A.DEFINITIONS

In this document the following words and phrases have the meaning stated hereunder unless indicated otherwise:

Bank refers to Oriental Bank of Commerce, a body corporate, constituted under the Banking Companies (Acquisition & Transfer of undertakings) Act No. 40 of 1980, having its Head Office at E Block, Harsha Bhavan, Connaught Place, New Delhi-110 001, the proprietors of the Card, and may include its successors, assigns and nominees appointed by Oriental Bank of Commerce.

Customer means an account holder of the Bank, who has agreed to these Terms and Conditions and is authorized to operate the Bank Account and thereby use the Banking Services including ATM services, and includes those having Joint Accounts, Multiple Users and their Authorised Representatives.

Customer includes any individual, sole proprietorship firm, partnership, company, co-operative society, association, corporation, association of persons, trust or other legal or natural entity or organisation.

DEBIT/ATM CARD or Card refers to the Oriental Bank of Commerce VISA International DEBIT/ATM CARD or domestic ATM Card issued by the bank to its Account Holder/s (hereinafter referred to as Customer) for using the Automated Teller Machines (ATMs), and for using at Merchant Establishments wherever located which honour the Card.

Cardholder means the approved Customer who has requested for the DEBIT/ATM CARD upon his/her undertaking to abide by the terms and conditions herein and who has been issued the Card and who is authorised to hold and use the Card.

Card Account(s) means the operative account specified by the Customer for the purpose of routing his/her Debit/ATM Card related Transactions. This, account is designated as the Primary Account. Should there be more than one such account, the other/s would be designated as Secondary Account

No. 1 or Secondary Account No. 2.... at the option of the Cardholder. Availability of the ATM / Card facility is subject to

continuation of the Primary Account with theBank and unless alternative prior arrangements aremadeby the Cardholder. Bank account(s) means the operative accounts of various customers of the bank.

ATM means any Automated Teller Machine whether in India or overseas, whether of the Bank or an ATM under specified Shared Network, at which, amongst other things, the Cardholder can use his Card to access his funds held in his Account with the Bank.

A-PIN means the confidential Automated Teller Machine - Personal Identification Number allotted to the Cardholder by the Bank or chosen by the Cardholder from time to time.

Shared Network shall mean network of ATMs other than MyTime ATMs where Debit/ATM Cards are accepted.

Account Statement means a monthly statement of card account sent by the Bank to a Cardholder setting out the Transactions carried out and balance in the card account as on that date, and any other information as the Bank may deem fit to include.

Loyalty Points Account means a tracking account kept by the Bank for every Cardholder under the Scheme in which the Loyalty Points earned by the Cardholder are accumulated as and when the scheme is introduced by the Bank.

International Transactions refers to the Transactions entered into by the Cardholder on his Debit Card outside of India, Nepal and Bhutan.

Merchant Establishment shall mean establishments wherever located which honour the Card and shall include, among others, stores, shops, restaurants, hotels, railways and airline organisations advertised as honouring the Card.

POS Terminal “POS (Point of Sale) Terminal shall mean point of sale electronic terminals at Merchant Establishment whetherinIndiaoroverseas,capableofprocessingCardTransactionsandatwhich,amongstotherthings,theCardholder can use his Card to access his funds in his Account held with the Bank to make purchases”.

Transactions shall mean any instruction given by a Cardholder using a Card, directly or indirectly, to the Bank to effect a transaction.

Valid Charges means charges incurred by the Cardholder for purchase of goods or services on the Card or any other charge as may be included by the Bank from time to time for the purpose of this Scheme.

24 Hour OBC Helpline refers to OBC Phone Banking Service 1800 3452424 or such other agency as may be nominated by the Bank, which shall be available to all Cardholders.

“Force Majeure Event” means any event such as fire, earthquake, flood, epidemic, strike, lockout, labour controversy, industrial disputes, riot, civil disturbance, war, civil commotion, natural disasters, acts of God, failure or delay of any transportationagency,oranyotherfurnisherofessentialsuppliesorotherfacilities,omissionsoractsofpublicauthorities preventing or delaying performance of obligation relating to acts of public authorities, including changes in Law, or other regulatory authority acts beyond the control of the Bank, or for any other reasons which cannot reasonably be forecast or provided against, and which cannot be predicted by men of ordinary prudence.

“Law” includes all applicable statutes, enactment, acts of legislature or Parliament, ordinances, rules, bye-laws, regulations,judgements,notifications,guidelines,policies,directions,circulars,directivesandordersofanyGovernment, statutory authority, tribunal, board, court or recognised stock exchange, final and interim decrees and judgments.

“Technical Problems” include any problems and difficulties arising due to power and electricity failure, computer errors, programming errors, software or hardware errors, computer breakdown, non-availability of Internet connection, communicationproblemsbetweentheBank’sserverandATMnetwork,shuttingdownoftheBank’sserver,non-availability of links, corruption of the computer software, problems in ATM, or any other Service Providers infrastructure and telecommunication network, problems in any other telecommunication network and any other technology related problems.

References to Shared Network /VISA regulations pertain to the guidelines issued by shared network concerned / VISA to all the member banks of its network.

The terms and conditions for use of the card are as specified in this document and as amended by the Bank from time to time.

Unless the context otherwise requires,

(a)words importing one gender include the other gender;

(b)words importing the singular include the plural and vice versa;

(c)any reference to a statutory provision shall be deemed to include a reference to any statutory modification or re- enactment;

(d)the clause headings do not form part of this Terms and conditions and shall not be taken into account in its construction or interpretation and

(e)any reference to the Agent shall, if appropriate, include his personal representatives.

B. PRESUMTIONS

1.Voluntary Consent: Customer(s) have completely.read and understood all the terms and conditions and have voluntarily agreed to open the Bank Account and/ or to utilise banking services including ATM Services.

2.The cardholder will be responsible for all facilities granted by the Bank in respect of the card and for all related charges, and shall act in good faith in relation to all dealings with the card and the Bank.

3.No Conflict: These Terms and Conditions are in addition to and not in derogation of the terms and conditions relating to any Bank Account of the customer, and in addition to any other contract between the customer and the Bank. In the event there is any conflict between the terms & conditions specified herein and any other agreement / contract between the customer and the Bank, the terms and conditions detailed herein shall prevail and override any such conflicting agreement / contract.

4.Applicability of clauses: There may be some clauses in these terms & conditions, which may be applicable to only particular Banking Services. Customer availing of those specific Banking Services must comply with such clauses.

5.Binding: Customer agrees that these Terms & Conditions are legally and unconditionally binding on the Customer and Customer shall take all steps necessary to comply with these terms & conditions.

C.AMENDMENTS TO THE TERMS AND CONDITIONS

The Bank reserves the right to alter, amend or revise any policy, benefit or feature offered on the card and also has the absolute discretion to amend, alter or supplement any of the terms and conditions detailed herein, for use of the card in any manner it considers appropriate at any time without prior notice to the Cardholder, though the bank will endeavour to give prior reasonable notice to the customers wherever feasible. The communication sent to the customer will be deemed as communication sent to all customers in respect of Multiple user accounts.

The Bank may, at its sole discretion, introduce new Banking Services or remove or modify the existing Banking Services from time to time under Debit/ATM Card.

Without prejudice to the foregoing, the Bank shall have the option to notify Customer of any changes in the terms & conditions, by delivering it to the cardholder personally or by posting it to his latest address recorded with the Bank or by e-mail or through a notice posted on the Bank’s website. The cardholder must notify the bank of any change to his

/her address. The terms and conditions regarding receipt of notice shall be applicable to any notice sent under this sub- clause.

Proof of posting to such last notified address shall be conclusive proof of the notification at the time when it ought to be delivered in due course by the post even if the notification may be returned through the post undelivered. The Bank may also give the cardholder notice of variation of these terms and conditions by displaying a notice on or within the immediate vicinity of the site of an ATM/Branch of the Bank or by a press advertisement or by a message in the cardholders account statement.

Customer agrees that the following actions/ in-actions shall be construed as the deemed acceptance of any changes in the terms & conditions by the Customer:

a.Any use of the Bank Account and/or Banking Services/ ATM Services by the Customer after the notice has been issued to the customer regarding the change in the terms & conditions.

b.Failure of the Customer to notify the Bank of his / its acceptance/ non-acceptance to the changes in the terms & conditions within 10 days of the issue of the notice to the customer regarding such changes; or

c.Sending an e-mail to the customer as to the changes in the terms & conditions, at the designated e-mail address of the customer, which is provided to the Bank at the time of registration for ATM services / Card and failure to reply to such e-mail within 7 days of the receipt of the e-mail.

d.Provided that as per the provisions of the Information Technology Act, 2000, the e-mail shall be deemed to be sent to the customer once the email enters a computer source outside the control of the Bank

e.Any acceptance or deemed acceptance of the changes or amendments to the terms and conditions shall be legally binding on the customer.

In the event the Customer does not agree to any changes or amendments made to the terms & conditions, the customer has the option to terminate the arrangement of use of ATM services and use of the Card at POS locations or otherwise by sending a notice to the Bank as mentioned in “Termination of ATM services” and “Notices” intimating- the Bank of the termination of the Bank Account / banks’ services”.

D.GENERAL TERMS AND CONDITIONS

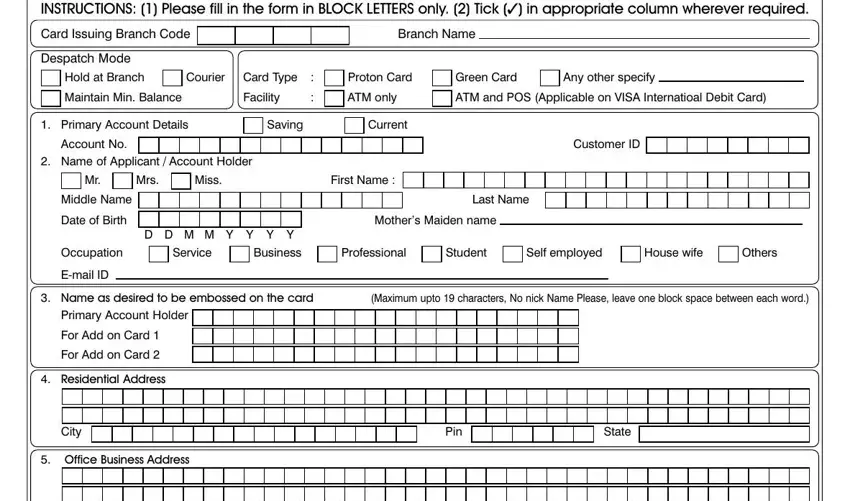

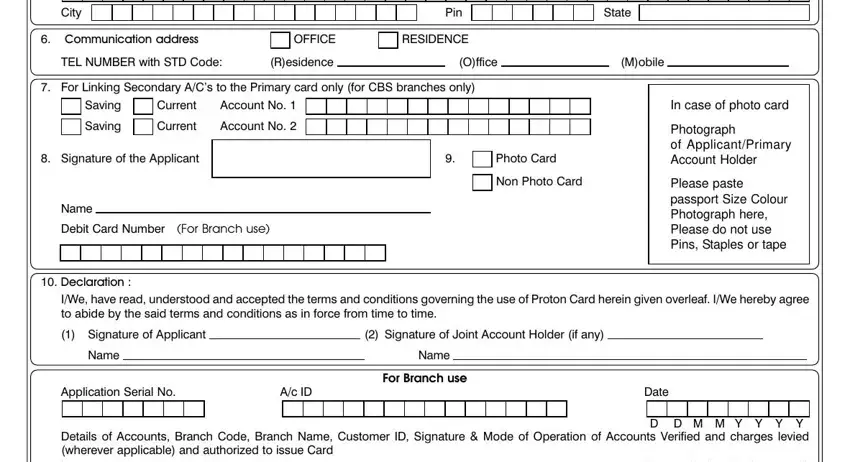

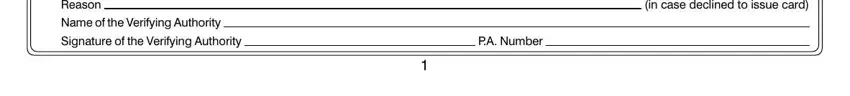

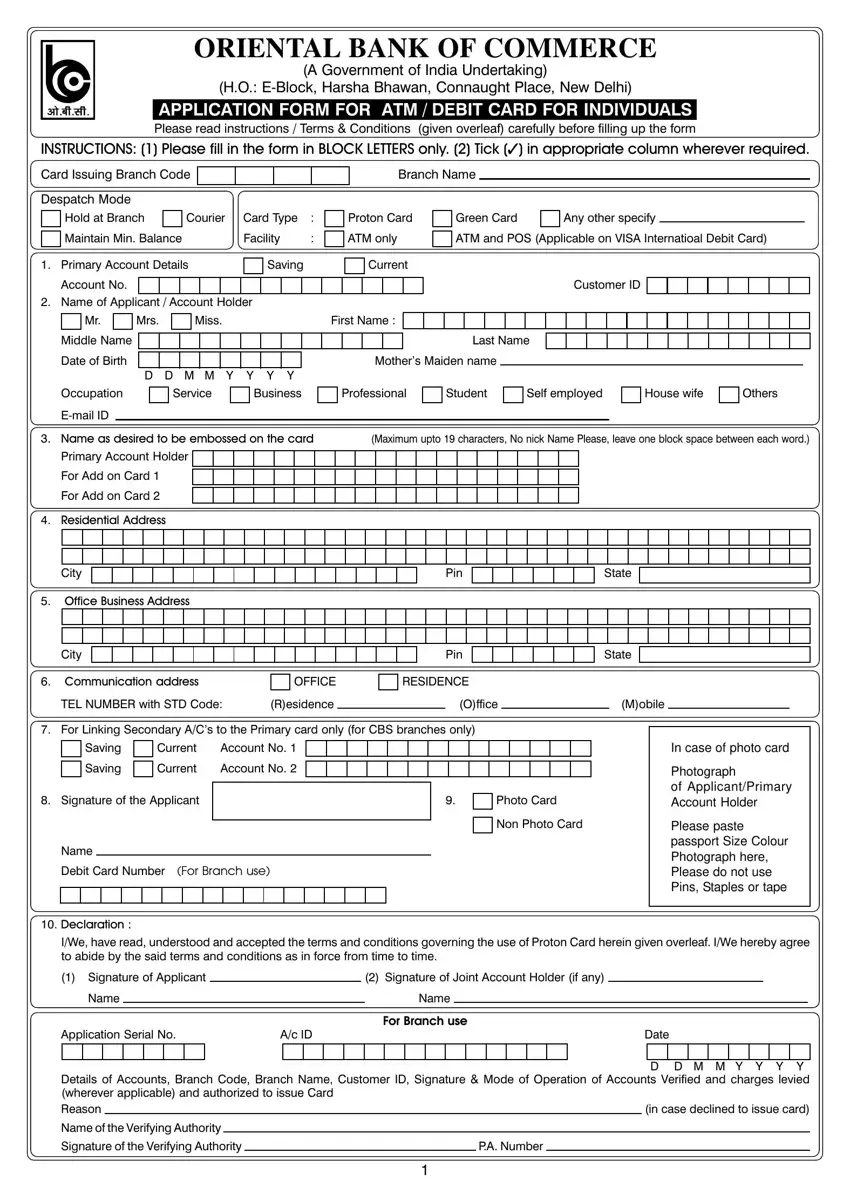

1.Application Form: Applicant(s) desiring to avail of Debit/ATM Card needs to sign an application form and declare therein that he/ they has/have agreed to abide by the terms and conditions laid down herein and all Laws, which are in force from time to time.

2.Debit/ATM Card: The Debit/ATM Card, shall be issued, at the discretion of the Bank to an approved Account Holder upon his/her applying for the same.

3.Mailing of Debit/ATM Card: Bank will send Debit/ATM Card in a sealed envelope directly to the addressee by a courier. Customer is advised to provide necessary identification to courier representative before taking the delivery. Debit/ATM Card will be sent by Registered Post, in case place of addressee is not covered under the courier arrangements.Customershallacknowledgetheproofofdelivery/Acknowledgmentreceiptonreceiptoftheenvelope.

4.Validity: Debit/ATM Card is valid for use at ATMs (whether of the bank or in the shared network) and Merchant EstablishmentsinIndiaandabroad.Debit/ATMCardisnotvalidforpaymentinforeignexchangeatMerchantEstablishments in India, Nepal and Bhutan. Debit/ATM Card is valid upto the last working day of the month indicated on the Card.

5.Card Account/s: The Cardholder shall give his preference of Card Account/s held by him/her in writing in the application form prescribed by the Bank for issue of Card. Accounts opened in the following manner are not eligible.

a.Minors Account

b.Joint Account where minor is a joint account holder

c.Joint Accounts and any other account to be operated “jointly”.

6.Multiple Accounts: The cardholder agrees that in case he/she has multiple accounts with the Bank, the Bank will decide the number of accounts, which will be linked to Debit/ATM Card.

In case of Debit/ATM Card linked to multiple accounts, transactions at ATMs in Shared Network and Merchant Establishments will be effected only in “Primary account”. In case there are no funds in this account, the Bank will not honour the transactions even if there are funds available in the other accounts linked to the same card.

The Bank will debit the accounts linked to the card for the value of all purchases of goods or services, cash, fees, charges and payments made by using the card. All transactions will be reflected in the account statement of the account(s) which are linked to the Card.

7.Funds in the card accounts: The Cardholder should not use or attempt to use the Card without sufficient funds in the card account(s). In the event of payment/debit made in excess of the balance available in the Cardholder/s card account/s for any reason whatsoever, the Cardholder undertakes to repay such amount overdrawn together with interest and other charges that may be debited by the Bank, within 2 days of such overdrawals.

8.Minimum Balance in Primary / Secondary Account: The cardholder shall maintain, at all times, such minimum balance in his/her card account/s, as the Bank may decide from time to time, and the Bank may at its discretion, levy such penal or service charges as per the Bank’s rules from time to time and/or withdraw the ATM / card facility, if at any time the amount of balance falls short of the required minimum as aforesaid, without giving any further notice to the Cardholder and/ or without incurring any liability of responsibility whatsoever by reason of such withdrawal.

9.Bank’s Lien: The Bank shall have the right of set off and lien, irrespective of any other lien or charge, present, as well as future on the balance held in the Cardholder’s Primary account and/or Secondary Account/s or in any other account whether in single name or joint name/ s to the extent of all outstanding dues, whatsoever, arising as result of the services extended to and/or used by the cardholder through Debit/ATM Card.

10.Joint Account: In case of joint account where only one card is issued to a joint account holder, the other joint account holder/s shall expressly agree with and give his/her/their consent on the application form for issue of the Card. If more than one person signs or agrees to be bound by these terms and conditions, the obligations of such person hereunder will be joint and several and as the context may require. Any notice hereunder to any one such person will be deemed as an effective notification to all such persons.

a.Stop operation

In case of any of the joint account holder/s gives “stop operation” instructions, no operations will be allowed on such Card account/s through the use of the Card. The “Stop operation” instruction can be given by one or more joint account holders only in respect of such card accounts in which he/she is a joint account holder.

b.Revoke-Stop operation

All the joint account holders shall jointly instruct the Bank to revoke “stop operation instructions”.

11.Multiple Cards: In case of joint accounts (Where mode of operation is severally) maximum two add-on cards will be issued besides the primary card. Additional fees for the issue of such multiple cards shall be debited to any of the designated card accounts of the Cardholders.

12.ATM-Facilities: Following facilities pertaining to Card Account/s linked to Debit/ATM Card shall be offered at the discretion of the Bank in ATMs, subject to change from time to time, without prior notice:

A. My Time ATMs

✪ Withdrawal of cash by the Cardholder from his/her Card Account upto a stipulated number of occasions and limit during a cycle of 24 hours, as may be prescribed by the Bank from time to time.

✪ Transfer of amount between any two Card accounts.

✪ Third Party Transfer of funds from card account to any bank account ✪ Payments to various Utility Service Providers.

✪ Enquiry about the balance in the card accounts. ✪ Requisition for a statement of card accounts.

✪ Requisition for issue of cheque-books for card accounts.

✪ Access to general information about the Bank etc. provided in the ATM.

The cardholder agrees that requests on the ATM such as chequebook requisitions and duplicate account statements will be processed normally on the next working day.

B. ATMs in shared network where Debit/ATM Cards are accepted:

✪ Withdrawal of cash by the Cardholder from his/her card Account upto a stipulated number of occasions and limit during a cycle of 24 hours, as may be prescribed by the Bank from time to time.

✪ Enquiry about the balance in the card accounts.

The operating hours of the ATMs will be at the sole discretion of the Bank and any change in timings may be effected by the Bank without any prior information.

13.A-PIN(ATM-PersonalIdentificationNumber):A-PINisasecretFOURdigitcodenumberreferredtoastheAutomated TellerMachinePersonalIdentificationNumber(A-PIN)whichisassignedbytheBanktothecardholder.TheCardholder will be required to enter his/her A-PIN to avail of the ATM services using the card. Cardholder shall ensure that the A-Pin mailed by the Bank is received in a sealed envelope with out any tampering.