This PDF editor was built to be as clear as it can be. As you follow the next actions, the process of managing the nyc 1127 instructions document will be hassle-free.

Step 1: To begin the process, press the orange button "Get Form Now".

Step 2: After you have entered the nyc 1127 instructions editing page you can discover all the options you'll be able to conduct regarding your document in the upper menu.

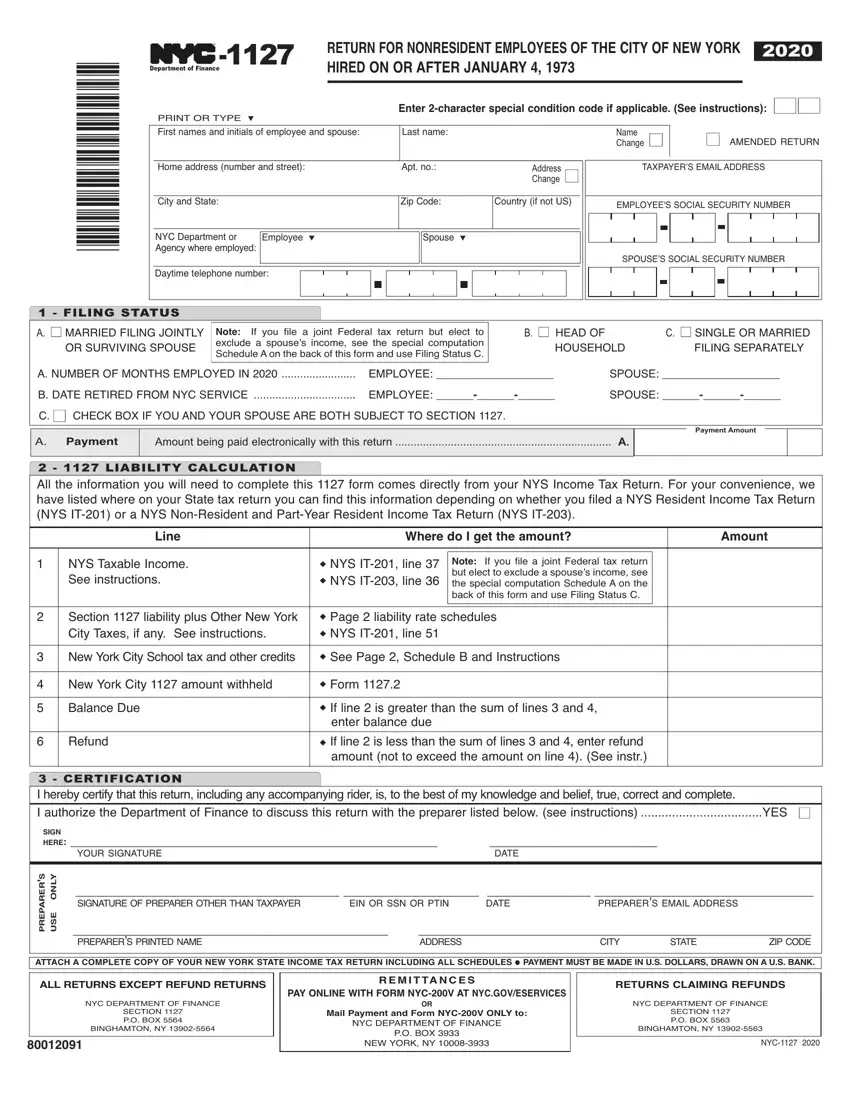

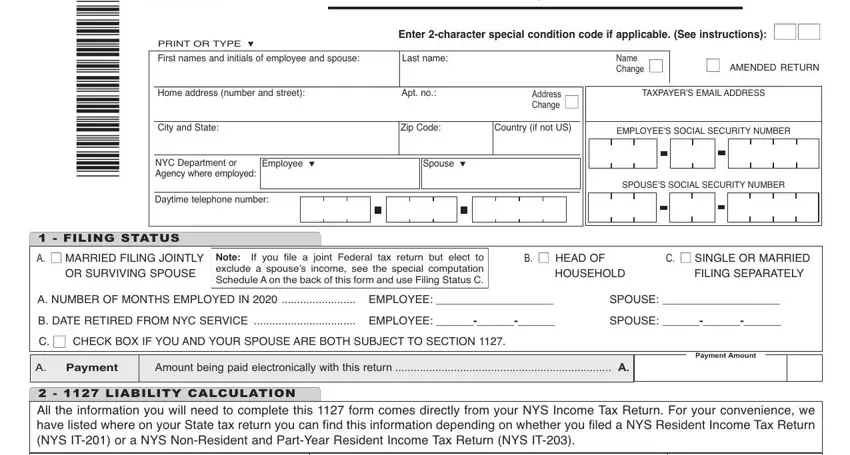

The next segments are what you are going to complete to have the prepared PDF file.

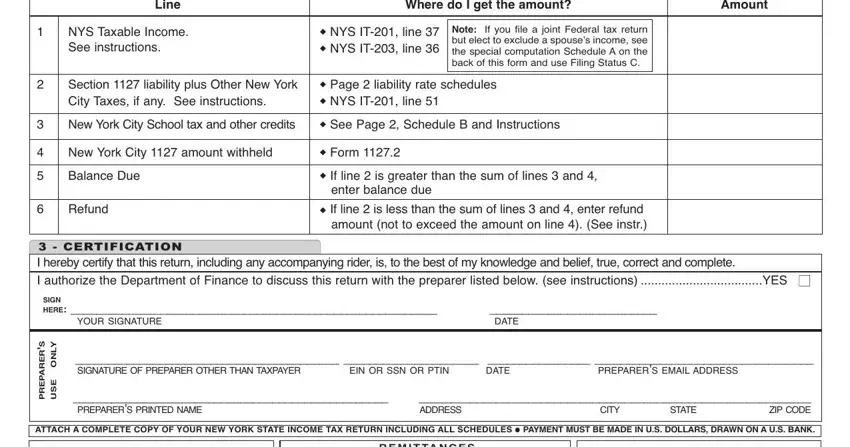

The program will require you to complete the Line, Where, doI, get, the, amount Amount, NYS, Taxable, Income, See, instructions NYS, IT, line, NYS, IT, line Page, liability, rate, schedules, NYS, IT, line New, York, City, School, tax, and, other, credits SeePage, Schedule, Band, Instructions New, York, City, amount, withheld Form, Balance, Due Refund, SIGN, HERE S, RE, RAPE, RP and YL, NO part.

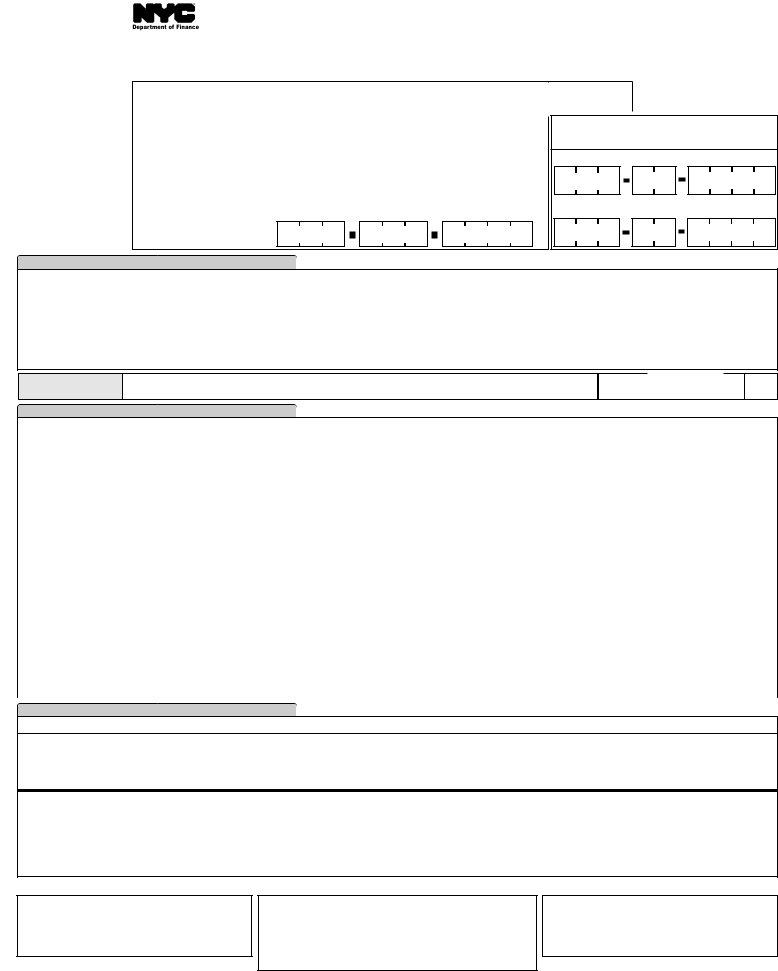

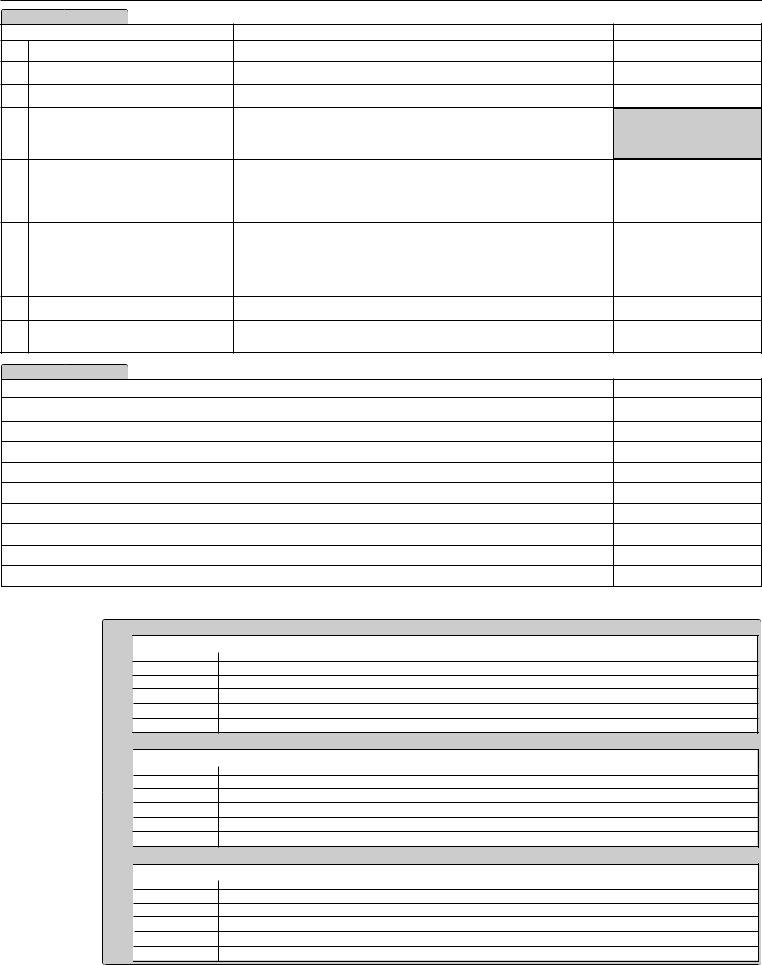

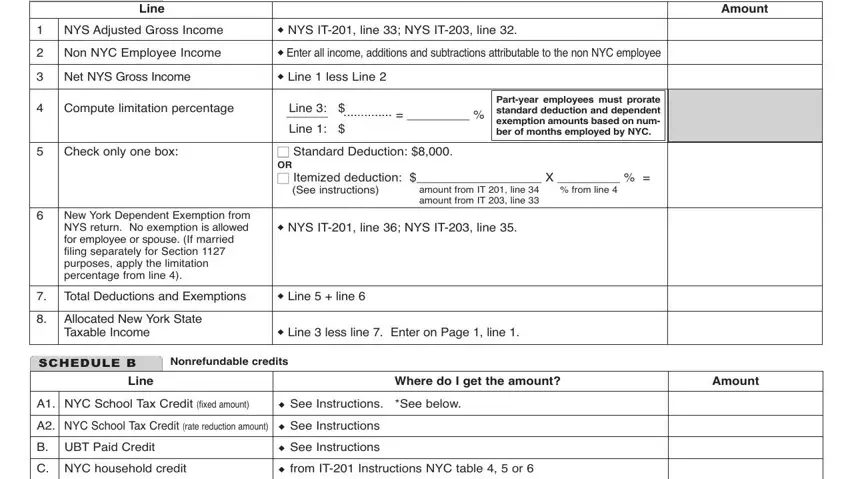

Write the vital data as you are within the Line, Amount, NYS, Adjusted, Gross, Income NYS, IT, line, NYS, IT, line Non, NYC, Employee, Income Net, NYS, Gross, Income Line, less, Line Compute, limitation, percentage Line, Line, Check, only, one, box NYS, IT, line, NYS, IT, line Total, Deductions, and, Exemptions Line, line and Allocated, New, York, State, Taxable, Income box.

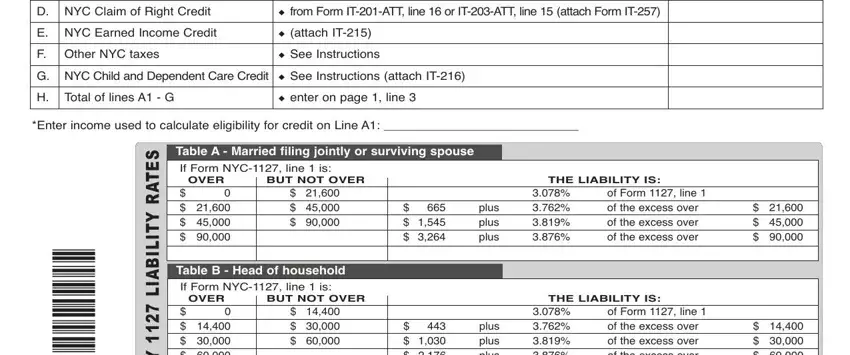

You should describe the rights and obligations of both sides in space D, NYC, Claim, of, Right, Credit E, NYC, Earned, Income, Credit attach, IT F, Other, NYC, taxes See, Instructions H, Total, of, line, sAG enter, on, page, line SETAR, Y, TIL, I, BAIL Y, TI BUT, NOT, OVER If, Form, NYC, line, is, OVER Table, B, Head, of, household BUT, NOT, OVER and If, Form, NYC, line, is, OVER

Step 3: Choose the Done button to confirm that your completed form is available to be exported to every electronic device you select or sent to an email you indicate.

Step 4: In order to avoid potential future complications, it's recommended to hold no less than a few copies of any file.