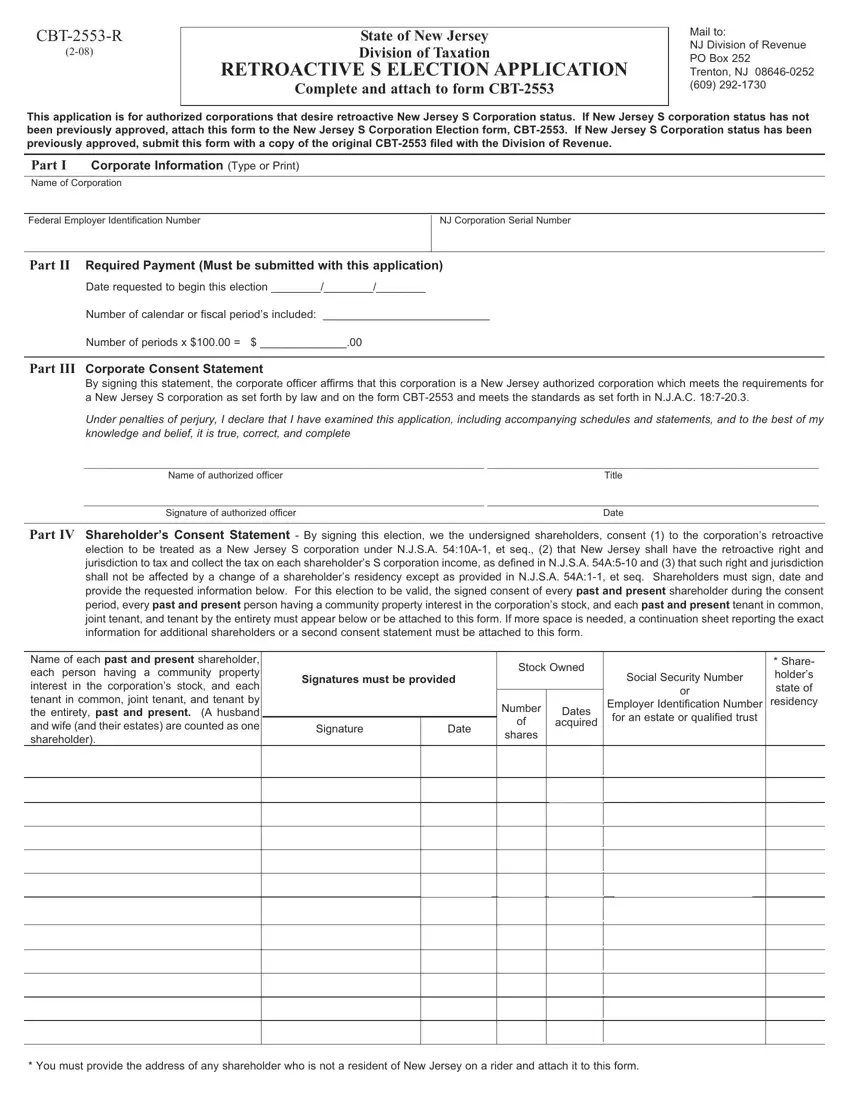

State of New Jersey

Division of Taxation

RETROACTIVE S ELECTION APPLICATION

Complete and attach to form CBT-2553

Mail to:

NJ Division of Revenue PO Box 252

Trenton, NJ 08646-0252 (609) 292-1730

This application is for authorized corporations that desire retroactive New Jersey S Corporation status. If New Jersey S corporation status has not been previously approved, attach this form to the New Jersey S Corporation Election form, CBT-2553. If New Jersey S Corporation status has been previously approved, submit this form with a copy of the original CBT-2553 filed with the Division of Revenue.

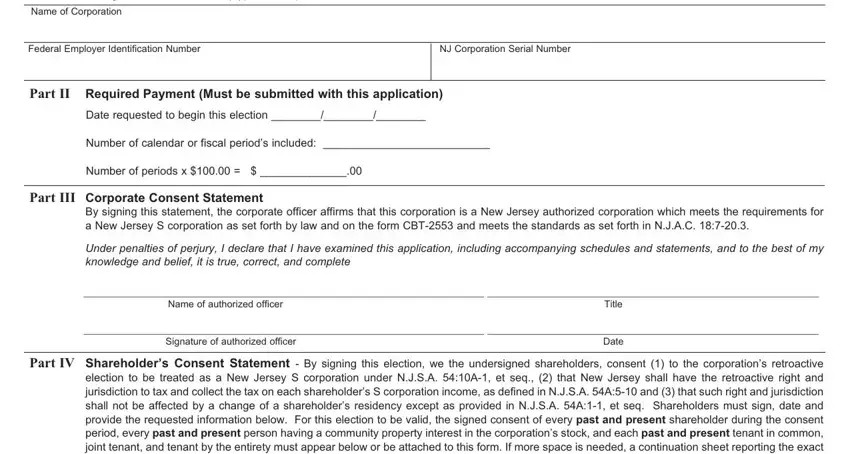

Part I Corporate Information (Type or Print)

Name of Corporation

Federal Employer Identification Number

NJ Corporation Serial Number

Part II Required Payment (Must be submitted with this application)

Date requested to begin this election ________/________/________

Number of calendar or fiscal period’s included: ___________________________

Number of periods x $100.00 = $ ______________.00

Part III Corporate Consent Statement

By signing this statement, the corporate officer affirms that this corporation is a New Jersey authorized corporation which meets the requirements for a New Jersey S corporation as set forth by law and on the form CBT-2553 and meets the standards as set forth in N.J.A.C. 18:7-20.3.

Under penalties of perjury, I declare that I have examined this application, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete

________________________________________________________________ _____________________________________________________

Name of authorized officerTitle

________________________________________________________________ _____________________________________________________

Signature of authorized officer |

Date |

|

|

Part IV Shareholder’s Consent Statement - By signing this election, we the undersigned shareholders, consent (1) to the corporation’s retroactive election to be treated as a New Jersey S corporation under N.J.S.A. 54:10A-1, et seq., (2) that New Jersey shall have the retroactive right and jurisdiction to tax and collect the tax on each shareholder’s S corporation income, as defined in N.J.S.A. 54A:5-10 and (3) that such right and jurisdiction shall not be affected by a change of a shareholder’s residency except as provided in N.J.S.A. 54A:1-1, et seq. Shareholders must sign, date and provide the requested information below. For this election to be valid, the signed consent of every past and present shareholder during the consent period, every past and present person having a community property interest in the corporation’s stock, and each past and present tenant in common, joint tenant, and tenant by the entirety must appear below or be attached to this form. If more space is needed, a continuation sheet reporting the exact information for additional shareholders or a second consent statement must be attached to this form.

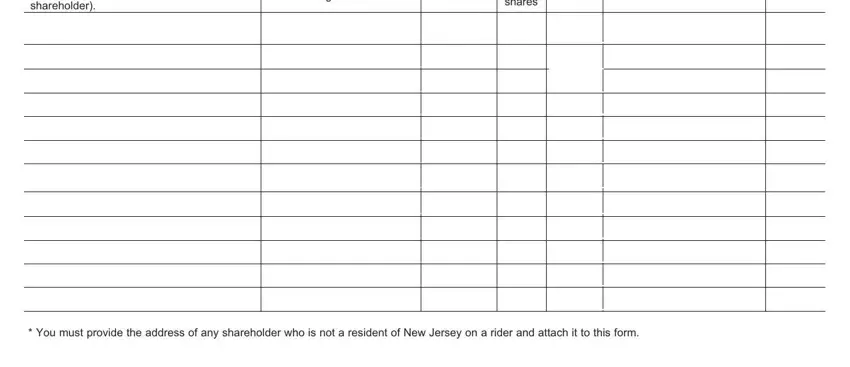

Name of each past and present shareholder, each person having a community property interest in the corporation’s stock, and each tenant in common, joint tenant, and tenant by the entirety, past and present. (A husband and wife (and their estates) are counted as one shareholder).

Signatures must be provided

Stock Owned

|

Number |

Dates |

|

of |

|

acquired |

|

shares |

|

|

|

|

Social Security Number

or

Employer Identification Number

for an estate or qualified trust

*Share- holder’s state of

residency

* You must provide the address of any shareholder who is not a resident of New Jersey on a rider and attach it to this form.

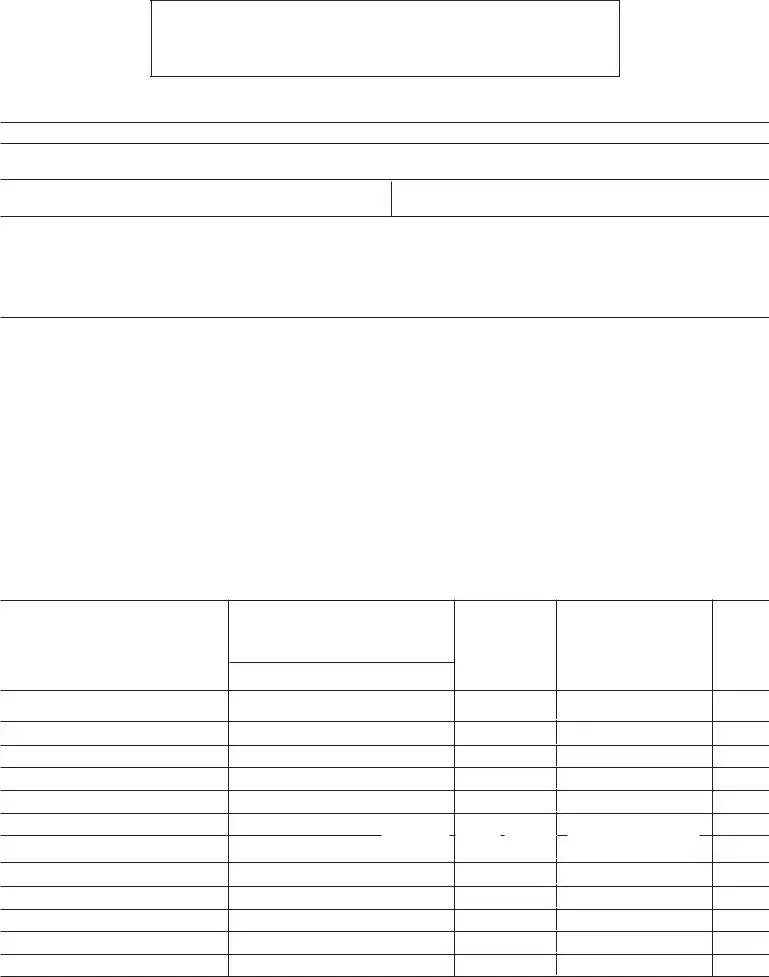

INSTRUCTIONS FOR FORM CBT-2553-R

1.This form is to be used by a currently authorized corporation electing New Jersey S corporation status effective retroactively to a prior return period. Submit a copy of the original CBT-2553 if previously approved. If the taxpayer does not currently have New Jersey S Corporation status, an original CBT-2553 must also be submitted.

2.Part I Name of Corporation: Type or print the name exactly as it appears on form NJ-REG and the CBT-2553.

3.Part I Federal Employer Identification Number (FEIN): As assigned by the Internal Revenue Service.

4.Part II Payment of $100.00 (non refundable) must be included for each and every year or privilege period for which this retroactive request applies.

5.Part III Please read the Corporate Attestation and the cited New Jersey rule.

6.Part III Print the name and title of the current corporate officer signing this document and the CBT-2553. Both documents must be signed by the same corporate officer.

7.Part IV All shareholders including original and subsequent shareholders for the retroactive period in question must sign and consent to New Jersey taxation in Part IV.

8.Mail the completed forms and appropriate payment to: New Jersey Division of Revenue, PO Box 252, Trenton, NJ 08646-0252.

9.After the application is reviewed, the taxpayer will be notified if the retroactive election is granted.

N.J.A.C. 18:7-20.3 Retroactive New Jersey S corporation elections

(a)A taxpayer that is authorized to do business in New Jersey and that is registered with the Division of Taxation and that has filed NJ-CBT-100S tax returns with New Jersey but has failed to file a timely New Jersey S corporation election may file a retroactive election to be recognized as a New Jersey S corporation.

(b)An administrative user fee of $ 100.00 shall be included with a taxpayer's filing of its retroactive New Jersey S corporation election Form CBT-2553-R, for each tax year that will be affected by the late filing.

(c)A retroactive New Jersey S corporation or Qualified Subchapter S Subsidiary election will not be granted if:

1.All appropriate corporation business tax returns have not been timely filed and taxes timely paid as if the New Jersey S corporation election request had been previously approved;

2.A New Jersey S corporation request is not received before an assessment becomes final;

3.The Division has issued a notice denying a previous late filed New Jersey S election request, and the taxpayer has not protested the denial within 90 days; or

4.All shareholders have not filed appropriate tax returns and paid tax in full when due as if the New Jersey S corporation election request had been previously approved, and the taxpayers have not reported the appropriate S corporation income on those returns.