nj w3 online filing can be filled in easily. Simply try FormsPal PDF editor to perform the job without delay. We at FormsPal are dedicated to making sure you have the perfect experience with our editor by consistently adding new capabilities and improvements. With these improvements, using our tool becomes easier than ever before! Getting underway is effortless! What you need to do is adhere to the following simple steps directly below:

Step 1: Click the "Get Form" button above on this webpage to open our PDF tool.

Step 2: With the help of this online PDF file editor, it's possible to do more than simply fill in blank form fields. Edit away and make your forms seem professional with customized text incorporated, or fine-tune the file's original input to excellence - all backed up by the capability to add stunning pictures and sign the file off.

It's an easy task to finish the pdf following our helpful guide! Here is what you should do:

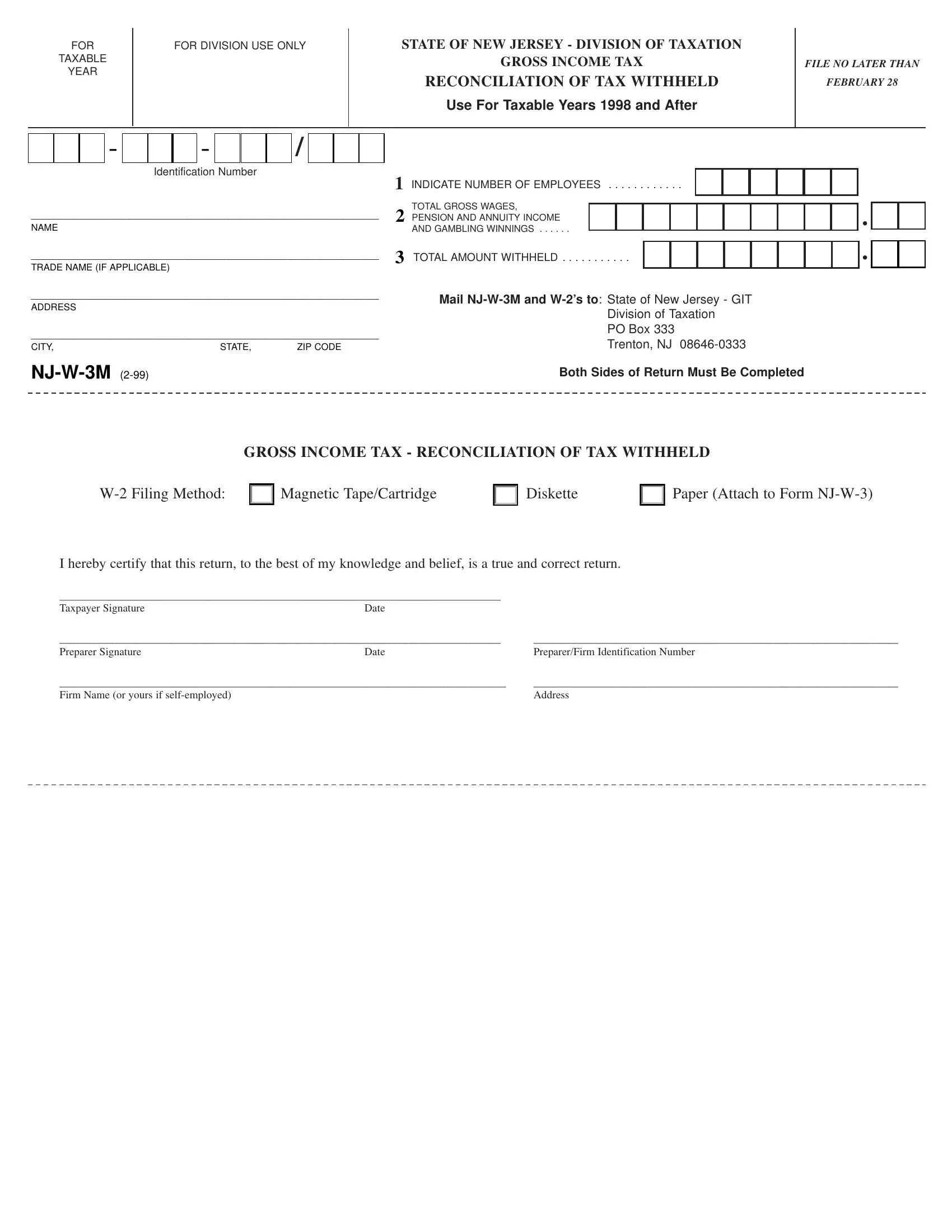

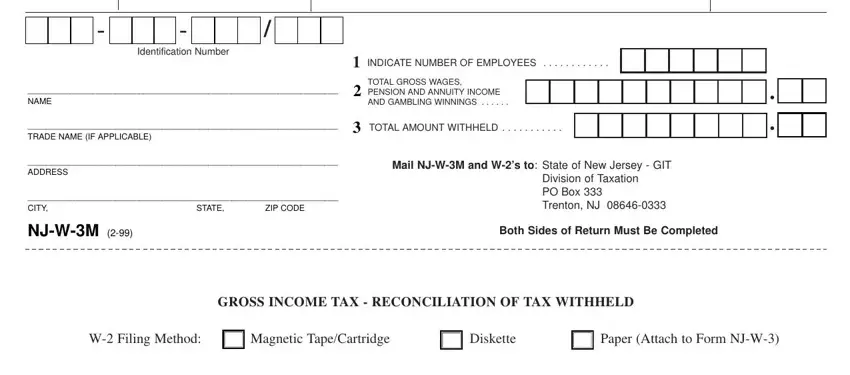

1. You have to fill out the nj w3 online filing properly, thus pay close attention while filling in the parts that contain all of these blank fields:

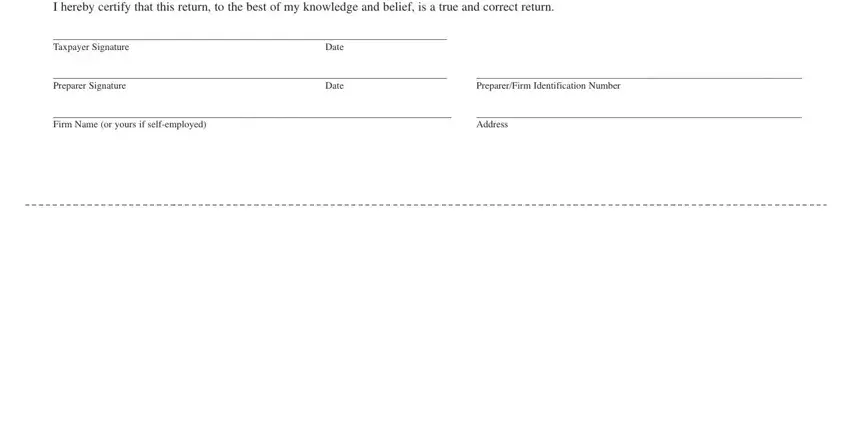

2. Once the last part is complete, you're ready to include the needed specifics in I hereby certify that this return, Taxpayer Signature, Date, Preparer Signature, Date, PreparerFirm Identification Number, Firm Name or yours if selfemployed, and Address in order to move forward further.

It's easy to make a mistake while completing your Address, for that reason be sure you take a second look prior to when you submit it.

Step 3: When you've looked again at the information entered, click on "Done" to finalize your document creation. Download the nj w3 online filing the instant you join for a free trial. Conveniently get access to the document inside your personal cabinet, together with any modifications and changes automatically saved! When using FormsPal, it is simple to complete documents without the need to be concerned about personal data leaks or records getting shared. Our secure platform ensures that your private details are maintained safely.