Are you considering submitting a UXRB form in New York City? With so many filing requirements, associated fees and time-sensitive instructions, the task can seem overwhelming. Luckily, our team at ____ is here to provide you with detailed information about what to expect and how to stay organized throughout the process. In this blog post, we'll take an in-depth look at things like types of forms available for submission, upcoming deadlines and rules that must be followed. Read on for everything you need to know about NYC UXRB Forms!

| Question | Answer |

|---|---|

| Form Name | Nyc Uxrb Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | nyc uxrb nyc uxs form |

*70211091*

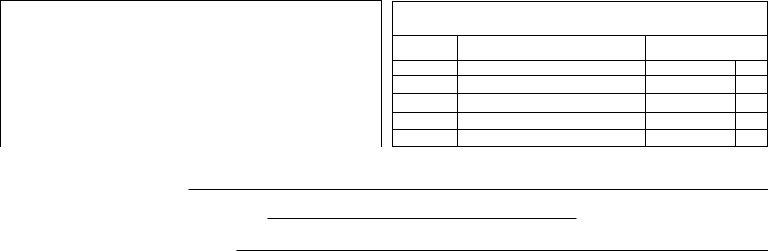

NEWYORK CITYDEPARTMENT OF FINANCE |

RETURNOFEXCISETAXBYUTILITIES |

|||||||||||||||||||

|

NYC |

FORUSEBYRAILROADS,BUSCOMPANIES,ANDOTHERCOMMONCARRIERSOTHERTHANTRUCKINGCOMPANIES |

||||||||||||||||||

FINANCE |

UXRB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● ■Corporation |

● ■Partnership |

|

● ■Individual |

|||||||||||||||||

Check type of business entity: |

|

|||||||||||||||||||

Check type of return: |

● ■Initial return |

● ■Amended return |

|

● ■Final return |

||||||||||||||||

Date business began in NYC |

● |

Date business ended in NYC ● |

||||||||||||||||||

Name: |

|

|

DATE: |

|||||||||||||||||

|

|

|

||||||||||||||||||

__________________________________________________________________________________________ |

EIN/SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Address (number and street): |

|

|

ACCOUNT TYPE: |

UXRB |

||||||||||||||||

__________________________________________________________________________________________ |

ACCOUNT ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

PERIOD BEGINNING: |

||||||||||||||||||||

City and State: |

|

Zip: |

||||||||||||||||||

|

|

|

PERIOD ENDING: |

|||||||||||||||||

__________________________________________________________________________________________ |

DUE DATE: |

|||||||||||||||||||

Business Telephone Number: |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

FEDERAL BUSINESS CODE:

|

|

SCHEDULE A |

Computation of Gross Income (See instructions) |

|

|

|

|

|

|

|

|

|

Payment Enclosed |

|

|

||

|

|

|

|

|

|

|

|

|

A. Payment |

...............Payamountshownonline32 - Makecheckpayableto: NYCDepartmentofFinance |

● |

|

|

|

|

||

▼ G R O S S I N C O M E ▼

REVENUEFROMTRANSPORTATION(withoutanydeductions) |

|

|

|

|

|

|

|

1. |

Passengerrevenue (see instructions) |

● 1a. |

|

|

● 1b. |

|

|

2. |

Freightrevenue(nottobeincludedbyrailroads) |

|

|

● 2. |

|

|

|

3. |

Mailrevenue |

|

|

● 3. |

|

|

|

4. |

Expressrevenue |

|

|

● 4. |

|

|

|

5. |

Miscellaneoustransportationrevenue(explaininScheduleC,page2) |

|

|

● 5. |

|

|

|

REVENUEOTHERTHANFROMTRANSPORTATION(withoutanydeductions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Advertising |

|

|

● 6. |

|||

7. |

Carandstationprivileges |

|

|

● 7. |

|||

8. |

Rentoffacilitiesusedinthepublicservice |

|

|

● 8. |

|||

9.RentderivedfromoperationofterminalfacilitiesinexcessofauserproportionofNewYorkCityrealpropertyand

|

specialfranchisetaxesandexpensesofmaintenanceandoperation |

● 9. |

||

10. |

Saleofpower |

● 10. |

||

11. |

Miscellaneous(explaininScheduleC) |

● 11. |

||

|

|

|

|

|

|

Interestfrompersonsotherthancorporations |

|

|

|

12. |

|

|

||

13. |

Royalties |

● 13. |

|

|

14. |

Profitfromthesaleofsecurities |

● 14. |

|

|

15. |

Profitfromthesaleofrealproperty |

● 15. |

|

|

16. |

Profitfromsaleofpersonalproperty (other than property of a kind which would properly be included in the inventory of the taxpayer) |

● 16. |

|

|

17. |

Miscellaneous(includinggainsorprofitsfromanysourcewhatsoever)(explaininScheduleC) |

● 17. |

|

|

18. |

TOTAL(addlines1bthrough17) |

● 18. |

|

|

▼ COMPUTATIONOFAMOUNTDUE ▼

19.Taxat3.52% - personsoperatingorleasingsleepingandparlorrailroadcarsoroperatingrailroads other than streetsurface,

|

rapidtransit,subwayandelevatedrailroads |

|

● 19. |

|

|

|

20. |

Taxat2.35% - personsoperatingorleasingstreetsurface,rapidtransit,subwayandelevatedrailroads |

● 20. |

|

|

||

21. |

Taxat1.17% - personsoperatingomnibusesandsubjecttothesupervisionoftheDepartmentofPublicService |

● 21. |

|

|

||

22. |

Taxat0.1% - personsoperatinglimitedfareomnibuscompanies,onamountfromline1a |

● 22. |

|

|

||

23. |

Salesandusetaxrefunded |

|

● 23. |

|

|

|

24. |

TOTALTAX(addlines19through23) |

|

● 24. |

|

|

|

25a. |

● 25a. |

|

|

|

|

|

25b. |

● 25b. |

|

|

|

|

|

25c. |

Previouspayment |

● 25c. |

|

|

|

|

26. |

TOTALPAYMENTSANDCREDITS(addlines25athrough25c) |

|

● 26. |

|

|

|

27. |

Ifline24islargerthanline26,enterbalancedue |

|

● 27. |

|

|

|

28. |

Ifline24issmallerthanline26,enteroverpayment |

|

● 28. |

|

|

|

29. |

Amountofline28toberefunded |

|

● 29. |

|

|

|

30. |

Interest (see instructions) |

|

● 30. |

|

|

|

31. |

Penalty (see instructions) |

|

● 31. |

|

|

|

32. |

TOTALREMITTANCE DUE (addlines27,30and31)(EnterpaymentonlineAabove) |

............................................................................................ |

|

● 32. |

|

|

CERTIFICATION OF ▼TAXPAYER ▼

I hereby certify that this return, including any accompanying schedules or statements, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) |

.................YES |

■ |

|||||||||||||||

|

|

|

|

|

Preparer's Social Security Number or PTIN |

||||||||||||

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of owner, partner or officer of corporation ▲ |

Title ▲ |

Date ▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's signature ▲ |

Preparerʼs printed name ▲ |

Date ▲ |

Check if self- |

Firm's Employer Identification Number |

|

● |

|||||

● |

|

|

employed ✔ |

||

|

|

■ |

|

||

Firm's name ▲ |

Address ▲ |

Zip Code ▲ |

|

70211091 |

SEE INSTRUCTIONS FOR MAILING AND PAYMENT INFORMATION |

Form |

|

|

Page 2 |

|

|

|

|

SCHEDULE B |

|

|

|

|

SCHEDULE C |

|

|

|

|

|

|

Enter below all income received during the period covered by this return and NOT reported in ScheduleA.

EXPLANATION |

AMOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Details of miscellaneous income, lines 5,11 and 17 reported in ScheduleA.

REFER TO LINE |

EXPLANATION |

AMOUNT |

#ON PAGE 1 |

ADDITIONALINFORMATIONREQUIRED

A.State kind and nature of business

B.Telephone number (_____) _________ - _________________

C.If a corporation, in what state did you incorporate?

D. Does this return cover business at more than one location? |

■Yes ■No (IF YES, YOU MUST ATTACH A SCHEDULE LISTING ADDRESS AND GROSS INCOME APPLICABLE TO EACH LOCATION.) |

E.The books of the taxpayer are in the care of:

Name ▲ |

Address ▲ |

Telephone ▲ |

|

|

|

*70221091*

70221091

NEWYORK CITYDEPARTMENT OF FINANCE

Instructions for Form

FINANCE

GENERAL INFORMATION

HIGHLIGHTS OFRECENTLEGISLATION

The law was amended in 2009 to provide taxpayers with additional time to applyforarefundoftheUtilityTax. FortaxyearsbeginningonorafterJan- uary 1, 2009, UtilityTax refunds may be claimed up to three years from the time the return is filed or two years from the time the tax is paid, the same as the period applying to refunds of General Corporation Tax, the Unincor- porated Business Tax, and the Bank Tax. Administrative Code section 11- 1108(a), as amended by Chapter 201 of the Laws of 2009, section 35.

BeginningJanuary1,2006,meteredsalesofenergytotenantsofcertainco- operative housing corporations are exempted from the City utility tax. The exemptionappliestocooperativecorporationswithatleast1,500apartments that own or operate a cogeneration facility that was in place before January 1, 2004 (or that replaces such a facility), and that make metered sales of the energy produced for the development’s tenants or occupants. SeeAd. Code

TheRelocationEmploymentAssistanceProgram(REAP)hasbeenreinstated and a program granting similar benefits to businesses that relocate to lower Manhattan(LMREAP)hasbeenenacted. BoththereinstatementoftheREAP programandtheenactmentoftheLMREAPprogramareeffectiveasofJuly 1, 2003. SeeAdministrative Code sections

EffectivefortaxperiodsbeginningonandafterAugust1,2002,entitiesthat receive eighty percent or more of their gross receipts from charges for the provisionofmobiletelecommunicationsservicestocustomerswillbetaxed as if they were regulated utilities for purposes of the NewYork City Utility Tax,GeneralCorporationTax,BankingCorporationTaxandUnincorporated BusinessTax. Thus, such entities will be subject to only the NewYork City Utility Tax. The amount of gross income subject to tax has been amended toconformtotheFederalMobileTelecommunicationsSourcingActof2000. Inaddition,ifanysuchentityisapartnership,itspartnerswillnotbesubject to the NewYork City UtilityTax on their distributive share of the income of anysuchentity. Finally,fortaxyearsbeginningonandafterAugust1,2002, partners in any such entity will not be subject to General Corporation Tax, Banking CorporationTax or Unincorporated BusinessTax on their distribu- tive share of the income of any such entity. Chapter 93, Part C, of the Laws of NewYork, 2002.

SCHEDULEA- COMPUTATION OFGROSS INCOME Enterinline1ballgrossincome,withoutanydeductions,derivedfrompas- senger revenue wholly earned within the territorial limits of the City.

Only Limited Fare Omnibus Companies as defined by Section 11- 1101.10 of the NYC Administrative Code, must report revenue from commuterservicesinline1a. Commuterservicesisdefinedasmasstrans- portation service (exclusive of limited stop service to airports, racetracks or anyotherplacewhereentertainment,amusement,orsportsactivitiesareheld or where recreational activities are supplied) provided pursuant to a fran- chise with, or consent of, the City of New York. Limited Fare Omnibus Companies must report all other passenger revenue in line 1b. Report other gross income, without any deductions, from transportation and other than transportation in the appropriate lines in ScheduleA.

GROSS INCOME

INCLUDE:

●all receipts from any sale made, including receipts from the sales of residuals and

the sale is made or the service is rendered for profit) without any de- duction for any cost, expense or discount paid;

●receipts from interest, dividends and royalties (other than interest and dividends received from corporations) without deduction for any ex- pense;

●profit from the sale of real property;

●profit from the sale of securities;

●

●gains or profits from any source whatsoever except as specifically ex- cluded below.

DO NOT INCLUDE:

●gross income from the operation of hotels, multiple dwellings or office buildings by railroads;

●rents,exceptthosederivedfromfacilitiesusedinthepublicservice,modifiedas providedinAd. Code

●gross income from sales for resale other than sales of gas, electricity, steam, water or refrigeration or gas, electric, steam, water or refrigera- tion service to a vendor of utility services for resale to tenants; and

●fortaxperiodsbeginningonorafterAugust1,2002,thetaxpayer’sdis- tributiveshare,ifany,ofincome,gains,lossesanddeductionsfromany partnership subject to the NYC UtilityTax as a utility or vendor of util- ity services, including its share of separately reported items. (SEE “UTILITY” defined below).

SCHEDULE B

Enter all other income in Schedule B, page 2.

UTILITY

EverypersonsubjecttothesupervisionoftheDepartmentofPublicService of the State of New York. Effective for tax periods beginning on and after August1,2002,entitiesthatreceiveeightypercentormoreoftheirgrossre- ceiptsfromchargesfortheprovisionofmobiletelecommunicationsservices to customers will be taxed as if they were subject to the supervision of the Department of Public Service of the State of NewYork and will not be con- sidered vendors of utility services.

IMPOSITION/BASIS/RATE OFTAX

The tax is imposed on every utility for the privilege of exercising a fran- chise or franchises, holding property or doing business in NewYork City.

Autility is taxable on gross income as defined above. The chart below pro- vides the rates.

CLASS ▼ |

RATE ▼ |

|

|

◆Omnibus operators subject to Department of Public

|

Service supervision |

1.17% of gross income |

◆ Limited fare omnibus operators - commuterserviceonly |

00.1% of gross income |

|

◆ |

Railroads |

3.52% of gross income |

◆ |

All other utilities |

2.35% of gross income |

Lines19,20and21

Multiply the amount on line 18 by the rate given on line 19, 20 or 21, whichever is appropriate.

If you received a refund in the current period of any sales and use taxes for whichyouclaimedacreditinapriorperiod,entertheamountofsuchrefund on line 23.

Form |

Page 2 |

EnteronthislinethecreditagainsttheUtilityTaxfortherelocationandem- ployment assistance program. (Attach Form

Enter on this line the credit against the Utility Tax for the new Lower Man- hattanrelocationandemploymentassistanceprogram. (AttachFormNYC- 9.8.UTX)

INTEREST

If the tax is not paid on or before the due date, interest must be paid on the amount of the underpayment from the due date to the date paid. For infor- mation as to the applicable rate of interest, visit the Finance website at nyc.gov/financeor call 311. Interest amounting to less than $1 need not be paid.

PENALTIES

a)If you fail to file a return when due, add to the tax (less any payments made on or before the due date or any credits claimed on the return) 5% for each month or partial month the form is late, up to 25%, unless the failure is due to reasonable cause.

b)Ifthisformisfiledmorethan60dayslate,theabovelatefilingpenaltycan- notbelessthanthelesserof(1)$100or(2)100%oftheamountrequiredto be shown on the form (less any payments made by the due date or credits claimed on the return).

c)If you fail to pay the tax shown on the return by the prescribed filing date, add to the tax (less any payments made) 1/2% for each month or partial month the payment is late up to 25%, unless the failure is due to reasonable cause.

d)Thetotaloftheadditionalchargesina)andc)maynotexceed5%forany one month except as provided for in b).

e)Additional penalties may be imposed on any underpayment of the tax.

If you claim not to be liable for these additional charges, a statement in sup- port of your claim should be attached to the return.

SIGNATURE

This report must be signed by an officer authorized to certify that the state- mentscontainedhereinaretrue. Ifthetaxpayerisapartnershiporanotherun- incorporatedentity,thisreturnmustbesignedbyapersondulyauthorizedto act on behalf of the taxpayer.

FILINGARETURNAND PAYMENTOFTAX

Returns are due on or before the 25th day of each month, if filing on a monthly basis, covering gross income for the preceding calendar month. However, if the tax liability is less than $100,000 for the preceding calendar year, determined on an annual or annualized basis, returns are due for the current tax year on a

PaymentmustbemadeinU.S.dollars,drawnonaU.S.bank. Checksdrawn on foreign banks will be rejected and returned. Make remittance payable to the order of NYC DEPARTMENT OF FINANCE.

For further information, call 311. If calling from outside the five NYC bor- oughs, call

PreparerAuthorization: If you want to allow the Department of Finance to discuss your return with the paid preparer who signed it, you must check the "yes" box in the signature area of the return. This authorization applies only to the individual whose signature appears in the "Preparer's Use Only" sectionofyourreturn. Itdoesnotapplytothefirm,ifany,showninthatsec- tion. By checking the "Yes" box, you are authorizing the Department of Fi- nance to call the preparer to answer any questions that may arise during the

processing of your return. You are also authorizing the preparer to:

●Give the Department any information missing from your return,

●Call the Department for information about the processing of your re- turn or the status of your refund or payment(s), and

●Respond to certain notices that you have shared with the preparer aboutmatherrors,offsets,andreturnpreparation. Thenoticeswillnot be sent to the preparer.

Youarenotauthorizingthepreparertoreceiveanyrefundcheck,bindyou to anything (including any additional tax liability), or otherwise represent you before the Department. The authorization cannot be revoked; however, the authorization will automatically expire twelve (12) months after the due date (without regard to any extensions) for filing this return. Failure to

checktheboxwillbedeemedadenialofauthority.

MAILREMITTANCEAND RETURNTO:

NYC DEPARTMENT OF FINANCE

P. O. BOX 5110

KINGSTON, NY

TOAVOIDTHE IMPOSITION OFPENALTIES,thisreturnmustbefiledwithyourre- mittanceinfullfortheamountofthetaxpostmarkedwithin25daysafterthe endoftheperiodcoveredbythereturn.