The PDF editor can make filling out documents simple. It is quite effortless update the [FORMNAME] file. Comply with the following actions if you want to accomplish this:

Step 1: To begin, choose the orange button "Get Form Now".

Step 2: Now you're on the document editing page. You can edit and add information to the form, highlight specified content, cross or check particular words, insert images, put a signature on it, erase needless fields, or remove them altogether.

The following sections will frame the PDF template that you will be completing:

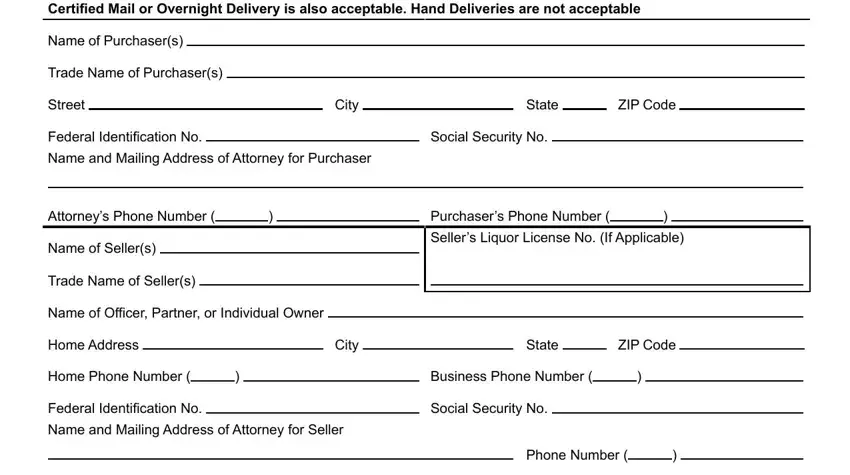

Type in the appropriate details in the segment Certified Mail or Overnight, Name of Purchasers, Trade Name of Purchasers, Street, City, State, ZIP Code, Federal Identification No, Social Security No, Name and Mailing Address of, Attorneys Phone Number, Name of Sellers, Trade Name of Sellers, Name of Officer Partner or, and Purchasers Phone Number.

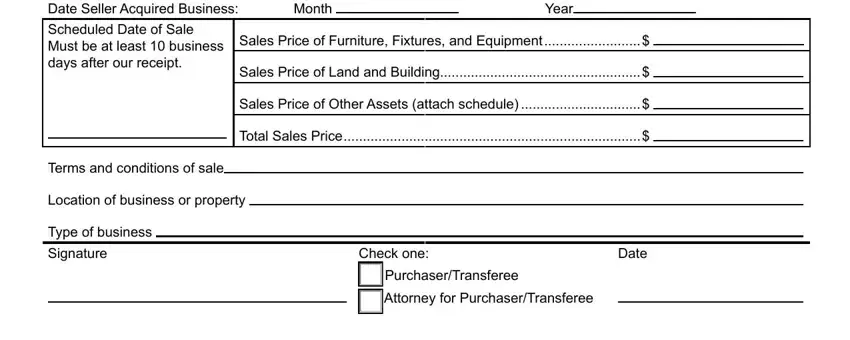

Write any information you may need inside the section Date Seller Acquired Business, Month, Year, Scheduled Date of Sale Must be at, Sales Price of Furniture Fixtures, Sales Price of Land and Building, Sales Price of Other Assets attach, Total Sales Price, Terms and conditions of sale, Location of business or property, Type of business, Signature, Check one, Date, and PurchaserTransferee.

Step 3: Click the "Done" button. It's now possible to upload the PDF form to your electronic device. As well as that, you can forward it by email.

Step 4: You will need to get as many duplicates of the file as you can to remain away from future misunderstandings.