Due to the purpose of allowing it to be as easy to go with as possible, we created our PDF editor. The entire process of filling the new health insurance marketplace coverage 2021 fillable form can be very simple in case you check out the following steps.

Step 1: Click the orange "Get Form Now" button on this webpage.

Step 2: The file editing page is presently available. Include text or modify present information.

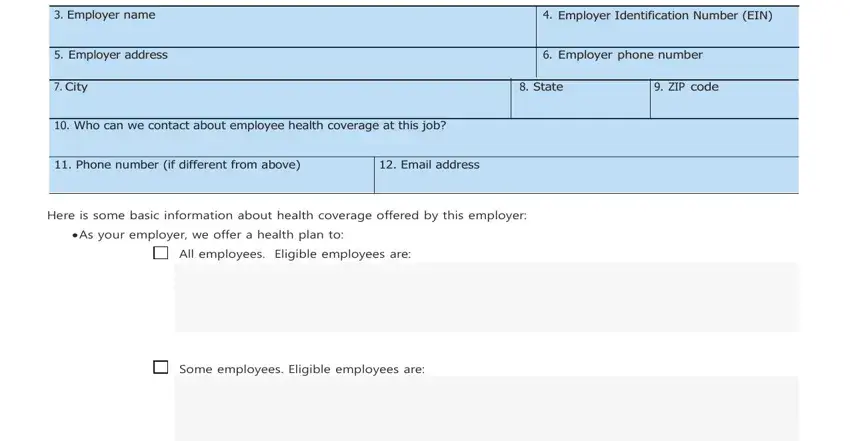

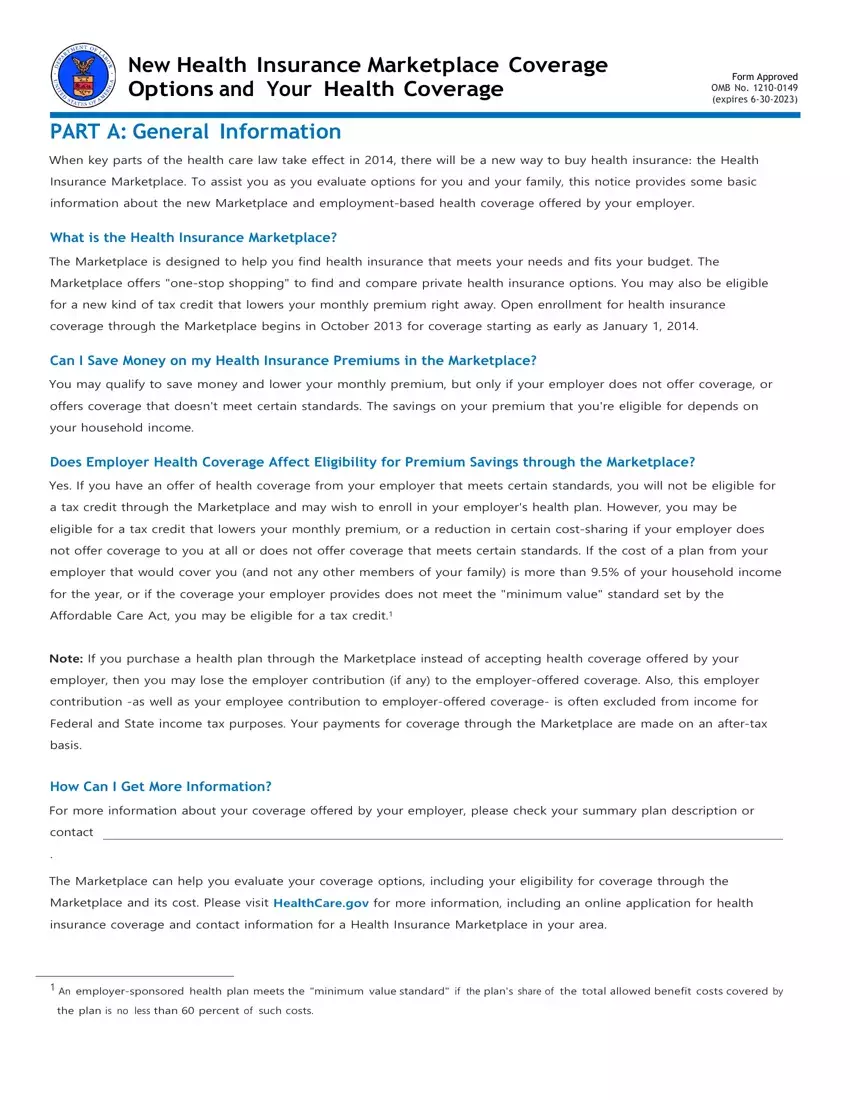

To prepare the new health insurance marketplace coverage 2021 fillable form PDF, enter the information for all of the sections:

Provide the requested data in the Employer name, Employer address, City, Employer Identification Number EIN, Employer phone number, State, ZIP code, Who can we contact about employee, Phone number if different from, Email address, Here is some basic information, As your employer we offer a, All employees Eligible employees, and Some employees Eligible employees segment.

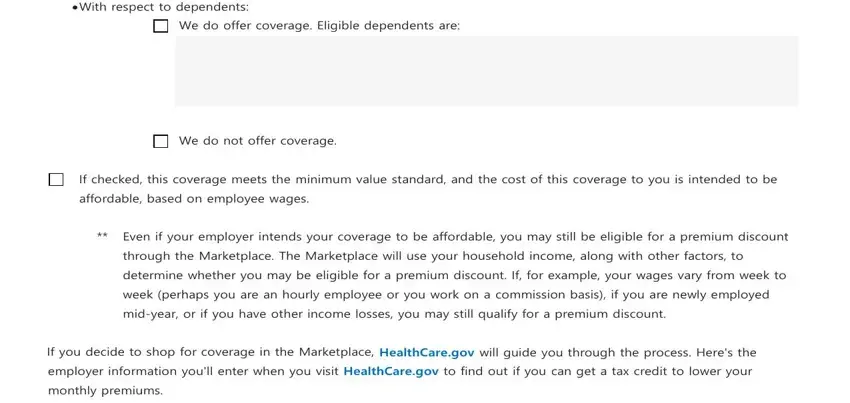

Write down all details you need inside the box With respect to dependents, We do offer coverage Eligible, We do not offer coverage, If checked this coverage meets the, affordable based on employee wages, Even if your employer intends, through the Marketplace The, determine whether you may be, week perhaps you are an hourly, midyear or if you have other, If you decide to shop for coverage, employer information youll enter, and monthly premiums.

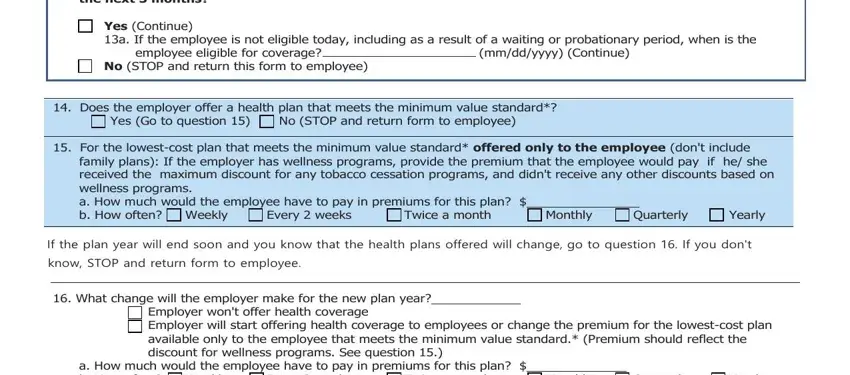

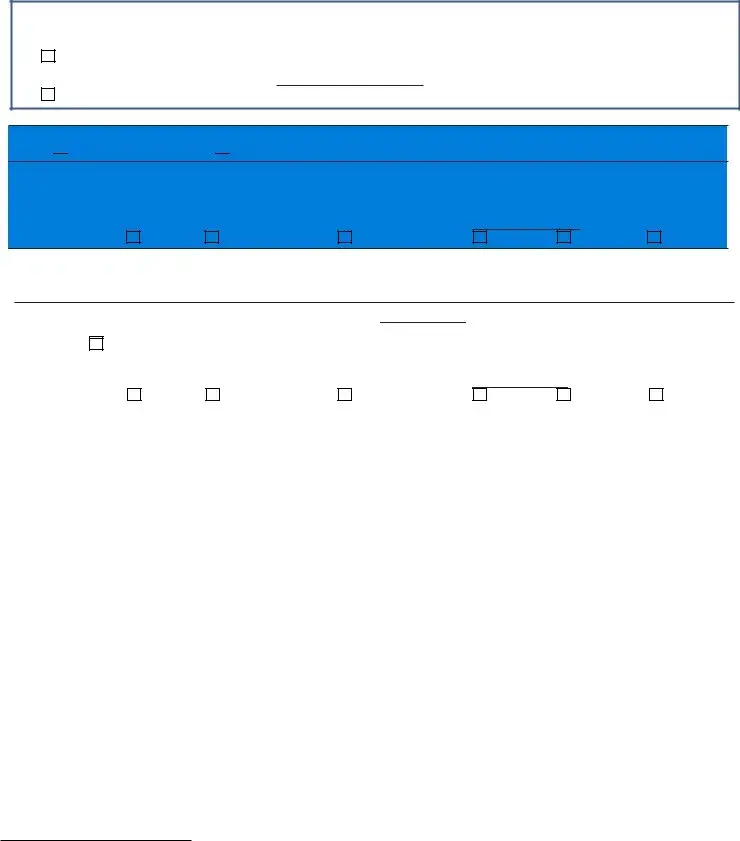

Inside the part the next months, Yes Continue a If the employee is, employee eligible for coverage No, mmddyyyy Continue, Does the employer offer a health, Yes Go to question, No STOP and return form to employee, For the lowestcost plan that, family plans If the employer has, Twice a month, Quarterly, Monthly, Yearly, If the plan year will end soon and, and know STOP and return form to, include the rights and obligations of the sides.

Finalize by taking a look at the next areas and filling them in as required: An employersponsored health plan, and plan is no less than percent of.

Step 3: Once you click the Done button, your prepared file may be transferred to any kind of your gadgets or to electronic mail given by you.

Step 4: You should get as many duplicates of the file as possible to avoid potential issues.

Yes (Go to question 15)

Yes (Go to question 15)  No (STOP and return form to employee)

No (STOP and return form to employee) Employer won't offer health coverage

Employer won't offer health coverage