Once you open the online PDF editor by FormsPal, it is easy to complete or alter how to nj ptr 1 right here and now. We at FormsPal are aimed at making sure you have the perfect experience with our editor by consistently introducing new functions and upgrades. Our tool is now much more user-friendly thanks to the most recent updates! Now, filling out documents is a lot easier and faster than ever. To begin your journey, take these simple steps:

Step 1: Click on the "Get Form" button in the top part of this webpage to get into our tool.

Step 2: Using this state-of-the-art PDF editing tool, you may accomplish more than just complete blank form fields. Try each of the functions and make your docs look professional with custom text added, or fine-tune the file's original content to perfection - all that backed up by an ability to incorporate stunning pictures and sign it off.

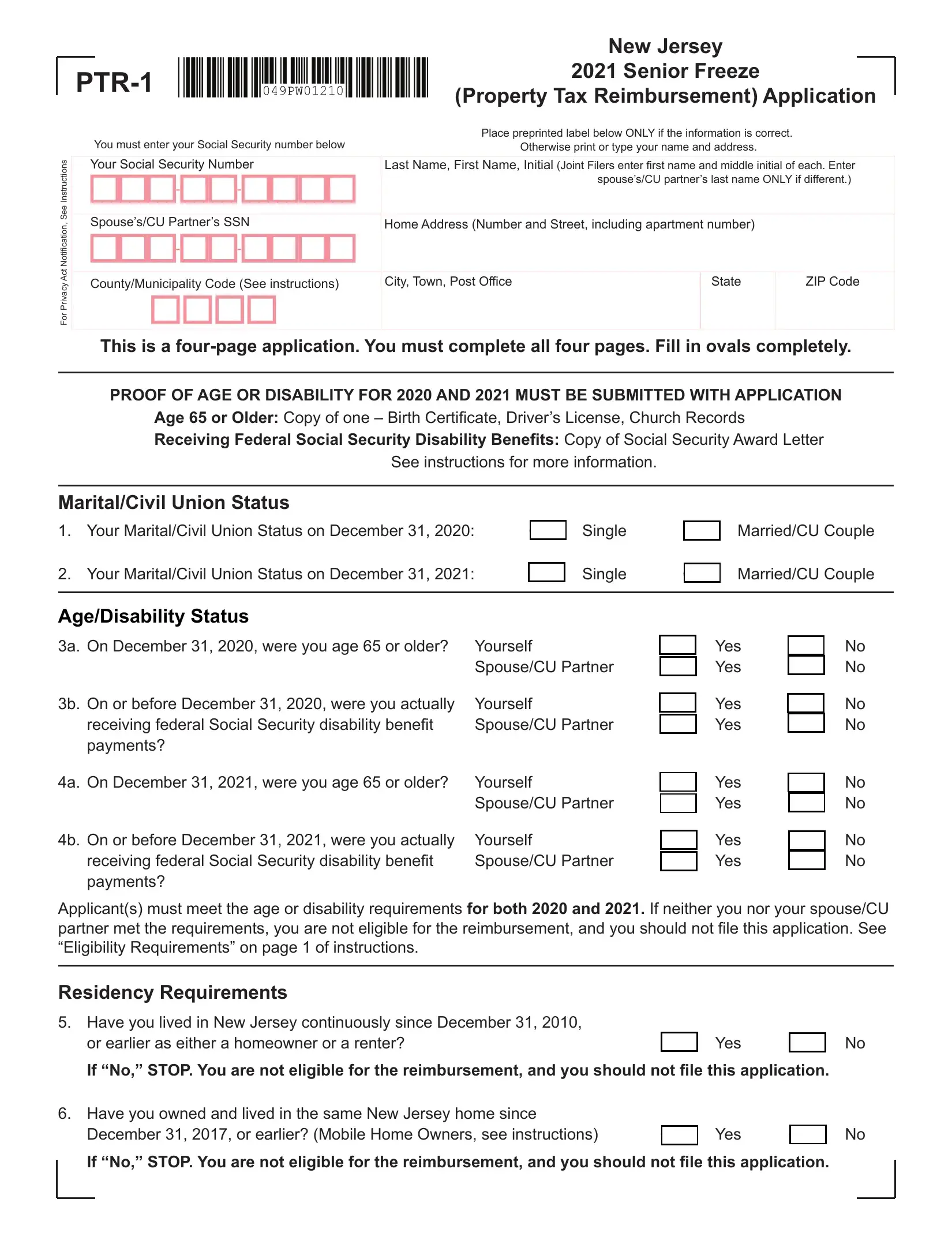

This document will require particular details to be filled in, therefore you should definitely take whatever time to enter precisely what is expected:

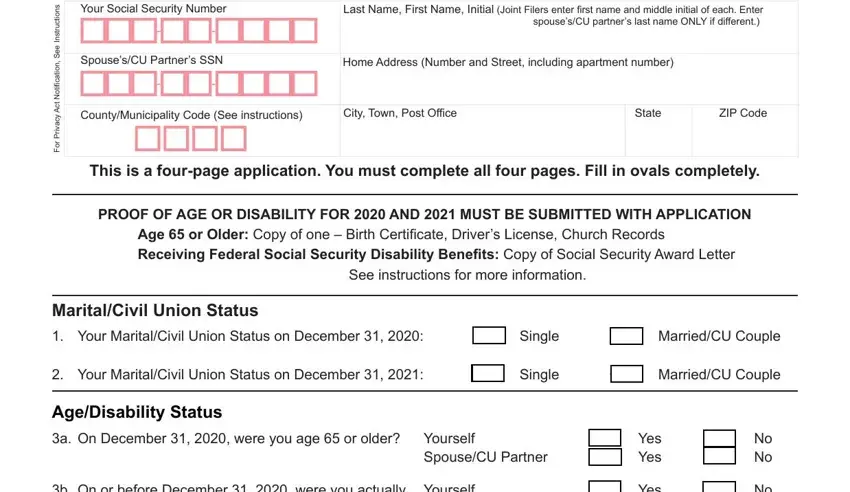

1. The how to nj ptr 1 involves specific information to be entered. Be sure the following fields are complete:

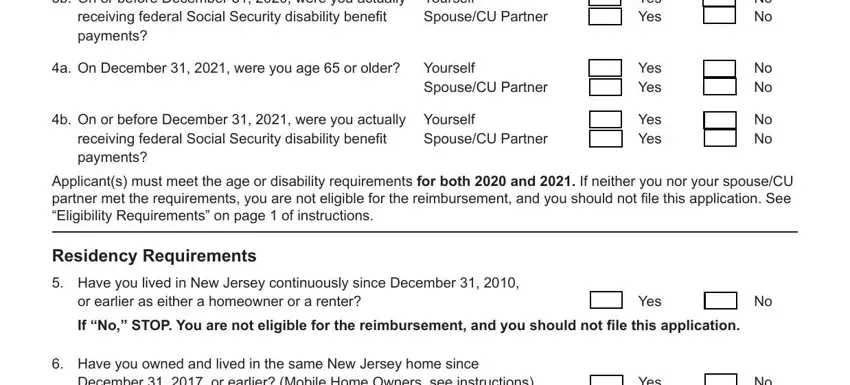

2. Given that the last segment is completed, you'll want to insert the needed details in b On or before December were you, receiving federal Social Security, SpouseCU Partner, a On December were you age or, Yourself SpouseCU Partner, Yes Yes, Yes Yes, No No, No No, receiving federal Social Security, b On or before December were you, SpouseCU Partner, Yes Yes, No No, and Residency Requirements Have you so you can move forward to the next part.

Those who use this form frequently get some things wrong when filling out Yes Yes in this area. Be certain to revise whatever you type in right here.

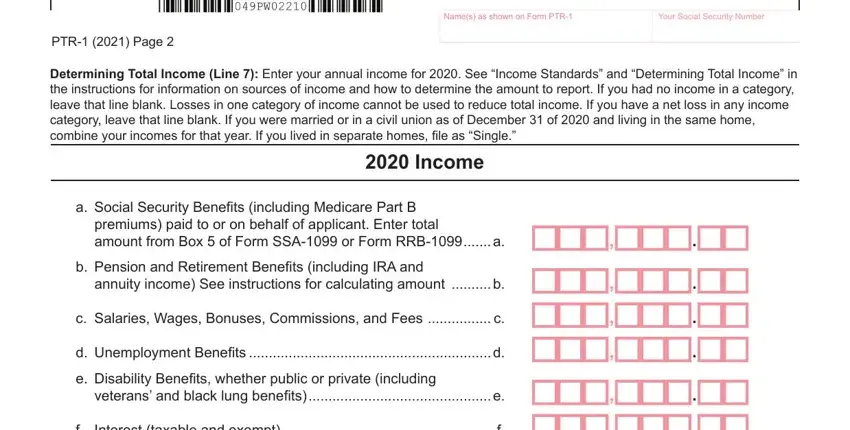

3. Completing PTR Page, Determining Total Income Line, Income, a Social Security Benefits, c Salaries Wages Bonuses, d Unemployment Benefits d e, veterans and black lung benefits e, and f Interest taxable and exempt f is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

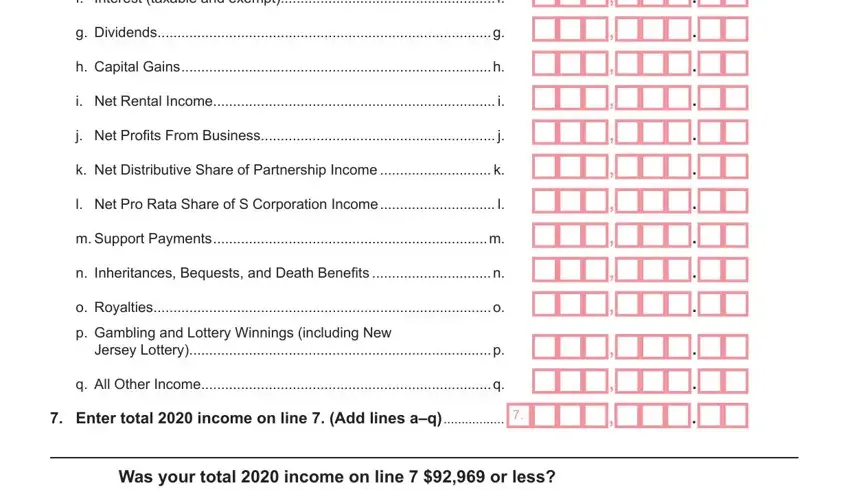

4. To move ahead, the following step involves typing in a handful of blanks. Examples include f Interest taxable and exempt f, g Dividends g, h Capital Gains h, i Net Rental Income i, j Net Profits From Business j, k Net Distributive Share of, l Net Pro Rata Share of S, m Support Payments m, n Inheritances Bequests and Death, o Royalties o p Gambling and, Jersey Lottery p, q All Other Income q, Enter total income on line Add, and Was your total income on line, which you'll find integral to carrying on with this document.

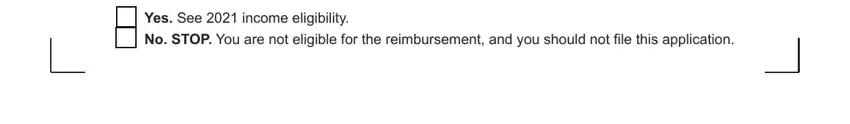

5. The form has to be completed by filling in this section. Further you will find an extensive list of fields that require appropriate information for your document submission to be accomplished: Yes See income eligibility No.

Step 3: Ensure your details are right and press "Done" to continue further. Grab your how to nj ptr 1 as soon as you subscribe to a 7-day free trial. Quickly gain access to the pdf from your personal account page, together with any edits and changes all preserved! We don't share or sell any details you enter when dealing with forms at our website.