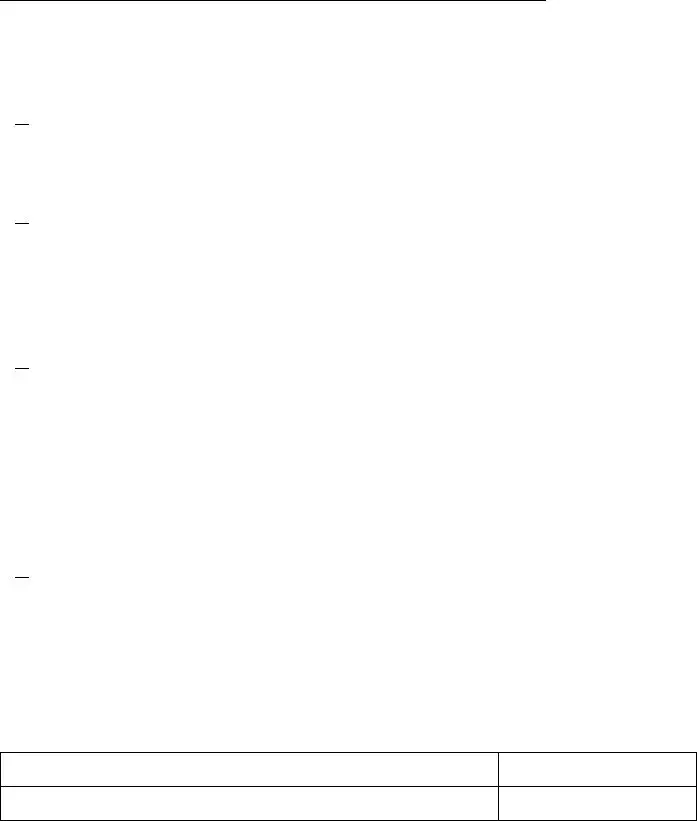

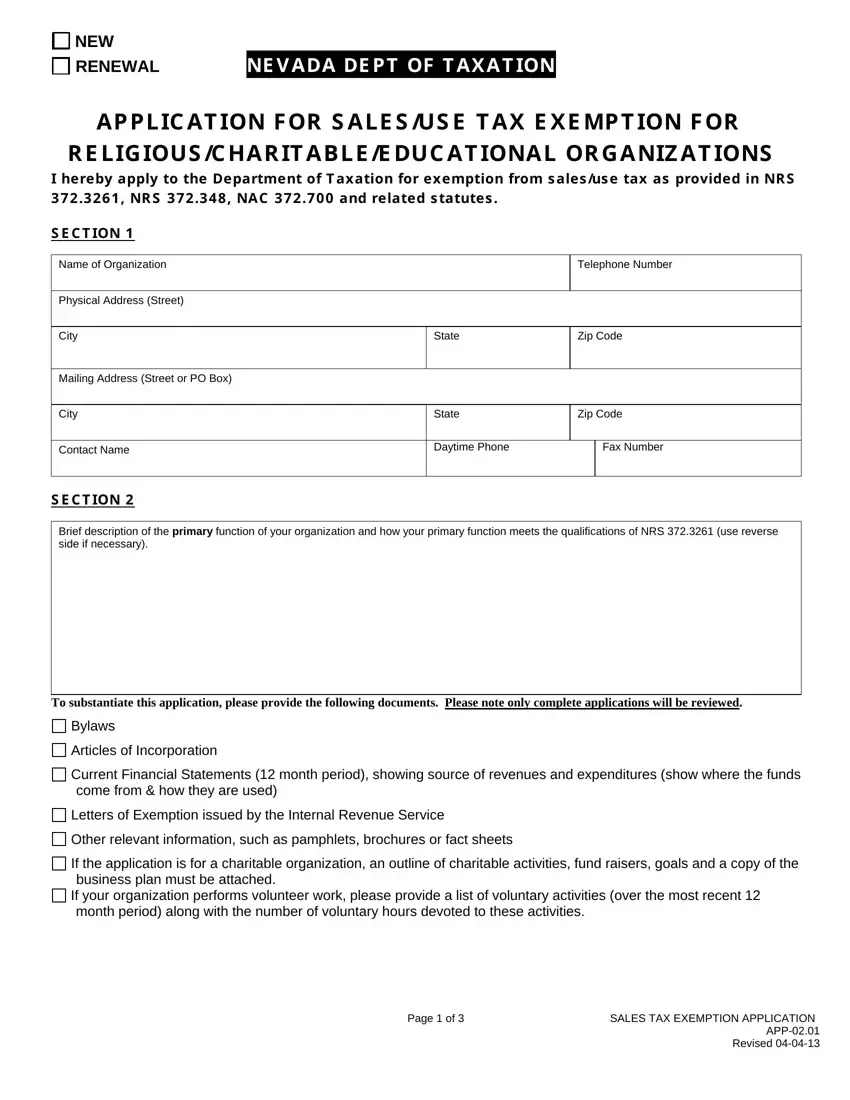

NEW

NEW

RENEWAL NEVADA DEPT OF TAXATION

RENEWAL NEVADA DEPT OF TAXATION

APPLICATION FOR SALES/USE TAX EXEMPTION FOR RELIGIOUS/CHARITABLE/EDUCATIONAL ORGANIZATIONS

I hereby apply to the Department of Taxation for exemption from sales/use tax as provided in NRS 372.3261, NRS 372.348, NAC 372.700 and related statutes.

SECTION 1

Name of Organization |

|

Telephone Number |

|

|

|

|

Physical Address (Street) |

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

Mailing Address (Street or PO Box) |

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

Contact Name |

Daytime Phone |

|

Fax Number |

|

|

|

|

SECTION 2

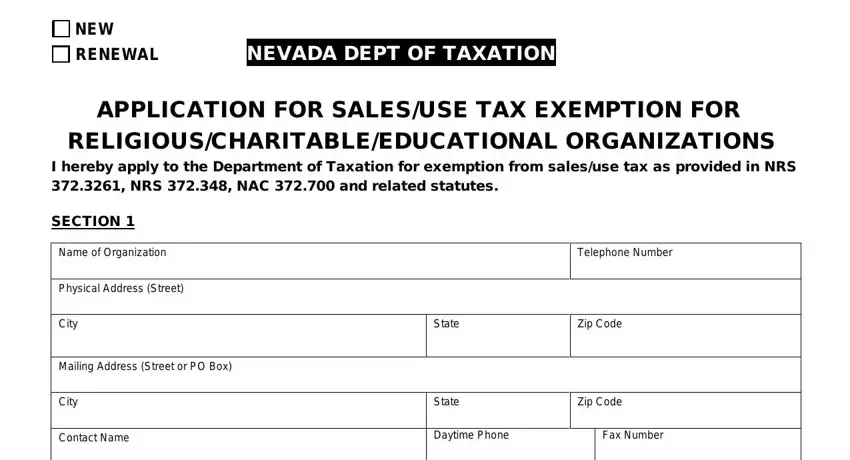

Brief description of the primary function of your organization and how your primary function meets the qualifications of NRS 372.3261 (use reverse side if necessary).

To substantiate this application, please provide the following documents. Please note only complete applications will be reviewed.

Bylaws

Bylaws

Articles of Incorporation

Articles of Incorporation

Current Financial Statements (12 month period), showing source of revenues and expenditures (show where the funds come from & how they are used)

Current Financial Statements (12 month period), showing source of revenues and expenditures (show where the funds come from & how they are used)

Letters of Exemption issued by the Internal Revenue Service

Letters of Exemption issued by the Internal Revenue Service

Other relevant information, such as pamphlets, brochures or fact sheets

Other relevant information, such as pamphlets, brochures or fact sheets

If the application is for a charitable organization, an outline of charitable activities, fund raisers, goals and a copy of the business plan must be attached.

If the application is for a charitable organization, an outline of charitable activities, fund raisers, goals and a copy of the business plan must be attached.

If your organization performs volunteer work, please provide a list of voluntary activities (over the most recent 12 month period) along with the number of voluntary hours devoted to these activities.

If your organization performs volunteer work, please provide a list of voluntary activities (over the most recent 12 month period) along with the number of voluntary hours devoted to these activities.

Page 1 of 3 |

SALES TAX EXEMPTION APPLICATION |

|

APP-02.01 |

|

Revised 04-04-13 |

SECTION 3 I have read NRS 372.3261 and deem my organization to be: (check appropriate box)

Note: The statutory requirements for a Nevada sales/use tax exemption are different than those of a Federal tax exemption (501 C).

NRS 372.3261 Requirements for organization created for religious, charitable or educational purposes.

1.For the purposes of NRS 372.326, an organization is created for religious, charitable or educational purposes if it complies with the provisions of this section.

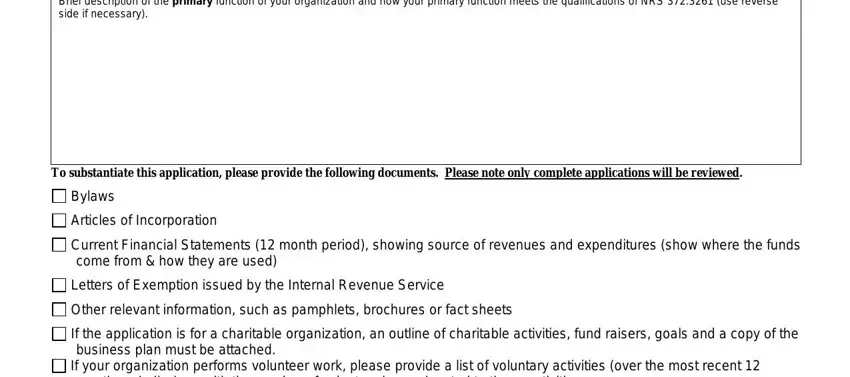

2. Religious. An organization is created for religious purposes if:

Religious. An organization is created for religious purposes if:

(a)It complies with the requirements set forth in subsection 5; and

(b)The sole or primary purpose of the organization is the operation of a church, synagogue or other place of religious worship at which nonprofit religious services and activities are regularly conducted. Such an organization includes, without limitation, an integrated auxiliary or affiliate of the organization, men’s, women’s or youth groups established by the organization, a school or mission society operated by the organization, an organization of local units of a church and a convention or association of churches.

3. Charitable. An organization is created for charitable purposes if:

Charitable. An organization is created for charitable purposes if:

(a)It complies with the requirements set forth in subsection 5;

(b)The sole or primary purpose of the organization is to:

(1)Advance a public purpose, donate or render gratuitously or at a reduced rate a substantial portion of its services to the persons who are the subjects of its charitable services, and benefit a substantial and indefinite class of persons who are the legitimate subjects of charity;

(2)Provide services that are otherwise required to be provided by a local government, this state or the Federal Government; or

(3)Operate a hospital or medical facility licensed pursuant to chapter 449 or 450 of NRS; and

(c)The organization is operating in this state.

4. Educational. An organization is created for educational purposes if:

Educational. An organization is created for educational purposes if:

(a)It complies with the requirements set forth in subsection 5; and

(b)The sole or primary purpose of the organization is to:

(1)Provide athletic, cultural or social activities for children;

(2)Provide displays or performances of the visual or performing arts to members of the general public;

(3)Provide instruction and disseminate information on subjects beneficial to the community;

(4)Operate a school, college or university located in this state that conducts regular classes and provides courses of study required for accreditation or licensing by the State Board of Education or the Commission on Postsecondary Education, or for membership in the Northwest Association of Schools and of Colleges and Universities;

(5)Serve as a local or state apprenticeship committee to advance programs of apprenticeship in this state; or

(6)Sponsor programs of apprenticeship in this state through a trust created pursuant to 29 U.S.C. § 186.

SECTION 3A

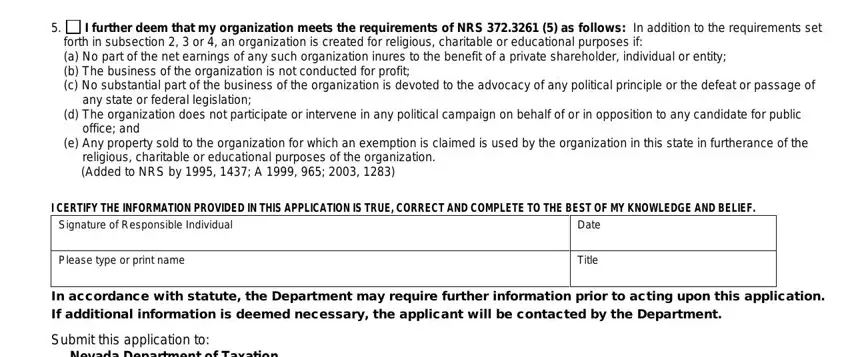

5. I further deem that my organization meets the requirements of NRS 372.3261 (5) as follows: In addition to the requirements set forth in subsection 2, 3 or 4, an organization is created for religious, charitable or educational purposes if:

I further deem that my organization meets the requirements of NRS 372.3261 (5) as follows: In addition to the requirements set forth in subsection 2, 3 or 4, an organization is created for religious, charitable or educational purposes if:

(a)No part of the net earnings of any such organization inures to the benefit of a private shareholder, individual or entity;

(b)The business of the organization is not conducted for profit;

(c)No substantial part of the business of the organization is devoted to the advocacy of any political principle or the defeat or passage of any state or federal legislation;

(d)The organization does not participate or intervene in any political campaign on behalf of or in opposition to any candidate for public office; and

(e)Any property sold to the organization for which an exemption is claimed is used by the organization in this state in furtherance of the religious, charitable or educational purposes of the organization.

(Added to NRS by 1995, 1437; A 1999, 965; 2003, 1283)

I CERTIFY THE INFORMATION PROVIDED IN THIS APPLICATION IS TRUE, CORRECT AND COMPLETE TO THE BEST OF MY KNOWLEDGE AND BELIEF.

Signature of Responsible Individual

Please type or print name

In accordance with statute, the Department may require further information prior to acting upon this application. If additional information is deemed necessary, the applicant will be contacted by the Department.

Submit this application to:

Nevada Department of Taxation

1550 College Parkway # 115

Carson City NV 89706-7921

Telephone (775) 684-2000

2 of 3

NEVADA DEPARTMENT OF TAXATION |

|

|

NRS 372.348 & NAC 372.700 |

|

n |

REQUIREMENTS FOR ORGANIZATION CREATED FOR |

|

|

RELIGIOUS, CHARITABLE OR EDUCATIONAL PURPOSES. |

|

|

NRS 372.348 Claim of exemption: Nonprofit organization created for religious, charitable or educational purposes.

1.Any nonprofit organization created for religious, charitable or educational purposes that wishes to claim an exemption pursuant to NRS 372.326, must file an application with the Department to obtain a letter of exemption. The application must be on a form and contain such information as is required by the Department.

2.If the Department determines that the organization is created for religious, charitable or educational purposes, it shall issue a letter of exemption to the organization. The letter of exemption expires 5 years after the date on which it is issued by the Department. At least 90 days before the expiration of the letter of exemption, the Department shall notify the organization to whom the letter was issued of the date on which the letter will expire. The organization may renew its letter of exemption for an additional 5 years by filing an application for renewal with the Department. The application for renewal must be on a form and contain such information as is required by the Department.

3.To claim an exemption pursuant to NRS 372.326 for the sale of tangible personal property to such an organization:

(a)The organization must give a copy of its letter of exemption to the retailer from whom the organization purchases the property; and

(b)The retailer must retain and present upon request a copy of the letter of exemption.

4.The Department shall adopt such regulations as are necessary to carry out the provisions of this section.

(Added to NRS by 1995, 1438)—(Substituted in revision for NRS 372.343) See also NRS 372.326

NAC 372.700 Charitable, Religious or Educational Organizations: Letters of Exemption

1.An organization requesting exempt status must submit to the department an application on a form prescribed by the department and copies of:

(a)Its bylaws;

(b)Its articles of incorporation;

(c)Financial information which provides verifiable sources of income and expenditures, which may include, without limitation, financial statements and independent audit reports;

(d)Letters of exemption issued to it by any governmental agency;

(e)If the application is for a charitable organization, an outline of its charitable activities, fund raisers and goals, and a copy of its business or strategic plan must be attached; and

(f)Any other information which the department deems relevant.

2.Upon approval of an application, the department will issue a letter of exemption. The letter is not transferable. The organization must notify the department of changes to the name, address, telephone number or responsible person of the organization. Each organization must apply for the renewal of its letter of exemption every 5 years. The department will mail a renewal application to the last known address of the organization at least 90 days before the expiration of the letter of exemption. Failure to receive a renewal application does not extend the validity of the exemption beyond the 5 years.

3.The department may deny an application for exemption if it finds that:

(a)The organization has failed to submit sufficient information on which to grant an exemption; or

(b)The organization does not meet the standards for exemption.

4.The department may withdraw the letter of exemption issued to any organization if the department finds that:

(a)The organization is no longer engaged in charitable, religious or educational pursuits;

(b)The organization has ceased to comply with the standards for exemption; or

(c)The application contained false or misleading information.

5.A charitable, religious or educational organization may petition the commission for reconsideration of any action by the department denying or withdrawing a letter of exemption. Upon reconsideration, the commission may grant or reissue the letter of exemption if the organization has presented satisfactory evidence that it complies with the standards for exemption.

6.As used in this section, "standards for exemption" means the criteria set out in this section and NRS 372.326 and 372.3261.

[Tax Comm'n, Combined Sales and Use Tax Ruling part No. 78, eff. 9-17-80]-(NAC A by 8084-97, 11-26-97; 8181-99, 5-16-2000)

Underlining/bolding has been added for emphasis.

3 of 3

NEW

NEW

Bylaws

Bylaws

Articles of Incorporation

Articles of Incorporation

Current Financial Statements (12 month period), showing source of revenues and expenditures (show where the funds come from & how they are used)

Current Financial Statements (12 month period), showing source of revenues and expenditures (show where the funds come from & how they are used)

Letters of Exemption issued by the Internal Revenue Service

Letters of Exemption issued by the Internal Revenue Service

Other relevant information, such as pamphlets, brochures or fact sheets

Other relevant information, such as pamphlets, brochures or fact sheets

If the application is for a charitable organization, an outline of charitable activities, fund raisers, goals and a copy of the business plan must be attached.

If the application is for a charitable organization, an outline of charitable activities, fund raisers, goals and a copy of the business plan must be attached.

If your organization performs volunteer work, please provide a list of voluntary activities (over the most recent 12 month period) along with the number of voluntary hours devoted to these activities.

If your organization performs volunteer work, please provide a list of voluntary activities (over the most recent 12 month period) along with the number of voluntary hours devoted to these activities.

I further deem that my organization meets the requirements of NRS 372.3261 (5) as follows:

I further deem that my organization meets the requirements of NRS 372.3261 (5) as follows: