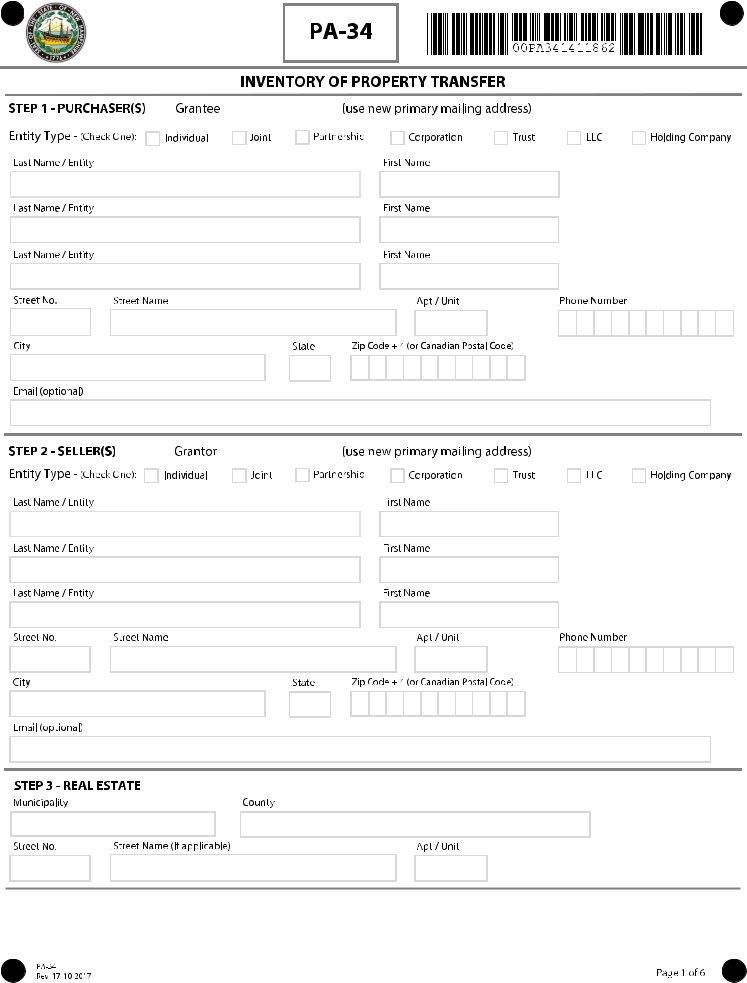

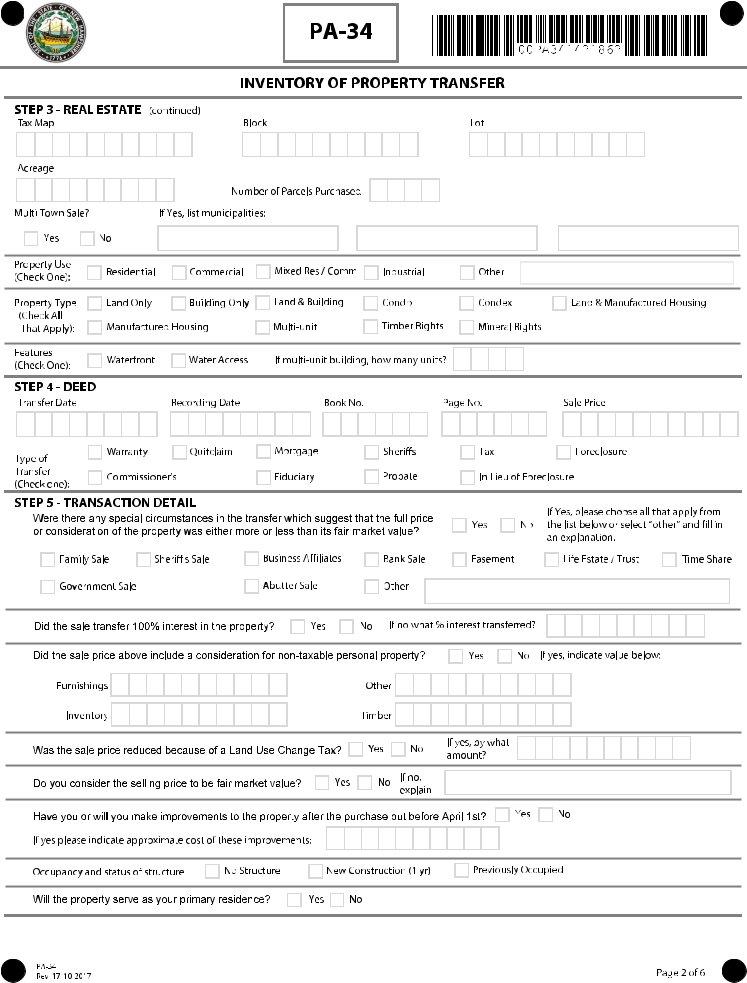

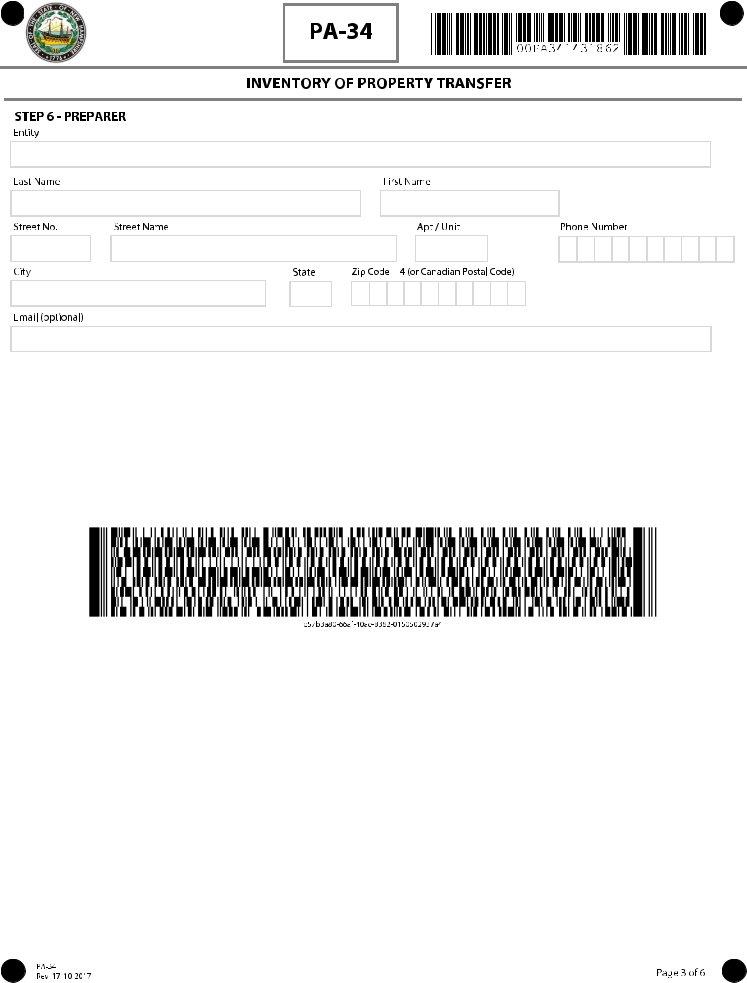

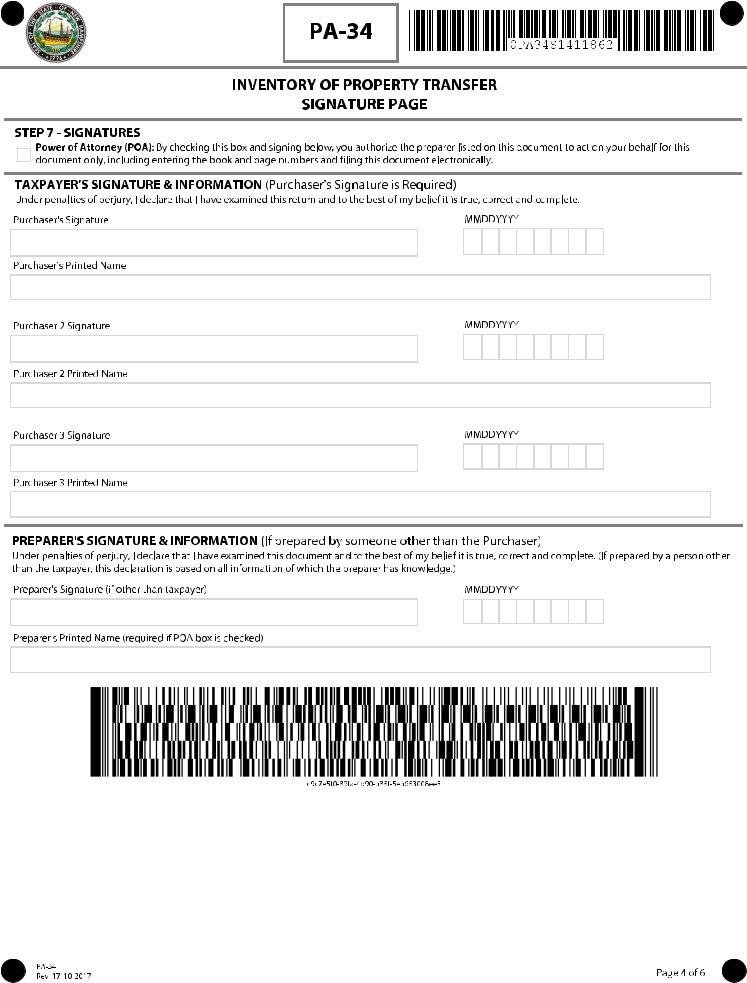

Navigating the intricacies of property taxation can often seem like a daunting task for homeowners and business entities alike. In the state of New Hampshire, the Department of Revenue Administration plays a crucial role in this process, providing essential forms and guidelines to ensure compliance and fairness in the assessment of property taxes. Among the critical documents provided by this department, the NH PA-34 form stands out as a pivotal piece. This instrument, formally known as the Inventory of Property Transfer form, serves as a vital tool for reporting property transfers within the state. Its use is not only a statutory requirement but also a cornerstone in maintaining the transparency and accuracy of property tax records. Understanding the NH PA-34 form involves recognizing its role in the broader framework of property taxation, its impact on both the state's revenue system and the individual's responsibilities, and navigating the specific information and deadlines associated with its submission. For property owners, real estate professionals, and legal advisors, mastering the details of this form is essential for ensuring that property transfers are conducted smoothly and in compliance with New Hampshire's taxation laws.

| Question | Answer |

|---|---|

| Form Name | Nh Pa34 Form |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | new hampshire form pa 34, 34 form nh, nh 34 pa34, nh dra pa 34 |

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration