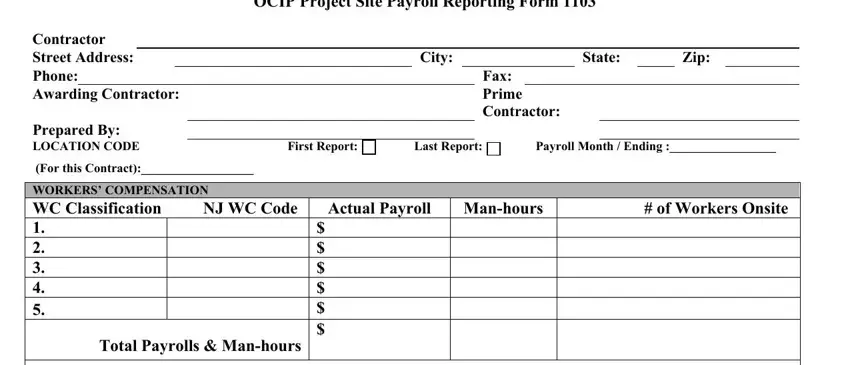

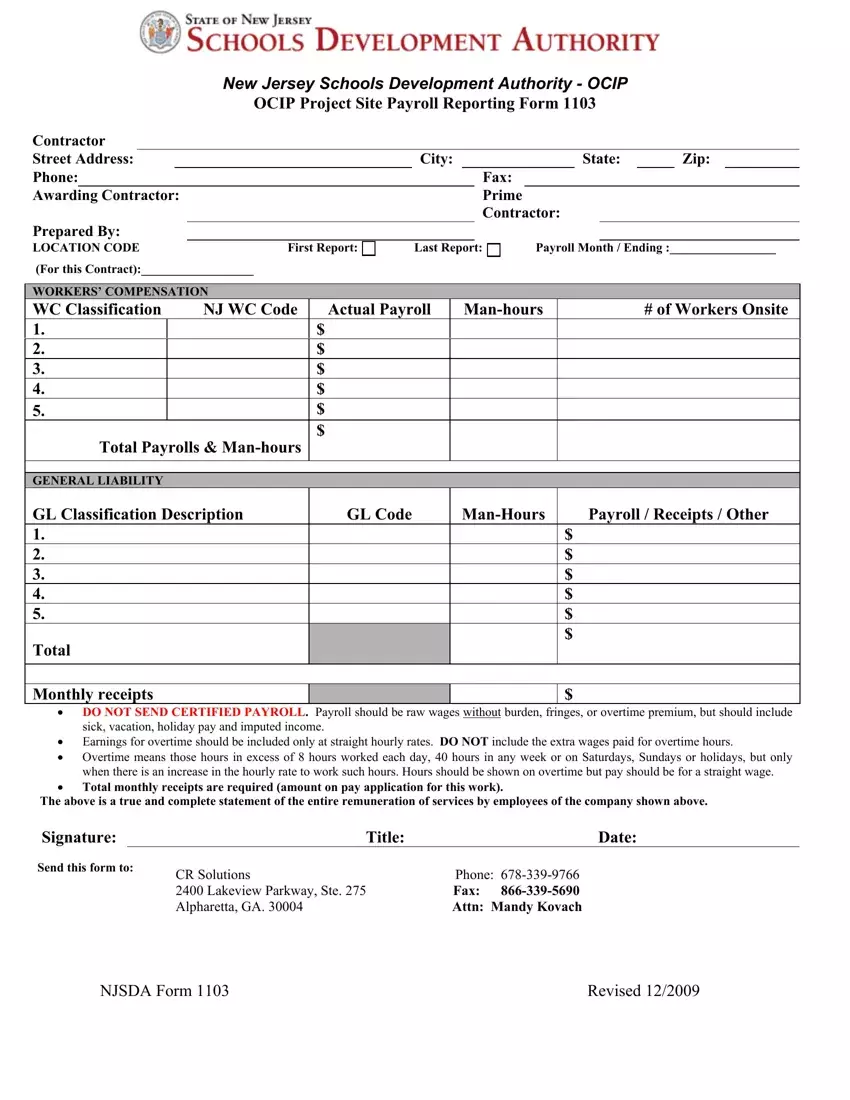

New Jersey Schools Development Authority - OCIP

OCIP Project Site Payroll Reporting Form 1103

Contractor

|

Street Address: |

|

|

|

|

City: |

|

|

|

|

|

State: |

|

Zip: |

|

|

Phone: |

|

|

|

|

|

|

|

Fax: |

|

|

|

|

|

|

|

|

|

Awarding Contractor: |

|

|

|

|

|

|

Prime |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contractor: |

|

|

|

|

|

|

|

Prepared By: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOCATION CODE |

First Report: |

Last Report: |

Payroll Month / Ending :_________________ |

|

(For this Contract):__________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WORKERS’ COMPENSATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WC Classification |

NJ WC Code |

Actual Payroll |

|

Man-hours |

|

|

|

|

# of Workers Onsite |

1. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Payrolls & Man-hours |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

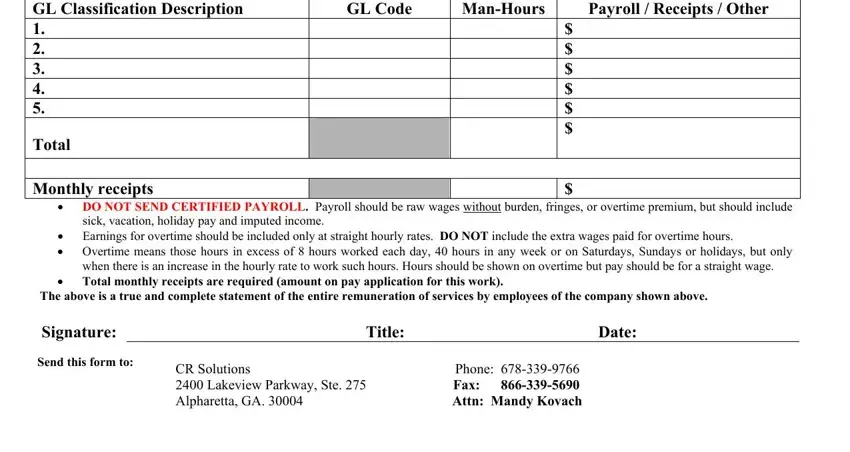

GENERAL LIABILITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GL Classification Description |

GL Code |

|

|

Man-Hours |

|

|

Payroll / Receipts / Other |

1. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly receipts |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

•DO NOT SEND CERTIFIED PAYROLL. Payroll should be raw wages without burden, fringes, or overtime premium, but should include sick, vacation, holiday pay and imputed income.

•Earnings for overtime should be included only at straight hourly rates. DO NOT include the extra wages paid for overtime hours.

•Overtime means those hours in excess of 8 hours worked each day, 40 hours in any week or on Saturdays, Sundays or holidays, but only when there is an increase in the hourly rate to work such hours. Hours should be shown on overtime but pay should be for a straight wage.

•Total monthly receipts are required (amount on pay application for this work).

The above is a true and complete statement of the entire remuneration of services by employees of the company shown above.

Signature: |

|

Title: |

Date: |

Send this form to: |

CR Solutions |

Phone: 678-339-9766 |

|

|

|

|

2400 Lakeview Parkway, Ste. 275 |

Fax: 866-339-5690 |

|

|

Alpharetta, GA. 30004 |

Attn: Mandy Kovach |

NJSDA Form 1103 |

Revised 12/2009 |

OCIP Monthly Payroll Reporting Form (1103)

Instructions

-To be completed monthly for all work on a project site.

-A pre-filled form is mailed to each contractor and subcontractor with the enrollment packet (Certificate of Insurance and SDA OCIP Manual). Only the pre-filled form will be accepted. This is a site-specific form for each contractor with the location code and information that was provided on the enrollment form (WC/GL Classifications and codes).

-Payroll and hours should be totally unburdened and represent raw wages only

-Do not include overtime, fringes or other burdens

-Overtime means those hours in excess of 8 hours worked each day, 40 hours in any week or on Saturdays, Sundays or holidays, but only when there is an increase in the hourly rate

-Earnings for overtime should be included only as straight hourly rates. DO NOT include the extra wages paid for overtime hours.

-Total Monthly Receipts amounts are required – this is the amount on your pay applications for the time period worked

-By contract, it is the responsibility of the General Contractor to ensure that these payroll forms

are submitted each month. The GC shall collect the form from all their subcontractors and forward it to the OCIP Administration NO LATER than the tenth (10th) business day of the following month.

-DO NOT add WC or GL classifications that you are not enrolled for. If you need to add one, you must notify the OCIP Administrator separately and a revised payroll form will be sent to you.

-You MUST include the following:

-Month and year for the report

-Hours worked for each WC and GL class code, even if it is zero

-Payroll for each class code, even if it is zero

-Monthly receipts amount

-Signature and date by an authorized member of your company

-A copy should be kept in your records so your work on this project can be excluded from your own insurance carrier’s audit.

-Payroll reports are forwarded to the New Jersey Compensation Rating & Inspection Bureau and have a direct impact on your experience modifier.