Whenever you wish to fill out false, you won't need to download any kind of programs - simply make use of our PDF editor. To have our editor on the leading edge of convenience, we aim to adopt user-driven capabilities and enhancements on a regular basis. We're routinely thankful for any suggestions - play a pivotal role in revolutionizing the way you work with PDF docs. Here is what you would have to do to start:

Step 1: Click the orange "Get Form" button above. It'll open our pdf tool so you could start filling in your form.

Step 2: The editor allows you to change your PDF form in various ways. Enhance it by including personalized text, correct original content, and include a signature - all readily available!

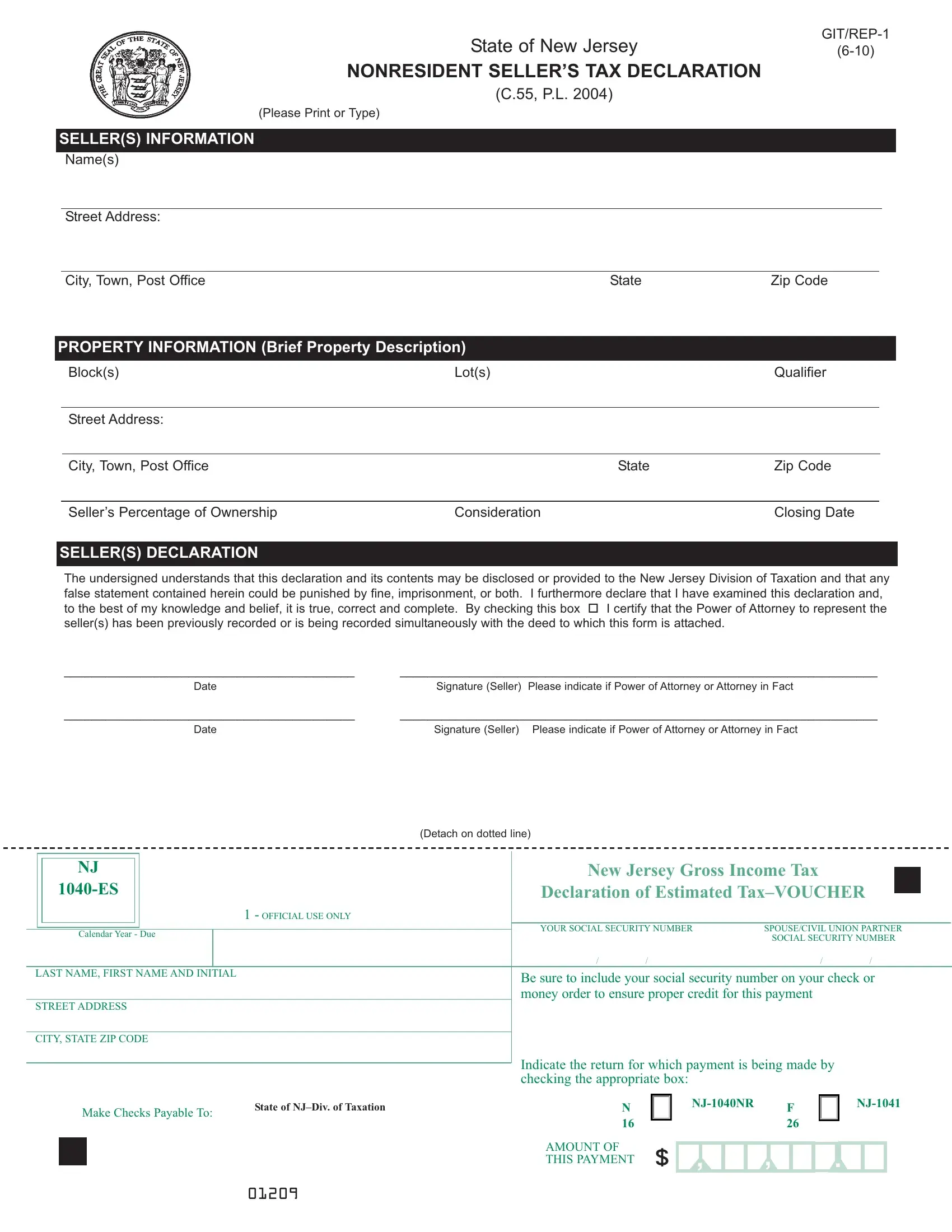

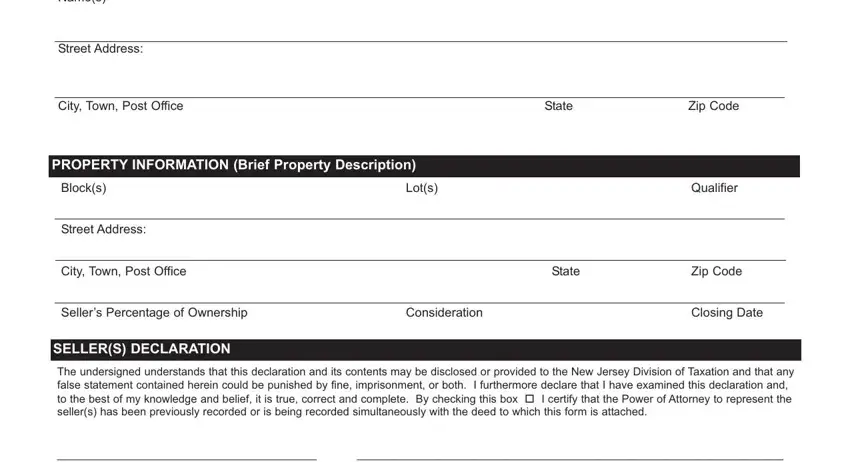

This PDF form will require specific information to be filled in, therefore you should take some time to type in what is asked:

1. Begin completing the false with a group of essential blank fields. Get all of the necessary information and make sure nothing is omitted!

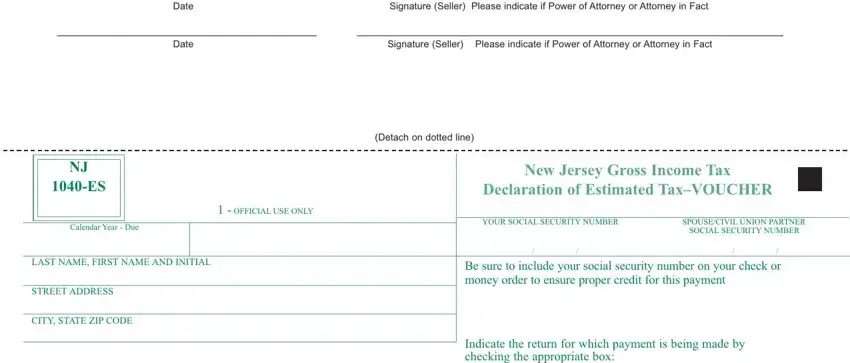

2. The next stage is usually to complete the following blanks: Date, Signature Seller Please indicate, Date, Signature Seller Please indicate, Calendar Year Due, OFFICIAL USE ONLY, LAST NAME FIRST NAME AND INITIAL, STREET ADDRESS, CITY STATE ZIP CODE, Detach on dotted line, New Jersey Gross Income Tax, Declaration of Estimated TaxVOUCHER, YOUR SOCIAL SECURITY NUMBER, SPOUSECIVIL UNION PARTNER, and SOCIAL SECURITY NUMBER.

3. This stage will be straightforward - complete all the blanks in Make Checks Payable To, State of NJDiv of Taxation, Indicate the return for which, NJNR, and AMOUNT OF THIS PAYMENT to conclude this part.

You can certainly make errors when filling in the NJNR, therefore be sure to look again prior to deciding to send it in.

Step 3: Go through all the details you've entered into the blank fields and then click on the "Done" button. Try a free trial plan at FormsPal and acquire direct access to false - download or modify inside your FormsPal account. FormsPal provides secure form editor with no personal information recording or sharing. Feel safe knowing that your information is in good hands with us!