We found the finest computer programmers to implement the PDF editor. The application will help you complete the form nj reg c l form simply and won't take too much of your energy. This simple guide will assist you to learn how to start.

Step 1: Choose the button "Get Form Here" on this site and press it.

Step 2: Now, you can change the form nj reg c l. Our multifunctional toolbar lets you add, get rid of, modify, highlight, and also perform similar commands to the content and areas inside the document.

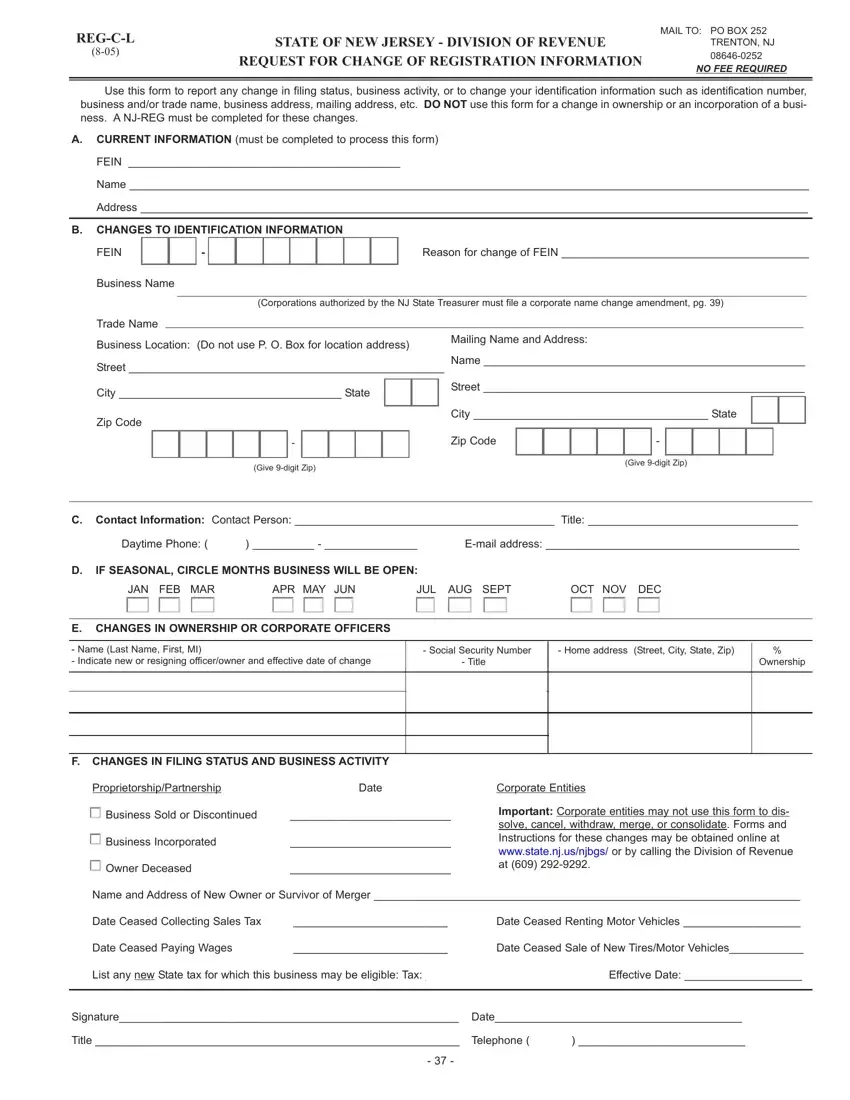

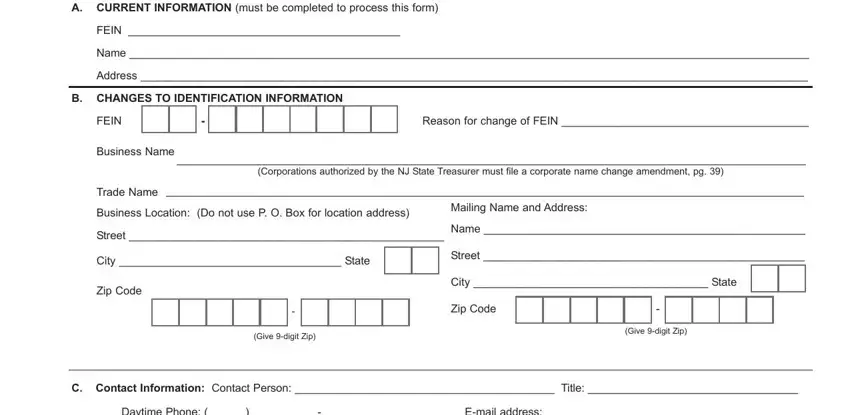

The next sections are in the PDF file you will be filling in.

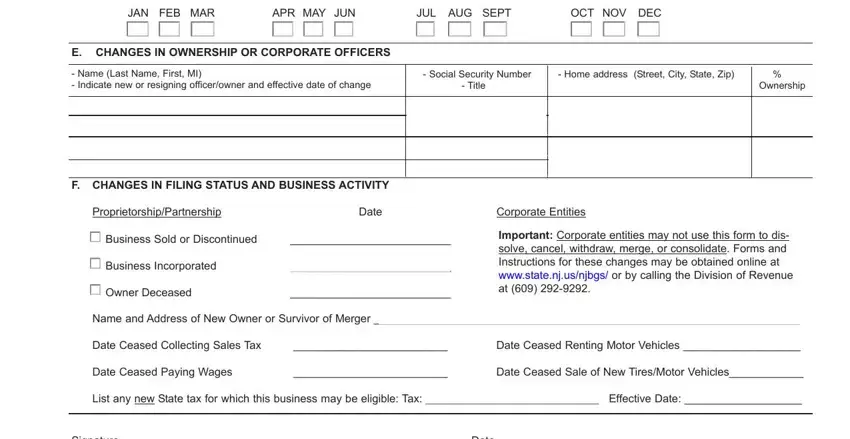

The application will need you to complete the IF SEASONAL CIRCLE MONTHS BUSINESS, JAN FEB MAR, APR MAY JUN, JUL AUG SEPT, OCT NOV DEC, E CHANGES IN OWNERSHIP OR, Name Last Name First MI Indicate, Social Security Number Home, Title, Ownership, F CHANGES IN FILING STATUS AND, ProprietorshipPartnership, Date, Corporate Entities, and cid Business Sold or Discontinued field.

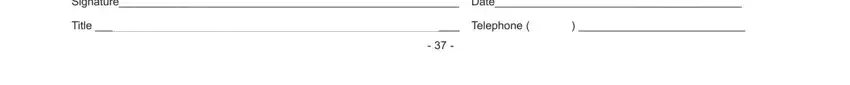

Within the segment discussing Signature Date, and Title Telephone, one should put down some vital data.

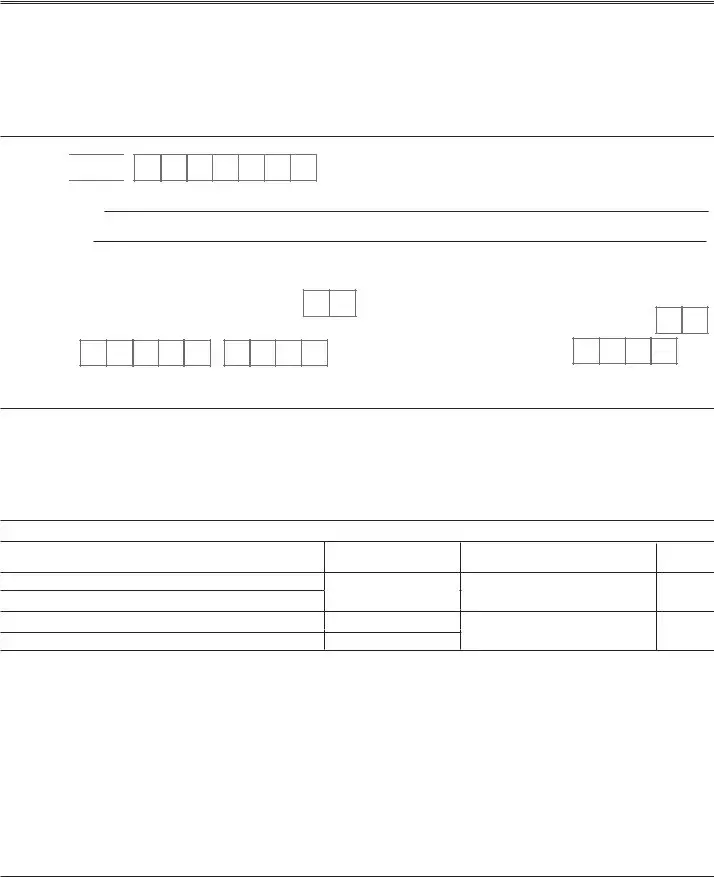

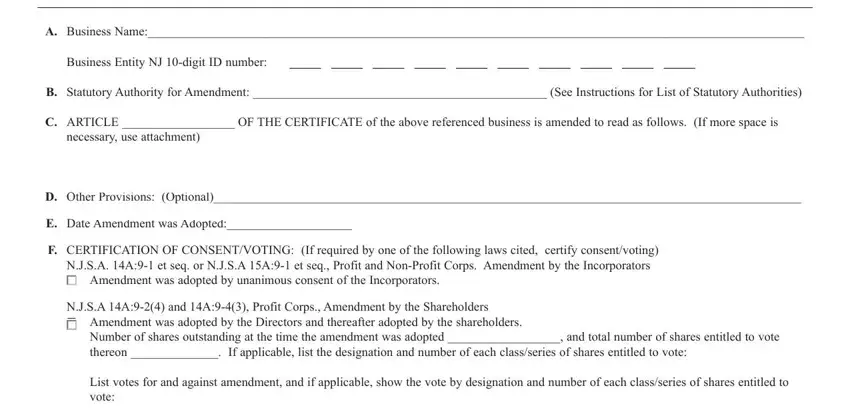

The Complete the following information, A Business Name, Business Entity NJ digit ID number, B Statutory Authority for, C ARTICLE OF THE CERTIFICATE of, necessary use attachment, D Other Provisions Optional, E Date Amendment was Adopted, F CERTIFICATION OF CONSENTVOTING, NJSA A and A Profit Corps, Number of shares outstanding at, and List votes for and against field is where both sides can put their rights and obligations.

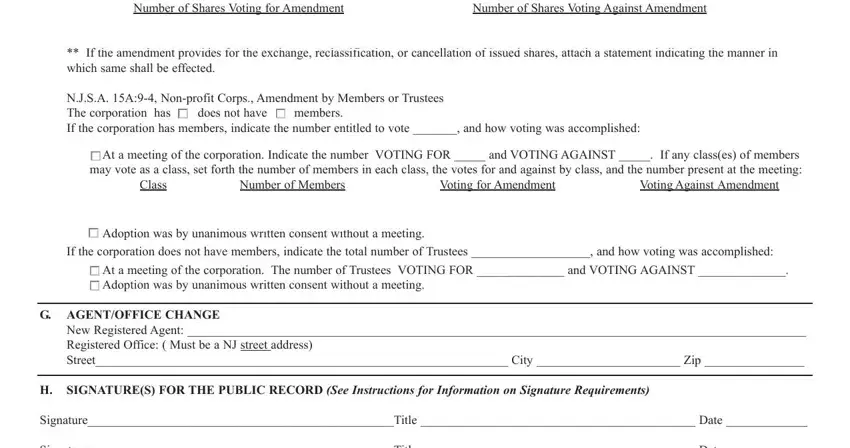

Finalize by analyzing the following sections and filling them out as needed: Number of Shares Voting for, Number of Shares Voting Against, If the amendment provides for the, NJSA A Nonprofit Corps Amendment, cid At a meeting of the, Class, Number of Members, Voting for Amendment, Voting Against Amendment, cid Adoption was by unanimous, If the corporation does not have, cid At a meeting of the, G AGENTOFFICE CHANGE, New Registered Agent Registered, and SIGNATURES FOR THE PUBLIC RECORD.

Step 3: As soon as you are done, press the "Done" button to transfer your PDF document.

Step 4: You should make as many duplicates of your document as possible to prevent future problems.