RPTL can be filled in online very easily. Just try FormsPal PDF editing tool to do the job in a timely fashion. Our tool is constantly evolving to provide the best user experience possible, and that is due to our resolve for continuous development and listening closely to customer opinions. For anyone who is looking to get going, here is what it will take:

Step 1: Press the orange "Get Form" button above. It is going to open our editor so that you could start filling in your form.

Step 2: This tool lets you work with nearly all PDF files in many different ways. Improve it by writing your own text, adjust original content, and add a signature - all readily available!

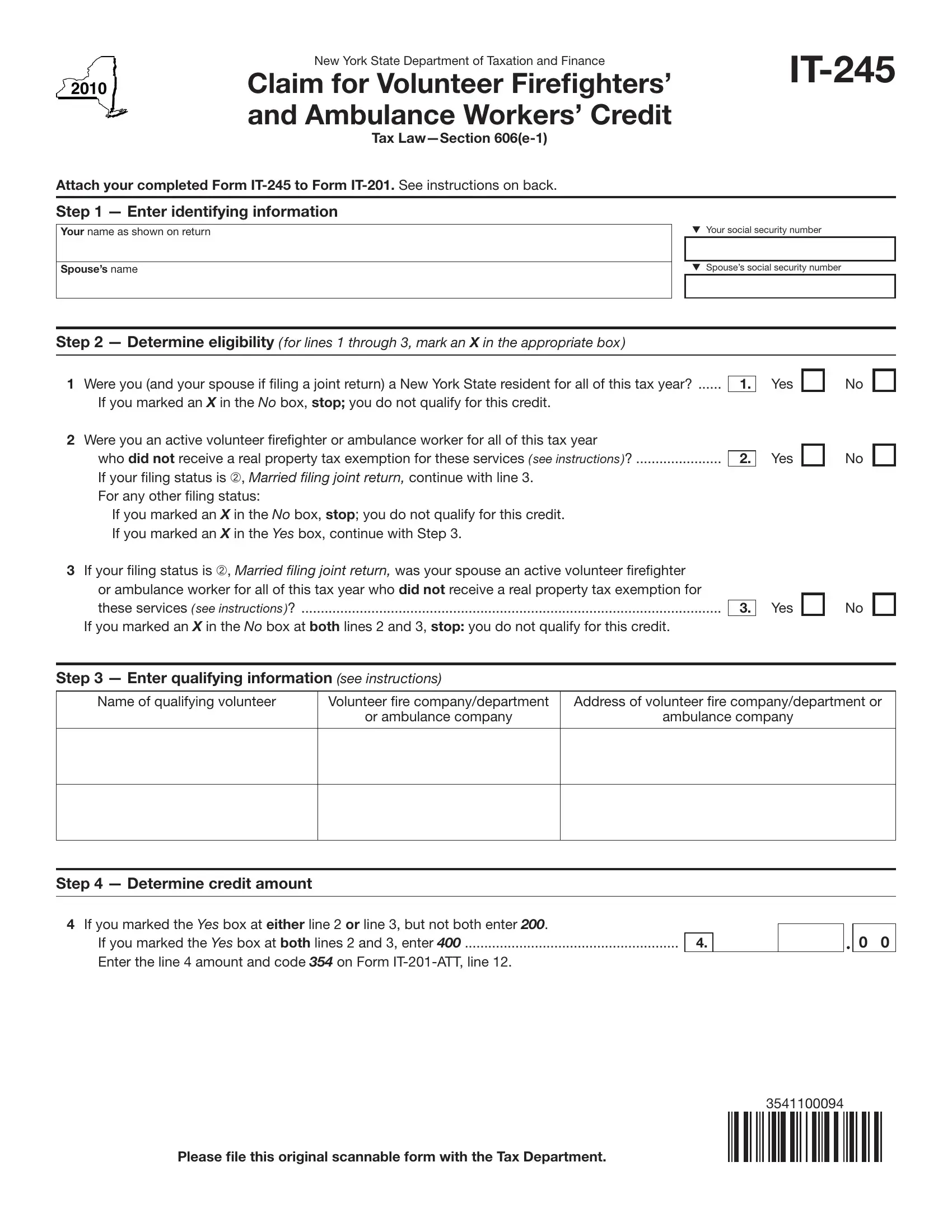

As for the blanks of this specific form, here's what you should consider:

1. You have to complete the RPTL correctly, so take care when filling out the sections comprising all these blank fields:

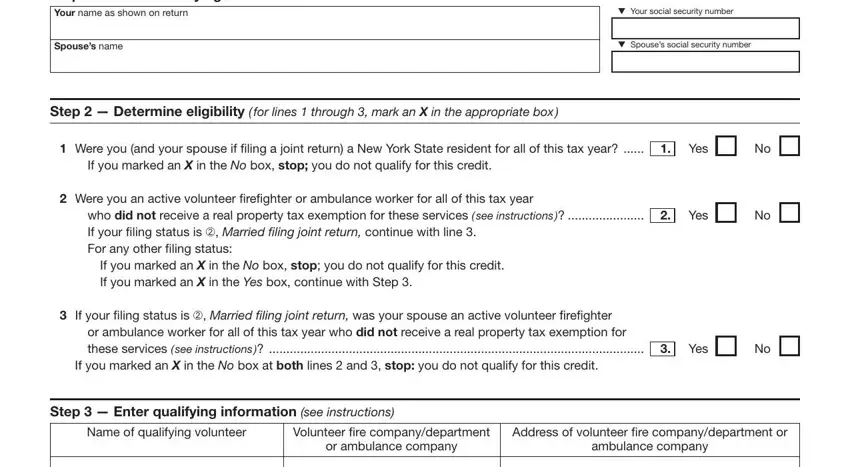

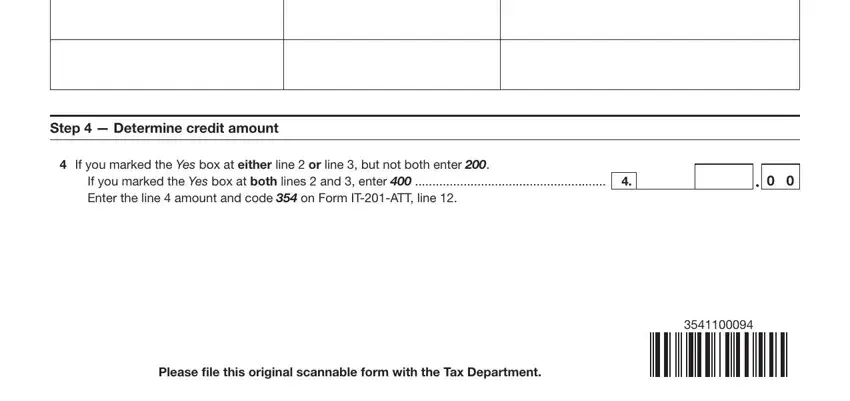

2. Right after this section is done, go on to enter the applicable information in all these - Step Determine credit amount, If you marked the Yes box at, Enter the line amount and code, If you marked the Yes box at both, and Please file this original scannable.

Be very mindful when filling out Please file this original scannable and If you marked the Yes box at, because this is where a lot of people make some mistakes.

Step 3: Just after double-checking your fields and details, click "Done" and you're good to go! Join us today and immediately gain access to RPTL, all set for download. All changes made by you are kept , which means you can edit the pdf later when necessary. FormsPal is focused on the personal privacy of our users; we make certain that all personal data processed by our system continues to be protected.