Facing the complexity of tax obligations, the NYC-5UBTI form stands out as a crucial document for individuals, estates, and trusts engaged in unincorporated businesses in New York City. This form serves as a declaration of estimated unincorporated business tax (UBT) for a given year, allowing taxpayers to comply with local tax laws by calculating and submitting their anticipated tax dues. The NYC-5UBTI form captures essential information, including taxpayer identification, business details, and the computation of estimated tax payable in installments throughout the fiscal year. Not only does this process ensure that taxpayers meet their legal obligations, but it also facilitates the smooth operation of the Department of Finance by providing a reliable estimate of tax revenue. The form highlights critical deadlines for payment installments and offers guidance on calculating net business income and applicable tax credits, underscoring the city's effort to streamline tax administration for unincorporated entities. Furthermore, it addresses potential adjustments through amended declarations and outlines penalties for underpayment, underscoring the importance of accurate and timely filings. As a key component of New York City’s tax landscape, the NYC-5UBTI form embodies the intersection of legal compliance and fiscal responsibility for the city's unincorporated business community.

| Question | Answer |

|---|---|

| Form Name | NYC 5UBTI Form |

| Form Length | 2 pages |

| Fillable? | Yes |

| Fillable fields | 52 |

| Avg. time to fill out | 10 min 58 sec |

| Other names | nyc 5ubti_2012 nyc 5ubti 2015 form |

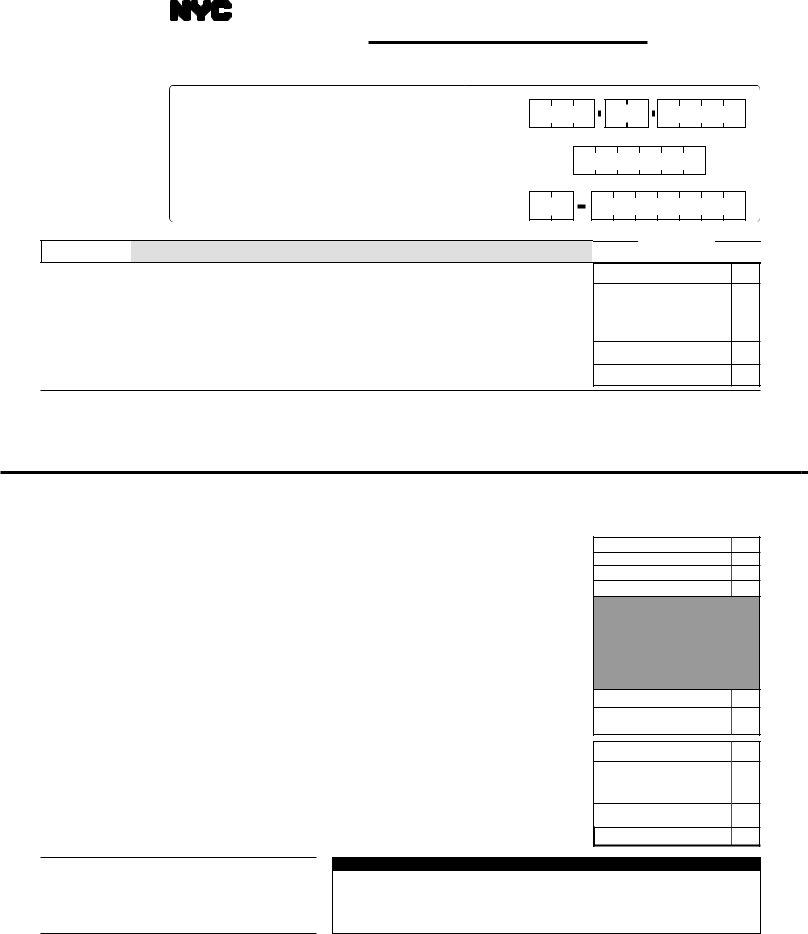

NEWYORKCITYDEPARTMENTOFFINANCE |

DECLARATION OF ESTIMATED |

2012 |

|

||

TM |

|

|

UNINCORPORATED BUSINESS TAX |

|

|

|

FINANCE |

(FORINDIVIDUALS,ESTATESANDTRUSTS) |

|

For CALENDAR YEAR 2012 or FISCAL YEAR beginning ______________________________ and ending ______________________________

*60611291*

Print or Type

First name and initial |

|

Last name |

|

|

|

|

|

Business name |

|

|

|

|

|

|

|

Business address (number and street) |

|

|

|

|

|

|

|

City and State |

|

|

Zip Code |

|

|

|

|

Business Telephone Number |

Taxpayerʼs EmailAddress |

||

|

|

|

|

SOCIAL SECURITY NUMBER

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

ESTATES, TRUSTS AND LLCs ONLY, ENTER EMPLOYER IDENTIFICATION NUMBER

Payment Enclosed

A. Payment

1a. |

2011 Unincorporated Business Tax: |

|

|

1b. Estimate of 2012 tax ....● 1b. |

|

|

COMPUTATION OF INSTALLMENT - (✔) Check proper box below and enter amount indicated. |

||||

2. |

If this declaration |

■ April 17, 2012, enter 1/4 of line 1b |

■ Sept. 17, 2012, enter 1/2 of line 1b |

||

|

is due on: |

|

|

■ Jan.15,2013,enteramountofline1b }.. 2. |

|

|

|

■ June 15, 2012, enter 1/3 of line 1b |

|||

3.Enteramountofoverpaymenton2011returnwhichyouelectedtohaveappliedasacreditagainst2012estimatedtax.● 3.

4.Amount to be paid with this declaration (line 2 less line 3) (Payable to: NYC DEPARTMENT OF FINANCE)..● 4.

Signature of taxpayer _______________________________________________________________________ Title __________________________________________________ Date ______________________

60611291 To receive proper credit, you must enter your correct Social Security Number or Employer Identification Number on your declaration and remittance.

DETACHONDOTTEDLINE&SENDUPPERPORTIONINASEPARATEENVELOPE.RETAINLOWERPORTIONFORYOURRECORDS

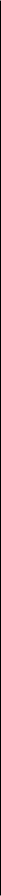

ESTIMATED TAX WORKSHEET

▼ KEEP THIS PORTION FOR YOUR RECORDS ▼

1. |

Net income from business expected in 2012 (see instructions) |

1. |

2. |

Exemption (see instructions) |

2. |

3. |

Line 1 less line 2 (estimated taxable business income) |

3. |

4. |

Tax - enter 4% of line 3 (see instructions) |

4. |

5a. |

Business Tax Credit (✔) (Check applicable box below and enter credit amount) |

|

❑Tax on line 4 is $3,400 or less. Your credit is the entire amount of tax on line 4.

❑Tax on line 4 is $5,400 or over. No credit is allowed. Enter "0".

❑Tax on line 4 is over $3,400 but less than $5,400, use formula for credit amount:

|

....................................................Tax on line 4 x ($5,400 minus tax on line 4) |

5a. |

|

|

|

|

$2,000 |

|

|

|

|

5b. |

Other credits (see instructions) |

5b. |

|

|

|

5c. |

Total credits (add lines 5a and 5b) |

|

5c. |

||

6.Estimated 2012 Unincorporated Business Tax (line 4 less line 5c)

|

Enter here, on line 7b, and on line 1b of declaration above |

|

6. |

||||||

7a. |

2011UnincorporatedBusinessTax..7a. |

|

|

|

7b. ESTIMATE OF 2012 TAX FROM LINE 6 |

7b. |

|||

|

|

|

|||||||

|

COMPUTATION OF INSTALLMENT - (✔) Checkproperboxbelowandenteramountindicated.Fiscalyeartaxpayersseeinstructions. |

|

|||||||

8. |

Ifthisdeclaration |

■ April 17, 2012, enter 1/4 of line 7b |

■ Sept. 17, 2012, enter 1/2 of line 7b |

...... |

|

||||

|

is due on: |

■ June 15, 2012, enter 1/3 of line 7b |

■ Jan.15,2013,enteramountofline7b} |

8. |

|||||

|

|

|

|||||||

9. |

Enteramountofoverpaymenton2011returnwhichyouelectedtohaveappliedasacreditagainst2012estimatedtax ... |

9. |

|||||||

10. |

Amount to be paid with this declaration(line 8 less line 9)(Payable to: NYC DEPARTMENT OF FINANCE) |

10. |

|||||||

Make remittance payable to the order of:

NYC DEPARTMENT OF FINANCE

Payment must be made in U.S. dollars,

drawn on a U.S. bank.

MAILINGINSTRUCTIONS

DECLARATIONS WITH REMITTANCES |

|

|

ALL OTHERS |

NYC DEPARTMENT OF FINANCE |

|

|

NYC DEPARTMENT OF FINANCE |

UNINCORPORATED BUSINESS TAX |

|

|

UNINCORPORATED BUSINESS TAX |

P. O. BOX 5070 |

|

|

P. O. BOX 5080 |

KINGSTON, NY |

|

|

KINGSTON, NY |

|

|

|

|

Form |

Page 2 |

NOTE

IfanyduedatefallsonSaturday,Sundayorlegalholiday,filingwillbetimelyifmadeby thenextdaywhichisnotaSaturday,Sundayorholiday.

PURPOSEOFDECLARATION

This declaration form provides a means of paying Unincorporated Business Tax on a current basis for individuals, estates and trusts engaged in carrying on an unincorporated business or profession, as defined in Section

Everyunincorporatedbusinessmustfileanincometaxreturnafterthecloseofitstaxableyear and pay any balance of tax due. If the tax has been overpaid, adjustment will be made only after the return has been filed.

WHOMUSTMAKEADECLARATION

A2012declarationmustbemadebyeveryindividual,estateandtrustcarryingonanunincor- poratedbusinessorprofessioninNewYorkCityifitsestimatedtax(line6oftaxcomputation schedule) can reasonably be expected to exceed $3,400 for the calendar year 2012 (or, in the case of a fiscal year taxpayer, for the fiscal year beginning in 2012).

WHENANDWHERETOFILEDECLARATION

You must file the declarationfor the calendar year 2012 on or beforeApril 17, 2012, or on the applicable later dates specified in these instructions.

- Allotherdeclarations- |

|

NYCDepartmentofFinance |

NYCDepartmentofFinance |

UnincorporatedBusinessTax |

UnincorporatedBusinessTax |

P.O.Box5070 |

P.O.Box5080 |

Fiscal year taxpayers, read instructions opposite regarding filing dates.

HOWTOESTIMATEUNINCORPORATEDBUSINESSTAXTheworksheetonthe front of this form will help you in estimating the tax for 2012.

LINE1-

The term “net income from business expected in 2012” means the amount estimated to be the 2012netincomefrombusiness,includingprofessions,beforetheunincorporatedbusinessex- emption.SeeScheduleA,line14ofthe2011UnincorporatedBusinessTaxReturnandrelated instructions (Form

For the amount of the allowable exemption, see the instructions for the 2011 Form

If you expect to receive a refund or credit in 2012 of any sales or compensating use tax for

Enteronline5btheamountestimatedtobethesumofanycreditsallowablefor2012underAd-

DECLARATION

Online1aofthedeclaration(line7aoftheEstimatedTaxWorksheet),entertheamounttheun-

PAYMENTOFESTIMATEDTAX

Exceptasspecifiedelsewhereintheseinstructions,theestimatedtaxonline1bofthedeclara- tionispayableinequalinstallmentsonorbeforeApril17,2012,June15,2012,September17, 2012 and January 15, 2013. The first installment payment must accompany the declaration. However, the estimated tax may be paid in full with the declaration.

Iftherewasanoverpaymentonthe2011UnincorporatedBusinessTaxReturnandonline30b

Make remittance payable to NYC DEPARTMENT OF FINANCE. All remittances must be payableinU.S.dollarsdrawnonaU.S.bank. Checksdrawnonforeignbankswillberejected and returned.Aseparate check for the declaration will expedite processing of the payment.

AMENDEDDECLARATION

If, after a declaration is filed, the estimated tax increases or decreases because of a change in income,deductions,orallocation,youshouldfileanamendeddeclarationonorbeforethenext date for payment of an installment of estimated tax. This is done by completing the amended

CHARGEFORUNDERPAYMENTOFINSTALLMENTSOFESTIMATEDTAX

Acharge is imposed for underpayment of an installment of estimated tax for 2012. For infor- mation regarding interest rates, call 311. If calling from outside of the five NYC boroughs, please call

PENALTIES

The law imposes penalties for failure to make a declaration or pay estimated tax due or for making a false or fraudulent declaration or certification.

FISCALYEARTAXPAYERS

AtaxpayerfilingitsUnincorporatedBusinessTaxReturnonafiscalyearbasisshouldsubstitute thecorrespondingfiscalyearmonthsforthemonthsspecifiedintheinstructions.Forexample, ifthefiscalyearbeginsonApril1,2012,theDeclarationofEstimatedUnincorporatedBusiness Tax will be due on July 16, 2012, together with payment of first quarter estimated tax. In this case,equalinstallmentswillbedueonorbeforeSeptember17,2012,December17,2012,and April 16, 2013.

CHANGESININCOME

EventhoughonApril17,2012, youdonotexpectyourunincorporatedbusinesstaxtoexceed $3,400, a change in income, allocation or exemption may require that a declaration be filed later. In this event the requirements are as follows:

|

|

File |

Amountof |

|

Installment |

Ifrequirementforfilingoccurs: |

declarationby: |

estimated |

|

payment |

|

|

|

|

taxdue |

|

dates |

AFTER |

BUT BEFORE |

|

|

|

|

|

|

|

|

|

|

April 1, 2012 |

June 2, 2012 |

June 15, 2012 |

1/3 |

(1) |

June 15, 2012 |

|

|

|

|

(2) |

Sept. 17, 2012 |

|

|

|

|

(3) |

Jan. 15, 2013 |

June 1, 2012 |

Sept. 2, 2012 |

Sept. 17, 2012 |

1/2 |

(1) |

Sept. 17, 2012 |

|

|

|

|

(2) |

Jan. 15, 2013 |

|

|

|

|

|

|

Sept. 1, 2012 |

Jan. 1, 2013 |

Jan. 15, 2013 |

100% |

|

None |

If you file your 2012 Unincorporated BusinessTax Return by February 15, 2013, and pay the fullbalanceoftaxdue,youneednot:(A) fileanamendeddeclarationoranoriginaldeclaration otherwisedueforthefirsttimeonJanuary15,2013,or(B) paythelastinstallmentofestimated tax otherwise due and payable on January 15, 2013.

CAUTION

An extension of time to file your federal tax return or New York State personal income tax return does NOTextend the filing date of your NewYork City tax return.

ELECTRONICFILING

Note:Registerforelectronicfiling. Itisaneasy,secureandconvenientwaytofileandpayan extension

NOTE

Filing a declaration or an amended declaration, or payment of the last installment on January 15,2013,or filingataxreturnbyFebruary15, 2013,will not satisfythefilingrequirementsif you failed to file or pay an estimated tax which was due earlier in the taxable year.

PRIVACYACTNOTIFICATION

TheFederalPrivacyActof1974,asamended,requiresagenciesrequestingSocialSecurityNumberstoin- form individuals from whom they seek this information as to whether compliance with the request is vol- untaryormandatory,whytherequestisbeingmadeandhowtheinformationwillbeused.Thedisclosure

To receive proper credit, you must enter your correct Social Security Number or Employer Identification Number on your declaration and remittance.