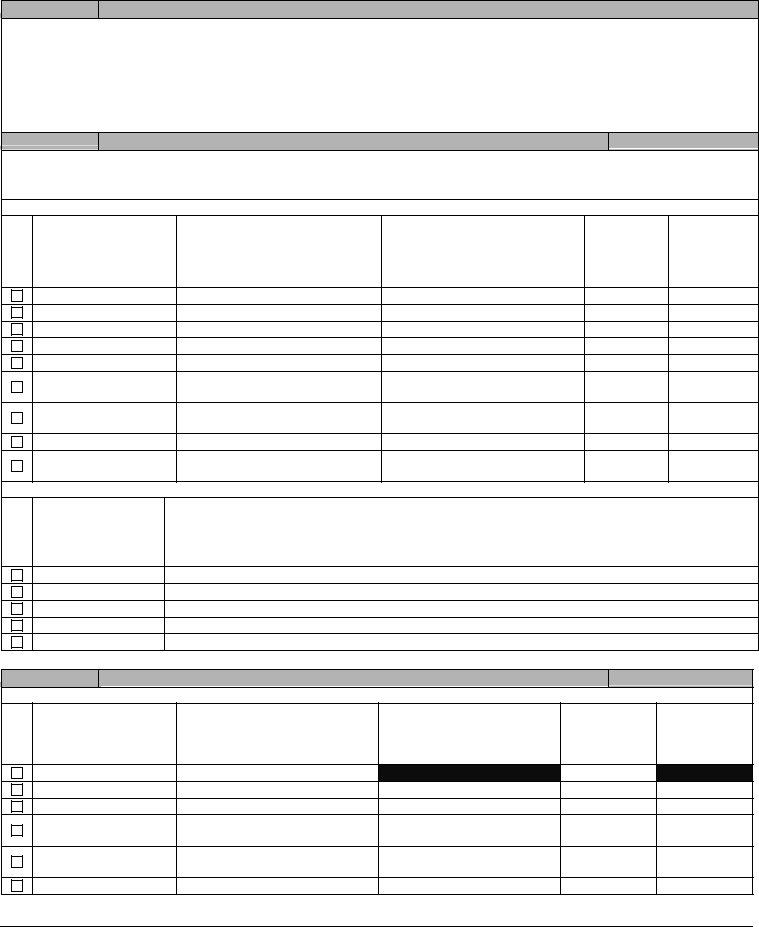

| Question | Answer |

|---|---|

| Form Name | Nevada Welfare Division Form |

| Form Length | 19 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min 45 sec |

| Other names | Forms_2905 EG state of nevada welfare division las vegas nv 2013 form |

Division of Welfare and Supportive Services

Application for Assistance

“Working for the Welfare of ALL Nevadans”

Programs You May Apply For:

Food Assistance from the Supplemental Nutrition Assistance Program (SNAP) helps people buy food.

Temporary Assistance for Needy Families (TANF) helps families with children meet their basic needs with cash assistance.

Time Frames

∙SNAP benefits are processed within 30 days from the date of the application. If your household has little or no income, you could receive SNAP benefits within 7 days from the date of your application. SNAP benefits are paid from the date of the application.

∙TANF benefits are paid from the date of approval or 30 days from the date of the application, whichever is sooner. TANF applications are processed within 45 days from the application date unless there are unusual circumstances.

Denial of benefits for one program does not automatically affect the decision on another program you may be applying for.

SNAP Expedite Rules

The following households are entitled to expedited service and should receive SNAP benefits within 7 days:

∙Households with less than $150 in monthly gross income and no more than $100 in liquid resources;

∙Migrant or seasonal farm worker households who are destitute, provided their liquid resources do not exceed $100;

∙Households with combined monthly gross income and liquid resources less than the household’s monthly rent or mortgage and utilities.

Social Security Numbers

You will be asked to provide Social Security Numbers (SSN) for all persons (including yourself) who are applying for assistance, pursuant to Title 42 USC

SSNs are used to verify your household’s income and resources and to conduct computer matching with other agencies such as the Social Security Administration, Employment Security Division, Child Support Enforcement Programs and the Internal Revenue Service. It is also used to gather workforce information, investigations, recover overpaid benefits and to ensure duplicate benefits are not received.

Citizenship/Immigration Status

You will be required to provide information about the citizenship and/or immigration status for all persons (including yourself) who are applying for assistance. For SNAP, if any of these persons do not want to give us information about his/her citizenship and/or immigration status, he/she will not be eligible for benefits. Other family or household members may still receive benefits if they are otherwise eligible. For TANF, if a required household member fails or refuses to provide verification of their status, the entire household will be ineligible for TANF benefits. Qualified

Where do I mail my completed application?

Send or submit your complete, signed application to the address below. Eligibility determinations will be based on rules and requirements which pertain to the program you are applying for. We will notify you if you are eligible or not, or give you further instructions for completing your application.

State of Nevada

Division of Welfare and Supportive Services

P.O. Box 15400

Las Vegas, NV

What if I need help with this application?

∙Phone:

∙Email: welfare@dwss.nv.gov Online: https://dwss.nv.gov

∙In person: Visit our website or call

∙Language Interpreter: Call

Applicant information, please keep this page for your records.

2905 – EG

This institution is prohibited from discriminating on the basis of race, color, national origin, disability, age, sex and in some cases religion or political beliefs.

The U.S. Department of Agriculture (USDA) also prohibits discrimination based on race, color, national origin, sex, religious creed, disability, age, political beliefs or reprisal or retaliation for prior civil rights activity in any program or activity conducted or funded by USDA.

Persons with disabilities who require alternative means of communication for program information (e.g. Braille, large print, audiotape, American Sign Language, etc.), should contact the Agency (State or local) where they applied for benefits. Individuals who are deaf, hard of hearing or have speech disabilities may contact USDA through the Federal Relay Service at (800)

To file a complaint of discrimination, complete the USDA Program Discrimination Complaint Form,

(1)mail: U.S. Department of Agriculture

Office of the Assistant Secretary of Civil Rights

1400 Independence Avenue, S.W.

Washington, D.C.

(2) |

fax: |

(202) |

(3)email: program.intake@usda.gov.

For any other information dealing with Supplemental Nutrition Assistance Program (SNAP) issues, persons should either contact the USDA SNAP Hotline Number at (800)

http://www.fns.usda.gov/snap/contact_info/hotlines.htm.

To file a complaint of discrimination regarding a program receiving Federal financial assistance through the U.S. Department of Health and Human Services (HHS),

write: HHS Director,

Office for Civil Rights, Room

or call: (202)

Applicant information, please keep this page for your records.

STEVE SISOLAK

GOVERNOR

STATE OF NEVADA

DEPARTMENT OF HEALTH AND HUMAN SERVICES

DIVISION OF WELFARE AND SUPPORTIVE

SERVICES

Notice of Required Verification

RJCHARD WHITLEY, MS

DIRECTOR

STEVE H. FISHER

ADMINISTRATOR

You may be required to provide proof of your household's circumstances to determine which benefits your household will receive. This proof will be required for all people in your household. It will help the application process if you provide the needed proof prior to or at your interview. The information below are examples of items you may be required to provide to meet this requirement.

The documents you provide to us should cover a

If you are having trouble getting the required information, we can assist you. Please contact us at

Identification/Citizenship

•United States Passport

•Government Issued Driver's License/Identification Card

•U.S. Military ID (active, dependent, retired)

•USCIS Verification of Citizenship

•Certified United States Birth Certificate

Unearned & Other Income Copy of award letter or other statement/verification for:

•Social Security Benefits (RSDI)

•Supplemental Security Income (SSI)

•Worker's Compensation

•Unemployment Benefits

•Veteran's Benefits (retirement, disability, educational)

•Retirement Pensions/Benefits

•Child Support Payments - Copy of Court Order

•Alimony

•Cash Contributions/Loans

•TANF or other Government Payment

•County or Indian General Assistance

•Educational Income (Government Grants, Student Loans, Scholarships, etc.)

•Any other income received by any household member

Earned Income

•Paycheck Stubs or Employer

•Statement

•If employment has ended in the last 90 days, proof of termination and final pay

•If unable to work, doctor's statement

•

•Returns

Nevada Residency

•Current Lease or Rental Agreement

•Nevada Driver's License

•Statement regarding homeless situation

Out of State Benefits

•Proof of any benefits received from another state

•Verification

•have been terminated

Resources

•Bank or Credit Union Statement

•Savings Bonds

•Vehicle Registration

•Life Insurance Policies

•Retirement Account Statements

•Trust Documents

•Proof of Stocks and Bonds

•Proof of Home or Property Ownership

Expenses

Shelter Expenses

•Rent or Mortgage Receipt

•Current Utility Bill

•Signed & Dated Landlord Statement

•Proof of Home Taxes & Insurance

Educational Expenses

•Financial Aid Statement from School

•Receipts

Dependent Care

Receipt/Statement from sitter or daycare center with the following information:

•Name of Sitter or Center

•Monthly Payment

•Names and ages of persons cared for

•Reason for Care

Court Ordered Child Support Paid

•Copy of Court Order

•Verification of Payments Made

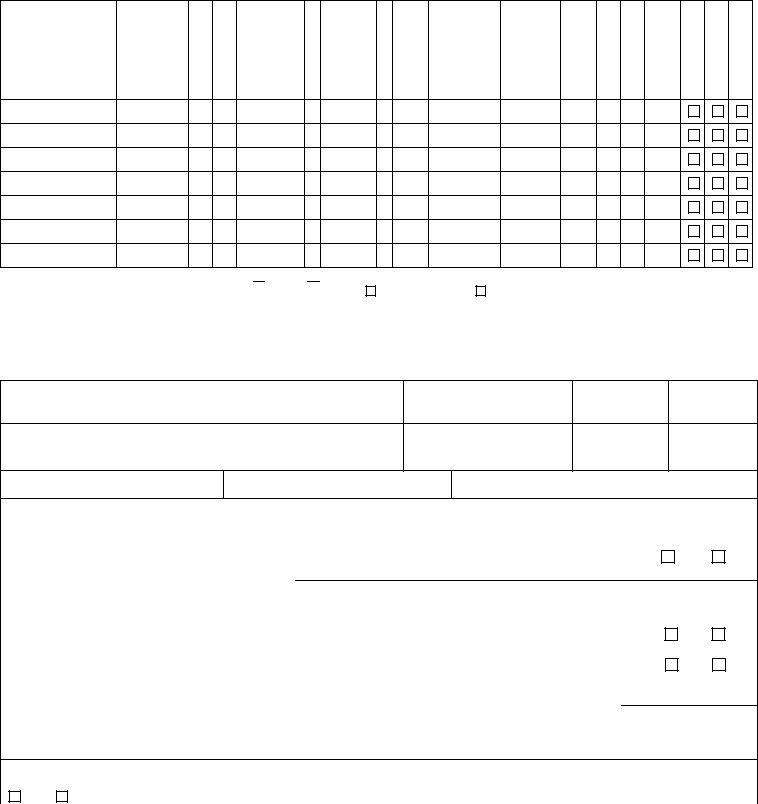

APPLICATION FOR ASSISTANCE

Please list everyone who lives in the home with you, whether you consider them household members or not. If someone is pregnant please list the unborn child(ren) as household members as well. Please list the head of household first; you may choose who this individual will be. The person chosen as the head of household will be the case name. Fill out as much of the application as you can; you may ask for help if you need it. You may complete only your name, address and signature in order to start the application process for Food Assistance. The remainder of the application may be submitted at or prior to your interview. You only need to answer the questions designated for the programs for which you are applying. The remaining pages may be turned in, mailed or faxed to the district office.

|

|

MiddleInitial |

ModifierJr. Sr. |

Last Name |

First Name |

|

Relation to |

|

|

|

You |

SELF

Are there additional people in your home? YES

Gender |

Date of |

Age |

Marital Status** |

Social |

State or |

CitizenU.S. |

Y/N |

*Race/Ethnicity |

GradeLast Completed |

Month/Year Completed |

FOOD |

TANF |

NONE |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Security |

Country |

|

|

|

|

|

|

|

|

|

|

Birth |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Number |

of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO If “YES”, list them on a separate sheet of paper.

Race - Please check one of the boxes that best describes your household - |

Hispanic/Latino or |

*Ethnicity (Optional) - Please choose one of the following ethnicity codes for each household member:

**Marital Status – Please choose one of the following marital status codes for each household member:

Home Address (Give directions if you do not have an address.)

City

State

Zip Code

Mailing Address (If different from your home address.)

City

State

Zip Code

Home Phone

Cell/Message/Daytime Phone

If you are applying for Food Assistance, please answer questions 1 through 6 about your household. A Food Assistance household includes all people who live and share food with you. Based on your answers below, you may qualify for expedited service.

1.Do you usually buy, prepare and eat with others you live with?

If “NO”, list who buys their food separately

YES

NO

2. |

List the total gross amount of money your household received or expects to receive this month. |

$_______________ |

||||||

3. |

How much do all persons have in cash, checking and savings accounts? |

$_______________ |

||||||

4. |

How much is your current monthly cost for housing (rent/mortgage) and utilities? |

$_______________ |

||||||

5. |

Are you or any person(s) in your household a migrant or seasonal farm worker? |

YES |

NO |

|||||

6. |

Have you or any person in your household received TANF, Food Assistance or Indian Commodities |

|

|

|||||

|

in Nevada or any other state? |

|

|

|

YES |

NO |

||

|

If “YES”, who? |

|

|

What benefits? |

|

|

|

|

|

Where? |

___________________________________ |

Last month and year benefits were received |

/ |

|

|||

I certify under penalty of perjury, my answers are correct and complete to the best of my knowledge and ability. I swear I have honestly reported the citizenship of myself and anyone I am applying for.

Your Signature |

Date |

FOR OFFICE USE ONLY – EXPEDITED SERVICE SCREENING: HOUSEHOLD ELIGIBLE FOR EXPEDITED SERVICE? |

|

YES NO Expedited service screener signature: ________________________________________ |

DATE: __________________ |

4

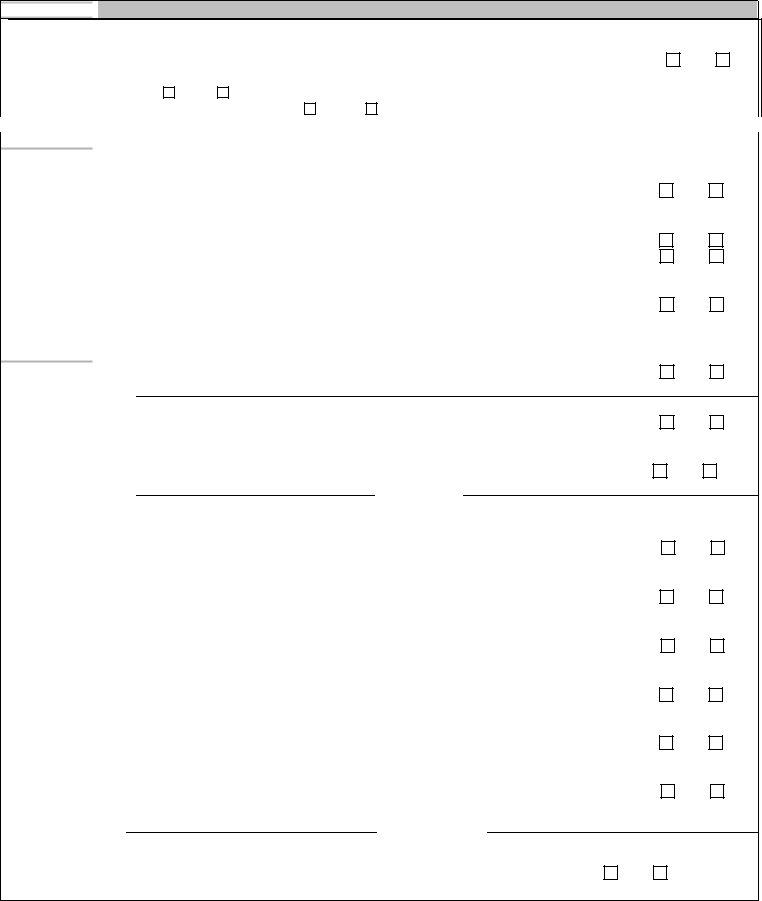

FOOD & TANF

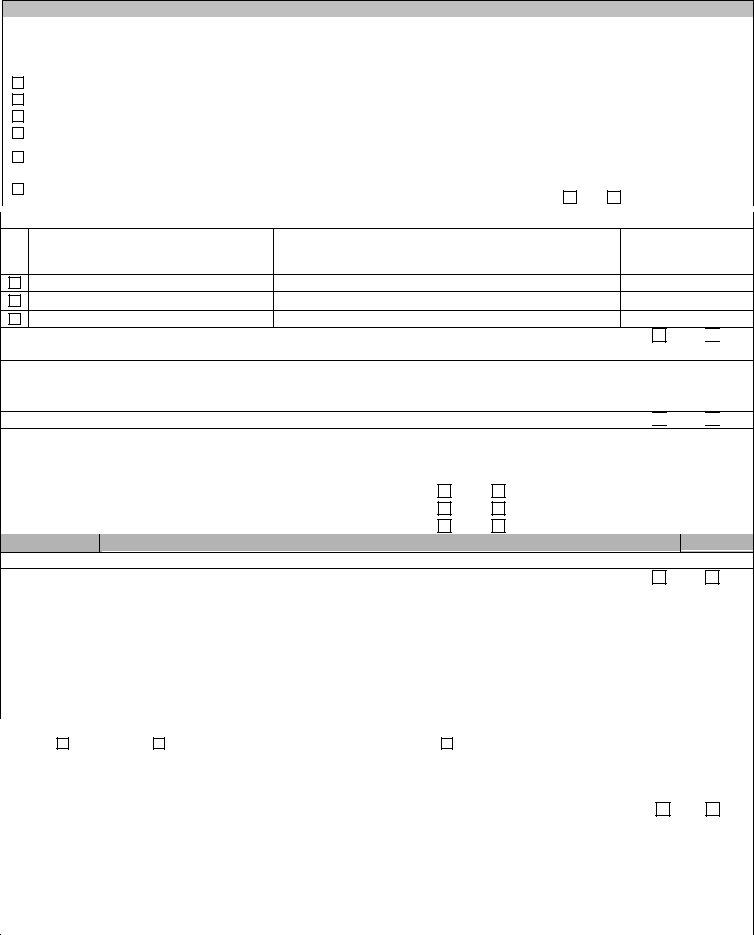

SPECIAL ACCOMMODATIONS

To get SNAP (food assistance) and/or TANF (cash assistance), most people are required to come into the office for a

|

interview; you need to bring identification with you. |

|

|

|

|

|

|

|

||||

|

Do you have a physical or mental condition that requires special accommodations during your interview? |

|

|

YES NO |

||||||||

|

If “YES”, what do you need? ________________________________________________________ (Most services are free to you.) |

|||||||||||

|

Do you speak English? |

YES |

NO If NO, what language do you speak? ____________________________________ |

|||||||||

|

Do you need an interpreter for your interview? |

YES |

NO |

(This service is free to you.) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

FOOD & TANF |

|

|

|

AUTHORIZED REPRESENTATIVE |

|

|

AREP |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

You have the right to assign up to two individuals to act on your behalf either to apply for benefits or to use your benefits for the household.

|

7. Do you want someone other than yourself, age 18 or older, to apply for benefits or act on your behalf? |

|

YES |

NO |

|||||||||||||

|

If “YES” who? |

|

|

|

Age? |

|

Telephone # |

|

( ) |

|

- |

|

|

||||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Is this individual currently serving a disqualification for an Intentional Program Violation? |

|

YES |

NO |

|||||||||||||

|

Do you want an additional person to apply for benefits or act on your behalf? |

|

|

|

|

YES |

NO |

||||||||||

|

If “YES”, who? ___________________________________________Age? ________ Telephone# ( |

) _______________ |

|

||||||||||||||

|

Address ____________________________________________________________________________________________ |

|

|||||||||||||||

|

Is this individual currently serving a disqualification for an Intentional Program Violation? |

|

YES |

NO |

|||||||||||||

|

8. In case of emergency, who would you like us to contact? Name |

|

|

Relationship |

|

|

|

|

|||||||||

|

Daytime Telephone # ( ) |

- |

Address |

|

|

|

|

|

|

|

|

||||||

|

FOOD & TANF |

|

|

|

ADDITIONAL HOUSEHOLD INFORMATION |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.Do you plan to continue living in Nevada? If “NO”, explain:

YES

NO

10. List the most recent date you started living in Nevada. |

|

/ |

(MM/YYYY) |

|||||

11. |

Are you or any person(s) in your household a member of an American Indian or Alaskan Native Tribe? |

YES |

NO |

|||||

|

If “YES,” who? |

|

|

What tribe? |

|

|

|

|

12. |

Are you or any person(s) in your household currently disqualified for an Intentional Program |

|

|

|||||

|

Violation (IPV)? |

|

|

|

|

YES |

NO |

|

|

If “YES”, who? |

What state? |

|

|

||||

13.

a. Have you or any person(s) in your household been convicted of a felony under Federal or State law for possession, use or distribution of a controlled drug substance (felony drug conviction) after August 22, 1996?

If “YES”, who? |

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

When? |

|

|

|

|

Where? |

|

|

|

|

|||||

b. Have you or any person(s) in your household been convicted of trading SNAP benefits for drugs after |

|

|

|

|||||||||||

September 22, 1996? |

|

|

|

|

|

|

|

|

|

YES |

NO |

|||

If “YES”, who? |

|

|

When? |

|

|

|

|

Where? |

|

|

|

|

||

c. Have you or any person(s) in your household been convicted of buying or selling SNAP benefits over |

|

|

|

|||||||||||

$500 after September 22, 1996? |

|

|

|

|

|

|

|

|

|

YES |

NO |

|||

If “YES”, who? |

|

|

When? |

|

|

|

|

Where? |

|

|

|

|

||

d. Have you or any person(s) in your household been convicted of fraudulently receiving duplicate SNAP |

|

|

|

|||||||||||

benefits in any State after September 22, 1996? |

|

|

|

|

|

|

|

|

|

YES |

NO |

|||

If “YES”, who? |

When? |

|

|

|

Where? |

|

|

|

||||||

e. Have you or any person(s) in your household been convicted of trading SNAP benefits for guns, |

|

|

|

|||||||||||

ammunition or explosives after September 22, 1996? |

|

|

|

|

|

|

YES |

NO |

||||||

If “YES”, Who? |

|

|

When? |

|

|

|

|

Where? |

|

|

|

|

||

14. Are you or any person(s) in your household currently participating in or have participated in a Drug |

|

|

|

|||||||||||

Addiction or Alcohol Treatment Program? |

|

|

|

|

|

|

|

|

|

YES |

NO |

|||

If “YES”, who? |

|

|

Date entered |

/ |

/ |

|

Date completed |

/ |

/ |

|

||||

Facility Name: |

|

|

Facility Address |

|

|

|

|

|

|

|

||||

15.Are you or any person(s) in your household hiding or running from the law to avoid prosecution, being taken into custody, or going to jail for a felony crime or attempted felony crime, or violating a

condition of parole or probation? |

YES |

NO |

|

If “YES”, who? |

________________________________ Why? |

___________________________________________ |

|

|

|

|

|

5

|

|

FOOD & TANF |

|

|

|

|

|

|

PREGNANCY |

|

|

|

|

|

|

|

PREG |

|

||||

|

16. Are you or any person(s) in your household pregnant? |

|

|

|

|

|

|

|

YES |

NO |

||||||||||||

|

|

If “YES”, who? |

|

|

Expected due date? |

/ |

/ |

|

(MM/DD/YYYY) |

|||||||||||||

|

FOOD & TANF |

|

|

|

|

|

|

DISABILITY |

|

|

|

|

|

|

|

DISA |

|

|||||

|

17. Are you or any person(s) in your household blind, disabled or unable to work due to illness or injury? |

|

|

YES |

NO |

|||||||||||||||||

|

|

If “YES”, who? |

|

|

|

When did this condition begin? |

|

/ |

|

/ |

|

(MM/DD/YYYY) |

||||||||||

|

|

What is the disability? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

FOOD & TANF |

|

|

|

|

|

|

|

|

|

|

|

ALIE |

|

||||||||

|

18. Are you or any person(s) in your household NOT a U.S. Citizen? |

|

|

|

|

|

|

|

YES |

NO |

||||||||||||

|

|

If “YES”, who? |

|

|

|

|

Alien Registration # |

|

|

|

|

|

|

|

||||||||

|

|

When did this person enter the United States? |

|

/ |

|

|

/ |

|

(MM/DD/YYYY) |

|||||||||||||

|

|

If “YES”, who? |

|

|

|

|

Alien Registration # |

|

|

|

|

|

|

|

||||||||

|

|

When did this person enter the United States? |

/ |

|

|

/ |

|

(MM/DD/YYYY) |

||||||||||||||

|

|

|

|

|

|

|

SCHOOL ATTENDANCE (TANF) |

|

|

|

|

|

|

|

SCHL |

|

||||||

19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

a. Are you or any person(s) in your household between the ages of 7 and 11 or over 16 attending school? |

|

|

YES |

NO |

||||||||||||||||

|

|

If “YES”, who? |

|

|

|

|

School name? |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

If additional persons “YES”, who? |

|

|

School name? |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

SCHOOL ATTENDANCE (FOOD) |

|

|

|

|

|

|

SCHL/EDIN |

|

|||||||

|

|

b. Are you or any person(s) in your home between the ages of 18 and 49 attending school above the |

|

|

|

|

|

|||||||||||||||

|

|

high school level? |

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|||||

|

|

If “YES”, who? ________________ |

School name? _____________________ |

Hours per week? ___________________ |

||||||||||||||||||

|

|

If additional persons “YES”? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Who? _____________________ |

School name? _____________________ |

Hours per week? ___________________ |

||||||||||||||||||

|

FOOD & TANF |

|

|

|

EARNED INCOME/WORK HISTORY |

|

|

|

JINC/SELF/OINC/QUIT/STRK |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. Are you or any person(s) in your household currently working, including

YES

NO

If “YES”, who is employed? |

|

|

|

Hourly wage? $ |

|

Hours worked per week? |

|||||

How often are they paid? |

|

|

|

|

|

Tips paid per month? |

$ |

|

|||

Start date? |

/ |

|

|

|

|

|

|

|

|

||

Employer’s name? |

|

|

|

Employer’s telephone? |

|

|

|

||||

Employer’s address? ____________________________________________________________________________________

If

____________________________________________________________________________________________________

If “YES”, for additional household members: |

|

|

|

|||||||

Who is employed? |

|

|

|

Hourly wage? $ |

|

Hours worked per week? |

||||

How often are they paid? |

|

|

|

|

Tips paid per month? |

$ |

|

|||

Start date? |

/ |

/ |

|

|

|

|

|

|

|

|

Employer’s name? |

|

|

|

Employer’s telephone? |

|

|

|

|||

Employer’s address?

If

____________________________________________________________________________________________________

If more than two persons are currently working, please attach an additional sheet of paper. |

|

|

|

|

|

|

|

|

||||||||||||||

21. Have you or any persons(s) in your household had a job that ended in the last 60 days? |

|

|

|

|

|

|

YES |

NO |

||||||||||||||

Who was employed? |

|

|

|

|

|

|

Hourly wage? $ |

|

|

|

Hours worked per week? |

|

||||||||||

How often were they paid? |

|

|

|

|

|

Tips received per month? |

$ |

|

|

|

|

|

|

|

||||||||

Employer’s name? |

|

|

|

|

|

Start date? |

/ |

/ |

|

When did the job end? |

|

|

/ |

/ |

||||||||

Employer’s address |

|

|

|

|

|

|

|

|

|

Employer’s |

telephone? |

( |

) |

- |

|

|||||||

Reason for leaving? |

|

Quit |

Fired |

Leave of Absence |

|

Applied Worker’s Compensation |

|

|

Other |

|

|

|||||||||||

If “YES” for additional household members: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Who was employed? |

|

|

|

|

|

|

Hourly wage? $ |

|

|

|

Hours worked per week? |

|

||||||||||

How often where they paid? |

|

|

|

|

|

Tips received per month? |

$ |

|

|

|

|

|

|

|

||||||||

Employer’s name? |

|

|

|

|

|

Start date? |

/ |

/ |

|

When did the job end? |

|

|

/ |

/ |

||||||||

Employer’s address |

|

|

|

|

|

|

|

|

|

Employer’s |

telephone? |

( |

) |

- |

|

|||||||

Reason for leaving? |

|

Quit |

Fired |

Leave of Absence |

|

Applied Worker’s Compensation |

|

|

Other |

|

|

|||||||||||

6

22. |

Are you or any person(s) in your household currently registered with or working for a temporary employment |

|

|

|||||||||||

|

|

service/agency? |

|

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

If “YES”, who? |

|

|

|

Which service/agency? |

|

|

|

|||||

23. |

Are you or any person(s) in your household currently on strike? |

|

|

|

YES |

NO |

||||||||

|

|

If “YES”, who? |

|

|

|

|

|

|

|

|

|

|

|

|

24. |

Do you or any person(s) in your household work in exchange for food, shelter or something else? |

YES |

NO |

|||||||||||

|

|

If “YES”, who? |

|

|

What do they receive for their work? |

|

|

|

||||||

|

|

What is the value of this exchange? |

$ |

|

When did this begin? |

|

|

|

|

|

||||

|

FOOD & TANF |

|

UNEARNED/OTHER INCOME |

|

|

UNIN/GAGA/LSUM/RINC/RBIN/EDIN |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. Please check the “YES” box for each of the types of the unearned income you or any person(s) in your household receives or has applied for. If you do not check the “yes” box for any of the unearned income below you are acknowledging neither you

or any person(s) in your household have any unearned or other income.

YES |

SOURCE |

Person Applied/Receiving |

Gross Amount Per Month |

|

Alimony |

|

$ |

|

Boarder/Roomer Income |

|

$ |

|

Child Support (Voluntary or Court Ordered) |

|

$ |

|

Contributions/Gifts |

|

$ |

|

Educational Assistance/Student Loans |

|

$ |

|

Foster Care |

|

$ |

|

General Assistance |

|

$ |

|

Insurance Settlements |

|

$ |

|

Interest/Dividends |

|

$ |

|

Loans |

|

$ |

|

Military Allotment |

|

$ |

|

Mining Claims |

|

$ |

|

Panhandling |

|

$ |

|

Pensions/Retirement |

|

$ |

|

Property Rentals |

|

$ |

|

Railroad Retirement |

|

$ |

|

Royalties |

|

$ |

|

Social Security Benefits (RSDI) |

|

$ |

|

Strike Benefits |

|

$ |

|

Subsidized Housing |

|

$ |

|

Supplemental Security Income (SSI) |

|

$ |

|

Supported Living Arrangement (SLA) |

|

$ |

|

TANF Assistance |

|

$ |

|

Trust Income |

|

$ |

|

Unemployment Insurance |

|

$ |

|

Utility Allowance/Rebate Check |

|

$ |

|

Veteran’s Benefits |

|

$ |

|

Gambling Winnings |

|

$ |

|

Worker’s Compensation or Temporary |

|

|

|

Disability |

|

$ |

|

Other: (please list) ____________________________ |

|

$ |

7

FOOD & TANF

INCOME MANAGEMENT

26. |

If you do not have any income, please explain how you are paying your bills and buying personal items for your household? |

||

FOOD & TANF |

RESOURCES |

BANK/LIFE/PROP |

|

27. Please mark the “YES” box for each types of resources you or any person(s) in your household has, even if jointly owned with |

|||

|

someone outside the household. If you do not check the “YES” box for any of the resources below you are acknowledging |

||

|

neither you or any person(s) in your household have any resources: |

|

|

YES

TYPE OF ACCOUNT

Savings Account

Checking Account

Credit Union Account

Minor Savings

Business Account

Christmas Club

Account

Educational Savings Account

Patient Trust Fund

Individual Indian Money Account

BANK ACCOUNTS

|

|

|

ACCOUNT |

|

|

|

NUMBER |

OWNER(S) |

NAME OF BANK |

VALUE |

(Please list the |

|

|

|

last 4 numbers |

|

|

|

only) |

$

$

$

$

$

$

$

$

$

LIFE INSURANCE/TRUSTS/BURIALS

YES

TYPE OF ACCOUNT

Life Insurance

Available Trusts

Unavailable Trusts

Burial Funds/Plans

Life Estates

|

|

|

|

|

|

|

POLICY OR |

|

|

|

NAME OF COMPANY |

|

|

|

|

ACCOUNT |

|

OWNER(S) |

|

|

FACE VALUE |

|

|

NUMBER |

|

|

|

OR BANK |

|

|

|

|

|||

|

|

|

|

|

|

(Please list the last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 numbers only) |

|

|

|

|

$ |

/CSV$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

/CSV$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOOD & TANF |

RESOURCES (CONT) |

BANK/LIFE/PROP |

YES

INVESTMENT & RETIREMENT ACCOUNTS

|

|

|

|

ACCOUNT |

|

TYPE OF ACCOUNT |

OWNER(S) |

NAME OF BANK OR |

VALUE |

NUMBER |

|

(Please list the |

|||||

COMPANY |

|||||

|

|

|

last 4 numbers |

||

|

|

|

|

||

|

|

|

|

only) |

Savings Bonds

Stocks or Bonds

Certificates of Deposit

Individual Retirement

Accounts (IRA)

Keogh Account (401K)

Annuities

8

PERSONAL PROPERTY

|

|

|

|

|

|

CURRENT |

|

YES |

TYPE OF PROPERTY |

OWNER(S) |

LOCATION |

CONTENTS OR TYPE OF |

OR |

|

RESOURCE |

MARKET |

||||

|

|

|

|

|||

|

|

|

|

|

|

VALUE |

|

|

Safe Deposit Box |

|

|

|

$ |

|

|

Livestock |

|

|

|

$ |

|

|

Land Mineral Rights |

|

|

|

$ |

|

|

Mining Claims |

|

|

|

$ |

|

|

Business Equipment/ |

|

|

|

$ |

|

|

Inventory |

|

|

|

|

|

|

Houses/Land or |

|

|

Is this property currently |

$ |

|

|

Buildings |

|

|

for sale? Yes No |

|

|

|

|

|

|

|

|

MISCELLANEOUS

YES |

TYPE OF RESOURCE |

OWNER(S) |

|

Promissory Notes

Cash on Hand

Other: (please list)

28. Are any of the resources in question 27 designated as money for burial?

If “YES”, which resources?

CURRENT VALUE

$

$

$

YES NO

|

FOOD & TANF |

|

|

VEHICLES |

|

|

CARS |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

29. Do you or any person(s) in your household own, or are they buying, a car, motorcycle, trailer, truck, camper, boat,

ATV, etc.? (Please include any vehicles that are not currently working.) YES NO

If “YES”, please complete the information below.

OWNER |

TYPE OF |

YEAR, MAKE & |

IS THE VEHICLE |

FAIR MARKET |

AMOUNT |

||

VEHICLE |

MODEL |

REGISTERED |

VALUE |

OWED |

|||

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

$ |

$ |

|

|

|

|

YES |

NO |

$ |

$ |

|

|

|

|

YES |

NO |

$ |

$ |

|

FOOD

TRANSFERRED RESOURCE

TRAN |

30. Have you or any person(s) in your household sold, traded or given away any money, vehicles, property or other resources, or

closed any bank accounts in the last 3 months? |

|

|

|

|

YES |

NO |

|||||

If “YES”, who? |

|

|

|

|

What resource was transferred? |

|

|

|

|

||

When? |

|

|

(MM/YYYY) |

What was the value of this resource when it was transferred? $ |

|

|

|||||

Who was the resource transferred to? |

|

|

Relationship to you? |

|

|

||||||

Why was the resource transferred? |

|

|

|

|

|

|

|||||

|

|

FOOD |

|

|

|

|

HOUSING EXPENSES |

|

|

RENT/HOME/UTIL |

|

|||||

|

|

|

|

|

|

|

|

|

||||||||

|

31. Please choose which of the following housing costs that you or any person(s) in your household pays. |

|

|

|

|

|

|

|||||||||

|

|

RENT |

MORTGAGE/RELATED EXPENSES |

NONE |

|

|

|

|

|

|

||||||

|

32. |

If you are renting your home, how much is the monthly rent? (Including space/lot rent) |

$_______________ |

|

||||||||||||

|

33. |

What is your landlord’s name? |

_________________________ |

Landlord’s telephone number? |

( |

) |

- |

|

||||||||

|

34. |

What is your landlord’s address? |

|

|

|

|

|

|

|

|

|

|

|

|||

|

35. |

Is your rent subsidized by any agency? |

|

|

|

|

|

|

YES |

NO |

||||||

|

36. |

If “YES,” by which agency? |

|

|

|

How much is subsidized? |

$ |

|

|

|||||||

|

37. |

If you are buying your home, please complete the areas with the current expenses: |

|

|

|

|

|

|

||||||||

|

|

Mortgage Amount (including second) $ |

|

|

How Often Paid? |

|

|

|

|

|

|

|

||||

|

|

Taxes (if paid separately) |

|

$ |

|

|

How Often Paid? |

|

|

|

|

|

|

|

||

|

|

Homeowners Insurance (if paid separately) $ |

|

|

How Often Paid? |

|

|

|

|

|

|

|

||||

|

|

Association Fees (if paid separately) |

$ |

|

|

How Often Paid? |

|

|

|

|

|

|

|

|||

|

|

Lot/Space Rent |

|

$ |

|

|

How Often Paid? |

|

|

|

|

|

|

|

||

9

38. Does anyone outside the home pay any of your rent or mortgage expenses?

YES

NO

|

|

If “YES”, who? |

|

Telephone? |

|

How much? $ |

|

|

How often? |

|

|

|

||||||||||||

39. |

Are you or any person(s) in your household responsible for paying any utility expenses? |

|

|

|

|

|

|

YES |

|

NO |

||||||||||||||

|

|

If “YES”, does this utility expense include costs for heating or cooling? |

|

|

|

|

|

|

YES |

|

NO |

|||||||||||||

|

|

If “NO”, please choose the utilities your household is responsible for paying: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

Electricity |

|

Wood |

|

|

Water |

|

Sewer |

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural Gas |

|

Propane |

|

|

Garbage |

|

Telephone |

|

|

|

|

|

|

|

|

|

|

|

|

40. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Does anyone outside your household pay a portion of your utility expenses? |

|

|

|

|

|

|

YES |

|

NO |

||||||||||||||

|

|

If “YES”, who? |

Telephone? |

|

How much? $ |

|

|

How often? |

|

|

|

|||||||||||||

|

b. Does your household receive or expect to receive assistance from the Energy Assistance Program? |

|

|

|

YES |

|

NO |

|||||||||||||||||

|

FOOD & TANF |

|

|

OTHER EXPENSES |

|

|

|

|

SUDE/MEDX/DCEX |

|

||||||||||||||

41. |

Do you or any person(s) in your household pay court ordered child support to someone outside the household? |

YES |

|

NO |

||||||||||||||||||||

|

|

If “YES”, who? |

|

|

|

How much do they pay per month? |

$ |

|

|

|

|

|

||||||||||||

42. |

Do you or any person(s) in your household pay child care or for the care of a disabled adult? |

|

|

|

|

YES |

|

NO |

||||||||||||||||

|

|

If “YES”, who? |

|

|

|

|

|

|

For whom? |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

How much per month? $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

43. |

Does any agency or anyone outside your home pay a portion of your daycare costs? |

|

|

|

|

|

|

YES |

|

NO |

||||||||||||||

|

|

If “YES”, who? |

|

|

|

|

How much per month? $ |

|

|

|

|

|

|

|

|

|

||||||||

44. |

Does anyone age 60 or over, or any person(s) who is disabled have |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

including costs for Medicare or medical insurance? |

|

|

|

|

|

|

|

|

|

YES |

|

NO |

||||||||||

|

|

If “YES”, who? |

|

|

|

|

How much per month? $ |

|

|

|

|

|

|

|

|

|

||||||||

45. |

Does anyone outside the household pay for any of these medical expenses? |

|

|

|

|

|

|

YES |

|

NO |

||||||||||||||

|

|

If “YES”, who? |

|

|

|

|

How much per month? $ |

|

|

|

|

|

|

|

|

|

||||||||

|

|

TANF |

|

|

|

INJURIES/ACCIDENTS |

|

|

|

|

|

|

|

|

|

SETT |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

46. |

Have you or anyone in your household been injured or in an accident in the last 12 months? |

|

|

|

|

YES |

|

NO |

||||||||||||||||

|

|

If “YES”, who? |

|

|

|

|

|

|

|

When? |

|

|

|

|

|

|

|

|

||||||

47. |

Is there a pending lawsuit because of the injury or accident? |

|

|

|

|

|

|

|

|

|

YES |

|

NO |

|||||||||||

|

|

If “YES”, what is the attorney’s name? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Attorney’s address? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

48. |

Have you or anyone in your household received or expect to receive an insurance reimbursement, payment or |

|

|

|

|

|

||||||||||||||||||

|

|

legal settlement? |

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

NO |

||||||

|

|

If “YES”, who? |

when? |

|

|

How much $ |

From where? |

|

|

|

|

|

|

|

|

|||||||||

|

|

TANF |

|

|

|

|

ABSENT PARENT INFORMATION |

|

|

|

|

|

|

|

|

NCPM |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

49. |

Is the parent(s) of the child(ren) you are applying for: (Check one) |

living somewhere else |

disabled or |

deceased |

||||||||||||||||||||

50. |

If anyone in your home is pregnant, is the father of the unborn in the home? |

|

|

|

|

|

|

YES |

|

NO |

||||||||||||||

|

|

If “YES”, who is the father? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Complete the following form with information about the absent parent of your child(ren) who is not living with you (including |

||||||||||||||||||||||

the parent of an unborn child). If there is more than one possible parent, complete a form for each one. Please provide as much

information as possible.

*Please make copies or request additional copies of this page for additional parents.

10

STATE OF NEVADA

DEPARTMENT OF HEALTH AND HUMAN SERVICES

DIVISION OF WELFARE AND SUPPORTIVE SERVICES

When applying for TANF the law requires you to cooperate with Child Support Enforcement (CSE) to establish paternity to get child support owed to you and/or any child(ren) that you are applying for. This may include genetic testing. If the test proves the person you named is not the father, you may be required to pay the cost of the test. You are also responsible for providing all available information requested by the CSE Program such as certified copies of divorce decrees and/or support orders, birth certificates and photographs of the absent parent.

The CSE Program locates absent parents and/or sources of income and assets, establishes and enforces financial support, reviews and adjusts existing child support orders, and collects and distributes financial payments.

The CSE Program has sole discretion in determining which legal remedies are used in pursuing support and cannot guarantee success. CSE may request assistance of another state, and thereby, be subject to the laws of that state. CSE does not provide services involving custody or visitation. CSE may close your case when your case meets closure rules established by federal and state regulation.

The CSE Program represents the State of Nevada when providing services and no

Good cause for not cooperating in pursuing child support or paternity may be allowed. If you do not cooperate with CSE and good cause has not been determined, your household will be ineligible for TANF. Good cause for not cooperating will be considered if you request it in writing. Examples of good cause are as follows:

●The child was conceived as a result of rape or incest.

●Legal proceedings for adoption of the child are pending before a court.

●You are being assisted by a public or licensed private social service agency to decide whether to keep or relinquish the child for adoption (no longer than three (3) months).

●Your cooperation in establishing paternity or securing support will result in physical or emotional harm to yourself or the child(ren).

You must provide your case manager with verification within twenty (20) days after claiming good cause. You will receive written notification of the good cause decision. If you are found to have good cause for not cooperating, CSE will NOT attempt to establish paternity or collect child support.

YES, I wish to claim good cause.

NO, I am not claiming good cause at this time.

______________________________________________________

Signature

You must report changes whenever a name change occurs; you have a new address or telephone number for home or work; you hire a private attorney or collection agency; another child support or paternity legal action is filed; you file for divorce; you receive support payments directly from the absent parent; you have a new address, telephone number, employment for the absent parent; a child(ren) no longer lives with you; a child(ren) is still in high school after age 18; a child(ren) becomes disabled before age 18; a child(ren) comes to live with you or you birth another child; a child marries, is adopted, joins the armed forces or is declared an adult by court order.

You are responsible for repayment of support amounts received in error, including payments from an IRS tax refund, which are adjusted by the IRS. If you fail to enter into a repayment agreement with the CSE Program, the outstanding balance may be reported to a credit reporting agency and money collected on your behalf by the CSE Program may be withheld for repayment. Additionally, legal action may be initiated against you.

11

NEVADA STATE DIVISION OF WELFARE AND SUPPORTIVE SERVICES

Complete one form for each parent who does not live with the child(ren) for whom you are requesting assistance. For example, if you have two children and each have a different father / mother, you need to complete two forms. If you are not the parent of the child(ren) you are requesting assistance for, you need to complete one form for the absent mother and one form for the absent father. Do not leave any question blank. Write or type unknown or N/A (not applicable) for any question that does not apply or you do not know the answer.

YOUR NAME: |

|

|

YOUR SSN: |

YOUR DOB: |

YOUR RELATIONSHIP TO THE |

||||||

|

|

|

|

|

|

|

|

|

|

CHILD(REN): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Have you or the children received public |

|

|

|

|

|

|

If YES, where? |

(City, State) |

|

||

assistance in the past? |

YES |

|

NO |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||

Fill in whatever you know about the |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME: |

|

|

|

FIRST NAME: |

|

MIDDLE INITIAL: |

MODIFIER (Jr., Sr., etc.): |

||||

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY: |

|

|

|

|

|

STATE: |

|

|

ZIP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY NUMBER: |

|

|

|

|

TELEPHONE / CELL PHONE: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

DATE OF BIRTH: |

|

|

|

|

BIRTH CITY AND STATE: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

IF DECEASED, DATE OF DEATH: |

|

|

|

|

IF DECEASED, PLACE OF DEATH: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

DATE LAST SEEN OR CONTACTED: |

|

|

|

|

IS HE OR SHE DISABLED? |

YES |

NO |

||||

|

|

|

|

|

|

|

|

|

|

|

|

RACE:

SEX:

HAIR COLOR:

EYE COLOR:

WEIGHT:

HEIGHT:

AT ANY TIME WAS THE MOTHER MARRIED TO |

|

|

DATE OF MARRIAGE: |

|

PLACE OF MARRIAGE: |

|

|||||||||||

THIS |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

IF MARRIED ARE THEY DIVORCED? |

YES |

NO |

|

DATE OF DIVORCE: |

|

PLACE DIVORCE FILED: |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

WAS THE MOTHER MARRIED TO |

|

|

|

ARE THERE OTHER POSSIBLE |

|

|

|

||||||||||

SOMEONE ELSE? |

|

|

YES |

NO |

|

FATHERS? |

|

|

|

|

YES |

NO |

|||||

EXISTING CHILD SUPPORT COURT ORDER? |

|

YES |

NO |

|

CITY AND STATE: |

|

|

|

|

|

|||||||

INFORMATION ON THE CHILDREN FOR THIS ABSENT PARENT: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Did the mother have |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

sexual relations with |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

another man (not |

|

|

|

Child’s |

|

|

|

|

|

|

|

Child’s |

|

Child’s date |

|

named above), during |

|

|

|||

|

|

|

|

|

|

|

|

|

30 days before or |

|

|

||||||

Social Security |

|

Child’s Last Name |

|

Child’s First Name |

|

|

Middle |

|

of birth |

|

after when pregnancy |

|

Custody |

||||

Number |

|

|

|

|

Initial |

|

(MM/DD/YY) |

|

began for this child? |

|

Month |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All cases for Temporary Assistance for Needy Families (TANF) must be referred for Child Support Enforcement. This information is correct to the best of my knowledge. I have read the “Important Child Support Information” section found on the

eligibility application. I understand if I have intentionally withheld or misrepresented information, I could be disqualified from receiving public assistance.

I declare under penalty of perjury that the information I have provided on this document is true to the best of my knowledge and belief and that the statements contained herein are made for the purposes stated here, including but not limited to, obtaining assistance in establishing paternity and/or an order for child support along with the collection of child support.

Your Signature: |

Date Signed: |

|

|

12

Important Child Support Information

By signing this application and by receiving TANF benefits, you agree to assign your child support rights to the State of Nevada Division of Welfare and Supportive Services (DWSS). This is a condition of eligibility for your household to receive TANF benefits. If you are receiving TANF, any court ordered or stipulated child support paid directly to you is required by law to be surrendered immediately to DWSS or Child Support Enforcement (CSE). By signing this application, you are authorizing DWSS to transfer all or part of the support collected each month to pay back the TANF benefits your household received.

When applying for TANF, the law requires you to cooperate with CSE to establish paternity to get child support owed to you and/or any child(ren) for which you are applying. Good cause for not cooperating in pursuing child support or paternity may be allowed. If you do not cooperate with Child Support Enforcement and good cause is not established, your household will be ineligible for TANF.

If TANF is terminated and child support is collected, any portion due to you will be made as a direct deposit onto a Nevada Debit Card or into your bank account. A Nevada Debit Card will be issued to you unless you request payments by direct deposit into your bank account. Visit our website: dwss.nv.gov for more information.

You are responsible for repayment of child support amounts received in error, including child support payments from an IRS tax refund which are adjusted by the IRS. If you fail to enter into a repayment agreement with the CSE program, money collected on your behalf by the CSE program may be withheld for repayment and the outstanding balance may be reported to a collection agency.

DWSS may charge a $25.00 fee for child support services provided to clients who have never received public assistance.

Do you wish to pursue child support if your household is found ineligible for TANF?

Yes No

Initials ____________

Electronic Benefits Transfer (EBT)

Federal law states the intended period of use for SNAP benefits is 12 months from the date of issuance. DWSS is required to

remove any unused SNAP benefits from an account 365 days after the benefit was issued and return them to the Federal government. Unused benefits are frozen 360 days after their issuance. If the client, or any adult member of the client’s household,

has any outstanding SNAP debt, the frozen benefit will be applied towards the SNAP debt.

Unused TANF benefits are removed from a client’s EBT account 180 days after the benefit was issued.

Per Federal Law, TANF EBT benefits cannot be accessed from ATM machines or used to purchase items in the following locations: casinos, gaming establishments, liquor stores or retail establishments which provide adult entertainment.

It is illegal to misuse, sell, attempt to sell, trade, purchase or alter an EBT card.

Initials______________

Work Requirements

If you are approved for TANF and/or SNAP, you may be required to cooperate with certain work requirements. Failure to comply with certain work requirements could disqualify you and/or other members of your household from participating in either program. For SNAP, if you or any other household member voluntarily quits a job or reduces work hours without good cause, this may be considered failure to comply with work requirements. The SNAP disqualification period for failure to comply with work requirements is one month and until compliance for the first violation, three months and until compliance for the second violation, and six months and until compliance for the third violation. For TANF, failure to cooperate with work requirements agreed to in their Personal Responsibility Plan may result in the household losing their TANF benefits for three full months.

Reviews and Investigations

By signing this application, you are authorizing the Department of Health and Human Services to make investigations concerning you, other members of your household, and/or your child(ren)’s legal or natural parent(s) that may be necessary to determine

eligibility for benefits you or your household receives or will receive under programs administered by the DWSS, including childcare assistance. Information provided to the DWSS may be verified or investigated by federal, state and local officials including Quality Control staff. If you do not cooperate in the investigation, your benefits may be denied or terminated. If you make false or misleading statements, misrepresent, conceal or withhold facts necessary for the DWSS to make an accurate determination on your benefits or alter any document, your benefits may be denied, reduced or terminated. You are responsible for repayment of all monies, services and benefits (including childcare assistance) for which you were not entitled to. Additionally, you may be disqualified from receiving benefits in the future and criminally prosecuted or otherwise penalized according to state and federal law.

13

Individuals found guilty of an intentional program violation in TANF and/or SNAP are barred from program benefits for twelve (12) months for the first violation,

If a court of law finds you guilty of using or receiving SNAP benefits in a transaction involving the sale of a controlled substance, you will not be eligible for benefits for two years for the first offense, and permanently for the second offense.

If a court of law finds you guilty of having used or received SNAP benefits in a transaction involving the sale of firearms, ammunition or explosives, you will be permanently ineligible to participate in the Program upon the first occasion of such violation.

If a court of law finds you guilty of having trafficked SNAP benefits for an aggregate amount of $500 or more, you will be permanently ineligible to participate in the Program upon the first occasion of such violation.

If you are found to have made a fraudulent statement or representation with respect to the identity or place of residence in order to receive multiple SNAP benefits simultaneously, you will be ineligible to participate in the Program for a period of 10 years.

Initials ____________

Initials ___________

Your Rights

Anyone whose application for assistance has been denied, not acted on within a reasonable time frame, or whose benefits have been reduced or terminated may request a conference or hearing. You may request a conference or hearing by writing your local district office or the administration office. For SNAP, you may request a hearing by calling your local district office. You may also request a hearing by signing and returning the Notice of Decision you receive. You must request a hearing for TANF or SNAP within 90 days of the notice date.

You will be notified of the hearing date, time and location in writing ten (10) days prior to the scheduled hearing. You may be represented at a conference/hearing by anyone whom you have given written authorization. This written authorization must be given to the DWSS office prior to the conference/hearing. You may request information on the various legal services that may be available in your community at no cost; please contact us for information. If you are dissatisfied with the hearing decision, you may appeal your case to your local District Court of the State of Nevada.

Important Information

If you are applying for TANF and SNAP with this application and your TANF benefits are approved, any adjustment to your SNAP benefits will be made at the same time. With this application, you are waiving your right to 13 days advance notice of any change in your SNAP benefits resulting from TANF approval. If your TANF benefit is less than $10.00, you will receive no cash payment.

The DWSS may mail information to you that may require you to respond by a certain date. If you are away from home, you are still responsible to respond by the required date. You may wish to make arrangements for your mail while you are away.

Your Responsibilities

If you are applying for TANF:

You must report changes in your mailing address immediately. Additional changes must be reported immediately after you apply and before you are approved benefits. Once your benefits are approved you must report the following changes and the change must be reported by the 5th of the following month. You must report changes such as your physical address, living expenses, subsidized

housing value, marital status, employment status, any money you receive or income from any source, assets/resources, absent parent’s address, number of people in the home, the birth of a child, school attendance, absence of any household member even if it

is temporary (if more than 30 days), and any other change which may affect your household benefits.

Initials __________

Initials ____________

14

Your Responsibilities

If you are applying for Supplemental Nutrition Assistance Program (SNAP):

You are required to report all changes in your household from the date you submit your application to the day of your interview.

Once SNAP benefits are approved, you must report required changes within 10 days from the date the change happened based on your household’s specific reporting requirements. You will receive a notice informing you of your specific requirement.

If your household is designated as a Change Status Reporting Household you will be required to report changes such as your physical address, living expenses, subsidized housing value, marital status, employment status, any money you receive or income from any source, assets/resources, number of people in the home, birth of a child in your home, school attendance, absence of any household member even if it is temporary (if more than 30 days), and any other change which may affect your household benefits.

If your household is designated as a Simplified Reporting Household you must only report when your household’s income exceeds 130% of the federal poverty level for your household size. If SNAP benefits are approved you will be notified of the income level for your household size.

Your case manager may request additional proof of the change. You will be required to provide the proof by a certain date in order to continue your eligibility or to avoid an overpayment or underpayment of benefits.

SNAP allows certain household expenses like rent, mortgage, property taxes, homeowner’s insurance, utility expenses, child/dependent care and child support paid by the household as a deduction to determine the amount of SNAP benefits your household is eligible for as long as the expense is reported and verified. Medical expenses over $35.00 are allowed if there is an elderly (age 60 or over) or disabled person applying for benefits. If you do not report or verify any of the expenses listed on the application, it will be considered that you do not want to receive a deduction for the unreported or unverified expense.

Initials ____________

Initials ____________

15

16

Blank page

Release of Information

I hereby authorize and consent to the release of all information concerning me or my household members to the Department of Health and Human Services by the holder of the information such as, but not limited to, wage information, information made confidential by law, as well as patient information privileged under NRS 49.225, or any other provision of law. I hereby release the holder of the information from liability, if any, resulting from the release (disclosure) of the required information.

If I am 60 years of age or older, I hereby consent to the disclosure of my identity and waive my right as an older person to have my identity kept confidential. I hereby release the holder of information from liability, if any, resulting from the disclosure of the required information.

Initials ____________

I understand if I fail to initial pages

I understand the questions on this application and the penalty for hiding or giving false information. I agree to notify the Nevada State Division of Welfare and Supportive Services of any changes in my household circumstances that may affect my benefits. I understand failure to report changes may cause an overpayment that I would be responsible to pay back and could even be prosecuted by a court of law. I certify under penalty of perjury, my answers are correct and complete to the best of my knowledge and ability. I swear I have honestly reported the citizenship of myself and anyone I am applying for.

Signature or Mark of Applicant |

Date |

Signature or Mark of Spouse/ |

Date |

|

|

Second Parent of Child(ren)/Adult Representative |

|

Witness: (Use if applicant cannot read or write or is blind.) The information in this application has been read to the applicant and I have witnessed the above signature.

Signature of Witness |

Date |

Your completed application may be submitted to your local Welfare office or mailed to PO Box 15400, Las Vegas, NV 89114.

IF YOU ARE NOT REGISTERED TO VOTE WHERE YOU LIVE NOW,

WOULD YOU LIKE TO REGISTER TO VOTE HERE TODAY?

(Please check one)

YES

NO

If you do not check either box, you will be considered to have decided not to register to vote at this time.

The NATIONAL VOTER REGISTRATION ACT provides you with the opportunity to register to vote at this location. If you would like help in filling out a voter registration application form, we will help you. The decision whether to seek or accept help is yours. You may fill out the application form in private.

IMPORTANT NOTICE: Applying to register or declining to register to vote WILL NOT AFFECT the amount of assistance you will be provided by this agency.

____________________________________________________________________________________________________

Signature |

Date |

CONFIDENTIALITY: Whether you decide to register to vote or not, your decision will remain confidential.

IF YOU BELIEVE SOMEONE HAS INTERFERED with your right to register or to decline to register to vote, or your right to choose your own political party or other political preference, you may file a complaint with the Office of the Secretary of State, Capitol Complex, Carson City, Nevada 89701.

17

18

Blank page

Your Rights

Anyone whose application for assistance has been denied, not acted on within a reasonable time frame, or whose benefits have been reduced or terminated, may request a conference or hearing. You may request a conference or hearing by writing your local district DWSS office or the administration office. For SNAP, you may request a hearing by calling your local district DWSS office. You may also request a hearing for assistance programs such as TANF or SNAP within 90 days of the notice date. You will be notified in writing 10 days prior to the hearing date, the time and location of the hearing. You may be represented at a conference/hearing by anyone you have given written authorization to which must be given to the DWSS office prior to the conference/hearing. You may request information on the various legal services which may be available in your community at no cost, please contact us for information. If you are dissatisfied with the hearing decision, you may appeal your case to your local District Court of the State of Nevada.

Your Responsibilities

If you are applying for TANF:

You must report changes in your mailing address immediately. Additional changes must be reported immediately after you apply and before you are approved benefits. Once your benefits are approved you must report the following changes and the change must be