It is possible to complete Exeter without difficulty with the help of our online tool for PDF editing. FormsPal is devoted to making sure you have the absolute best experience with our tool by regularly introducing new capabilities and upgrades. Our editor has become a lot more user-friendly as the result of the most recent updates! Now, working with documents is simpler and faster than ever. To get the ball rolling, consider these easy steps:

Step 1: Click the "Get Form" button above on this webpage to get into our PDF tool.

Step 2: Once you start the tool, there'll be the document made ready to be completed. Besides filling in various blanks, you might also perform various other actions with the Document, specifically writing custom text, changing the original text, adding graphics, putting your signature on the form, and much more.

Filling out this form calls for attentiveness. Ensure that every blank is completed accurately.

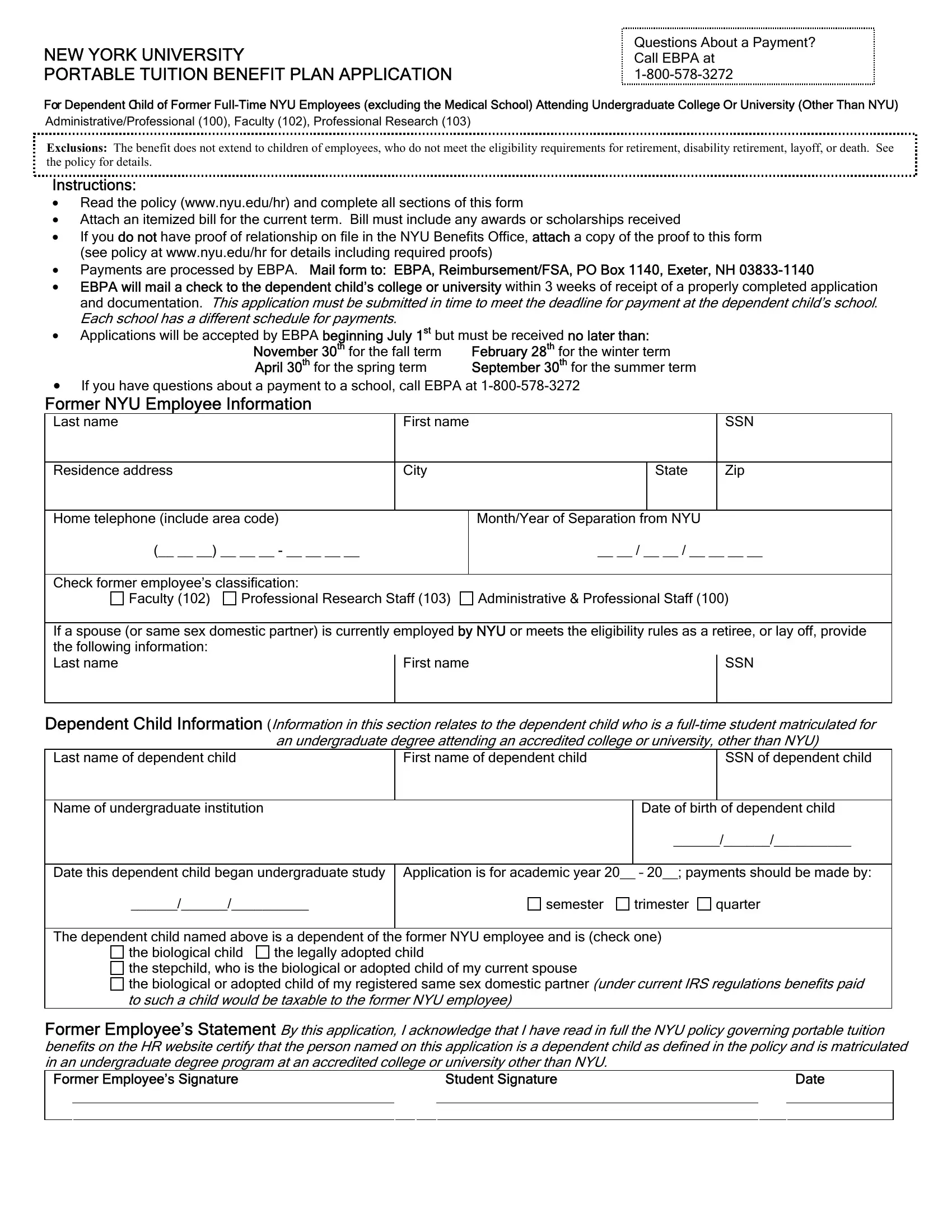

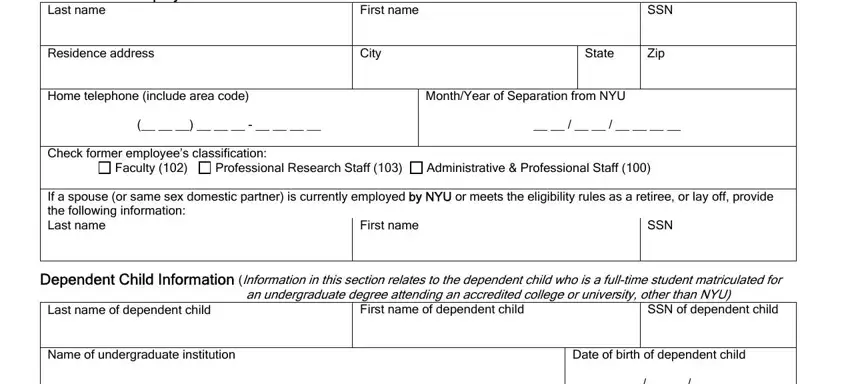

1. The Exeter usually requires particular details to be entered. Be sure that the following fields are filled out:

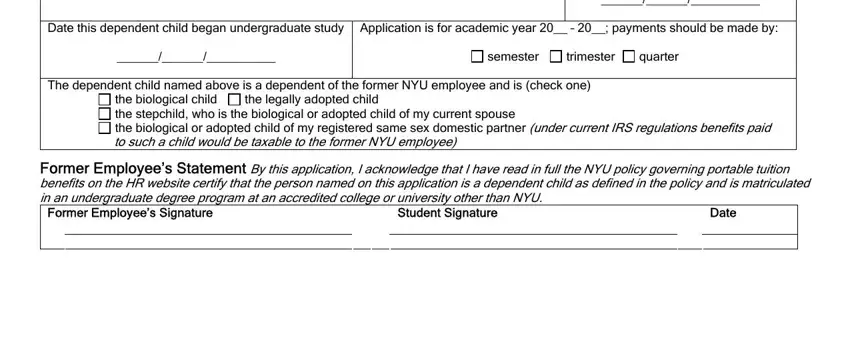

2. After completing the last step, go to the next stage and fill out the essential details in these blanks - Date this dependent child began, Application is for academic year, semester, trimester, quarter, The dependent child named above is, the biological child the stepchild, the legally adopted child, to such a child would be taxable, Former Employees Statement By this, Former Employees Signature, Student Signature, and Date.

Be extremely attentive when filling in the legally adopted child and semester, because this is where a lot of people make errors.

Step 3: Reread all the information you have inserted in the form fields and hit the "Done" button. Join us right now and instantly gain access to Exeter, prepared for downloading. Every single edit you make is conveniently preserved , helping you to modify the form further if needed. FormsPal is invested in the confidentiality of all our users; we always make sure that all personal information entered into our editor is confidential.