Number of tasks can be simpler than filling out documentation making use of our PDF editor. There isn't much you should do to modify the nz customs client code form - merely abide by these steps in the next order:

Step 1: Click the button "Get Form Here".

Step 2: Now you will be within the document edit page. You can add, customize, highlight, check, cross, include or remove areas or phrases.

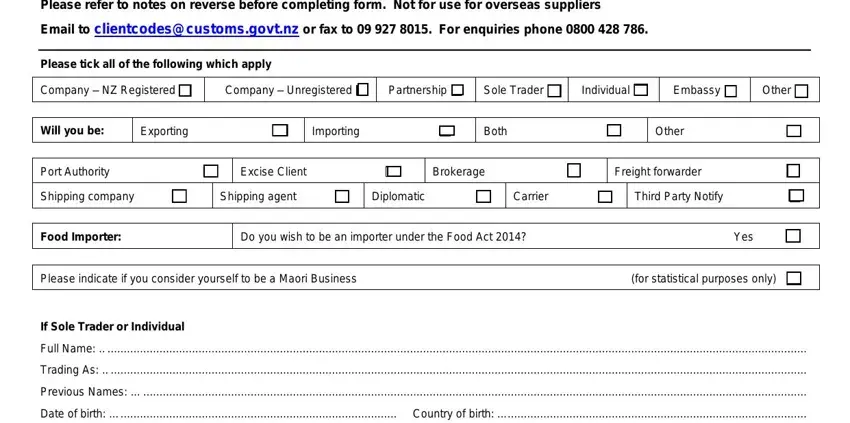

In order to create the nz customs client code PDF, provide the content for each of the segments:

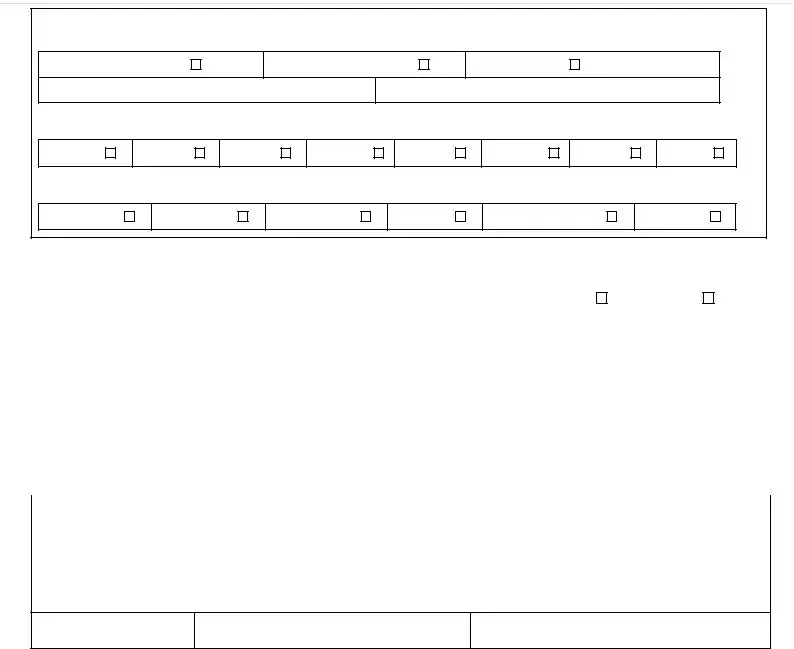

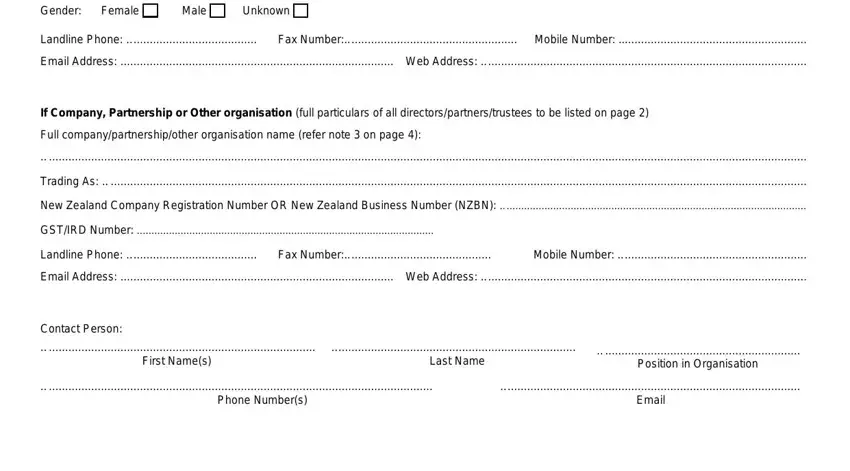

Write down the data in Gender, Female, Male, Unknown, Landline Phone, Fax Number Mobile Number, Email Address Web Address, If Company Partnership or Other, Full companypartnershipother, Trading As, New Zealand Company Registration, GSTIRD Number, Landline Phone, Fax Number, and Mobile Number.

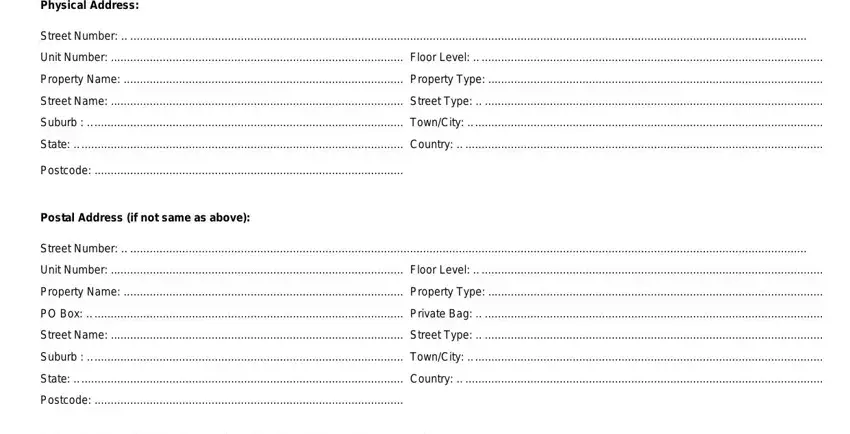

You will have to put down particular information within the box Physical Address, Street Number, Unit Number, Floor Level, Property Name, Property Type, Street Name, Street Type, Suburb, TownCity, State, Country, Postcode, Postal Address if not same as above, and Street Number.

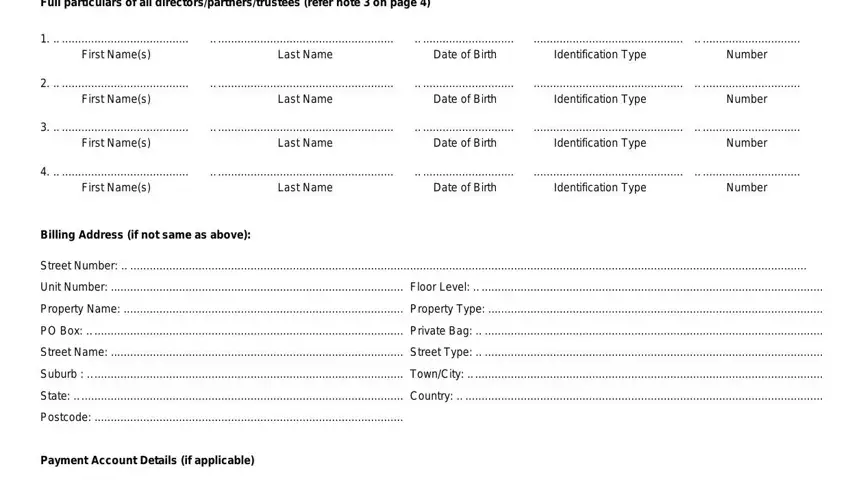

The Full particulars of all, First Names, Last Name, Date of Birth, Identification Type, Number, First Names, Last Name, Date of Birth, Identification Type, Number, First Names, Last Name, Date of Birth, and Identification Type area will be your place to include the rights and responsibilities of all parties.

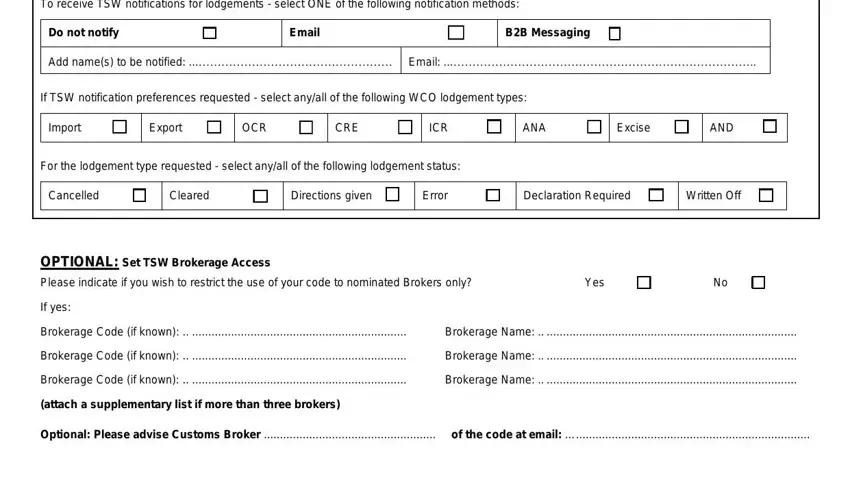

Check the sections To receive TSW notifications for, Do not notify, Email, BB Messaging, Add names to be notified Email, If TSW notification preferences, Import, Export, OCR, CRE, ICR, ANA, Excise, AND, and For the lodgement type requested and thereafter fill them in.

Step 3: Hit "Done". You can now export your PDF file.

Step 4: Produce copies of the form. This is going to save you from upcoming worries. We don't read or distribute your information, as a consequence be assured it will be safe.