The idea regarding our PDF editor was to allow it to become as simple as possible. The entire procedure of filling up it 201 2020 really easy if you keep to the next actions.

Step 1: Choose the button "Get Form Here".

Step 2: So you're on the file editing page. You may edit and add text to the file, highlight words and phrases, cross or check particular words, insert images, insert a signature on it, get rid of unneeded fields, or remove them entirely.

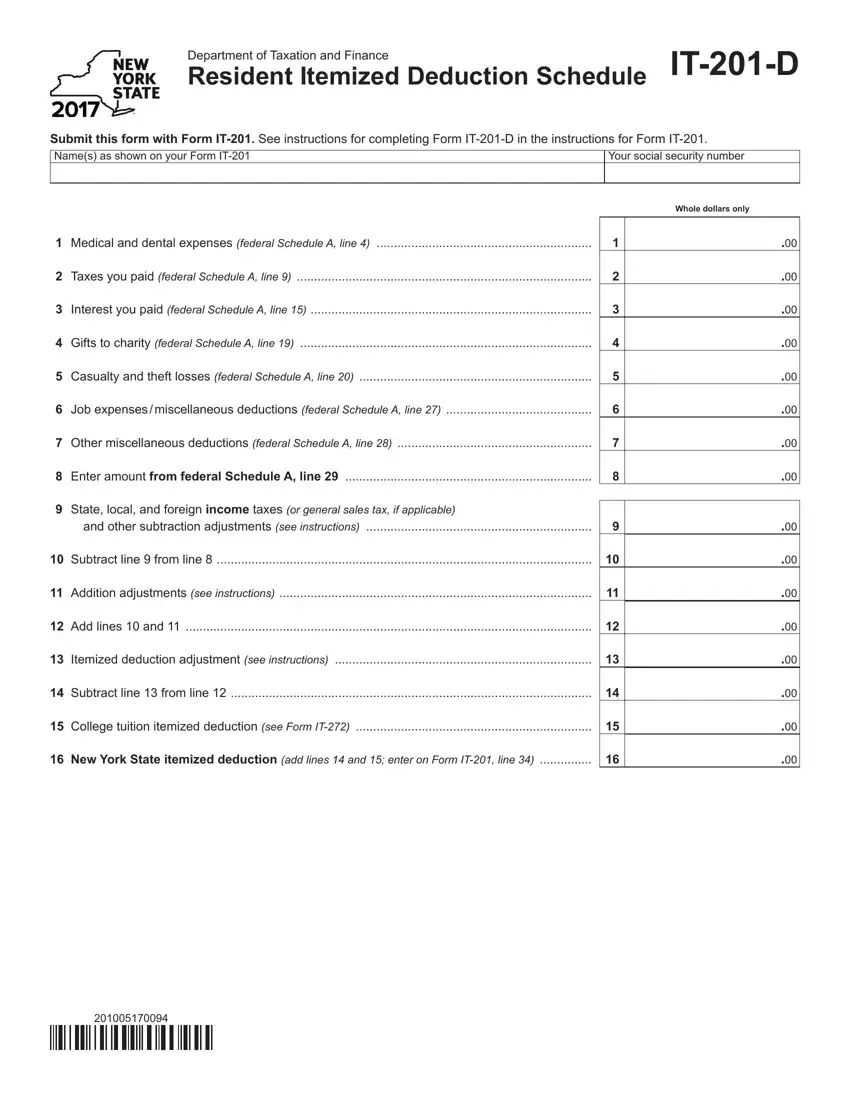

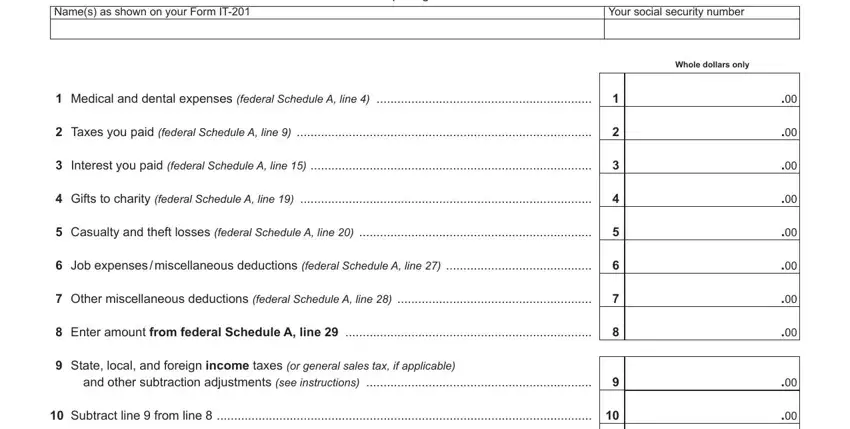

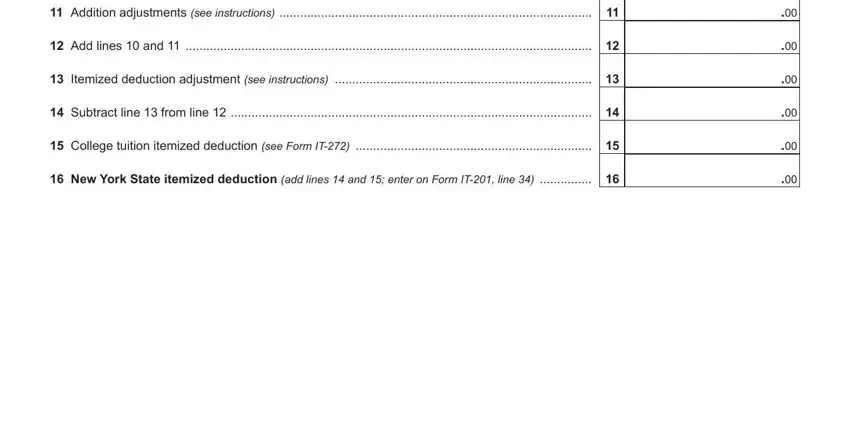

All of the following segments are what you will need to prepare to obtain the finished PDF document.

Feel free to write your data inside the area Addition adjustments see, Add lines and, Itemized deduction adjustment see, Subtract line from line, College tuition itemized, and New York State itemized deduction.

Step 3: The moment you click on the Done button, the finished file is simply exportable to any kind of of your devices. Or, you might deliver it by means of mail.

Step 4: Generate at least a few copies of your form to refrain from any specific future issues.