Navigating the complexities of state-required reports can seem daunting for businesses, especially when it comes to understanding specific forms like the NJ 927 W, also known as the Employer's Quarterly Report. This form serves as a critical submission to the State of New Jersey, where businesses are required to disclose comprehensive details regarding gross income tax withholdings, alongside contributions related to unemployment, disability, workforce, and family leave insurance. As demonstrated in the sample form for the first quarter of 2009 under the TEST CASE 04, it meticulously captures period-specific gross income tax (GIT) withholdings across multiple weeks, alongside obligations tied to unemployment insurance (UI), disability insurance (DI), workforce development (WF), and family leave insurance (FLI). Each section of the NJ 927W form is dedicated to ensuring accurate reporting, from the calculation of wages subject to various state insurances to the final reconciliation of payments due against credits received. This structured format not only aids in fostering compliance with state laws but also in upholding a fair and supportive environment for workers in New Jersey. Understanding the components of this form is essential for businesses to meet their reporting responsibilities effectively and maintain compliance with state regulations.

| Question | Answer |

|---|---|

| Form Name | Nj Form 927 W |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | get the nj 927 form, nj927 form pdf, 2015 nj 927, nj 927 online |

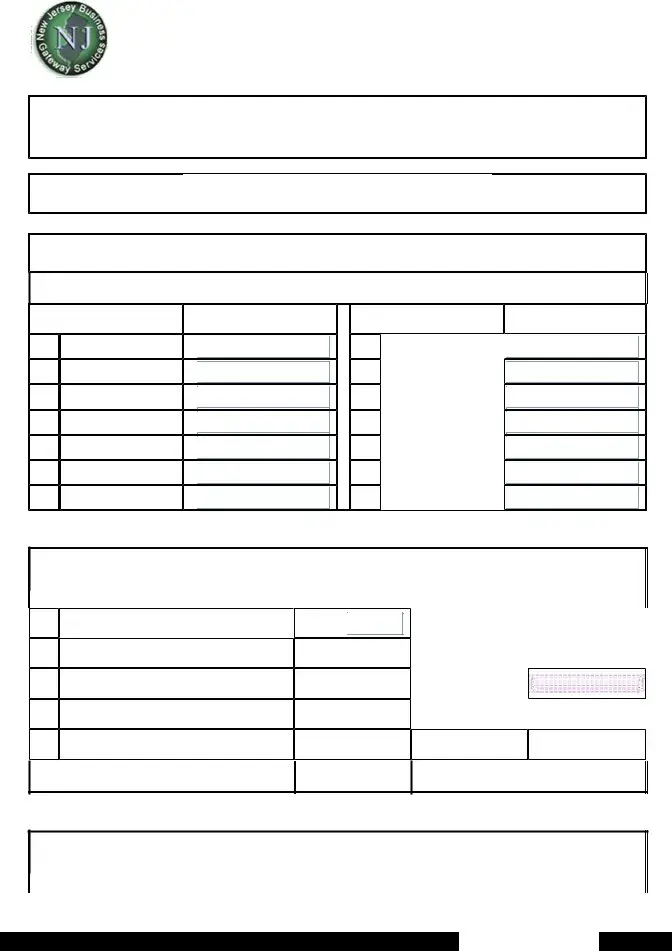

NJ927 - Employer's Quarterly Report |

Page 1 of 3 |

State of New Jersey

NJ927W

Employer's Quarterly Report

FEIN: |

Quarter/Yr: 1/2009 |

||

Business Name: TEST CASE 04 |

|

|

|

|

|

|

|

Quarter Ending Date: 03/31/2009 |

Return Due Date: 04/30/2009 |

||

Date Filed: Not Filed |

|

|

|

GIT Amounts Withheld For Quarter

Enter GIT Amount Withheld Each Period (Press the line description on the left for help)

|

Week/Period |

01 |

|

02 |

|

03 |

|

04 |

|

05 |

06

07

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

Week/Period

08

09

10

11

12

13

14

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

Employer Gross Income Tax (GIT) Withholding

Line (Press the line number for help)

01Wages Subject to Gross Income Tax

02 Total GIT Amount ue This Quarter

03Total GIT Remitted This Quarter Plus Credits (If Applicable)

04GIT Balance ue

05GIT Overpayment Amount

06

GIT Payment Amount

GIT Payment Amount

$0.00

$0.00

|

|

Payments/Credits |

|

$0.00 |

|

Review Details |

|

|

for Quarter |

||

|

|

|

|

|

|

|

$0.00

Overpayment

$0.00N/A

Instructions

$0.00

Unemployment, Disablity, Work Force, and Family Leave

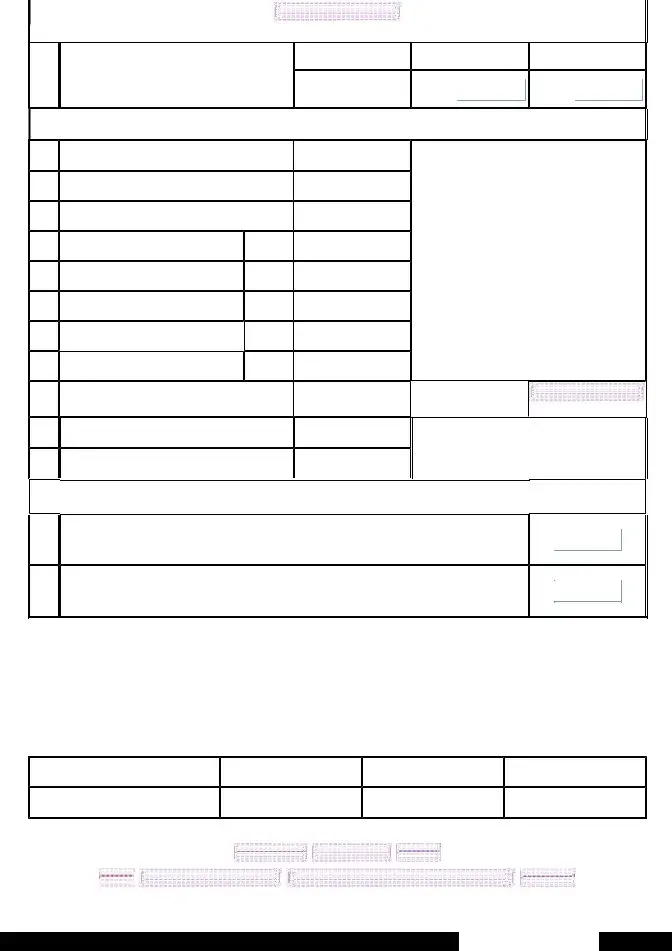

NJ927 - Employer's Quarterly Report |

Page 2 of 3 |

|

|

|

View Rate Detail |

||||

Line (Press the line number for help) |

|

|

|

|

|

|

|

|

The count of all |

Month 1 |

|||||

07 |

covered workers who worked during, or |

|

|

|

|

|

|

|

received pay for the pay period that |

|

0 |

|

|||

|

included the 12th day of each month. |

|

|

||||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

08 |

Total of All Wages Paid Subject to |

|

|

|

|

||

|

|

$0.00 |

|

|

|||

09 |

UI, DI, WF & FLI |

|

|

|

|

|

|

|

|

|

|

|

|

||

Wages in Excess of First $27,700 |

|

|

|

||||

|

|

$0.00 |

|

|

|||

|

|

|

|

|

|

|

|

10 |

Taxable Wages UI & WF |

|

$0.00 |

|

|

||

11 |

Taxable Wages Subject to DI |

P |

$0.00 |

|

|

||

12 |

Taxable Wages Subject to FLI |

P |

$0.00 |

|

|

||

13 |

Total UI & WF Contributions |

0.032250 |

$0.00 |

|

|

||

14 |

Total DI Contributions |

0.000000 |

$0.00 |

|

|

||

15 |

Total FLI Contributions |

0.000000 |

$0.00 |

|

|

||

16 |

Payments Received for this Quarter |

$100.00 |

|

|

|||

17 |

Balance Due - UI, WF, DI & FLI |

|

$0.00 |

|

|||

18 |

Payment Amount - UI, WF, DI & FLI |

$0.00 |

|

||||

Month 2

0

Payments/Credits

for Quarter

Month 3

0

Review Details

Private Plan

The count of all

19Plan" for TDI who worked during or received pay for the pay period that included the 12th day of each month.

The count of all

20Plan" for FLI who worked during or received pay for the pay period that included the 12th day of each month.

0

0

|

Summary Balance Due and Payment Information |

|

||

|

|

|

|

Grand Total |

|

|

|

|

Gross Income Tax and |

|

Gross Income Tax |

UI, WF, DI & FLI |

UI, WF, DI, & FLI |

|

|

Balance ue |

$0.00 |

$0.00 |

$0.00 |

The Amount You Indicate to Pay |

$0.00 |

$0.00 |

$0.00 |

|

|

|

|||

|

|

|

|

|

|

Calculate |

Next Page |

Reset |

|

Help |

Email the Division |

Return To Processing Center |

Logout |

|

NJ927 - Employer's Quarterly Report |

Page 3 of 3 |