Working with PDF forms online can be very easy with our PDF editor. You can fill out form 8938 continuation sheet 2017 here effortlessly. Our team is dedicated to providing you with the ideal experience with our tool by constantly releasing new functions and upgrades. With these updates, using our tool gets better than ever before! In case you are seeking to start, here's what it takes:

Step 1: Press the "Get Form" button above. It will open up our pdf tool so you could begin completing your form.

Step 2: After you launch the tool, you will see the form prepared to be filled in. Besides filling out various blanks, it's also possible to do some other things with the PDF, particularly putting on any text, changing the original textual content, inserting images, affixing your signature to the PDF, and more.

It really is straightforward to finish the form adhering to our detailed tutorial! Here's what you should do:

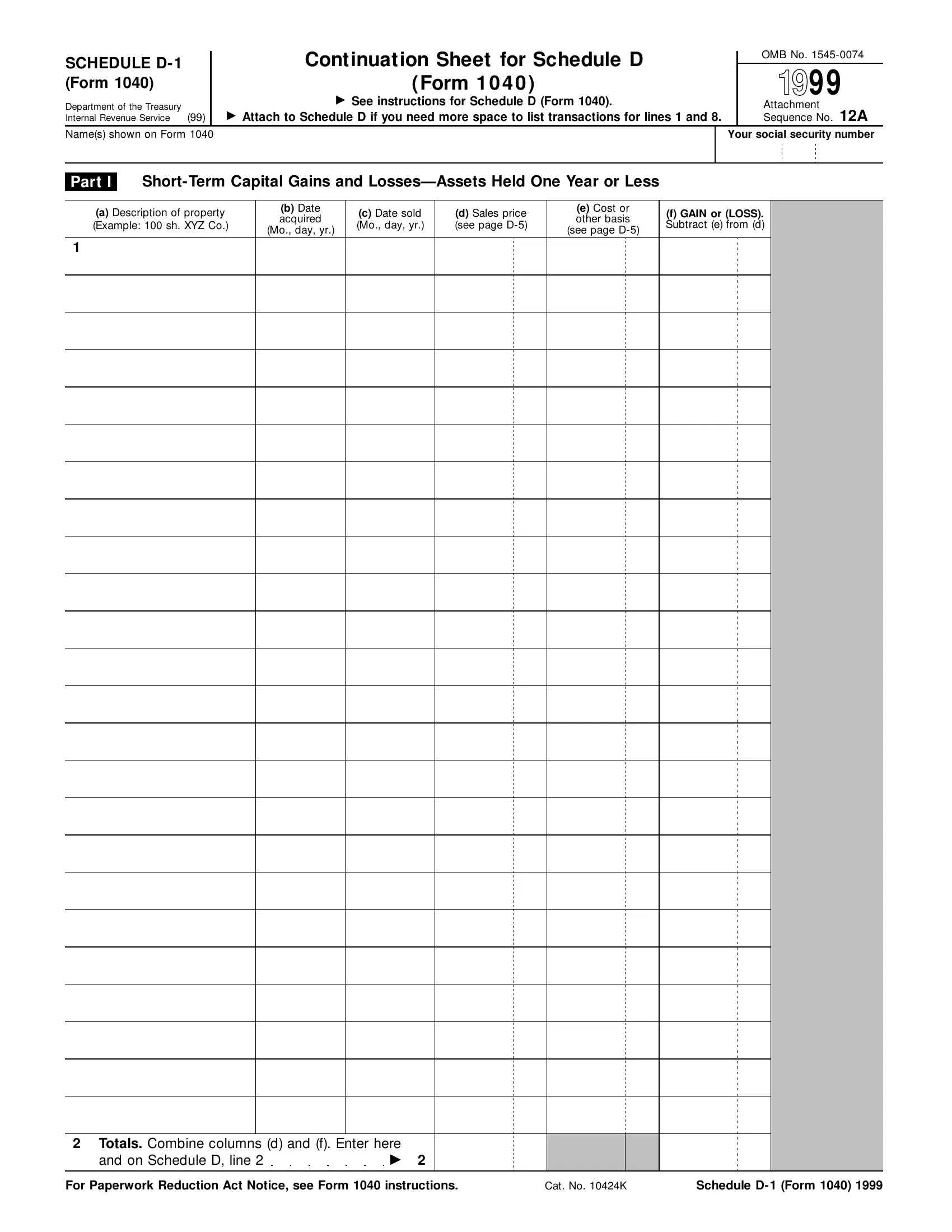

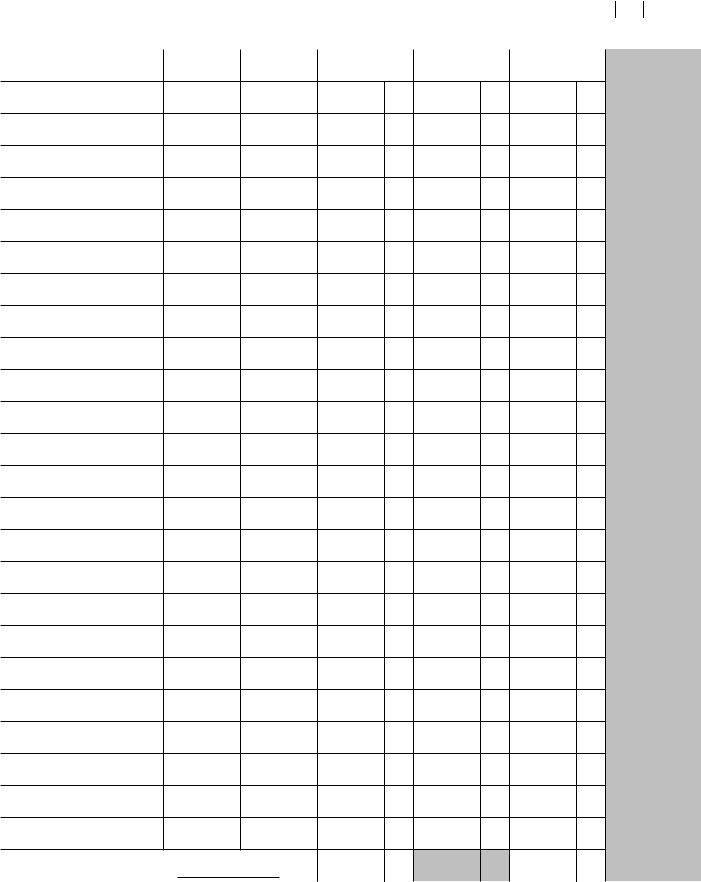

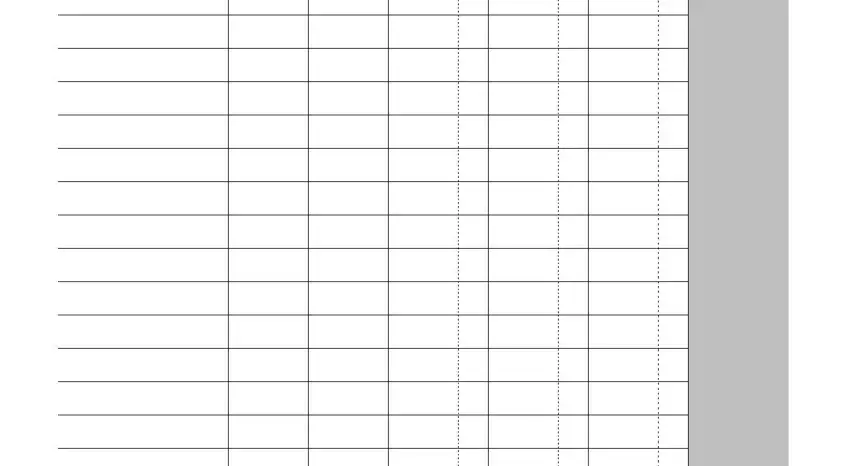

1. Fill out the form 8938 continuation sheet 2017 with a selection of necessary blank fields. Consider all the important information and be sure there's nothing neglected!

2. The third part would be to fill in these particular blank fields: .

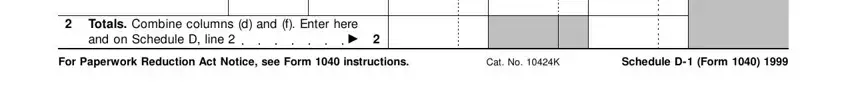

3. This stage is generally easy - fill in all of the empty fields in Totals Combine columns d and f, For Paperwork Reduction Act Notice, Cat No K, and Schedule D Form to conclude the current step.

You can potentially get it wrong when filling out your Schedule D Form, consequently be sure to look again before you send it in.

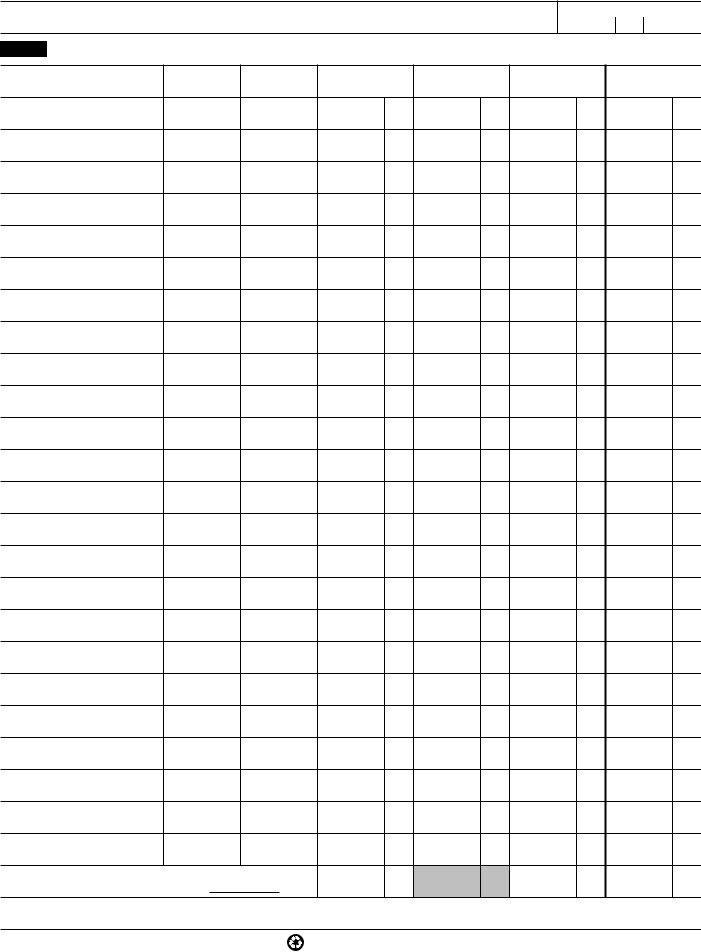

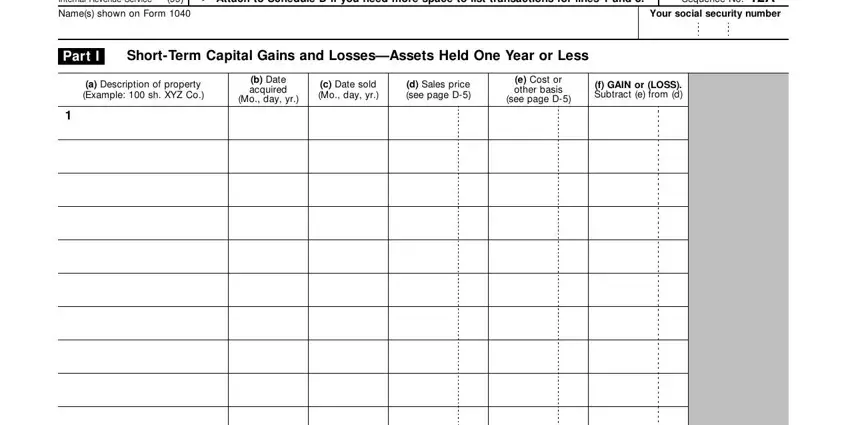

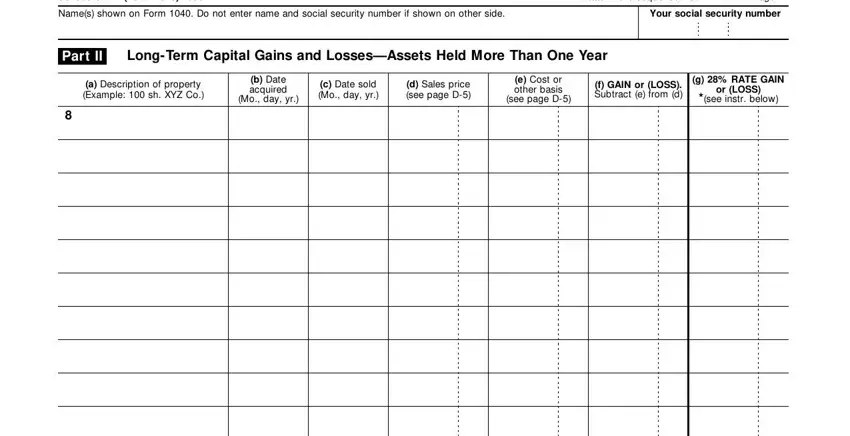

4. You're ready to proceed to the next form section! In this case you have all of these Schedule D Form, Attachment Sequence No A, Page, Names shown on Form Do not enter, Your social security number, Part II, LongTerm Capital Gains and, a Description of property Example, b Date acquired, Mo day yr, c Date sold Mo day yr, d Sales price see page D, e Cost or other basis, see page D, and f GAIN or LOSS Subtract e from d blank fields to complete.

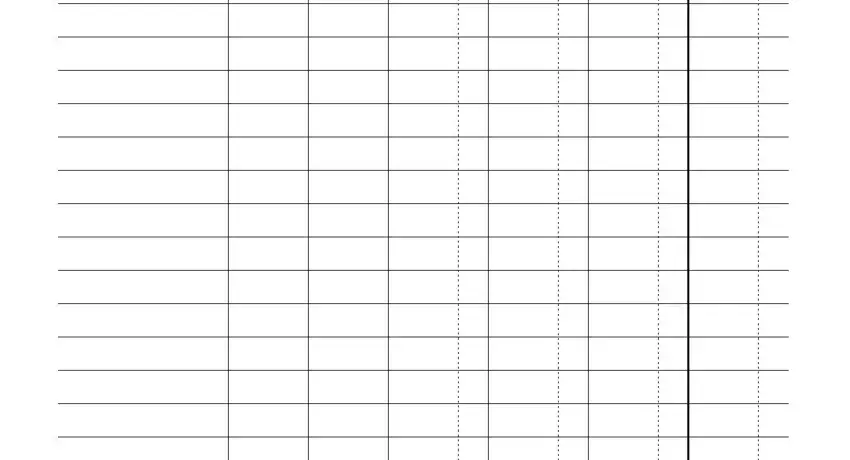

5. The document should be finished by filling out this section. Further you will find a detailed list of form fields that need appropriate information for your form submission to be accomplished: .

Step 3: Reread all the information you've inserted in the blank fields and then click the "Done" button. Download your form 8938 continuation sheet 2017 as soon as you subscribe to a 7-day free trial. Conveniently get access to the form from your personal account, with any modifications and adjustments automatically kept! At FormsPal.com, we do everything we can to make certain that your details are kept secure.