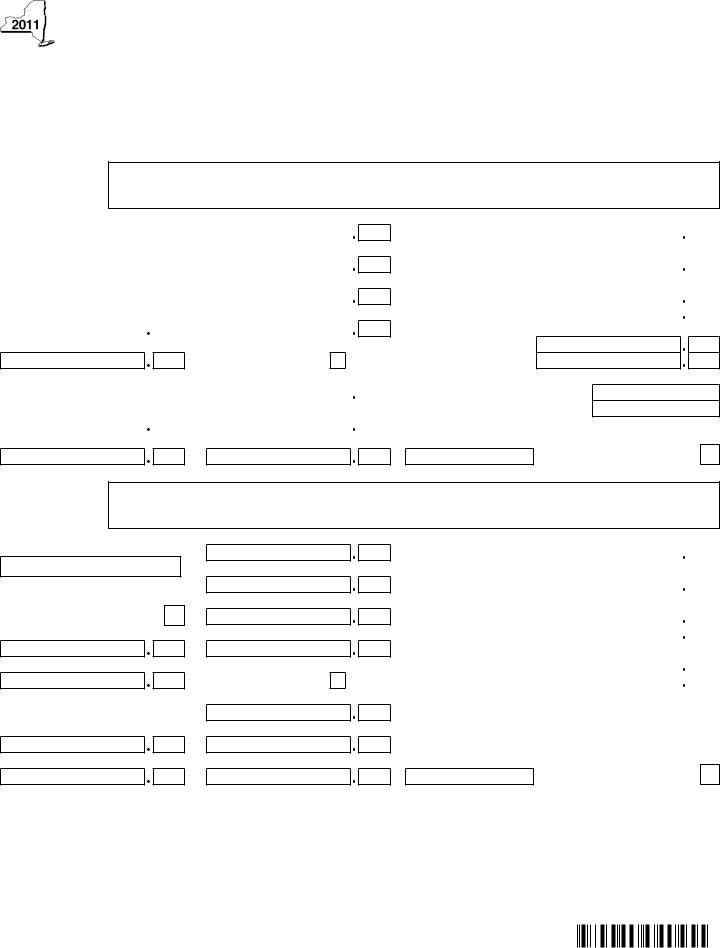

When it comes to filing taxes in New York, understanding the intricacies of the forms you need is crucial for a seamless process. The New York State Department of Taxation and Finance issues the IT-2 form, a vital document for taxpayers that serves as a summary of W-2 statements. It specifically covers information relevant to New York State, New York City, and Yonkers. What makes the IT-2 stand out is its requirement for taxpayers not to detach or separate the W-2 records below, ensuring the form is filed as an entire page. This procedure is designed to streamline the tax filing process, providing a clear summary of earnings, tips, and other compensations alongside details such as dependent care benefits, nonqualified plans, and various tax withholdings. It also differentiates between the taxpayer and spouse when applicable, making it a comprehensive tool for accurately reporting income and taxes withheld at the state and local levels. Instructions on the back guide taxpayers through properly completing the form, making the IT-2 an indispensable resource for individuals navigating their tax responsibilities in New York.

| Question | Answer |

|---|---|

| Form Name | New York Form It 2 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | w-2, New_York, 12d, EIN |

New York State Department of Taxation and Finance

Summary of

New York State • New York City • Yonkers

Do not detach or separate the

Taxpayer’s irst name and middle initial |

Taxpayer’s last name |

|

|

Your social security number |

|

|

|

|

|

Spouse’s irst name and middle initial |

Spouse’s last name |

|

|

Spouse’s social security number |

|

|

|

|

|

Box c Employer’s name and full address ( including ZIP code )

RECORD 1

|

|

|

|

|

|

|

|

|

Box 12a |

Amount |

Box b Employer identiication number ( EIN ) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box 12b |

Amount |

This |

|

|

|

|

|

|

|

|

||

( MARK AN X IN ONE BOX ): |

|

|

|

|

|

|

Box 12c |

Amount |

||

Taxpayer |

|

|

Spouse |

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

Box 1 Wages, tips, other compensation |

Box 12d |

Amount |

||||||||

|

|

|

|

|

|

|

|

|

|

|

Code |

Box 15 State Box 16 State wages, tips, etc. ( for NYS ) |

|||||||

|

|

|

|

|

|

|

|

|

Code |

|

|

|

Box 17 New York State income tax withheld |

||||

|

|

|

|

|

|

|

|

|

Code |

|

|

|

Box 18 |

Local wages, tips, etc. ( SEE INSTR. ) |

|||

|

|

|

Locality a |

|

|

|

|

|

Code |

|

Locality b |

|

|

|

|

||

|

|

|

|

|

Box 19 |

Local income tax withheld |

|

|

Box 8 Allocated tips

Box 13 Statutory employee

Box 14 a Amount

|

Locality a |

|

Locality b |

Description |

Box 20 Locality name |

|

|

|

|

|

|

|

|

|

|

Locality a |

Box 10 |

Dependent care beneits |

|

|

|

Box 14 b Amount |

Description |

Locality b |

|||

|

|

|

|

|

|

|

|

|

|

|

Box 11 |

Nonqualiied plans |

|

|

|

Box 14 c Amount |

Description |

|

|||

Do not detach.

RECORD 2

Corrected (

Box c Employer’s name and full address ( including ZIP code )

Box b Employer identiication number ( EIN )

This

( MARK AN X IN ONE BOX ):

Taxpayer |

|

Spouse |

|

|

|

Box 1 Wages, tips, other compensation

Box 8 Allocated tips

Box 10 Dependent care beneits

Box 12a Amount

Box 12b Amount

Box 12c Amount

Box 12d Amount

Box 13 Statutory employee Box 14 a Amount

Box 14 b Amount

Code |

Box 15 State |

Box 16 |

State wages, tips, etc. ( for NYS ) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

Box 17 New York State income tax withheld |

|||||

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

Box 18 |

Local wages, tips, etc. ( SEE INSTR. ) |

||||

|

|

|

Locality a |

|

|

|

|

|

||

Code |

|

Locality b |

|

|

|

|

|

|||

|

|

|

|

|

|

Box 19 |

Local income tax withheld |

|

|

|

|

|

|

Locality a |

|

|

|

|

|

||

|

|

|

Locality b |

|

|

|

|

|

||

Description |

|

|

Box 20 Locality name |

|||||||

|

|

|

|

|

|

Locality a |

|

|||

Description |

Locality b |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

Box 11 Nonqualiied plans |

Box 14 c Amount |

Description |

Corrected (

1021110094

Please ile this original scannable form with the Tax Department.